Mobile Surgical Unit Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Mobile Surgical Unit Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

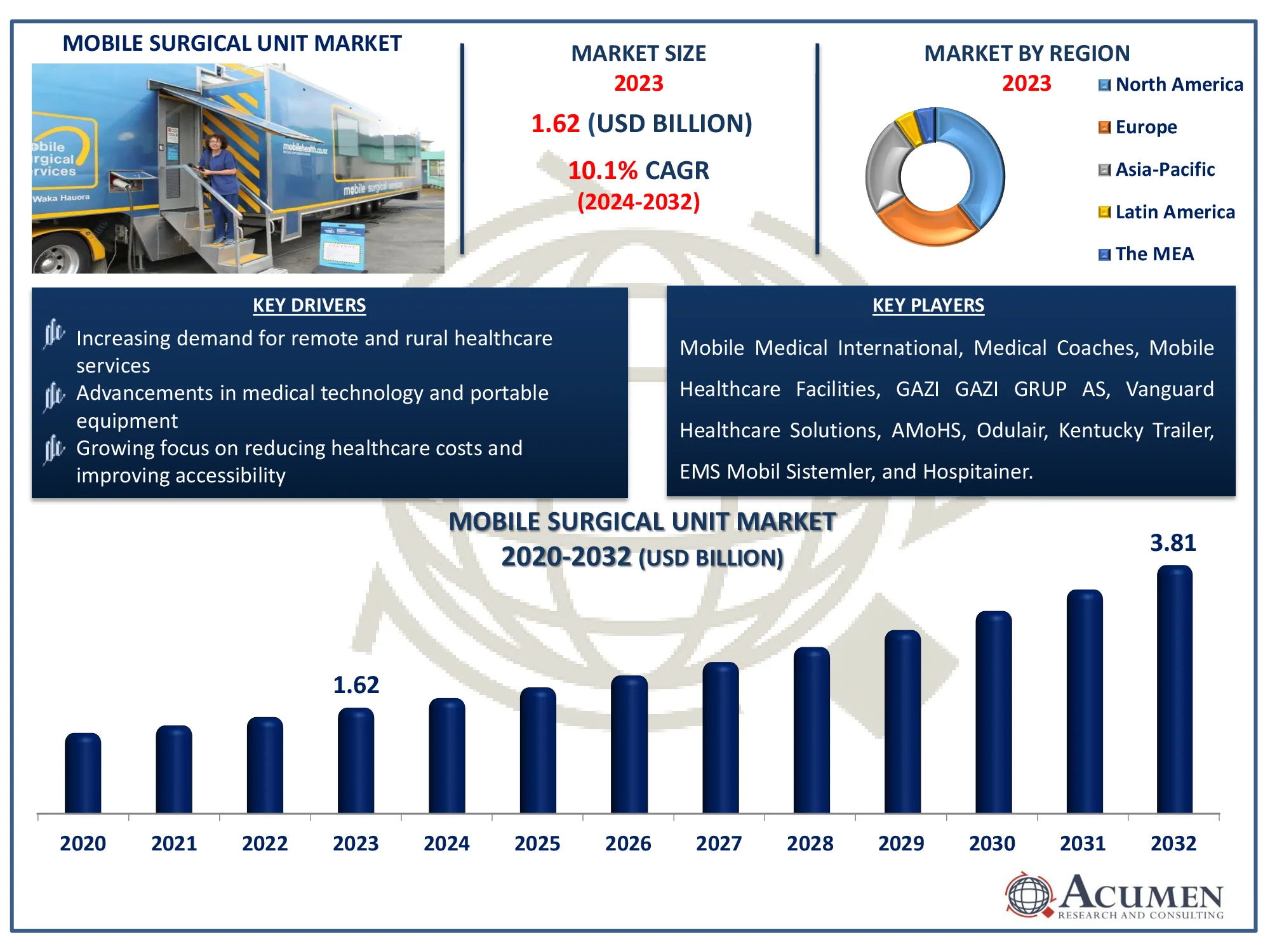

Request Sample Report

The Global Mobile Surgical Unit Market Size accounted for USD 1.62 Billion in 2023 and is estimated to achieve a market size of USD 3.81 Billion by 2032 growing at a CAGR of 10.1% from 2024 to 2032.

