Polysilicon Market | Acumen Research and Consulting

Polysilicon Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

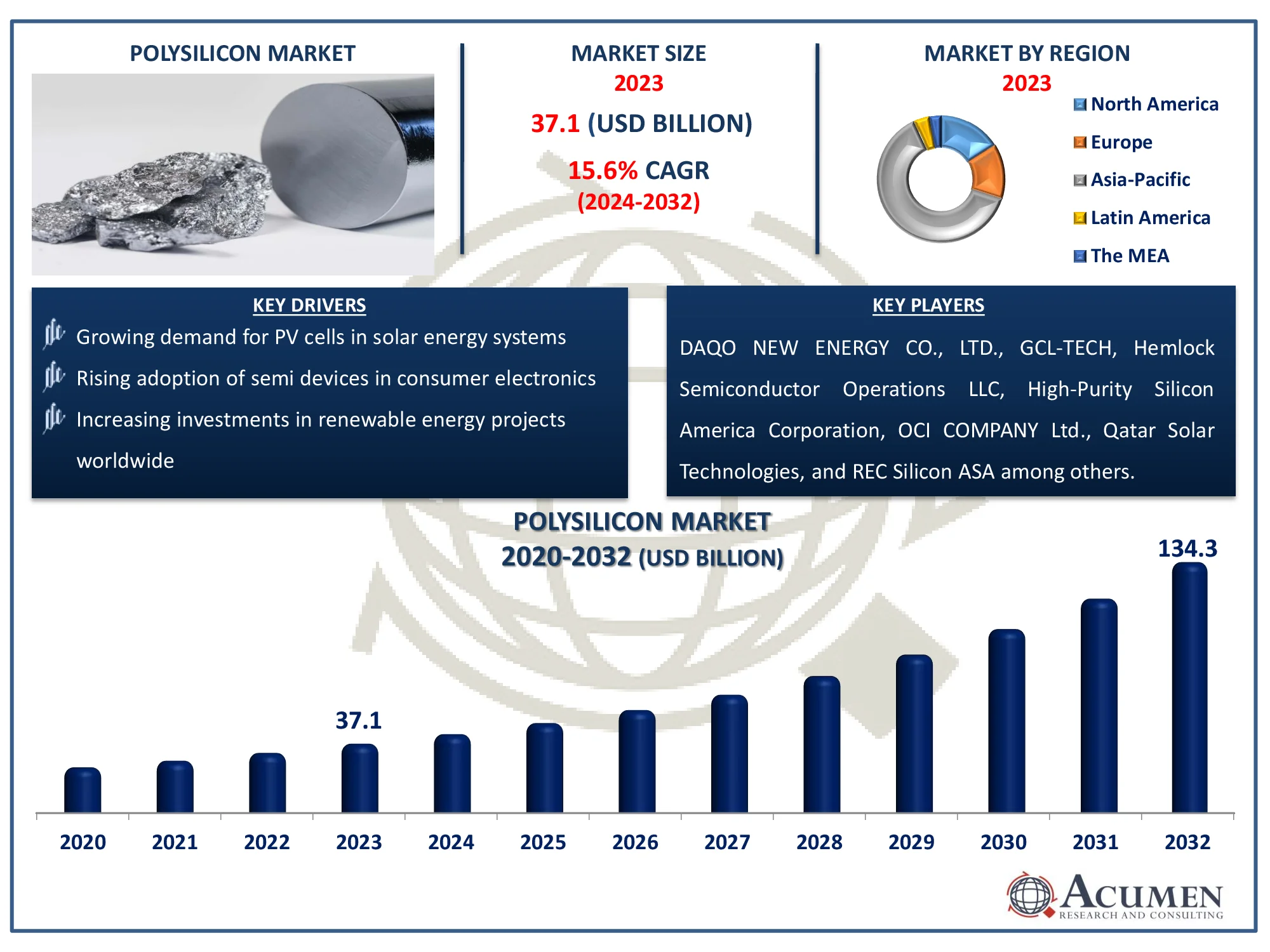

The Global Polysilicon Market Size accounted for USD 37.1 Billion in 2023 and is estimated to achieve a market size of USD 134.3 Billion by 2032 growing at a CAGR of 15.6% from 2024 to 2032.

