Polymer Foam Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Polymer Foam Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Polymer Foam Market Size accounted for USD 141.8 Billion in 2023 and is estimated to achieve a market size of USD 239.2 Billion by 2032 growing at a CAGR of 6.1% from 2024 to 2032.

Polymer Foam Market Highlights

- Global polymer foam market revenue is poised to garner USD 239.2 billion by 2032 with a CAGR of 6.1% from 2024 to 2032

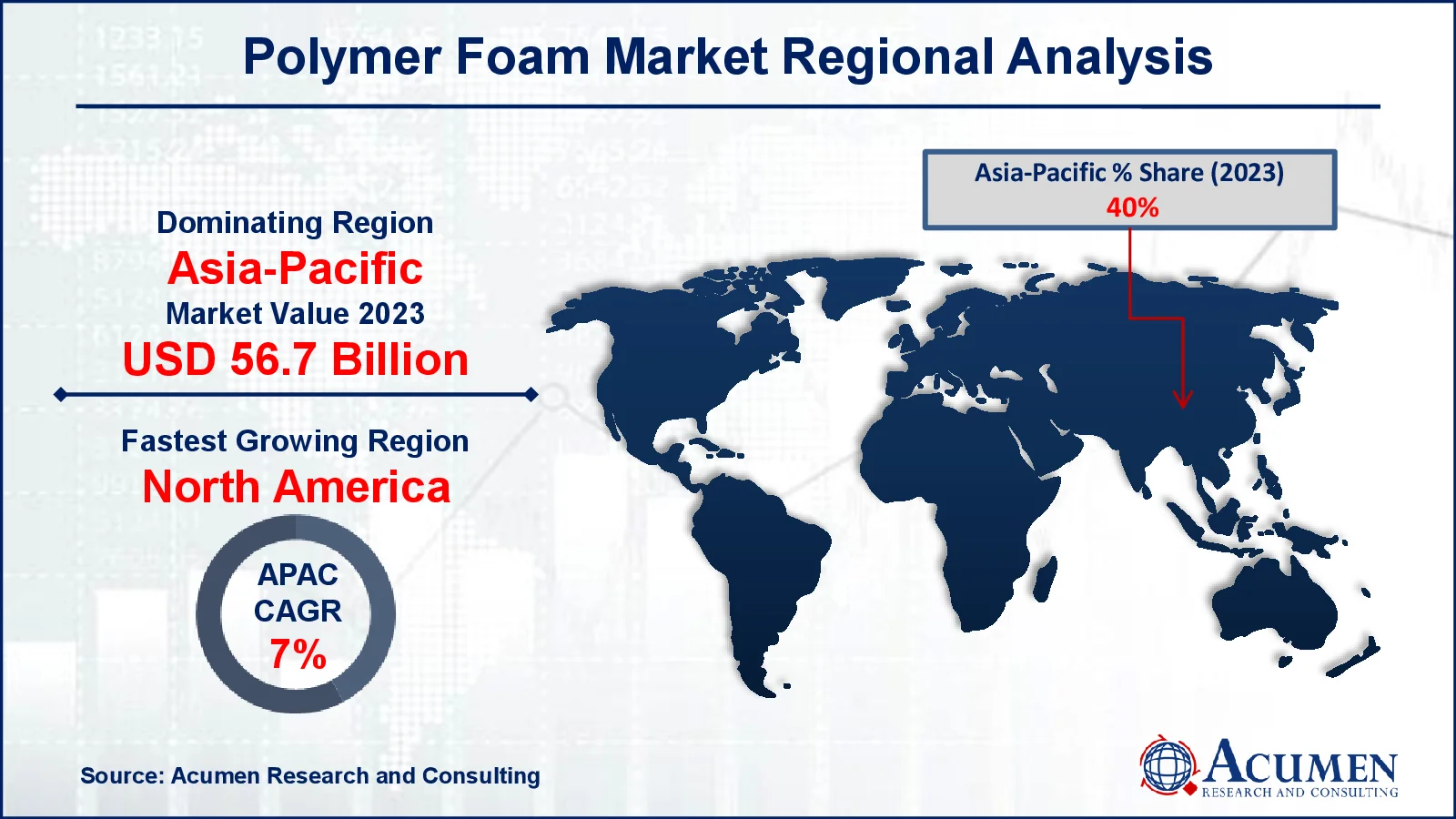

- Asia-Pacific polymer foam market value occupied around USD 56.7 billion in 2023

