Plant Based Protein Supplements Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Plant Based Protein Supplements Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

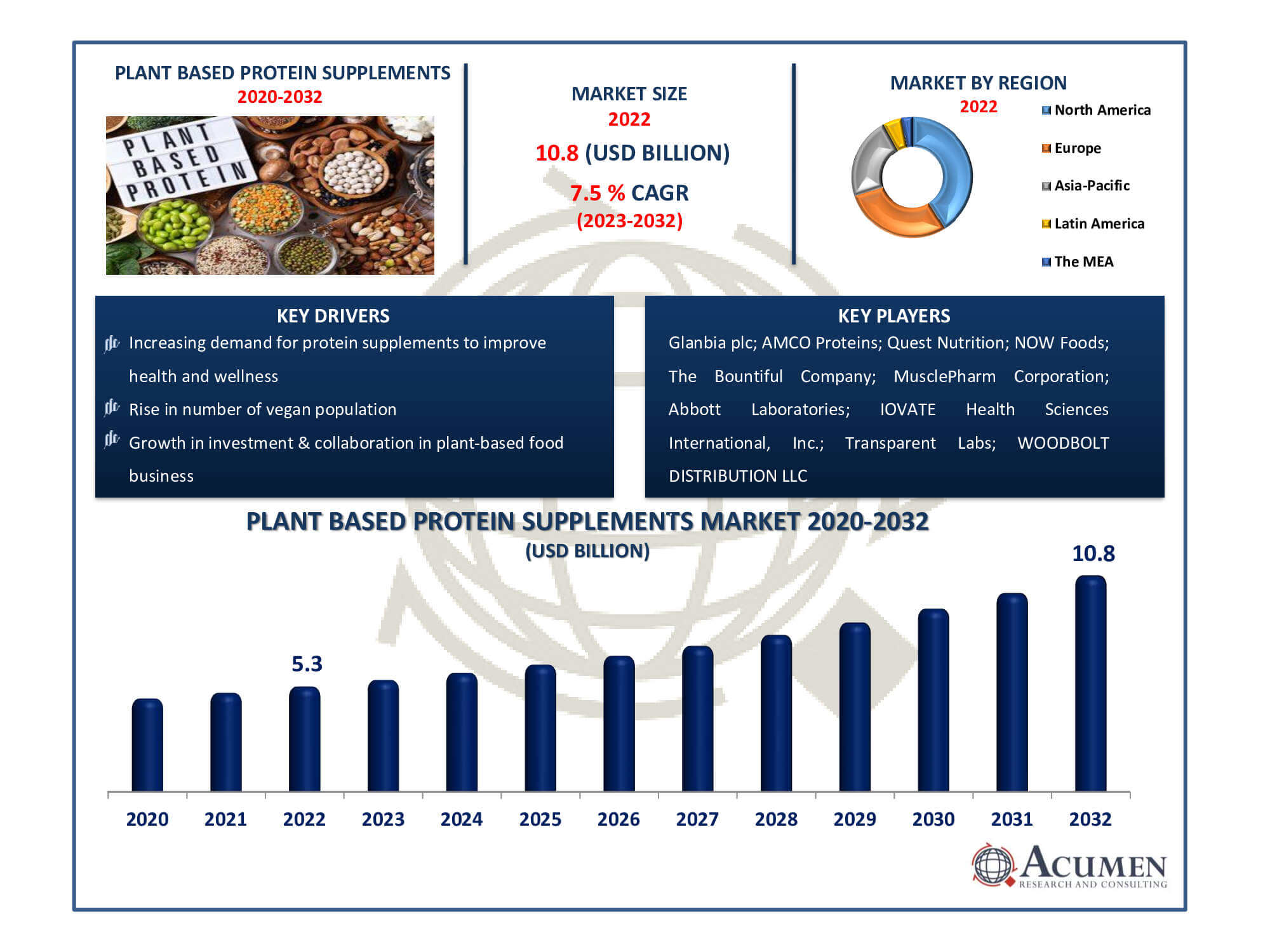

The Global Plant Based Protein Supplements Market Size accounted for USD 5.3 Billion in 2022 and is estimated to achieve a market size of USD 10.8 Billion by 2032 growing at a CAGR of 7.5% from 2023 to 2032.

