Online Gaming Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

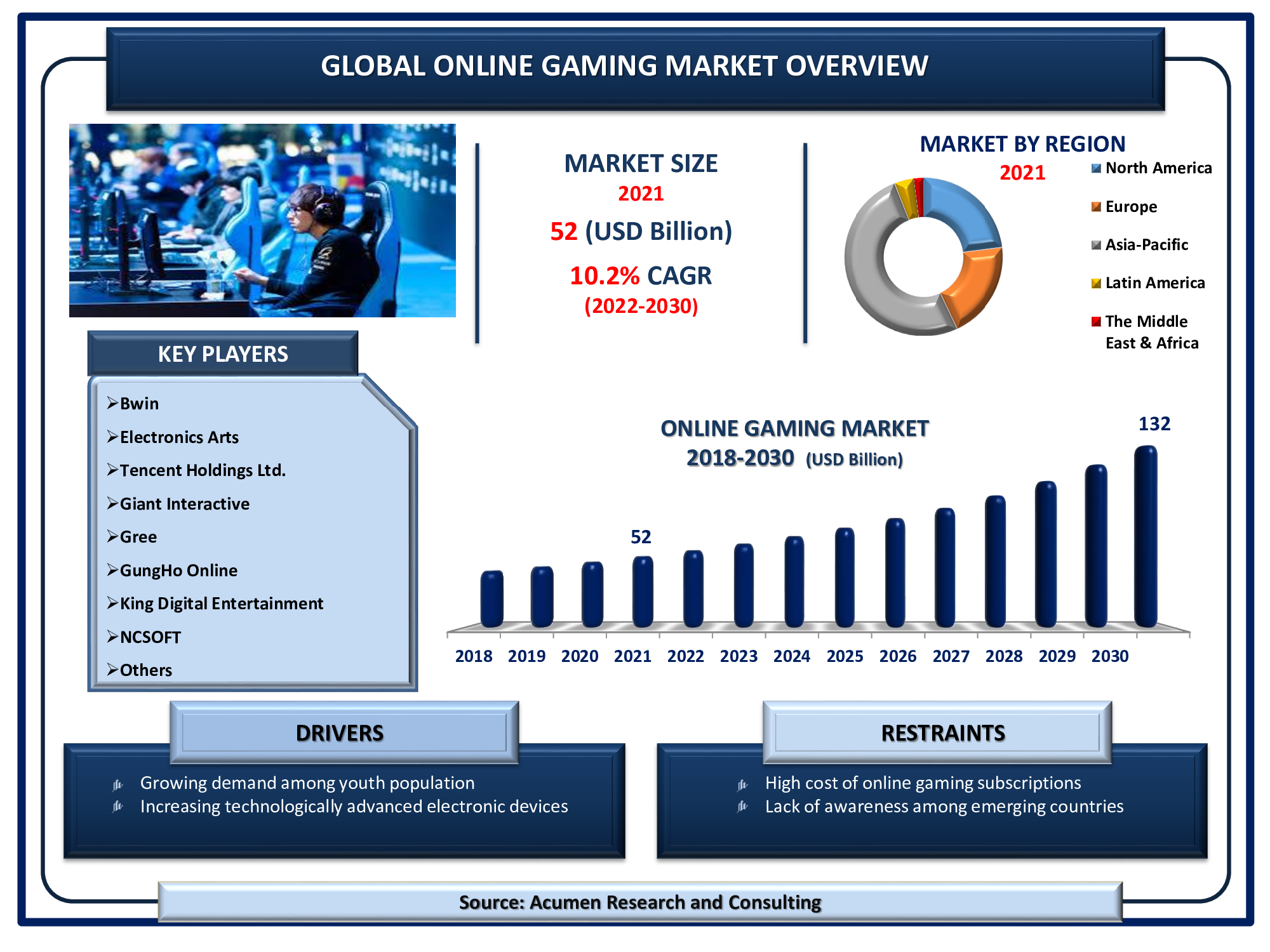

The Global Online Gaming Market Size accounted for USD 56 Billion in 2021 and will achieve a market size of USD 132 Billion by 2030, budding at a CAGR of 10.2%.

Online gaming is witnessing high growth among the young age group people. The latest games offer online interactions with other players along with actual transaction options. Increasing interest among youth due to rising international e-sports events such as Free Fire World Series 2021 Singapore, PUBG Mobile Global Championship, M3 World Championship, League of Legends World Championship, and Fortnite World Cup are boosting the online gaming market revenue. According to our online gaming industry analysis, the growing number of mobile games will generate numerous growth opportunities for the market from 2022 to 2030. Furthermore, the arrival of COVID-19 pandemic positively impacted the online gaming industry due to the regulations laid down by government to stay at home.

