Metal Stamping Market | Acumen Research and Consulting

Metal Stamping Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

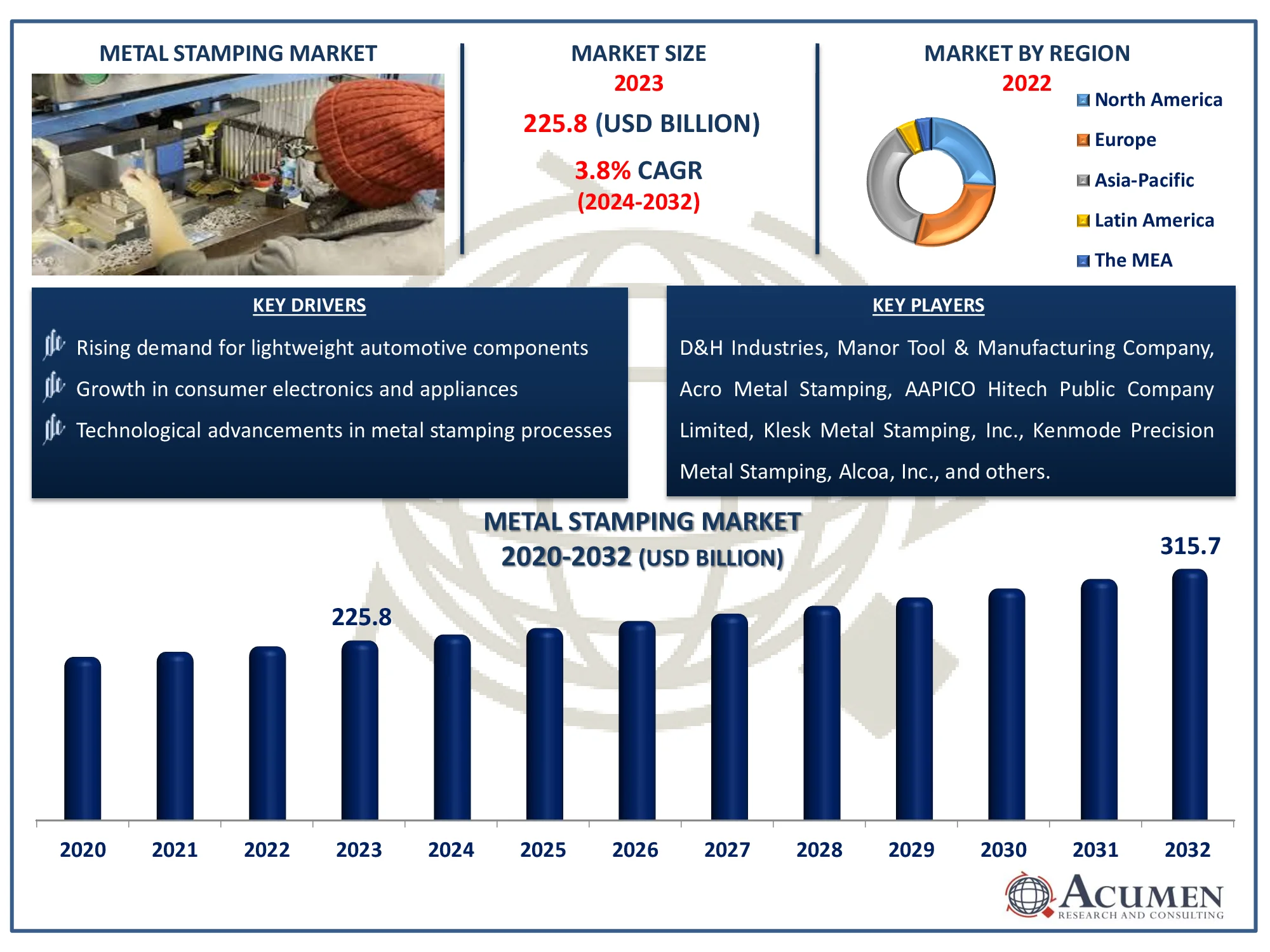

The Global Metal Stamping Market Size accounted for USD 225.8 Billion in 2023 and is estimated to achieve a market size of USD 315.7 Billion by 2032 growing at a CAGR of 3.8% from 2024 to 2032.

