Sports Equipment Market | Acumen Research and Consulting

Sports Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

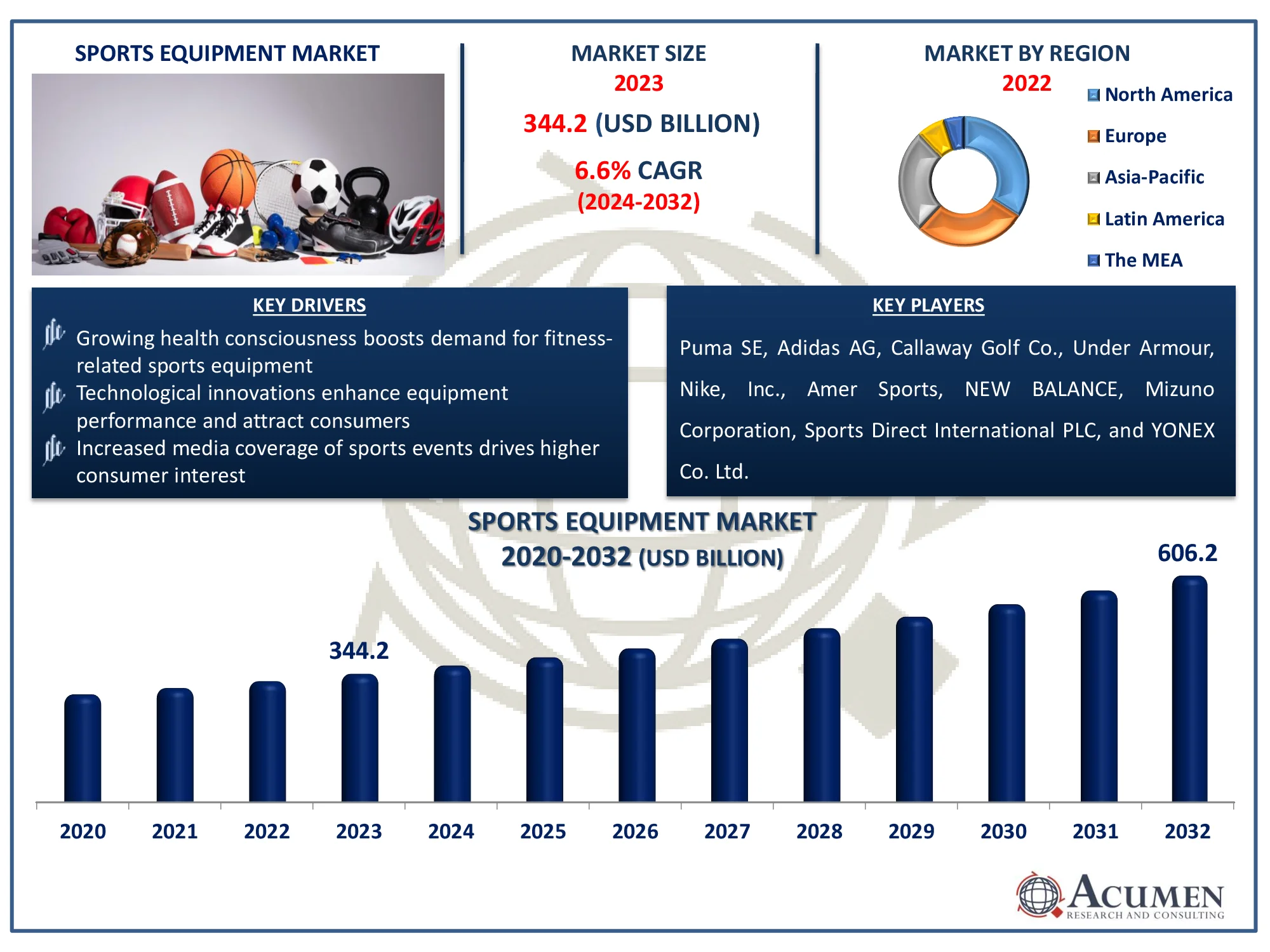

The Global Sports Equipment Market Size accounted for USD 344.2 Billion in 2023 and is estimated to achieve a market size of USD 606.2 Billion by 2032 growing at a CAGR of 6.6% from 2024 to 2032.

Sports Equipment Market (By Product: Ball over net games, Ball games, Fitness/strength equipment, Athletic training equipment, and Others; By Distribution Channel: Online retail, Specialty & sports shops, and Department & discount stores; and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Sports Equipment Market Highlights

- Global sports equipment market revenue is poised to garner USD 606.2 billion by 2032 with a CAGR of 6.6% from 2024 to 2032

- North America sports equipment market value occupied around USD 117.02 billion in 2023

- Asia-Pacific sports equipment market growth will record a CAGR of more than 7.4% from 2024 to 2032

- Based on product, the ball over net games sub-segment generated 35% market share in 2023

- Based on distribution channel, the specialty & sports shops sub-segment shows 45% growth in 2023

- Rise in the adoption of smart wearable’s and connected sports gear is the sports equipment market trend that fuels the industry demand

Sports equipment encompasses all of the gear needed in various sports and physical activities. This can include anything from balls and bats to protective equipment and exercise equipments. Football players, for example, wear helmets and pads, whereas tennis players use racquets and balls. Dumbbells and treadmills are examples of fitness equipment that can help people gain strength and stay in shape. Each piece of equipment is intended to enhance performance while ensuring safety. Using the proper equipment makes sports more pleasant and helps to prevent injuries.