Mobile Surgical Unit Market Highlights

- Global mobile surgical unit market revenue is poised to garner USD 3.81 billion by 2032 with a CAGR of 10.1% from 2024 to 2032

- North America mobile surgical unit market value occupied around USD 631.8 million in 2023

- Asia-Pacific mobile surgical unit market growth will record a CAGR of more than 10.8% from 2024 to 2032

- Widespread applications of mobile surgical units in emergencies, pandemics, and in underserved areas is the mobile surgical unit market trend that fuels the industry demand

A mobile surgical unit is a fully equipped, transportable medical facility that may perform surgical procedures in distant or underserved areas. The governments of industrialized and developing countries are attempting to extend the healthcare system's reach to rural areas. Their idea for offering better on-site care to patients is gaining popularity. The growing number of surgeries around the world is increasing the demand for mobile surgical solutions to improve patient care. Every year, 313 million surgical procedures are conducted globally. According to a report, 5 billion people do not have access to safe and affordable medical procedures when needed. To close these gaps, the government is collaborating with public and private organizations to improve health care. This is expected to boost demand for mobile surgical units.

Countries like Brazil and Ecuador are implementing universal healthcare systems. These programs involve a wide range of health-care networks, including the Ministry of Public Health, the Social Security Institute, the national police, and non-governmental and commercial health-care providers. For example, Ecuador established the "Cinterandes Foundation" mobile surgery care service.

Global Mobile Surgical Unit Market Dynamics

Market Drivers

- Increasing demand for remote and rural healthcare services

- Advancements in medical technology and portable equipment

- Growing focus on reducing healthcare costs and improving accessibility

Market Restraints

- High initial investment and operational costs

- Regulatory challenges and lack of standardized protocols

- Limited availability of skilled healthcare professionals in mobile units

Market Opportunities

- Expansion of mobile surgery units in emerging markets

- Integration of telemedicine for remote consultations and monitoring

- Collaborations with governments and NGOs for disaster relief and crisis management

Mobile Surgical Unit Market Report Coverage

|

Market |

Mobile Surgical Unit Market |

|

Mobile Surgical Unit Market Size 2023 |

USD 1.62 Billion |

|

Mobile Surgical Unit Market Forecast 2032 |

USD 3.81 Billion |

|

Mobile Surgical Unit Market CAGR During 2024 - 2032 |

10.1% |

|

Mobile Surgical Unit Market Analysis Period |

2020 - 2032 |

|

Mobile Surgical Unit Market Base Year |

2023 |

|

Mobile Surgical Unit Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type Of Surgery, By Mobile Infrastructure, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Mobile Medical International, Medical Coaches, Mobile Healthcare Facilities, GAZI GAZI GRUP AS, Vanguard Healthcare Solutions, AMoHS, Odulair, Kentucky Trailer, EMS Mobil Sistemler, and Hospitainer. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Mobile Surgical Unit Market Insights

An NGO introduced a fully operable mobile surgical unit installed on a 24-foot truck, which provided low-cost surgical care to patients in remote, rural, and metropolitan locations. With healthcare expenses continually growing, it is becoming more difficult for low- and middle-income consumers to obtain modern surgical care. Every year, about 33 million people endure major financial pressures as a result of surgery procedures. Mobile surgical units, which are outfitted with advanced medical technology and an efficient operation delivery model, provide an affordable alternative that is projected to propel mobile surgery unit market expansion.

The pandemic has significantly impacted global healthcare systems, with Covid-19 patients receiving priority, resulting in delays in numerous surgeries. According to the International Consortium, approximately 58,000 planned procedures in India were postponed or canceled, while more than 24.8 million elective surgeries were delayed worldwide. The increasing unmet demand for improved surgical equipment is expected to drive market growth. Furthermore, key industry players are making significant investments in developing innovative products to attract new clients. Strategic acquisitions and collaborations for business growth are also predicted to have a substantial impact on mobile surgery units market development.