Metal Stamping Market (By Process: Blanking, Embossing, Bending, Coining, Flanging, and Others; By Press Type: Mechanical Press, Hydraulic Press, Servo Press, and Others; By Thickness: Less than & up to 2.5 mm, and More than 2.5 mm, By End Use: Automotive, Industrial Machinery, Consumer Electronics, Aerospace, Electrical & Electronics, Telecommunications, Others and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Metal Stamping Market Highlights

- The global metal stamping market revenue is projected to reach USD 315.7 billion by 2032, growing at a CAGR of 3.8% from 2024 to 2032

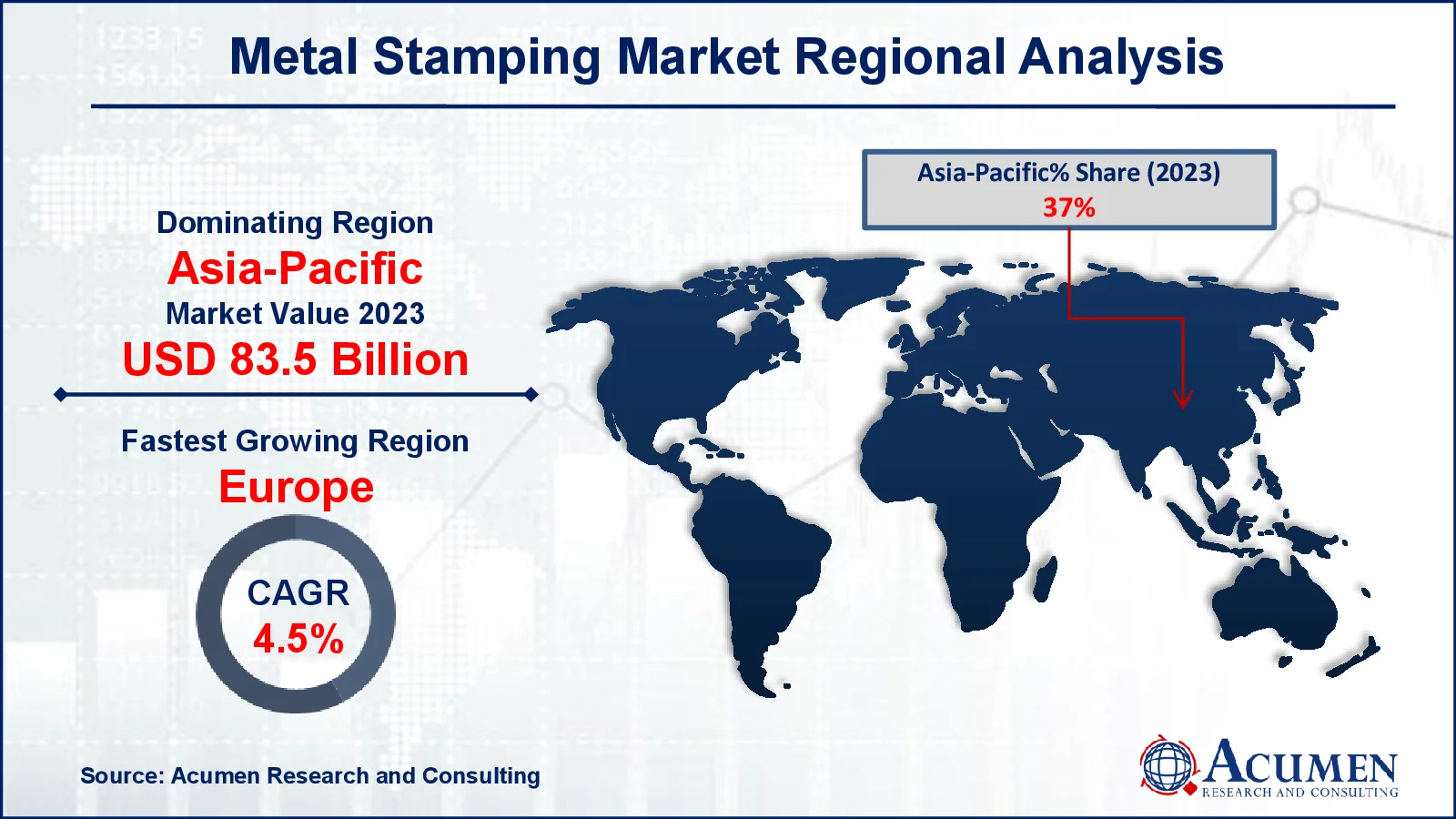

- The Asia-Pacific metal stamping market was valued at approximately USD 83.5 billion in 2023