Global Sports Equipment Market Dynamics

Market Drivers

- Growing health consciousness boosts demand for fitness-related sports equipment

- Technological innovations enhance equipment performance and attract consumers

- Increased media coverage of sports events drives higher consumer interest

Market Restraints

- High cost of advanced equipment limits accessibility for some consumers

- Economic downturns reduce discretionary spending on non-essential items

- Market saturation makes it challenging for new brands to compete

Market Opportunities

- Emerging markets offer new growth potential for sports equipment sales

- E-commerce expansion provides broader market reach and convenience

- Customization and personalization attract consumers seeking unique products

Sports Equipment Market Report Coverage

| Market | Sports Equipment Market |

| Sports Equipment Market Size 2022 |

USD 344.2 Billion |

| Sports Equipment Market Forecast 2032 | USD 606.2 Billion |

| Sports Equipment Market CAGR During 2023 - 2032 | 6.6% |

| Sports Equipment Market Analysis Period | 2020 - 2032 |

| Sports Equipment Market Base Year |

2022 |

| Sports Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Puma SE, Adidas AG, Callaway Golf Co., Under Armour, Nike, Inc., Amer Sports, NEW BALANCE, Mizuno Corporation, Sports Direct International PLC, and YONEX Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Sports Equipment Market Insights

Sensor technology has improved to the point that it is integrated into a wide range of sports equipment, such as tennis rackets, golf clubs, angling poles, and swimming goggles. These sensors are capable of calculating movement and capturing detailed biometric data, which can be used to determine problems caused by a competitor's swing, cast, or stroke.

One of the most recent trends in the industry is the combination of easygoing and athletic architectures for the advancement of gaming gear, which is poised to provide a key boost to market growth. Expanding urbanization, improving quality of life, and more disposable income are all contributing to a growing preference for games to ensure a healthy way of life.

Furthermore, young common laborers are increasingly leading sedentary lifestyles, rendering this segment of the population more vulnerable to a wide range of lifestyle diseases. To stay active, people participate in games, which are expected to move the market over the estimated time period.

The industry is spreading rapidly around the world as a result of the growing popularity of games and recreational activities among people as a way to relieve stress and improve well-being mindfulness. For instance, according to Outdoor Industry Association, in 2022 U.S, 80% of outdoor activity categories saw increased participation, including broad categories like camping and fishing as well as smaller categories like sport climbing and skateboarding. The extensive media coverage of select global sporting events, such as the FIFA World Cup, Commonwealth Games, and Olympic Games, raises the profile of games and expands their global reach, reassuring young people to participate.

Sports Equipment Market Segmentation

The worldwide market for sports equipment is split based on product, distribution channel, and geography.

Sports Equipment Products

- Ball Over Net Games

- Ball Games

- Fitness/Strength Equipment

- Athletic Training Equipment

- Others

According to the sports equipment industry analysis, ball games are the biggest part of the market because they’re very popular. Many sports like soccer and basketball need specific equipment, so people buy a lot of balls and related gear. New technology and materials make the equipment better. Big events and media coverage also increase the demand for these products.

Sports Equipment Distribution Channels

- Online Retail

- Specialty & Sports Shops

- Department & Discount Stores

According to the sports equipment market forecast, specialty and sports shops lead the sports equipment market because they offer a wide range of high-quality, specialized gear for different sports. These stores provide expert advice and personalized service, helping customers find the right equipment. They often carry exclusive or premium products, and focus on sports gear make them a popular choice for athletes. This specialization helps them stand out in the market.