Global Online Gaming Market DRO’s:

Market Drivers:

- Growing demand among youth population

- Increasing technologically advanced electronic devices

- Improving platforms for online streaming

Market Restraints:

- High cost of online gaming subscriptions

- Issues related to data theft and privacy

Market Opportunities:

- Growth in number of competitive events across the world

- Massive investments in the online gaming industry

- Advent of novel technologies such as 5G, cloud gaming, virtual and augmented reality

Report Coverage

| Market | Online Gaming Market |

| Market Size 2021 | USD 56 Billion |

| Market Forecast 2030 | USD 132 Billion |

| CAGR During 2022 - 2030 | 10.2% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Age Group, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Bwin, Electronics Arts, GungHo Online, Giant Interactive, Gree, Tencent, King Digital Entertainment, NCSOFT, Sony Corp., Peak Games, Playdom, Riot Games, and Zynga. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Online gaming is highly popular among people of all age group. Consumers spend a larger amount of time on gaming each year. Across the globe gamers spend an average eight hours each week playing games. Rapid technological advancement in electronic devices and introduction of mobile and tabs with more enhanced graphic making it compatible for gaming is resulting in people of young age inclining towards buying high end electronic devices. This factor considerably fuels the online gaming market value. Young age people from countries such as China, South Korea, and India are investing large amount of time on gaming. Organizations are establishing various contests and gaming competitions with some prize this is encouraging the players. According to the data published by the Korea Creative Content Agency, more than 64% of Korean people aged between 10-65 years old are playing games on a regular basis. In 2019, mobile games accounted for 90 percent of the total app revenue in Korea, an estimated US$ 6.3 billion in sales. In 2018, Playstation Plus subscribers an online gaming service reached to 34.2 million. These are major factors expected to drive the growth of global online gaming market.

Favorable government policy in order to support the augmentation of industry is expected to impact the online gaming market growth. In 2020, the government of Korea is focused on lowering the strictness on the gaming sector. It is focused on implementing flexible game ratings system, increasing a limit on the amount of money one can bet within games and promoting government led industry events. This is expected to help the industry flourish and increase revenue generation. Factors such as high charges of online gaming and issues related to data theft and privacy are major factors expected to hamper the global online gaming market share. In addition, complex and strict government regulations related to online gaming is expected to challenge the growth of target market. Barring online fantasy sports (OFS) games, most other modern day games face similar ambiguity. The government of Andhra Pradesh and Telangana has banned real money games altogether while Tamil Nadu permits skill games. Kerala has banned online rummy played for stakes. However, chancing government regulations, increasing transparency and enhanced care related to data privacy and high investment by major players in online competition are factors expected to create new opportunities for players operating in the online gaming market over the forecast period. In addition, introduction of new games is expected to attract new players this is expected to support the revenue transaction of the target market.

