Polysilicon Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

CHAPTER 1. Industry Overview of Polysilicon Market

1.1. Definition and Scope

1.1.1. Definition of Polysilicon

1.1.2. Market Segmentation

1.1.3. Years Considered for the Study

1.1.4. Assumptions and Acronyms Used

1.1.4.1. Market Assumptions and Market Forecast

1.1.4.2. Acronyms Used in Global Polysilicon Market

1.2. Summary

1.2.1. Executive Summary

1.2.2. Polysilicon Market By Application

1.2.3. Polysilicon Market By Region

CHAPTER 2. Research Approach

2.1. Methodology

2.1.1. Research Programs

2.1.2. Market Size Estimation

2.1.3. Market Breakdown and Data Triangulation

2.2. Data Source

2.2.1. Secondary Sources

2.2.2. Primary Sources

CHAPTER 3. Market Dynamics And Competition Analysis

3.1. Market Drivers

3.1.1. Driver 1

3.1.2. Driver 2

3.2. Restraints and Challenges

3.2.1. Restraint 1

3.2.2. Restraint 2

3.2.3. Restraint 3

3.3. Growth Opportunities

3.3.1. Opportunity 1

3.3.2. Opportunity 2

3.3.3. Opportunity 3

3.4. Porter’s Five Forces Analysis

3.4.1. Bargaining Power of Suppliers

3.4.2. Bargaining Power of Buyers

3.4.3. Threat of Substitute

3.4.4. Threat of New Entrants

3.4.5. Degree of Competition

3.5. Market Concentration Ratio and Market Maturity Analysis of Polysilicon Market

3.5.1. Go To Market Strategy

3.5.1.1. Introduction

3.5.1.2. Growth

3.5.1.3. Maturity

3.5.1.4. Saturation

3.5.1.5. Possible Development

3.6. Technological Roadmap for Polysilicon Market

3.7. Value Chain Analysis

3.7.1. List of Key Manufacturers

3.7.2. List of Customers

3.7.3. Level of Integration

3.8. Cost Structure Analysis

3.8.1. Price Trend of Key Raw Materials

3.8.2. Raw Material Suppliers

3.8.3. Proportion of Manufacturing Cost Structure

3.8.3.1. Raw Material

3.8.3.2. Labor Cost

3.8.3.3. Manufacturing Expense

3.9. Regulatory Compliance

3.10. Competitive Landscape, 2023

3.10.1. Player Positioning Analysis

3.10.2. Key Strategies Adopted By Leading Players

CHAPTER 4. Manufacturing Plant Analysis

4.1. Manufacturing Plant Location and Establish Date of Major Manufacturers in 2023

4.2. R&D Status of Major Manufacturers in 2023

CHAPTER 5. Polysilicon Market By Application

5.1. Introduction

5.2. Polysilicon Revenue By Application

5.2.1. Polysilicon Revenue (USD Million) and Forecast, By Application, 2020-2032

5.2.2. Solar PV

