Asthma and COPD Drug Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Asthma and COPD Drug Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

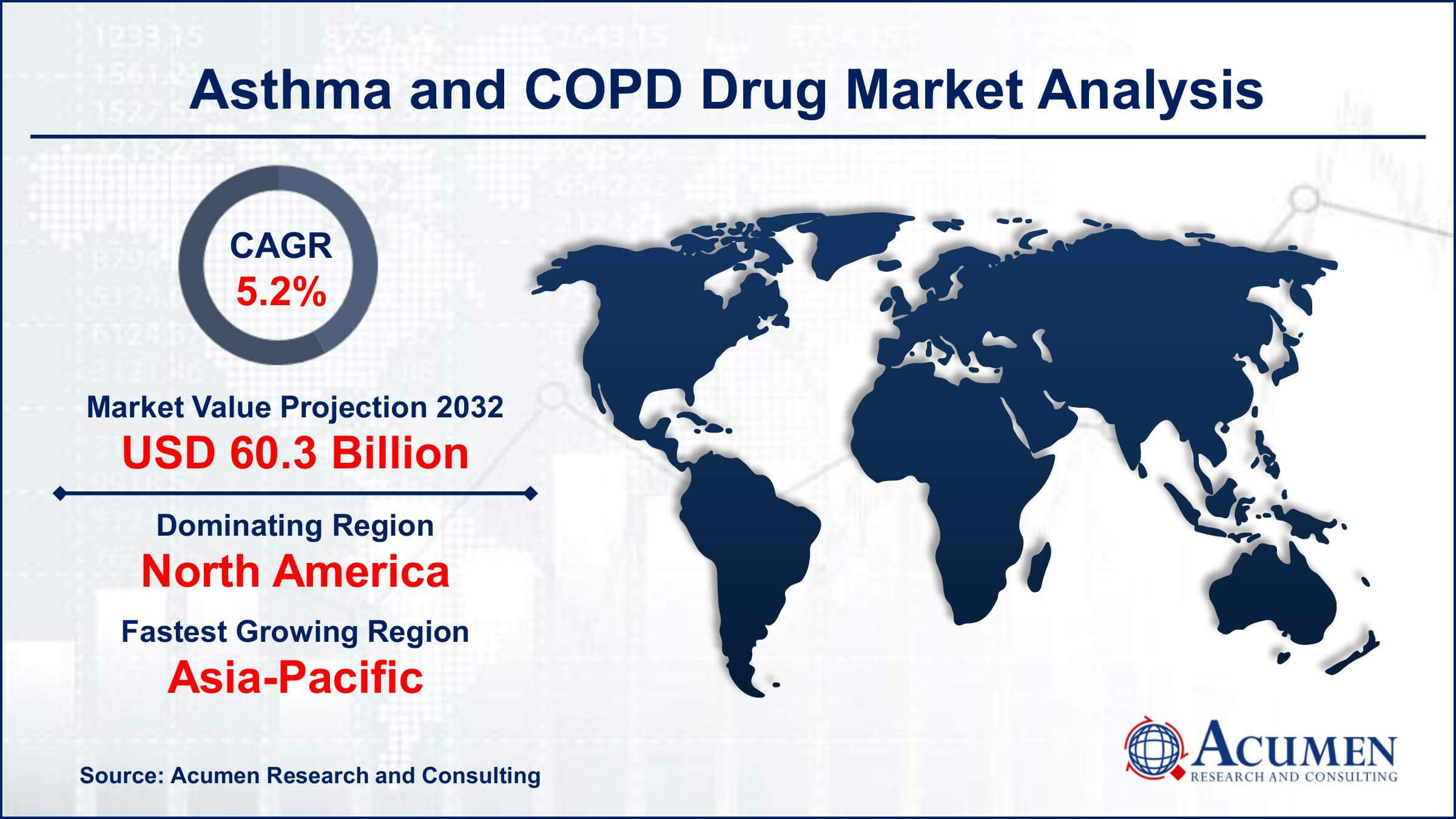

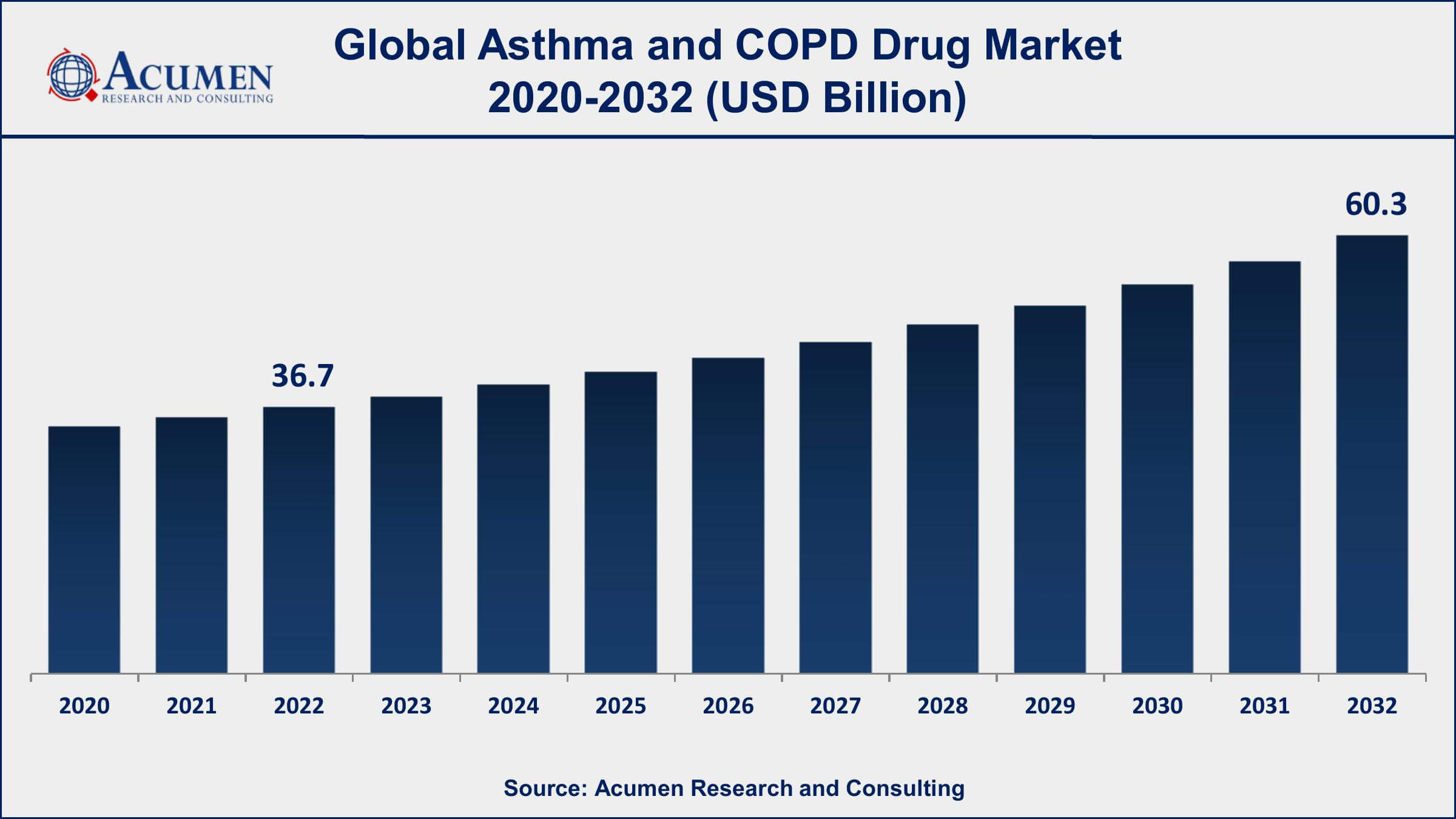

The Global Asthma and COPD Drug Market Size accounted for USD 36.7 Billion in 2022 and is projected to achieve a market size of USD 60.3 Billion by 2032 growing at a CAGR of 5.2% from 2023 to 2032.