- North America polymer foam market growth will record a CAGR of more than 7% from 2024 to 2032

- Among type, the polystyrene (PS) sub-segment generated around USD 120.5 billion revenue in 2023

- Based on application, the building & constructions sub-segment generated 35% polymer foam market share in 2023

- Development of new applications in sports and recreational products is a popular polymer foam market trend that fuels the industry demand

Polymer foam is a lightweight material made from polymers, characterized by its porous structure filled with gas bubbles. These foams are created through processes such as extrusion, molding, or chemical reactions, which introduce air or other gases into the polymer matrix, forming a cellular structure. Polymer foams can be classified into two main types: open-cell and closed-cell. Open-cell foams have interconnected pores, providing flexibility and breathability, while closed-cell foams have sealed cells, offering better insulation and water resistance. Commonly used in packaging, insulation, and cushioning applications, polymer foams are valued for their low density, thermal insulation, and shock absorption properties. They are found in everyday products like mattresses, automotive parts, and electronic device packaging. The material’s versatility and customizable properties make it a popular choice across various industries.

Global Polymer Foam Market Dynamics

Market Drivers

- Increasing demand for lightweight materials in automotive and aerospace sectors

- Growing construction industry focusing on energy-efficient and insulated buildings

- Rising consumer preference for eco-friendly and sustainable products

- Advancements in polymer foam technologies improving performance and applications

Market Restraints

- High production costs of advanced polymer foams

- Environmental concerns related to foam disposal and degradation

- Regulatory restrictions on certain types of polymer foams

Market Opportunities

- Expansion into emerging markets with growing infrastructure development

- Innovation in recycling technologies and biodegradable polymer foams

- Increased use of polymer foams in medical and healthcare applications

Polymer Foam Market Report Coverage

| Market | Polymer Foam Market |

| Polymer Foam Market Size 2022 |

USD 141.8 Billion |

| Polymer Foam Market Forecast 2032 | USD 239.2 Billion |

| Polymer Foam Market CAGR During 2023 - 2032 | 6.1% |

| Polymer Foam Market Analysis Period | 2020 - 2032 |

| Polymer Foam Market Base Year |

2022 |

| Polymer Foam Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Huntsman Corporation, BASF SE, Kaneka Corporation, Armacell International S.A., Sealed Air Corporation, DowDuPont, Inc., Rogers Corporation, Recticel, Covestro AG, and Arkema Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Polymer Foam Market Insights

The polymer foam market benefits significantly from the booming construction industry, particularly as the focus shifts toward energy-efficient and well-insulated buildings. Polymer foams, such as polyurethane and polystyrene foams, are widely used for thermal insulation in residential and commercial buildings. Their excellent insulating properties help reduce energy consumption by minimizing heat loss or gain, which aligns with global trends toward sustainable construction practices. Governments and organizations are increasingly implementing regulations and incentives to improve energy efficiency in buildings, further boosting the demand for polymer foams in this sector.

A major constraint in the polymer foam market is the high production costs associated with advanced foam technologies. Advanced polymer foams, which offer superior performance in terms of insulation, durability, and environmental resistance, often involve complex manufacturing processes and expensive raw materials. These high costs can limit their adoption, especially in price-sensitive markets. Additionally, the initial investment required for advanced production equipment and technology can be substantial, posing a financial barrier for manufacturers and potentially increasing the end product's cost for consumers.

The growing application of polymer foams in the medical and healthcare sectors presents a significant opportunity for market expansion. Polymer foams are used in various medical devices, including cushioning for prosthetics, orthopedic supports, and wound care products. Their ability to provide comfort, support, and protection makes them valuable in medical settings. With advancements in foam technology, including biocompatible and antimicrobial properties, the potential applications in healthcare continue to expand. This growth is driven by increasing demand for innovative and high-quality medical products, offering manufacturers new avenues for revenue and polymer foam market development.

Polymer Foam Market Segmentation

The worldwide market for polymer foam is split based on type, application, and geography.

Polymer Foam Types

- Polyethylene (PE)

- Polyurethane (PU)

- Polystyrene (PS)

- Polypropylene (PP)

- Ethylene-Vinyl Acetate (EVA)

- Others

According to polymer foam industry analysis, the polystyrene (PS) segment stands out as the largest due to its widespread use and versatility. PS foams, including expanded polystyrene (EPS) and extruded polystyrene (XPS), are extensively utilized in construction for insulation, packaging for protection, and consumer goods. Their cost-effectiveness, ease of processing, and excellent thermal insulation properties contribute to their dominant position in the polymer foam market.