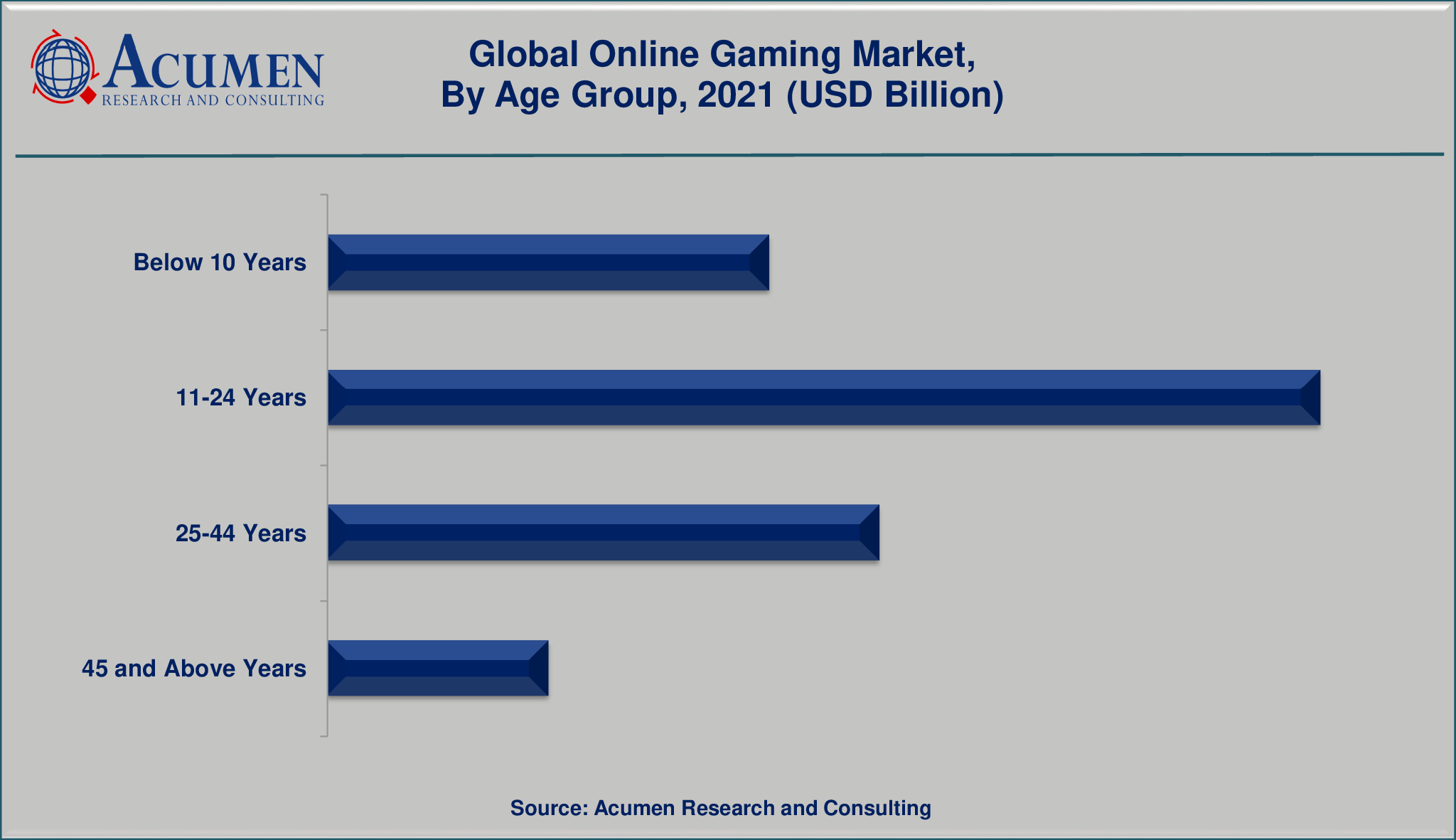

Online Gaming Market Segmentation

The worldwide online gaming market is split based on type, age group and geography. The global online gaming market is segmented into type and age group. The type segment is bifurcated into mobile games, pay-to-play games, free-to-play games, and pay-in-play games. Among type the mobile games segment is expected to account for major revenue share in the global online gaming market due to high penetration of smart phones with enhanced graphics. The age group segment is divided into below 10 years, 11-24 years, 25-44 years, and above 45 years.

Market by Type

- Mobile Games

- Free-To-Play Games

- Pay-To-Play Games

- Pay-In-Play Games

Market by Age Group

- Below 10 Years

- 11-24 Years

- 25-44 Years

- 45 and Above Years

Online Gaming Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Growing number of youth playing online games in Asia-Pacific region, fuels the regional market growth

The market in Asia Pacific is expected to account for significant revenue share in the global online gaming market due to high penetration of high speed internet and increasing number of consumers spending time on gaming. Favorable business policies and presence of major gaming production houses and gaming device manufacturers operating in the countries such as Japan and South Korea are factors expected to support the growth of target market. Changing government policies and introduction of new online games is emerging economies is expected to attract consumers this is expected to augment the growth of regional market.

Online Gaming Market Players

Some of the top online gaming companies offered in the professional report includes Bwin, Electronics Arts, GungHo Online, Giant Interactive, Gree, Tencent, King Digital Entertainment, NCSOFT, Sony Corp., Peak Games, Playdom, Riot Games, and Zynga.

Frequently Asked Questions

How much was the global online gaming market size in 2021?

The global online gaming market size in 2021 was accounted to be USD 56 Billion.

What will be the projected CAGR for global online gaming market during forecast period of 2022 to 2030?

The projected CAGR online gaming market during the analysis period of 2022 to 2030 is 10.2%.

Which are the prominent competitors operating in the market?

The prominent players of the global online gaming market are Bwin, Electronics Arts, GungHo Online, Giant Interactive, Gree, Tencent, King Digital Entertainment, NCSOFT, Sony Corp., Peak Games, Playdom, Riot Games, and Zynga.

Which region held the dominating position in the global online gaming market?

North America held the dominating online gaming during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for online gaming during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global online gaming market?

Growing demand among youth population, increasing technologically advanced electronic devices, and improving platforms for online streaming drives the growth of global online gaming market.

By segment type, which sub-segment held the maximum share?

Based on type, mobile games segment held the maximum share online gaming market in 2021.