Polysilicon Market Highlights

- The global polysilicon market is anticipated to reach USD 134.3 billion by 2032, with a CAGR of 15.6% from 2024 to 2032

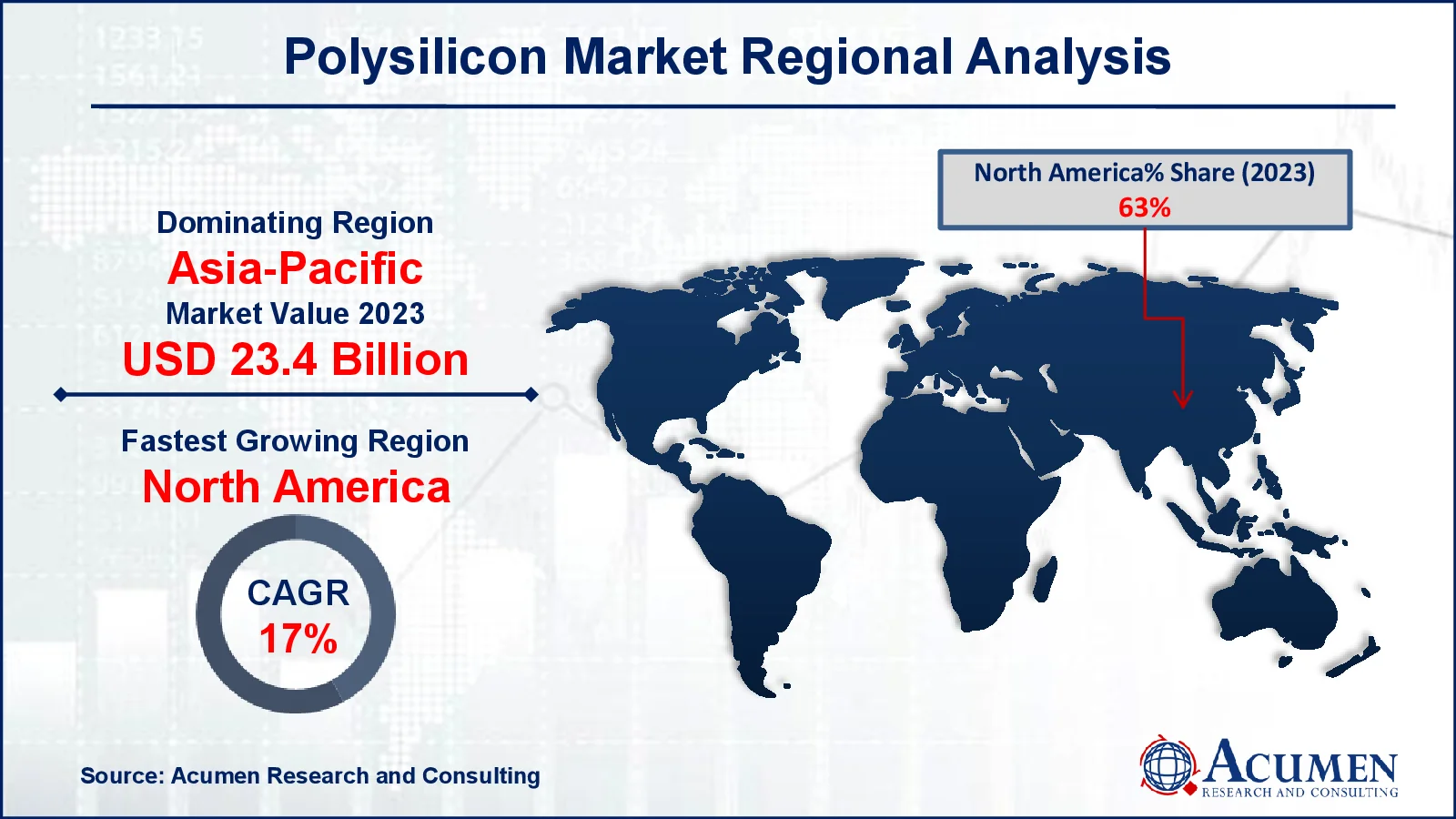

- In 2023, the polysilicon market in Asia-Pacific was valued at approximately USD 23.4 billion

- The North America polysilicon market is expected to experience a CAGR exceeding 17% from 2024 to 2032

- Based on application, the solar PV sub-segment achieved over USD 28.2 billion revenue in 2023

- Electronics (semiconductor) application is expected to reach over 16% CAGR throughout 2024 to 2032