However, the high costs of these units are projected to limit market growth. Despite this, partnerships between donors and social entrepreneurs can hasten the adoption of mobile surgery units. This can be accomplished through innovative mobile technology integration, which can be fully realized when investors, social entrepreneurs, and private sector players work together and capitalize on their respective strengths. Furthermore, digital health strategies are critical in detecting gaps and establishing goals, hence providing a favorable climate for the acceptance and expansion of mobile surgical units. These trends are expected to create new potential for industry participants to expand their companies during the projected period.

Mobile Surgical Unit Market Segmentation

Mobile Surgical Unit Market Segmentation

The worldwide market for mobile surgical unit is split based on type of surgery, mobile infrastructure, and geography.

Mobile Surgical Unit Market By Type of Surgery

- Endoscopy

- Emergency Care

- General Surgery

- Plastic Surgery

- Others

According to the mobile surgical unit industry analysis, general surgery is expected to hold the largest revenue share in industry. In 2023, general surgery generated notable revenue growth in this market. Meanwhile, plastic surgery is gaining popularity among both young and older populations, driven by social media influence and the desire for a youthful appearance. This type of surgery involves the restoration, reconstruction, or alteration of body parts as desired by the patient and is categorized into two types: reconstructive surgery and cosmetic surgery.

Mobile Surgical Unit Market By Mobile Infrastructure

- ICU Mobile Operating Room

- Modular Mobile Operating Room

- Integrated Mobile Operating Room

According to the mobile surgical unit market forecast, mobile surgical units are commonly utilized to provide temporary solutions during the remodeling of existing medical facilities or to provide additional operating room capacity during peak demand. These units provide a handy option for patient care during busy surgical periods. Even in emergency situations, innovative features like robotic arms and modular cabinetry help surgeons undertake effective treatments.

Mobile Surgical Unit Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Mobile Surgical Unit Market Regional Analysis