5.2.2.1. Solar PV Market Revenue (USD Million) and Growth Rate (%), 2020-2032

5.2.3. Monocrystalline Solar Panel

5.2.3.1. Monocrystalline Solar Panel Market Revenue (USD Million) and Growth Rate (%), 2020-2032

5.2.4. Multicrystalline Solar Panel

5.2.4.1. Multicrystalline Solar Panel Market Revenue (USD Million) and Growth Rate (%), 2020-2032

5.2.5. Electronics (Semiconductor)

5.2.5.1. Electronics (Semiconductor) Market Revenue (USD Million) and Growth Rate (%), 2020-2032

CHAPTER 6. North America Polysilicon Market By Country

6.1. North America Polysilicon Market Overview

6.2. U.S.

6.2.1. U.S. Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

6.3. Canada

6.3.1. Canada Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

6.4. North America PEST Analysis

CHAPTER 7. Europe Polysilicon Market By Country

7.1. Europe Polysilicon Market Overview

7.2. U.K.

7.2.1. U.K. Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

7.3. Germany

7.3.1. Germany Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

7.4. France

7.4.1. France Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

7.5. Spain

7.5.1. Spain Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

7.6. Rest of Europe

7.6.1. Rest of Europe Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

7.7. Europe PEST Analysis

CHAPTER 8. Asia Pacific Polysilicon Market By Country

8.1. Asia Pacific Polysilicon Market Overview

8.2. China

8.2.1. China Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

8.3. Japan

8.3.1. Japan Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

8.4. India

8.4.1. India Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

8.5. Australia

8.5.1. Australia Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

8.6. South Korea

8.6.1. South Korea Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

8.7. Rest of Asia-Pacific

8.7.1. Rest of Asia-Pacific Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

8.8. Asia Pacific PEST Analysis

CHAPTER 9. Latin America Polysilicon Market By Country

9.1. Latin America Polysilicon Market Overview

9.2. Brazil

9.2.1. Brazil Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

9.3. Mexico

9.3.1. Mexico Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

9.4. Rest of Latin America

9.4.1. Rest of Latin America Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