The polyurethane (PU) segment also holds a notable share during the polymer foam market forecast period, driven by its superior flexibility and durability. PU foams are used in a variety of applications, including automotive seating, furniture cushioning, and industrial insulation. Their adaptability to different densities and firmness levels makes them highly versatile. Advances in PU foam technology, such as improved flame retardancy and environmental resistance, have further solidified their role in diverse sectors.

Together, PS and PU foams cater to a broad range of industries, with PS leading due to its extensive use in insulation and packaging, while PU contributes significantly due to its wide-ranging applications in comfort and structural support. This dynamic positions both segments as key players in the polymer foam market.

Polymer Foam Applications

- Packaging

- Building & Constructions

- Furniture & Bedding

- Automotive

- Rail

- Wind

- Marine

- Others

The polymer foam market encompasses various applications, among which the building & construction segment stands out prominently. Polymer foams are utilized extensively in this sector due to their beneficial properties such as lightweight, thermal insulation, sound insulation, and energy efficiency. These foams are made from a variety of polymers, including polyurethane, polystyrene, and polyethylene, each offering distinct advantages. In building and construction, polymer foams are primarily used for insulation purposes. They help in maintaining temperature by reducing heat transfer, thereby enhancing energy efficiency and reducing heating and cooling costs. This makes them an ideal material for insulating walls, roofs, and floors in residential, commercial, and industrial buildings. Additionally, their sound insulation properties make them suitable for use in acoustic panels and soundproofing applications.

Another significant application is in structural components. Polymer foams provide strength and rigidity while remaining lightweight, making them ideal for use in structural insulated panels (SIPs) and insulated concrete forms (ICFs). They are also used in cavity wall insulation and under-slab insulation to prevent heat loss and moisture ingress. Furthermore, polymer foams are employed in decorative applications, such as moldings and trim, due to their versatility and ease of shaping. They can be molded into various shapes and sizes, allowing for customized designs and finishes.

Polymer Foam Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Polymer Foam Market Regional Analysis

In terms of polymer foam market analysis, Asia-Pacific was the largest region, accounting for a significant share of the global revenue. The positive outlook for the manufacturing industry, driven by a growing focus on research and development along with favorable government initiatives to attract investments, is expected to result in regional market expansion. The rapidly expanding automotive and packaging industries in emerging economies such as India and China are also expected to drive regional growth. Additionally, increasing foreign direct investment is anticipated to contribute to market development.

North America region is the growing over the polymer foam industry forecast period. The U.S. regional market was driven by the growing demand for polyurethane (PU) and polystyrene foam in building and construction and marine applications, and PVC foam in wind energy applications. According to the U.S. Department of Housing and Urban Development, the rise in new residential housing completions has led to increased demand for PU foam in the building and construction sector.

Polymer Foam Market Players

Some of the top polymer foam companies offered in our report include Huntsman Corporation, BASF SE, Kaneka Corporation, Armacell International S.A., Sealed Air Corporation, DowDuPont, Inc., Rogers Corporation, Recticel, Covestro AG, and Arkema Group.

Frequently Asked Questions

How big is the polymer foam market?

The polymer foam market size was valued at USD 141.8 billion in 2023.

What is the CAGR of the global polymer foam market from 2024 to 2032?

The CAGR of polymer foam is 6.1% during the analysis period of 2024 to 2032.

The CAGR of polymer foam is 6.1% during the analysis period of 2024 to 2032.

The key players operating in the global market are including Huntsman Corporation, BASF SE, Kaneka Corporation, Armacell International S.A., Sealed Air Corporation, DowDuPont, Inc., Rogers Corporation, Recticel, Covestro AG, and Arkema Group.

Which region dominated the global polymer foam market share?

Asia-Pacific held the dominating position in polymer foam industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of polymer foam during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global polymer foam industry?

The current trends and dynamics in the polymer foam industry include increasing demand for lightweight materials in automotive and aerospace sectors, growing construction industry focusing on energy-efficient and insulated buildings, rising consumer preference for eco-friendly and sustainable products, and advancements in polymer foam technologies improving performance and applications.

Which application held the maximum share in 2023?

The building & constructions application held the maximum share of the polymer foam industry.