- The European metal stamping market is expected to grow at a CAGR of over 4.5% from 2024 to 2032

- In 2023, the blanking sub-segment accounted for 33% of the market share among processes

- The mechanical press sub-segment captured 51% of the market share in 2023 based on press type

- The sub-segment for thickness less than and up to 2.5 mm generated 64% of the market share in 2023

- Growing adoption of automation and industry 4.0 technologies for improved production efficiency is the metal stamping market trend that fuels the industry demand

Metal stamping is a manufacturing process that uses mechanical or hydraulic presses to shape and cut metal sheets into predetermined shapes. This procedure uses a variety of techniques, such as blanking, bending, and punching, to produce complicated structures with high precision. Metal stamping is commonly used to manufacture automotive components such as brackets, panels, and chassis parts, as well as electrical devices, appliances, and industrial machinery. The technology is highly regarded for its efficiency and capacity to create huge quantities of parts with little waste. Metal stamping can also accept a broad variety of materials, such as steel, aluminum, and copper.

Global Metal Stamping Market Dynamics

Market Drivers

- Rising demand for lightweight automotive components

- Growth in consumer electronics and appliances

- Technological advancements in metal stamping processes

Market Restraints

- High initial setup costs for machinery

- Fluctuating raw material prices

- Intense competition from alternative fabrication methods

Market Opportunities

- Expansion in electric vehicle production

- Increasing use of advanced materials like high-strength steel

- Growing adoption of automation and robotics in manufacturing

Metal Stamping Market Report Coverage

| Market | Metal Stamping Market |

| Metal Stamping Market Size 2022 |

USD 225.8 Billion |

| Metal Stamping Market Forecast 2032 | USD 315.7 Billion |

| Metal Stamping Market CAGR During 2023 - 2032 | 3.8% |

| Metal Stamping Market Analysis Period | 2020 - 2032 |

| Metal Stamping Market Base Year |

2022 |

| Metal Stamping Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Process, By Press Type, By Thickness, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | D&H Industries, Manor Tool & Manufacturing Company, Acro Metal Stamping, AAPICO Hitech Public Company Limited, Klesk Metal Stamping, Inc., Kenmode Precision Metal Stamping, Alcoa, Inc., Clow Stamping Company, Inc., and Goshen Stamping Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Metal Stamping Market Insights

The rising technological innovation and improvement in the automotive sector is the primary factor driving the growth of the global metal stamping market. In the automotive industry, the global metal stamping market finds applications in sideboards, sections, hats, rooftops, holders, and so on. Rising demand in aerospace, consumer electronics, electrical and electronics, defense, engineering machinery, and telecommunications are among the drivers driving the need for target products and the expansion of the global metal stamping market. Cutting-edge metal stamping technology has generated a dynamic draw for the growth of the global metal stamping industry.

Furthermore, the use of bites the dust is optional, which saves time and money for the company. The growing use of various procedures, particularly casting and manufacturing during metal construction because they produce high-quality products and can be used to form large and heavy metals, as well as the high cost of raw materials, are some of the challenges facing the global metal stamping market.

The increased use of automation and robotics in production improves precision, efficiency, and scalability in metal stamping processes. For instance, according to International Federation of Robotics reports, artificial intelligence (AI) has enormous potential for robots, providing a variety of benefits in manufacturing. The global stock of operational robots has reached a new high of approximately 3.5 Billion units, with the value of installations estimated at $15.7 billion. Manufacturers can eliminate human error, speed up production, and improve stamping consistency by incorporating modern robotics. This also allows for more accurate processing of complicated designs, which opens up new prospects for innovation in industries such as automotive, aerospace, and electronics.

Metal Stamping Market Segmentation

The worldwide market for metal stamping is split based on process, press type, thickness, end-use industry, and geography.