Sports Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

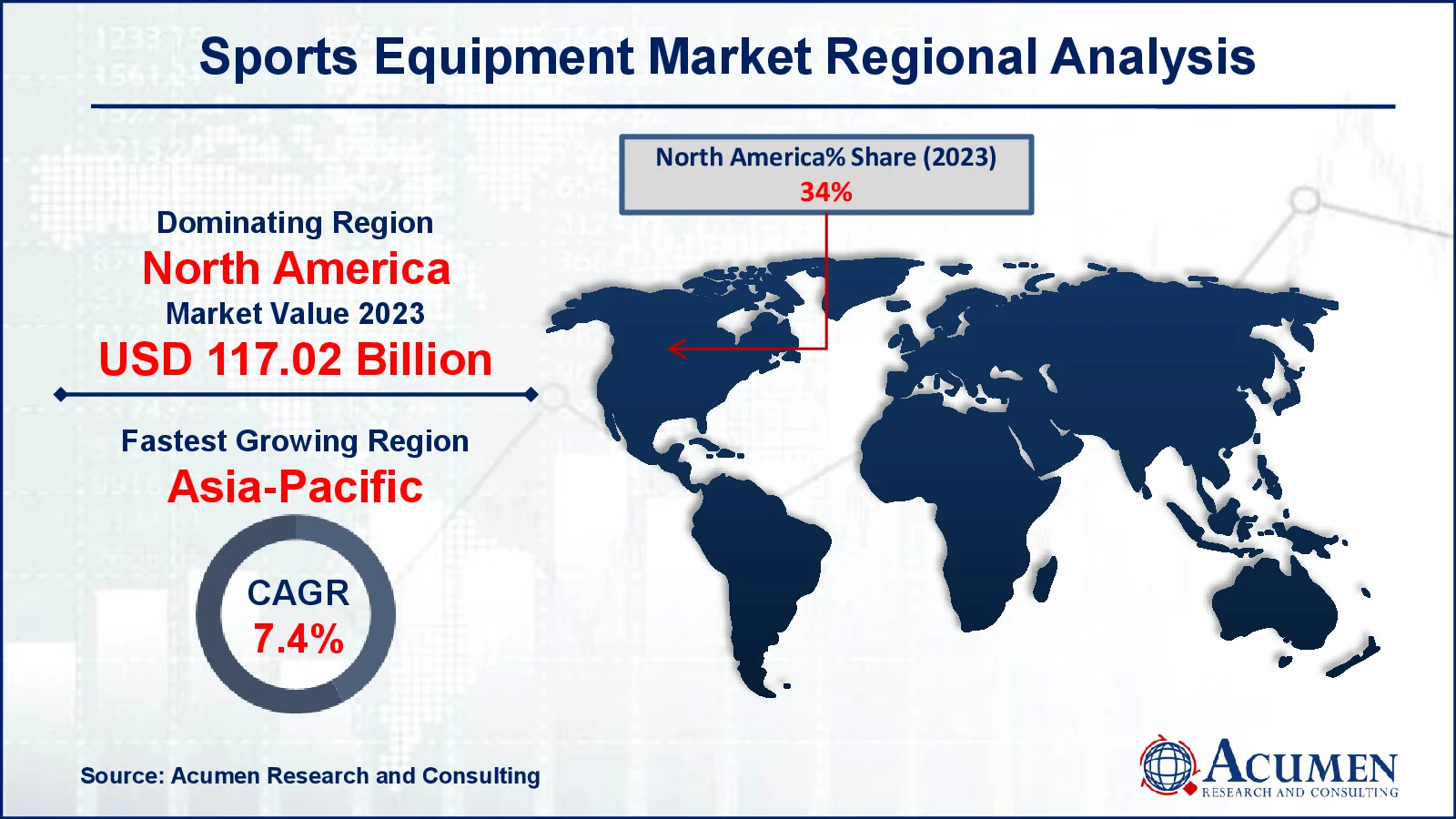

Sports Equipment Market Regional Analysis

For several reasons, the market in North America is likely to see an increase in popularity for sporting equipment in the future years. North America accounted for more than 34% of the absolute pie in 2023. Expanding customer spending on sports equipment sellers is assisting the local market in gaining significant force. Furthermore, growing health and fitness awareness among people, as well as the rising obesity epidemic, are driving up demand for gaming gear in this market.

However, Asia Pacific is expected to grow at the fastest rate over the forecast period. In 2023, Asia Pacific countries saw a rapid increase in offers of ball and sports equipment. For instance, september 2021, Adidas, the leading sportswear maker, has established its first Flagship store in India. The Connaught Place location of 'The Home of Possibilities' shop combines numerous digital touchpoints, a sustainability zone, and the future of consumer retail experience. Furthermore, popularity in Australia can be attributed to the increased focus on games.

Sports Equipment Market Players

Some of the top sports equipment companies offered in our report includes Puma SE, Adidas AG, Callaway Golf Co., Under Armour, Nike, Inc., Amer Sports, NEW BALANCE, Mizuno Corporation, Sports Direct International PLC, and YONEX Co. Ltd.

Frequently Asked Questions

How big is the sports equipment market?

The sports equipment market size was valued at USD 344.2 billion in 2023.

What is the CAGR of the global sports equipment market from 2024 to 2032?

The CAGR of sports equipment is 6.6% during the analysis period of 2024 to 2032.

Which are the key players in the sports equipment market?

The key players operating in the global market are including Puma SE, Adidas AG, Callaway Golf Co., Under Armour, Nike, Inc., Amer Sports, NEW BALANCE, Mizuno Corporation, Sports Direct International PLC, and YONEX Co. Ltd.

Which region dominated the global sports equipment market share?

North America held the dominating position in sports equipment industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of sports equipment during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global sports equipment industry?

The current trends and dynamics in the sports equipment industry include growing health consciousness boosts demand for fitness-related sports equipment, technological innovations enhance equipment performance and attract consumers, and increased media coverage of sports events drives higher consumer interest

Which product held the maximum share in 2023?

The ball games expected to hold the maximum share of the sports equipment industry.