Asthma and COPD Drug Market Report Key Highlights

- Global asthma and COPD drug market revenue is expected to increase by USD 60.3 Billion by 2032, with a 5.2% CAGR from 2023 to 2032

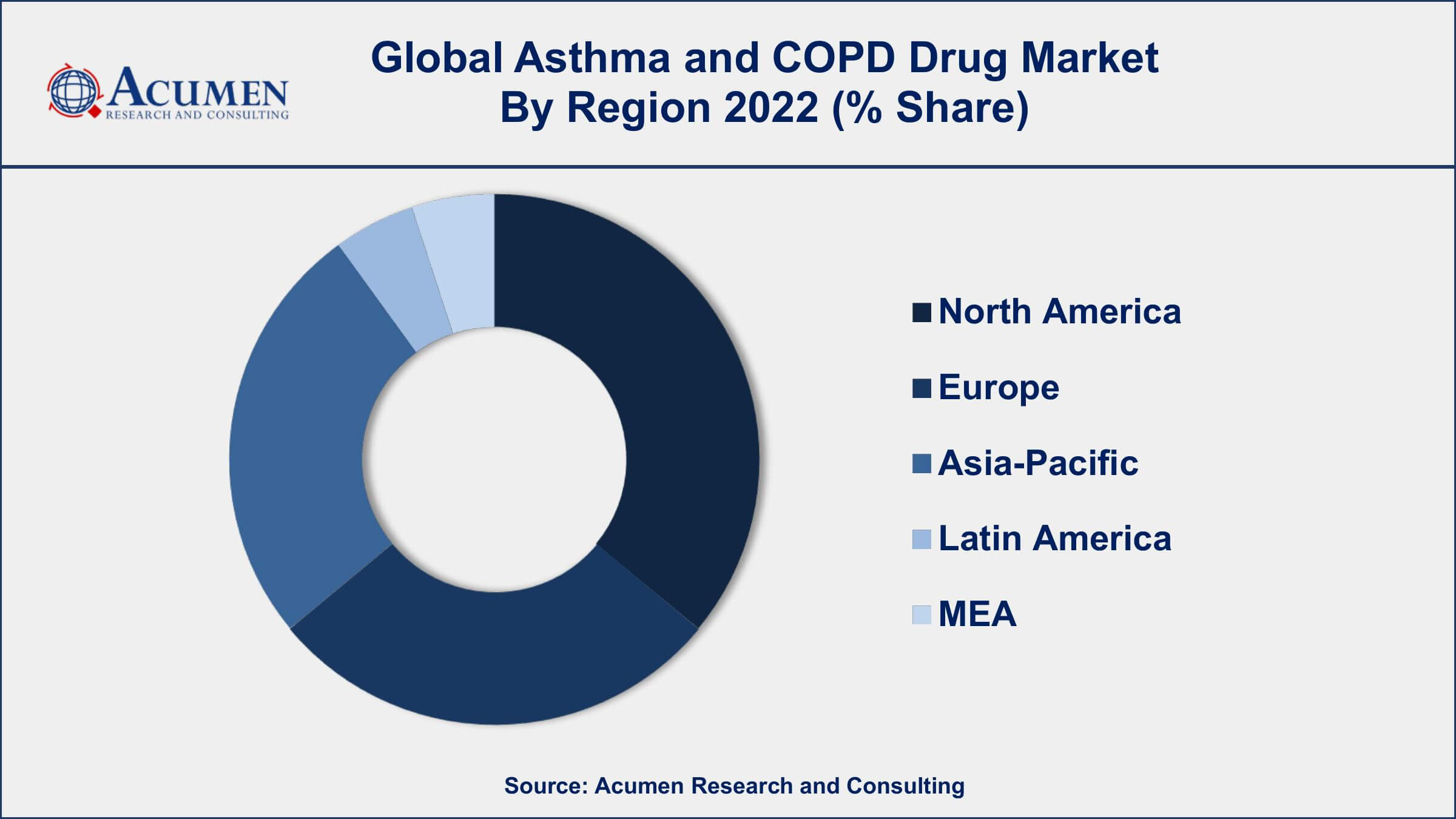

- North America region led with more than 36% of asthma and COPD drug market share in 2022

- According to the World Health Organization (WHO), around 235 million people worldwide suffer from asthma.