- Increasing shift toward ultra-high-purity polysilicon production is a popular polysilicon market trend that fuels the industry demand

Polysilicon or polycrystalline silicon is a type of silicon containing multiple small silicon crystals obtained from quartzite a rock that contains high crystalline silicon. As a p-type and n-type material, polysilicon is widely used in solar and electronics industries because of its energy generation capability, which is almost equivalent to that of monocrystalline silicon. In solar applications, polysilicon is used in the production of solar cells found in photovoltaic (PV) panels that have the essential function of harnessing and transforming sunlight into electricity. In addition to solar, polysilicon is used in making semiconductors, which form the basis of a wide variety of electronics, including mobile phones, laptops, automobiles and more.

Polysilicon production starts with large high purity silicon rods, which is then subjected through a series of processes in clean room in order to meet the required quality of material especially for application in sensitive instruments. The rods are further subdivided into small specific sizes and put in multicrystalline ingots and then processed into thin silicon wafers. These wafers are applied in semiconductors, and some of them are doped with other material such as aluminum, gallium, and magnesium to control the resistivity of the material. Due to these unique properties such as high insulation and high temperature, polysilicon is still widely used in enhancing the performance of electronics and renewable energy technologies. The use of high-purity polysilicon in these sectors is on the rise and this is the main driver of the global polysilicon market.

Global Polysilicon Market Dynamics

Market Drivers

- Growing demand for photovoltaic cells in solar energy systems

- Rising adoption of semiconductor devices in consumer electronics

- Increasing investments in renewable energy projects worldwide

Market Restraints

- High energy consumption and environmental impact of polysilicon production processes limit growth

- Volatile raw material costs create pricing challenges in the polysilicon industry

- Supply chain disruptions and geopolitical tensions affect polysilicon availability

Market Opportunities

- Advances in polysilicon purification techniques present cost and efficiency improvements

- Expanding electric vehicle (EV) industry increases demand for polysilicon-based electronic components

- Rising demand for high-purity polysilicon in emerging technologies offers market expansion potential

Polysilicon Market Report Coverage

| Market | Polysilicon Market |

| Polysilicon Market Size 2022 |

USD 37.1 Billion |

| Polysilicon Market Forecast 2032 | USD 134.3 Billion |

| Polysilicon Market CAGR During 2023 - 2032 | 15.6% |

| Polysilicon Market Analysis Period | 2020 - 2032 |

| Polysilicon Market Base Year |

2022 |

| Polysilicon Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | DAQO NEW ENERGY CO., LTD., GCL-TECH, Hemlock Semiconductor Operations LLC and Hemlock Semiconductor, L.L.C., High-Purity Silicon America Corporation, OCI COMPANY Ltd., Qatar Solar Technologies, REC Silicon ASA, Tokuyama Corporation, Tongwei Group Co., Ltd, Wacker Chemie AG, and Xinte Energy Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Polysilicon Market Insights

The polysilicon market is growing at an impressive rate mainly due to higher demand from the solar and semiconductor industries. In solar energy, polysilicon is used for production of PV cell and its demand has risen sharply due to increased government policies and support for renewable energy in order to reduce carbon emissions. Other government initiatives like India’s “Digital India” and other policies of global green energy, are also driving investment in solar structures that can be used for polysilicon in PV manufacturing. Furthermore, polysilicon has a high efficiency and purity that has made it to be used in the fabrication of crystalline silicon cells hence, directly contributing to the growth of solar power globally.

The polysilicon market is also benefited from the increasing digitalization process since it escalates the need for semiconductors in consumer electronics, automotive, telecommunications, and other industries. Due to the high thermal conductivity, low capacitance, and high voltage capacity, polysilicon is best suited for high efficient and high power density electronic devices like semiconductor devices. With the increase in pace of digitalization, the requirement of high-performing electronic parts, which can be fulfilled by polysilicon, is likely to boost the market even more. New opportunities are emerging for manufacturers and producers around the world due to increased government support for digital infrastructure and the use of polysilicon-based components.

Furthermore, the manufacturing technology of polysilicon has been improved; the cost of polysilicon has been reduced, which makes polysilicon cheaper for large applications. These have made it more popular in both solar and electronic uses making polysilicon a cheaper option in the market with good prospect. All these factors are expected to drive the polysilicon market as it is in tandem with global goals of decentralizing energy and embracing digitalization.