Plant Based Protein Supplements Market Highlights

- Global plant based protein supplements market revenue is poised to garner USD 10.8 billion by 2032 with a CAGR of 7.5% from 2023 to 2032

- North America plant-based protein supplements market value occupied around USD 2.2 billion in 2022

- Asia-Pacific plant based protein supplements market growth will record a CAGR of more than 8.6% from 2023 to 2032

- Among product, the protein powder sub-segment generated over US$ 2.3 billion revenue in 2022

- Based on distribution channel, the online stores sub-segment generated around 60% share in 2022

- Focus on aquatic plants as new & emerging sources of protein is a popular plant based protein supplements market trend that fuels the industry demand

The plant-based protein supplements market is expanding rapidly as customers increasingly turn to plant-derived sources for their nutritional requirements. These supplements are made from soy, pea, hemp, spirulina, pumpkin seeds, and rice, and they provide a more sustainable and ethical alternative to animal-based protein products. The market is being driven by increased global demand for vegan and vegetarian products, with e-commerce playing an important role in making them more accessible. Retail behemoths like Wal-Mart are pushing their suppliers to provide more plant-based options, indicating the market's potential for development. Furthermore, health-conscious consumers are switching to vegan diets to minimize their risk of cardiovascular disease and type 2 diabetes, which are linked to meat intake. The glutamic problems and lactose intolerance are also gaining popularity in the market.

Global Plant Based Protein Supplements Market Dynamics

Market Drivers

- Increasing demand for protein supplements to improve health and wellness

- Rise in number of vegan population

- Concerns about the environmental impact of meat production and animal agriculture

- Growth in investment & collaboration in plant-based food business

Market Restraints

- Presence of cheaper substitutes

- Plant-based protein supplements are more expensive

Market Opportunities

- Rise in number of millennial populations

- Develop convenient and sustainable packaging solutions to reduce environmental impact

- Rise of social media marketing

Plant Based Protein Supplements Market Report Coverage

| Market | Plant Based Protein Supplements Market |

| Plant Based Protein Supplements Market Size 2022 | USD 5.3 Billion |

| Plant Based Protein Supplements Market Forecast 2032 | USD 10.8 Billion |

| Plant Based Protein Supplements Market CAGR During 2023 - 2032 | 7.5% |

| Plant Based Protein Supplements Market Analysis Period | 2020 - 2032 |

| Plant Based Protein Supplements Market Base Year |

2022 |

| Plant Based Protein Supplements Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By Distribution Channel, By Raw Material, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Glanbia plc, AMCO Proteins, Quest Nutrition, NOW Foods, The Bountiful Company, MusclePharm Corporation, Abbott Laboratories, IOVATE Health Sciences International, Inc., Transparent Labs, and WOODBOLT DISTRIBUTION LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Plant Based Protein Supplements Market Insights

Growing concerns regarding the use of animal-based protein supplements have compelled manufacturers to develop human nutrition products derived from plant-based sources such as soy, spirulina, pumpkin seeds, hemp, peas, and rice.

The plant-based protein supplements market is expected to experience significant growth due to the increasing global demand for vegan products. The rapid expansion of e-commerce has contributed to the consumption of protein supplements. Walmart, as the largest retailer, is encouraging its suppliers to offer more plant-based items. Additionally, the rising concern for food safety in the food and beverage sector is driving the demand for high-quality food service and liquid packaging boards.

The growing importance of a vegan diet, driven by concerns about cardiovascular diseases and type 2 diabetes associated with the consumption of meat products, is expected to positively impact market growth. The global market is projected to witness substantial growth over the next eight years, driven by the increasing population of flexitarians in the United States and Canada, thanks to extensive campaigns promoting vegetarian diets through various media platforms.

Furthermore, the rising awareness of glutamic disorders and lactose intolerance among millennials in developed markets like Germany and the United States is expected to boost the consumption of soy and pea protein supplements. Many manufacturers distribute their products through various channels, including e-commerce portals, direct sales contracts, and supermarkets. These products are available in various forms, such as powder, liquids, ready-to-drink (RTD) options, and capsules.

Plant Based Protein Supplements Market Segmentation

The worldwide market for plant based protein supplements is split based on product, application, distribution channel, raw material, and geography.

Plant Based Protein Supplement Products

- Protein Powder

- Protein Bars

- Ready-to-Drink (RTD)

- Others

The protein powder category leads the plant-based protein supplements sector due to its diversity and ease. Protein powders are simple to add into a variety of dishes and beverages, giving consumers greater flexibility in their use. Furthermore, they are frequently regarded as a pure and concentrated source of plant-based protein, making them a favoured choice for people attempting to reach their daily protein intake targets. Protein powder's versatility and nutritional worth have catapulted it to market leadership.

