Polyethylene Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Polyethylene Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Polyethylene Market Size accounted for USD 114.8 Billion in 2022 and is estimated to achieve a market size of USD 180.6 Billion by 2032 growing at a CAGR of 4.7% from 2023 to 2032.

Polyethylene Market Highlights

- Global polyethylene market revenue is poised to garner USD 180.6 billion by 2032 with a CAGR of 4.7% from 2023 to 2032

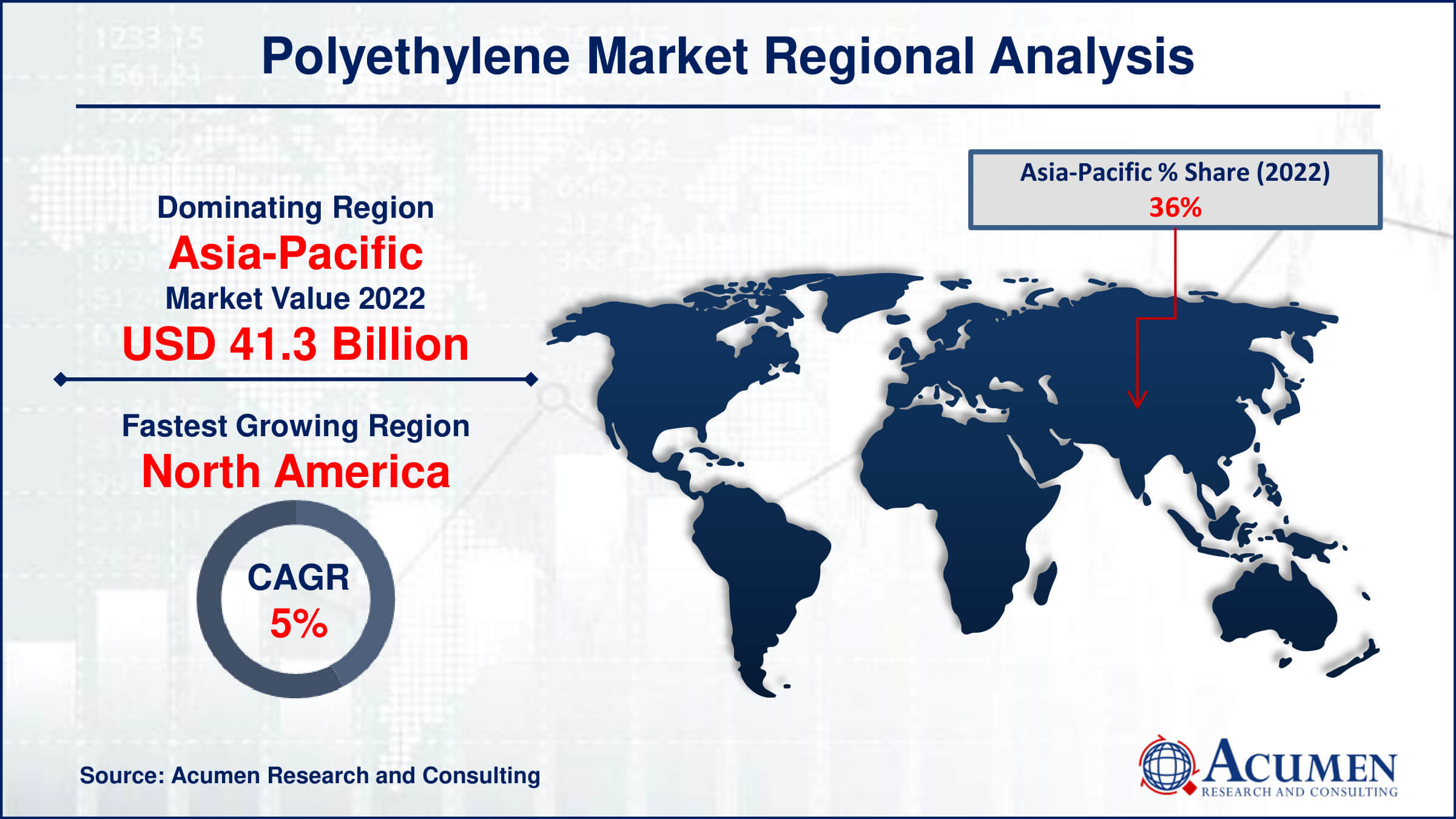

- Asia-Pacific polyethylene market value occupied around USD 41.3 billion in 2022