9.5. Latin America PEST Analysis

CHAPTER 10. Middle East & Africa Polysilicon Market By Country

10.1. Middle East & Africa Polysilicon Market Overview

10.2. GCC

10.2.1. GCC Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

10.3. South Africa

10.3.1. South Africa Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

10.4. Rest of Middle East & Africa

10.4.1. Rest of Middle East & Africa Polysilicon Revenue (USD Million) and Forecast By Application, 2020-2032

10.5. Middle East & Africa PEST Analysis

CHAPTER 11. Player Analysis Of Polysilicon Market

11.1. Polysilicon Market Company Share Analysis

11.2. Competition Matrix

11.2.1. Competitive Benchmarking of key players by price, presence, market share, and R&D investment

11.2.2. New Product Launches and Product Enhancements

11.2.3. Mergers And Acquisition In Global Polysilicon Market

11.2.4. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements

CHAPTER 12. Company Profile

12.1. DAQO NEW ENERGY CO., LTD.

12.1.1. Company Snapshot

12.1.2. Business Overview

12.1.3. Financial Overview

12.1.3.1. Revenue (USD Million), 2023

12.1.3.2. DAQO NEW ENERGY CO., LTD., 2023 Polysilicon Business Regional Distribution

12.1.4. Product /Service and Specification

12.1.5. Recent Developments & Business Strategy

12.2. GCL-TECH

12.3. Hemlock Semiconductor Operations LLC and Hemlock Semiconductor, L.L.C.

12.4. High-Purity Silicon America Corporation

12.5. OCI COMPANY Ltd.

12.6. Qatar Solar Technologies

12.7. REC Silicon ASA

12.8. Tokuyama Corporation

12.9. Tongwei Group Co., Ltd

12.10. Wacker Chemie AG

12.11. Xinte Energy Co., Ltd.

Frequently Asked Questions

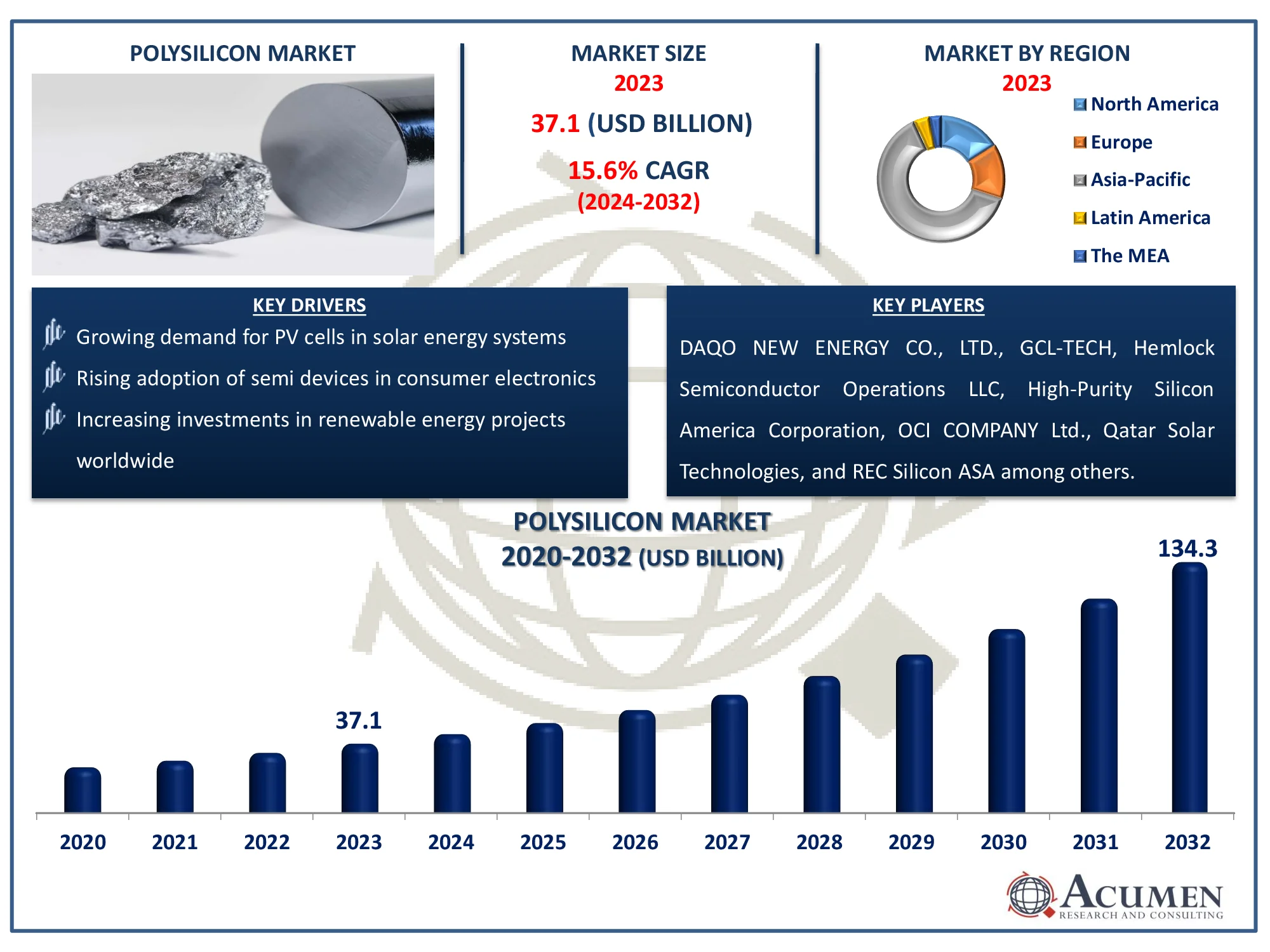

How big is the Polysilicon market?

The Polysilicon market size was valued at USD 37.1 Billion in 2023.

What is the CAGR of the global Polysilicon market from 2024 to 2032?

The CAGR of Polysilicon is 15.6% during the analysis period of 2024 to 2032.

Which are the key players in the Polysilicon market?

The key players operating in the global market are including DAQO NEW ENERGY CO., LTD., GCL-TECH, Hemlock Semiconductor Operations LLC and Hemlock Semiconductor, L.L.C., High-Purity Silicon America Corporation, OCI COMPANY Ltd., Qatar Solar Technologies, REC Silicon ASA, Tokuyama Corporation, Tongwei Group Co., Ltd, Wacker Chemie AG, and Xinte Energy Co., Ltd.