- COPD is the third leading cause of death globally, and according to the World Health Organization, an estimated 251 million people worldwide suffer from COPD

- In the United States, around 25 million people have asthma and over 16 million adults have been diagnosed with COPD.

- The bronchodilators drug segment is the largest segment, accounting for over 35% of the total market share

- Some of the key players in the market include GlaxoSmithKline, AstraZeneca, Boehringer Ingelheim, Novartis, and Teva Pharmaceutical Industries.

- Growing demand for biologics and targeted therapies, drives the asthma and COPD drug market size

Asthma and COPD (Chronic Obstructive Pulmonary Disease) drugs are medications that help manage and treat symptoms of these respiratory diseases. Asthma is a chronic lung disease that causes inflammation and narrowing of the airways, leading to difficulty in breathing, coughing, and wheezing. COPD is a group of progressive lung diseases that cause airflow obstruction, including chronic bronchitis and emphysema.

The global market for asthma and COPD drugs has been growing steadily over the years and is expected to continue to do so in the coming years. The increasing prevalence of asthma and COPD, coupled with the rising aging population and urbanization, are the major driving factors for the growth of the market. The market is also influenced by the growing awareness about diseases, advancements in medical technology, and the availability of a wide range of drugs.

Global Asthma and COPD Drug Market Trends

Market Drivers

- Increasing prevalence of asthma and COPD worldwide

- Growing aging population and urbanization

- Rising awareness about respiratory diseases

- Technological advancements in drug delivery devices and formulations

- Availability of a wide range of drugs and combination therapies

- Growing demand for personalized medicine

Market Restraints

- Stringent regulatory requirements for drug approvals

- High cost of developing and marketing drugs

- Adverse side effects of some drugs

Market Opportunities

- Development of novel drugs and drug delivery devices

- Increasing focus on combination therapies

- Growing demand for biologics and targeted therapies

Asthma and COPD Drug Market Report Coverage

| Market | Asthma and COPD Drug Market |

| Asthma and COPD Drug Market Size 2022 | USD 36.7 Billion |

| Asthma and COPD Drug Market Forecast 2032 | USD 60.3 Billion |

| Asthma and COPD Drug Market CAGR During 2023 - 2032 | 5.2% |

| Asthma and COPD Drug Market Analysis Period | 2020 - 2032 |

| Asthma and COPD Drug Market Base Year | 2022 |

| Asthma and COPD Drug Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Indication, By Drug Class, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | GlaxoSmithKline, Boehringer Ingelheim, AstraZeneca, Novartis, Teva Pharmaceutical Industries, Sanofi, Merck & Co., Roche, Pfizer, Johnson & Johnson, Abbott Laboratories, and Sunovion Pharmaceuticals Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

In medical practice, asthma is defined as a condition in which there is inflammation and constriction of the airways through which a body breathes owing to various environmental triggers. It has been regarded as a serious medical disorder and it has been estimated that around 300 million people globally are suffering from asthma. The drug therapy is most commonly used for the treatment of asthma and for the prevention of this disorder patients are advised to avoid any type of triggers. Over the past decades, pharmaceutical companies have innovated effective asthma drugs that act faster and more efficiently to treat asthma. The newest generation of asthma-curing drugs such as AstraZeneca's Symbicort and GlaxoSmithKline's Advair is estimated to command a major gain over the older products available in the market.

However, AstraZeneca, GlaxoSmithKline, and Merck are expected to be the market leaders until their drug patents expire in the future years. Drugs such as Singulair, Symbicort, and Advair are estimated to command the highest share in asthma and COPD drug market during the forecast period. Presently, Advair was observed to be the market leader to treat asthma followed by Singulair which was the second largest revenue-generating drug in terms of revenue.

Also, owing to the high demand for new drug entrants in combinational therapies, inhaled corticosteroids, and beta-agonists, there is intense competition in the asthma market. There are numerous growth opportunities in the asthma and COPD market as the majority of large companies are concentrating on contract manufacturing outsourcing (CMO). Also, the key market players are engaged in the development of new products that provide better treatment for asthma.