Mobile Surgical Unit Market Regional Analysis

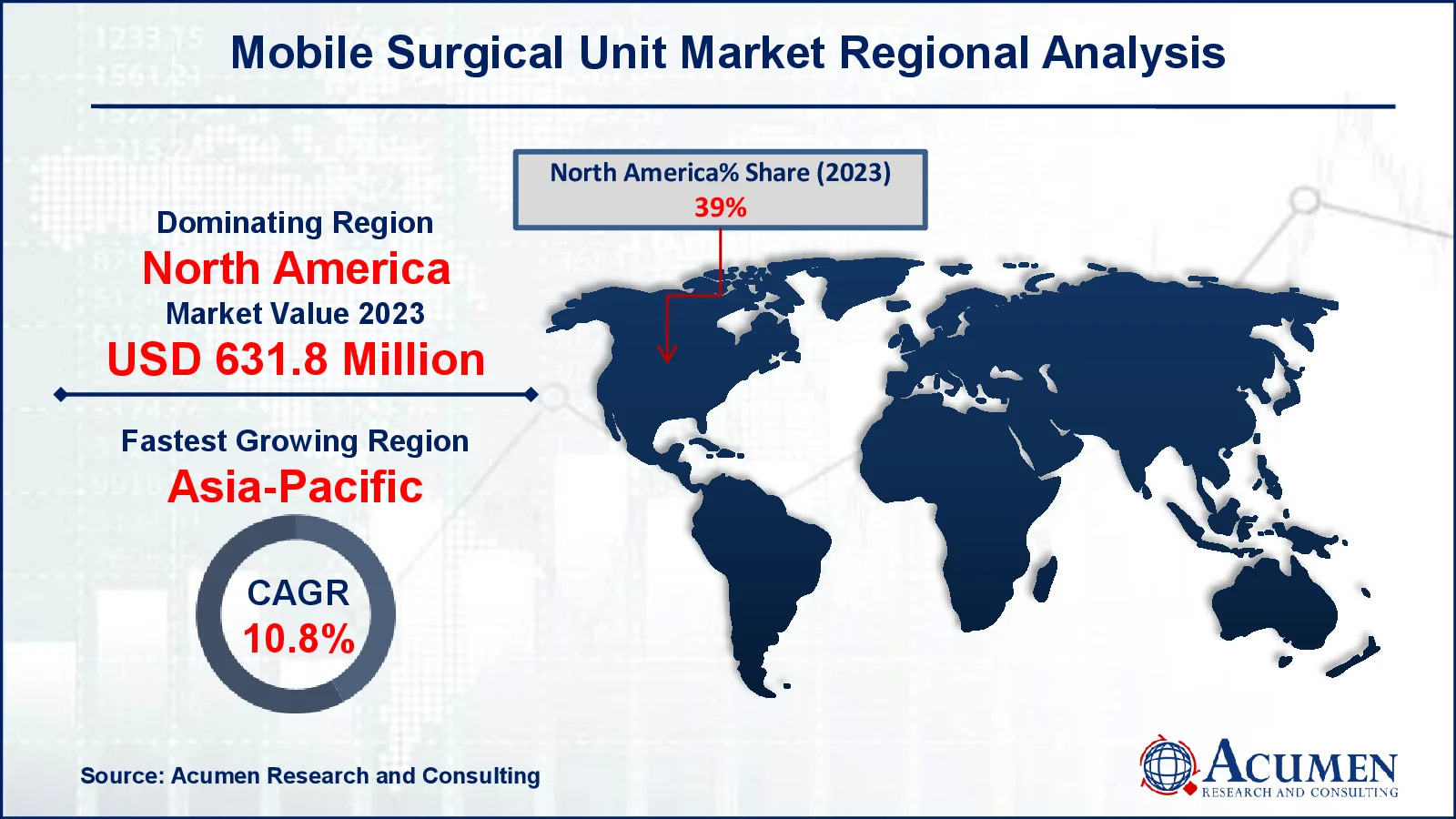

For several reasons, North America leads the mobile surgery units market due to high healthcare spending, advanced infrastructure, and a well-established healthcare system. For example, according to the Centers for Medicare & Medicaid Services (CMS), health-care spending in the United States will increase by 7.5% in 2023, reaching $4.9 trillion, or $14,570 per capita. Health spending made for 17.6 percent of the nation's GDP. The need is being fueled by the growing use of mobile surgical units in rural areas and emergency medical services. Furthermore, the presence of prominent market players and technological advancements contribute to market growth.

The Asia-Pacific region is the fastest-growing mobile surgery units market, as nations such as China and India experience an upsurge in demand for mobile healthcare solutions, particularly in distant and underserved areas. According to the National Institute of Health (NIH), mobile surgical units (MSUs) can significantly improve access to surgical care in Africa by eliminating the need for patients to travel long distances, fostering better surgical collaborations, addressing the surgeon shortage, and reducing the risk of infection, particularly in tropical areas prone to frequent disease outbreaks. These units are carefully built to enhance patient preparation and recovery processes, assuring efficiency and safety despite restricted space. Growing investments in healthcare innovation help to drive regional growth.

Mobile Surgical Unit Market Players

Some of the top mobile surgical unit companies offered in our report include Mobile Medical International, Medical Coaches, Mobile Healthcare Facilities, GAZI GAZI GRUP AS, Vanguard Healthcare Solutions, AMoHS, Odulair, Kentucky Trailer, EMS Mobil Sistemler, and Hospitainer.

Frequently Asked Questions

How big is the Mobile Surgical Unit Market?

The mobile surgical unit market size was valued at USD 1.62 Billion in 2023.

What is the CAGR of the global Mobile Surgical Unit Market from 2024 to 2032?

The CAGR of mobile surgical unit is 10.1% during the analysis period of 2024 to 2032.

Which are the key players in the Mobile Surgical Unit Market?

The key players operating in the global market are including Mobile Medical International, Medical Coaches, Mobile Healthcare Facilities, GAZI GAZI GRUP AS, Vanguard Healthcare Solutions, AMoHS, Odulair, Kentucky Trailer, EMS Mobil Sistemler, and Hospitainer.

Which region dominated the global Mobile Surgical Unit Market share?

North America held the dominating position in mobile surgical unit industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of mobile surgical unit during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Mobile Surgical Unit industry?

The current trends and dynamics in the mobile surgical unit industry include increasing demand for remote and rural healthcare services, advancements in medical technology and portable equipment, and growing focus on reducing healthcare costs and improving accessibility.

Which type of surgery held the maximum share in 2023?

The general surgery expected to hold the maximum share of the mobile surgical unit industry.