- North America polyethylene market growth will record a CAGR of more than 5% from 2023 to 2032

- Among product, the high-density polyethylene (HDPE) sub-segment generated noteworthy revenue in 2022

- Based on application, the packaging sub-segment generated around 51% share in 2022

- Growing focus on circular economy principles and recycling initiatives is a popular polyethylene market trend that fuels the industry demand

.jpg)

Polyethylene is a thermoplastic polymer that finds extensive usage in many applications owing to its cost-effectiveness, resilience, and adaptability. Plastic bags, containers, pipelines, and packaging materials are frequently made with it. Globally, the polyethylene market is expanding rapidly. Growing demand for packaging materials, especially in the food and beverage sector, is driving the market. Additionally, the need for polyethylene in pipes and other building applications is fueled by rising construction activity, particularly in emerging nations. The market is further propelled by the transition to sustainable and lightweight materials. Innovations in recycling technology are helping the polyethylene market to grow sustainably in spite of environmental concerns. The market is expected to grow significantly in the polyethylene industry forecast period as long as companies are looking for cost-effective and environmentally friendly solutions.

Global Polyethylene Market Dynamics

Market Drivers

- Growing demand for packaging materials in the food and beverage industry

- Increasing construction activities driving demand for polyethylene in infrastructure

- Rise in the adoption of lightweight materials in various applications

- Ongoing innovations in recycling technologies for sustainable polyethylene solutions

Market Restraints

- Environmental concerns regarding plastic waste

- Fluctuating raw material prices impacting production costs

- Regulatory challenges related to plastic usage and disposal

Market Opportunities

- Expansion of polyethylene applications in the healthcare sector

- Technological advancements for enhanced polyethylene properties

- Rising demand for eco-friendly and bio-based polyethylene products

Polyethylene Market Report Coverage

| Market | Polyethylene Market |

| Polyethylene Market Size 2022 | USD 114.8 Billion |

| Polyethylene Market Forecast 2032 | USD 180.6 Billion |

| Polyethylene Market CAGR During 2023 - 2032 | 4.7% |

| Polyethylene Market Analysis Period | 2020 - 2032 |

| Polyethylene Market Base Year |

2022 |

| Polyethylene Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled Construction & Building | Zotefoams Plc., Armacell, JSP, The Dow Chemical Company, Sealed Air Corporation, INOAC Corporation, Thermotec, Wisconsin Foam Products, Trecolan GmbH, and PAR Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Polyethylene Market Insights

The flourishing automotive sector worldwide, coupled with manufacturers' focus on reducing vehicle weight, is driving the demand for polyethylene (PE), a major factor expected to fuel the global market's growth. The gradual increase in passenger vehicle sales in developing countries, with manufacturers prioritizing weight reduction, further contributes to the demand for PE. Rapid advancements in packaging technology and the growing e-commerce sector in developing countries are fostering demand for smart and reliable packaging solutions, another critical factor supporting the market's growth. Additionally, major players' emphasis on new product launches to expand customer bases is expected to contribute to the global market's growth.

In 2019, Toppan Printing Co., Ltd. introduced GL-X-LE, a PE barrier film for mono-material packaging, catering to products such as dry baby food, beef jerky, and granola bars. This move is anticipated to broaden the company's product portfolio and enhance its customer base.

Major players are actively pursuing business development through strategic mergers and acquisitions to augment their product portfolios and increase profit ratios. For instance, in 2019, Chevron Phillips Chemical Co. acquired Nova Chemicals Corp., a chemical manufacturing company with seven manufacturing sites in Canada and the United States. This acquisition aims to strengthen the company's position in the PE market in North America.

However, factors such as fluctuating raw material prices and stringent government regulations related to product approval are expected to hinder the growth of the global polyethylene (PE) market. Additionally, rising environmental safety regulations and rules regarding PE production pose challenges to the target market's growth.

Innovative product offerings by major players and a focus on the development of bio-based and bio-degradable polyethylene are factors creating new opportunities for players in the target market over the forecast polyethylene market forecast period. Furthermore, players' interest in emerging economies, driven by the easy availability of raw materials and low-cost labor, is expected to further support revenue growth in the target market.

Polyethylene Market Segmentation

The worldwide market for polyethylene is split based on product, technology, application, and geography.