Metal Stamping Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

According to the metal stamping industry analysis, blanking accounted for the largest market share in 2023 and is expected to be the fastest expanding category, with a share of 33% over the anticipated years. This procedure's advantages, such as increased dimensional precision and a faster manufacturing rate, are expected to drive up demand. This technology is employed in customized stamped parts that are used to manufacture complex boards in cars. The process is also used in the assembly of small joints, hinges, and for casting a hole or any other shape in a component.

Metal Stamping Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

- Others

According to the metal stamping industry analysis, the mechanical press metal stamping market focuses on the use of mechanical presses to form metal sheets into desired components using high-speed, repeated force. Mechanical presses, known for their efficiency and cost-effectiveness, are frequently employed in automotive, electronics, and industrial manufacturing due to their capacity to handle high output numbers.

Metal Stamping Thickness

- Less than & up to 2.5 mm

- More than 2.5 mm

According to the metal stamping market forecast, the metal stamping market for sheets with thicknesses of up to 2.5 mm is critical for industries such as automotive, electronics, and consumer products that require precise and lightweight components. Stamping thinner metal sheets enables the creation of complicated pieces, which improves product performance while lowering material usage. This segment benefits from the growing need for miniaturised electronic devices and lightweight automobile components.

Metal Stamping End Use

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Others

According to the metal stamping market forecast, the automotive end-use industry dominates the market due to the high demand for diverse metal components in vehicle manufacture. Stamped components such as brackets, panels, and structural elements are critical to improving vehicle performance, safety, and aesthetics. As the automobile industry switches to lightweight materials for fuel efficiency and electric car production, the demand for precise and durable stamped components grows.

Metal Stamping Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Metal Stamping Market Regional Analysis

For several reasons, Asia-Pacific dominates in metal stamping market. Increased investment in India and China is stimulating the expansion of local initiatives in these countries, hence promoting market growth. Customer electronics companies such as Samsung, Sony, LG, Hitachi, and Panasonic have established assembly plants in developing economies to reduce manufacturing costs. This is also predicted to boost market growth in the approaching years.

Europe's metal stamping industry is expanding rapidly due to the substantial presence of the automotive and aerospace sectors, both of which require high-precision components. The region's emphasis on electric vehicle production, as well as developments in manufacturing technologies, stimulates demand.

The increasing use of sheet metal in the production of automobile transmission chassis, components, and basic parts is expected to drive the market. Furthermore, rising disposable income among developing populations has resulted in rapid urbanization, notably in the developing economies of Asia Pacific, the Middle East and Africa, and Latin America.

This is expected to boost automobile demand over the forecasted time range, hence driving market growth. Developing countries, such as India, China, South Africa, and Brazil, are expected to be prominent players in their respective regional marketplaces in the next years.

Metal Stamping Market Players

Some of the top metal stamping companies offered in our report include D&H Industries, Manor Tool & Manufacturing Company, Acro Metal Stamping, AAPICO Hitech Public Company Limited, Klesk Metal Stamping, Inc., Kenmode Precision Metal Stamping, Alcoa, Inc., Clow Stamping Company, Inc., and Goshen Stamping Company.

Frequently Asked Questions

How big is the metal stamping market?

The metal stamping market size was valued at USD 225.8 billion in 2023.

What is the CAGR of the global metal stamping market from 2024 to 2032?

The CAGR of metal stamping is 3.8% during the analysis period of 2024 to 2032.

Which are the key players in the metal stamping market?

The key players operating in the global market are including D&H Industries, Manor Tool & Manufacturing Company, Acro Metal Stamping, AAPICO Hitech Public Company Limited, Klesk Metal Stamping, Inc., Kenmode Precision Metal Stamping, Alcoa, Inc., Clow Stamping Company, Inc., and Goshen Stamping Company.

Which region dominated the global metal stamping market share?

North America held the dominating position in metal stamping industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of metal stamping during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global metal stamping industry?

The current trends and dynamics in the metal stamping industry include rising demand for lightweight automotive components, growth in consumer electronics and appliances, and technological advancements in metal stamping processes.

Which process held the maximum share in 2023?

The blanking process held the maximum share of the metal stamping industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date