Asthma and COPD Drug Market Segmentation

The global asthma and COPD drug market segmentation is based on indication, drug class, and geography.

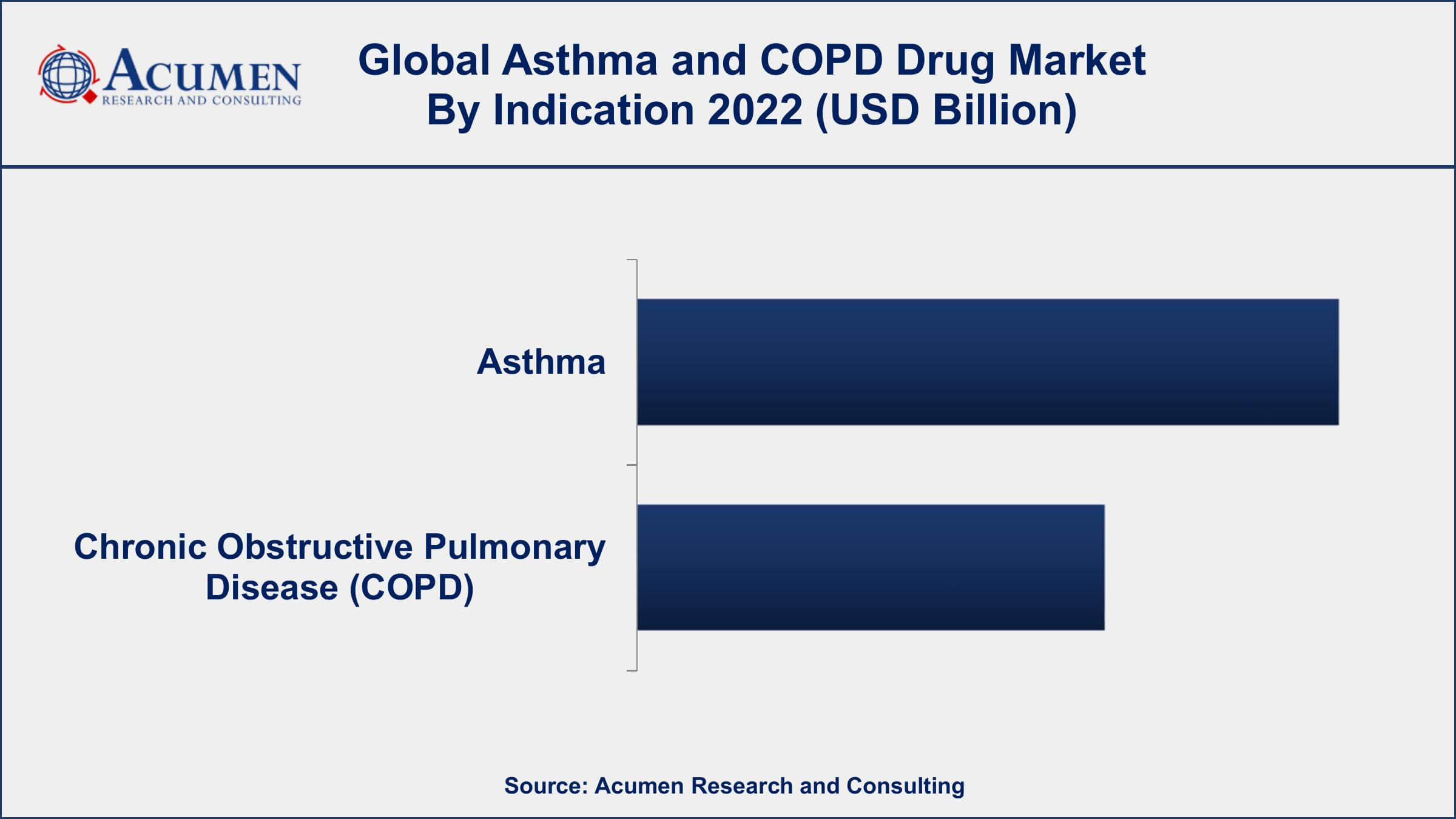

Asthma and COPD Drug Market By Indication

- Asthma

- Chronic Obstructive Pulmonary Disease (COPD)