Polyethylene PE Market by Products

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

Accordning to the polyethylene industry analysis, the market is expected to be dominated by the high-density polyethylene (HDPE) segment owing to its advantageous features and extensive uses. High strength to density polyethylene (HDPE) is widely recognised for its exceptional chemical resistance, longevity, and suitability for a wide range of applications. The packaging, building, automotive, and infrastructure sectors all make substantial use of it. Its expanding demand is partly due to its adaptability and recyclable nature. The growing need for effective packaging solutions and the growing emphasis on lightweight materials in the automotive industry both contribute to the HDPE segment's dominance. HDPE is well-positioned to hold the top spot in the polyethylene industry thanks to its many applications and advantageous market conditions.

Polyethylene PE Market by Technologies

- Blow Molding

- Pipe Extrusion

- Films & Sheet extrusion

- Injection molding

- Others

Blow moulding technology is widely used in the packaging industry to manufacture bottles, containers, and other hollow products. Its adaptability for various sizes and capacities makes it suitable for both large- and small-scale production. The rising demand for packaging solutions, particularly in the food and beverage industry, positions blow moulding as a dominant technology in the Polyethylene Market, with the potential for continued growth and market leadership. The blow moulding segment is expected to be the largest in the polyethylene market due to its versatile applications and efficiency in producing a variety of plastic products.

Polyethylene PE Market by Applications

- Packaging

- Construction

- Automotive

- Electrical and Electronics

- Household Appliances

- Consumer Goods

- Agriculture

- Pharmaceuticals

The growing need for adaptable and effective packaging solutions across a range of sectors is driving the growth of the packaging segment in the polyethylene market. Polyethylene is a material of choice for packaging purposes because of its flexibility, strength, and low weight. Polyethylene is widely utilised in the food and beverage sector for packaging materials such as films, bottles, and containers. Its extensive application in packaging for online sales adds to the packaging segment's supremacy. Polyethylene's recyclability adds to its popularity as consumer preferences move towards convenient and environmental packaging. The packaging category is positioned as a major driver for the growth of the polyethylene market due to the ongoing increase in the global packaging industry, which is being driven by e-commerce trends.

Polyethylene Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Polyethylene Market Regional Analysis

In terms of polyethylene market analysis, the Asia-Pacific area continues to be the greatest market for polyethylene due to its strong economic growth, urbanization, and industrialization. China, in particular, is crucial because of its expanding middle class and robust manufacturing sector, which are driving up consumer expectations. The region's position in a number of end-use industries, including packaging, construction, agriculture, and the automobile industry, further emphasizes its supremacy in the polyethylene market. The demand for affordable and lightweight materials, along with the quick growth of these industries, greatly influences the polyethylene market share in the region.

On the other hand, the polyethylene market shows that North America is expanding at the quickest rate. Particularly in the United States, significant development is being observed due to improvements in manufacturing technology, creative packaging solutions, and an increase in construction activity. The region's dedication to environmentally friendly activities, such as recycling polyethylene products, is in line with the increased emphasis on environmental responsibility around the world. Furthermore, North America is leading the Polyethylene market's expansion and is a significant player in the changing industrial landscape due to the strong demand for Polyethylene in a variety of applications, including packaging and automotive components.

Polyethylene Market Players

Some of the top polyethylene companies offered in our report includes Zotefoams Plc., Armacell, JSP, The Dow Chemical Company, Sealed Air Corporation, INOAC Corporation, Thermotec, Wisconsin Foam Products, Trecolan GmbH, and PAR Group.

Frequently Asked Questions

How big is the polyethylene market?

The polyethylene market size was valued at USD 114.8 billion in 2022.

What is the CAGR of the global polyethylene market from 2023 to 2032?

The CAGR of polyethylene is 4.7% during the analysis period of 2023 to 2032.

Which are the key players in the polyethylene market?

The key players operating in the global market are including Zotefoams Plc., Armacell, JSP, The Dow Chemical Company, Sealed Air Corporation, INOAC Corporation, Thermotec, Wisconsin Foam Products, Trecolan GmbH, and PAR Group.

Which region dominated the global polyethylene market share?

Asia-Pacific held the dominating position in polyethylene industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of polyethylene during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global polyethylene industry?

The current trends and dynamics in the polyethylene industry include growing demand for packaging materials in the food and beverage industry, increasing construction activities driving demand for polyethylene in infrastructure, rise in the adoption of lightweight materials in various applications, and ongoing innovations in recycling technologies for sustainable polyethylene solutions.

Which application held the maximum share in 2022?

The packaging application held the maximum share of the polyethylene industry.