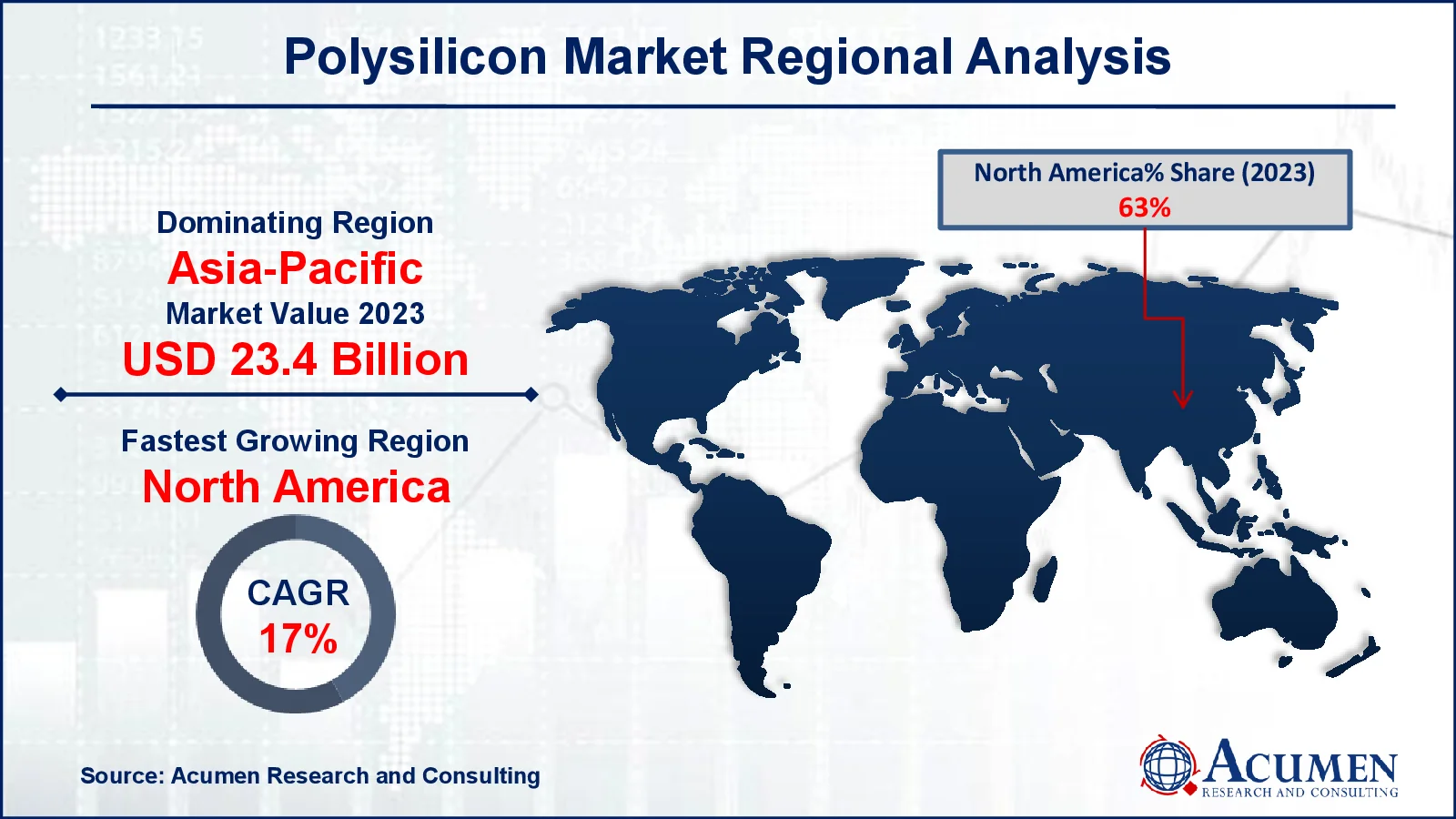

Which region dominated the global Polysilicon market share?

Asia-Pacific held the dominating position in Polysilicon industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of Polysilicon during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Polysilicon industry?

The current trends and dynamics in the polysilicon industry include growing demand for photovoltaic cells in solar energy systems, rising adoption of semiconductor devices in consumer electronics, and increasing investments in renewable energy projects worldwide.

Which application held the maximum share in 2023?

The Solar PV application held the maximum share of the polysilicon industry

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date