The global polysilicon market is subjected to some limitations, which mainly include high energy consumption and environmental issues of polysilicon production. The actual purification process is quite elaborate and very energy intensive, which means that many use sources from fossil energy hence the high carbon footprint and increased environmental concerns. Furthermore, the market of polysilicon is sensitive to the change of price of its raw materials, such as quartzite and carbon that can affect the production cost and the profit margin. Trade restrictions, including tariffs, that are in force and those that are threatened, especially between the main producing countries such as China, the US, and the EU add to supply chain disruptions and cost pressures. All these factors present difficulties in the continuous growth of the market and especially as environmental and regulatory pressures increase around the world.

Polysilicon Market Segmentation

The worldwide market for polysilicon is split based on application, and geography.

Polysilicon Types

- Solar PV

- Monocrystalline Solar Panel

- Multicrystalline Solar Panel

- Electronics (Semiconductor)

According to polysilicon industry analysis, solar PV segment gathered utmost market share in 2023. The global increase in the solar PV systems and systems like the Chinese, the US, and the various regions in Europe has also fueled the consumption of polysilicon. As per the statistic of the International Energy Agency, Solar PV generation recorded a new high of 270 T Wh in the year 2022, which is 26% higher than the previous year and touches nearly 1300 T Wh. This was the highest absolute increase in generation among all renewable technologies that year and the first time that solar had outstripped wind. The growth rate corresponds to the levels expected in the Net Zero Emissions by 2050 Scenario from 2023 to 2030. Similarly the IEA states that the Solar PV capacity additions received global investments of over USD 320 billion in 2022, an increase of over 20% in 2022. Investment in solar PV generation was 44.7% of the total electricity generation investment in 2022, which is more than three times the expenditure on all fossil fuel technologies.

Polysilicon Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Polysilicon Market Regional Analysis

The Asia Pacific region dominated the polysilicon market globally in 2023, with China as the market leader because of its high manufacturing capacity, export competence, and access to cheap labor and coal. According to the Oxford Institute of Energy Studies, China leads the world in solar power deployment, accounting for over one-third of global capacity. Since 2015, China has maintained this leadership position, adding 53 GW of solar power capacity in 2021-representing 40% of the global total. By the end of 2021, China’s total solar power capacity reached 307 GW. The country also dominates global solar manufacturing; in 2020, 67% of the world's solar PV modules were produced in China, along with a substantial share of global PV cell and polysilicon output. In 2021, solar power constituted 13% of China’s power capacity and generated around 4% of its electricity.

On the other hand, the North America market is expected to secure the highest CAGR in the polysilicon market due to the rising investments in the renewable energy and government policies that support solar power growth.

Polysilicon Market Players

Some of the top polysilicon companies offered in our report include DAQO NEW ENERGY CO., LTD., GCL-TECH, Hemlock Semiconductor Operations LLC and Hemlock Semiconductor, L.L.C., High-Purity Silicon America Corporation, OCI COMPANY Ltd., Qatar Solar Technologies, REC Silicon ASA, Tokuyama Corporation, Tongwei Group Co., Ltd, Wacker Chemie AG, and Xinte Energy Co., Ltd.

Frequently Asked Questions

How big is the Polysilicon market?

The Polysilicon market size was valued at USD 37.1 Billion in 2023.

What is the CAGR of the global Polysilicon market from 2024 to 2032?

The CAGR of Polysilicon is 15.6% during the analysis period of 2024 to 2032.

Which are the key players in the Polysilicon market?

The key players operating in the global market are including DAQO NEW ENERGY CO., LTD., GCL-TECH, Hemlock Semiconductor Operations LLC and Hemlock Semiconductor, L.L.C., High-Purity Silicon America Corporation, OCI COMPANY Ltd., Qatar Solar Technologies, REC Silicon ASA, Tokuyama Corporation, Tongwei Group Co., Ltd, Wacker Chemie AG, and Xinte Energy Co., Ltd.

Which region dominated the global Polysilicon market share?

Asia-Pacific held the dominating position in Polysilicon industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of Polysilicon during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Polysilicon industry?

The current trends and dynamics in the polysilicon industry include growing demand for photovoltaic cells in solar energy systems, rising adoption of semiconductor devices in consumer electronics, and increasing investments in renewable energy projects worldwide.

Which application held the maximum share in 2023?

The Solar PV application held the maximum share of the polysilicon industry