Plant Based Protein Supplement Applications

- Sports Nutrition

- Additional Nutrition

Sports nutrition dominates the market for plant-based protein supplements due to rising demand from athletes and fitness enthusiasts. Plant-based protein supplements are in line with the emerging trend of clean and sustainable nutrition, and they appeal to people looking for protein sources that help with muscle recovery, performance, and overall health. These supplements provide an effective solution for physically active people to achieve their protein needs while still adhering to their dietary preferences and environmental considerations. Increased participation in sports and fitness activities by health-conscious consumers has propelled the sports nutrition segment to market leadership in the plant-based protein supplements market.

Plant Based Protein Supplement Distribution Channels

- Supermarket

- Online Stores

- DTC

- Others

For numerous reasons, the online store segment leads the plant-based protein supplements industry. For starters, it provides consumers with convenience by allowing them to browse and purchase a wide range of things from the comfort of their own homes. Second, online platforms give plant-based protein supplement makers access to a global market, broadening their reach. Furthermore, internet retailers frequently offer competitive pricing, promotions, and customer feedback, which improves the whole purchasing experience. As more people turn to e-commerce for their nutritional needs, the online retailers category continues to prosper as the preferred distribution channel for plant-based protein supplements.

Plant Based Protein Supplement Raw Materials

- Soy

- Spirulina

- Pumpkin Seed

- Hemp

- Rice

- Pea

- Others

Wihin the raw material segment the soy sub-segment held the largest share of the market. The soy segment's dominance in the plant-based protein supplements market can be ascribed to many important factors.

Complete protein profile is an important aspect in boosting growth. Soy protein is regarded as a high-quality, complete protein source, containing adequate amounts of all essential amino acids. This makes it a popular choice among consumers searching for a complete protein supplement with an amino acid profile similar to that of animal-based proteins.

Another motivator is nutritional value. Iron, calcium, and B vitamins are among the necessary minerals found in soy protein. Because of its nutritional fullness and versatility, it is an appealing option for individuals looking for a well-rounded dietary supplement.

Plant Based Protein Supplements Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Plant Based Protein Supplements Market Regional Analysis