According to asthma and COPD drug industry analysis, the asthma indication segment is one of the most significant segments in the market. Asthma is a chronic respiratory disease characterized by inflammation and narrowing of the airways, leading to symptoms such as wheezing, coughing, and shortness of breath. According to the World Health Organization, an estimated 235 million people worldwide suffer from asthma, making it one of the most common chronic diseases globally. The market for asthma drugs is driven by factors such as the increasing prevalence of asthma, the availability of a wide range of drugs and combination therapies, and the growing awareness about the disease. The market is also influenced by the technological advancements in drug delivery devices and formulations, which have enabled the development of more effective and convenient treatments. The emergence of biologics and targeted therapies is expected to further boost the growth of the market in the coming years.

Asthma and COPD Drug Market By Drug Class

- Bronchodilators

- Anticholinergic Agents

- Long-acting Beta-2 Agonists

- Short-acting Beta-2 Agonists

- Anti-inflammatory Drugs

- Phosphodiesterase Type-4 Inhibitors

- Anti-leukotrienes

- Oral and Inhaled Corticosteroids

- Other

- Monoclonal Antibodies

- Combination Drugs

According to asthma and COPD drug market forecast, the bronchodilators segment is expected to grow significantly in the coming years. Bronchodilators are a type of medication that relaxes the muscles in the airways, allowing for easier breathing in patients with asthma and COPD. The market for bronchodilators is driven by the increasing prevalence of asthma and COPD, which has led to a growing demand for effective and convenient treatments. The availability of a wide range of bronchodilators and combination therapies, as well as the technological advancements in drug delivery devices, have also contributed to the growth of the market. The emergence of biologics and targeted therapies is expected to further drive the growth of the market in the coming years.

Asthma and COPD Drug Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asthma and COPD Drug Market Regional Analysis

North America is dominating asthma and COPD drugs market due to several factors. One of the key drivers is the high prevalence of respiratory diseases such as asthma and COPD in the region. According to the Centers for Disease Control and Prevention (CDC), around 25 million Americans have asthma and over 16 million adults have been diagnosed with COPD. The region also has a large aging population, which is more susceptible to respiratory diseases, thereby increasing the demand for drugs and treatments.

Another factor contributing to the dominance of North America in the market is the strong presence of key market players in the region, such as GlaxoSmithKline, AstraZeneca, and Teva Pharmaceutical Industries. These companies have a significant market share and invest heavily in research and development to develop new and innovative drugs and drug delivery devices. The region also has a well-established healthcare infrastructure, including advanced diagnostic and treatment facilities, which supports the development and adoption of new treatments.

Asthma and COPD Drug Market Player

Some of the top asthma and COPD drug market companies offered in the professional report includes GlaxoSmithKline, Boehringer Ingelheim, AstraZeneca, Novartis, Teva Pharmaceutical Industries, Sanofi, Merck & Co., Roche, Pfizer, Johnson & Johnson, Abbott Laboratories, and Sunovion Pharmaceuticals Inc.

Frequently Asked Questions

How big is the asthma and COPD drug market?

The asthma and COPD drug market size was USD 36.7 Billion in 2022.

What is the CAGR of the global asthma and COPD drug market during forecast period of 2023 to 2032?

The CAGR of asthma and COPD drug market is 5.2% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global asthma and COPD drug market are GlaxoSmithKline, Boehringer Ingelheim, AstraZeneca, Novartis, Teva Pharmaceutical Industries, Sanofi, Merck & Co., Roche, Pfizer, Johnson & Johnson, Abbott Laboratories, and Sunovion Pharmaceuticals Inc.

Which region held the dominating position in the global asthma and COPD drug market?

North America held the dominating position in asthma and COPD drug market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for asthma and COPD drug market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global asthma and COPD drug market?

The current trends and dynamics in the asthma and COPD drug industry include the increasing prevalence of asthma and COPD worldwide and growing demand for personalized medicine.

Which indication held the maximum share in 2022?

The asthma indication held the maximum share of the asthma and COPD drug market.