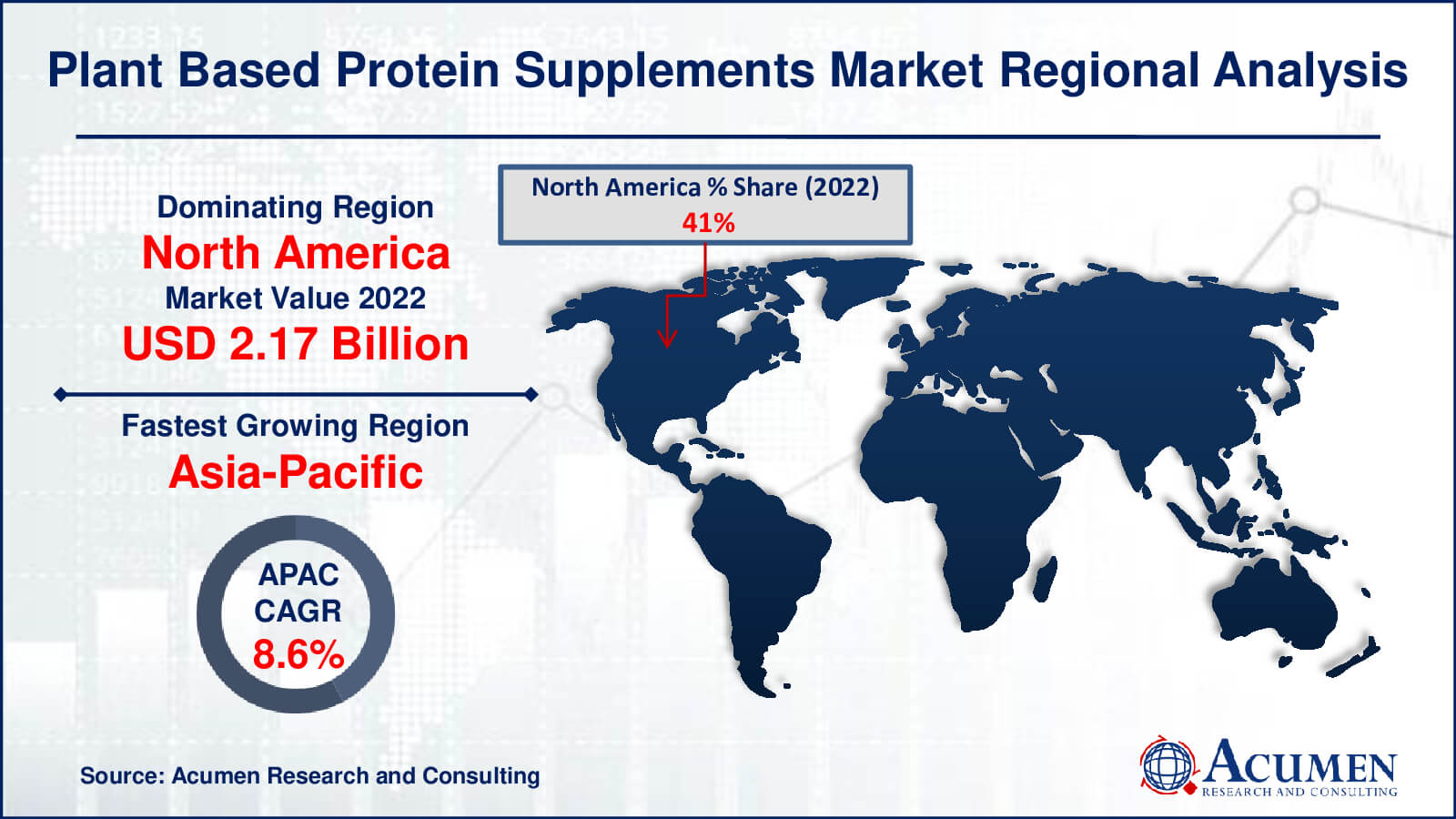

North America accounted for 41% of the global revenue share in 2022. The increasing awareness of vegan diets and the growing trend toward vegetarianism, driven by new brand campaigns on social media and television, is expected to drive the demand for plant-based protein supplements in the near future. The demand in the U.S. is expected to grow steadily over the forecast period due to the increasing consumption of sports nutrition supplements. Additionally, rising concerns about weight management and growing consumer awareness of the importance of a nutritious diet and a healthy lifestyle are expected to support regional market growth over the forecast period.

Europe has a thriving industry for plant-based products, including supplements. This market's progress is fueled by factors comparable to those in North America, such as rising health consciousness, environmental concerns, and the growing popularity of vegan and vegetarian diets.

Asia-Pacific is projected to remain one of the most profitable markets for plant-based protein supplements in the next eight years. The growth of the middle-class population in developing countries, including China and India, along with increased state government spending on infrastructure development and a favorable taxation environment for multinational companies (MNCs) to establish offices, is expected to drive demand.

Plant Based Protein Supplements Market Players

Some of the top plant based protein supplements companies offered in our report includes Glanbia plc, AMCO Proteins, Quest Nutrition, NOW Foods, The Bountiful Company, MusclePharm Corporation, Abbott Laboratories, IOVATE Health Sciences International, Inc., Transparent Labs, and WOODBOLT DISTRIBUTION LLC.

Frequently Asked Questions

What was the market size of the global plant based protein supplements in 2022?

The market size of plant based protein supplements was USD 5.3 billion in 2022.

What is the CAGR of the global plant based protein supplements market from 2023 to 2032?

The CAGR of plant based protein supplements is 7.5% during the analysis period of 2023 to 2032.

Which are the key players in the plant based protein supplements market?

The key players operating in the global market are including Glanbia plc; AMCO Proteins; Quest Nutrition; NOW Foods; The Bountiful Company; MusclePharm Corporation; Abbott Laboratories; IOVATE Health Sciences International, Inc.; Transparent Labs; WOODBOLT DISTRIBUTION LLC.

Which region dominated the global plant based protein supplements market share?

North America held the dominating position in plant based protein supplements industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of plant based protein supplements during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global plant based protein supplements industry?

The current trends and dynamics in the plant based protein supplements industry include increasing demand for protein supplements to improve health and wellness, rise in number of vegan population, concerns about the environmental impact of meat production and animal agriculture, and growth in investment & collaboration in plant-based food business.

Which product held the maximum share in 2022?

The protein powder product held the maximum share of the plant based protein supplements industry.