Industry 4.0 Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Industry 4.0 Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

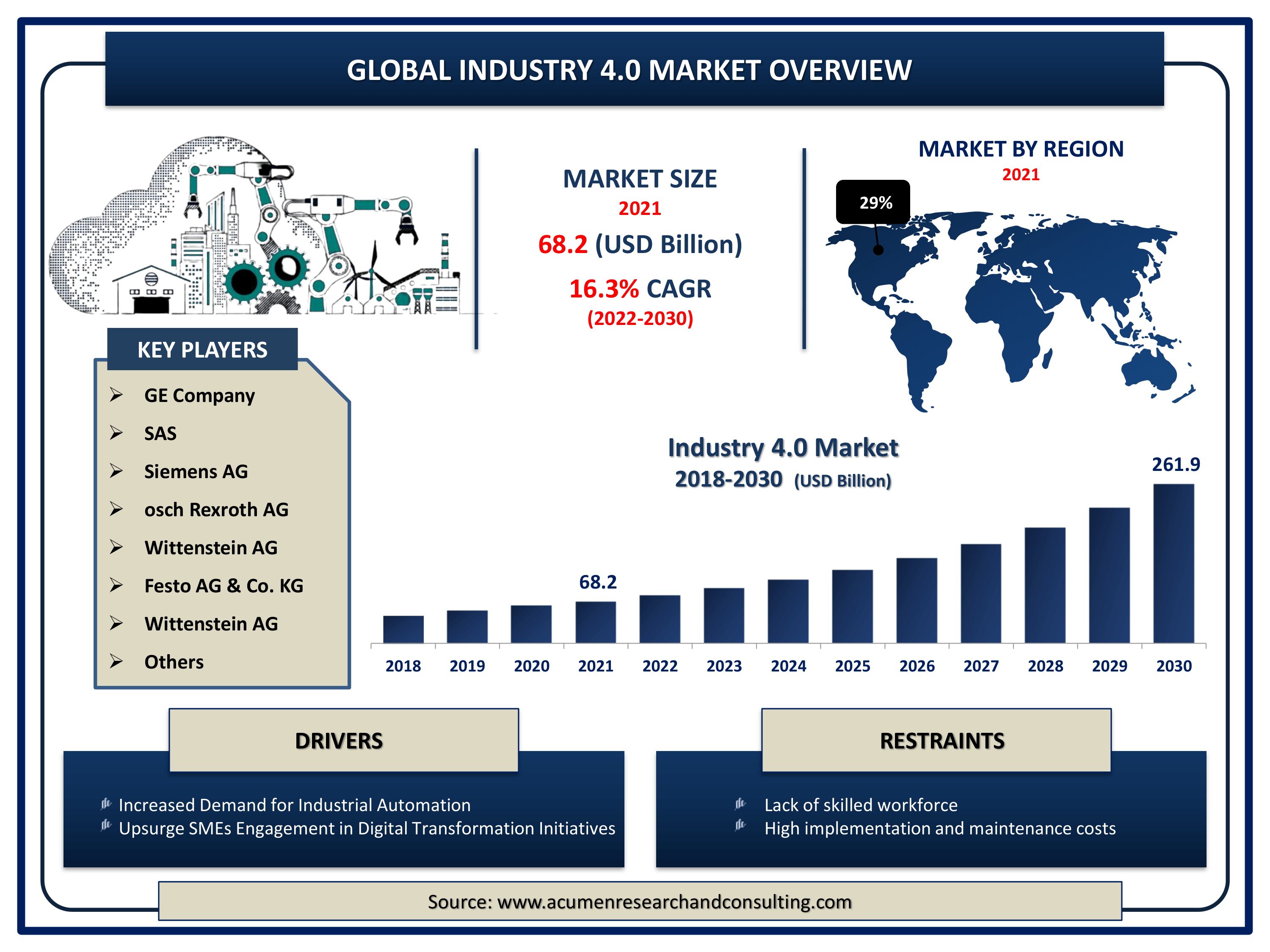

Request Sample Report

The Global Industry 4.0 Market Size accounted for USD 68.2 Billion in 2021 and is estimated to achieve a market size of USD 261.9 Billion by 2030 growing at a CAGR of 16.3% from 2022 to 2030. Growing adoption of automation technologies and the rise in industrial automation demand fuels the industry 4.0 market growth. Moreover, rising emphasis on profitability and cutting production costs, expanding acceptance of digital technologies across the sector, and growing adoption of robotics for production quality are all supporting the industry 4.0 market value in the coming years.

Industry 4.0 Market Report Key Highlights

- Global industry 4.0 market revenue is estimated to expand by USD 261.9 billion by 2030, with a 16.3% CAGR from 2022 to 2030

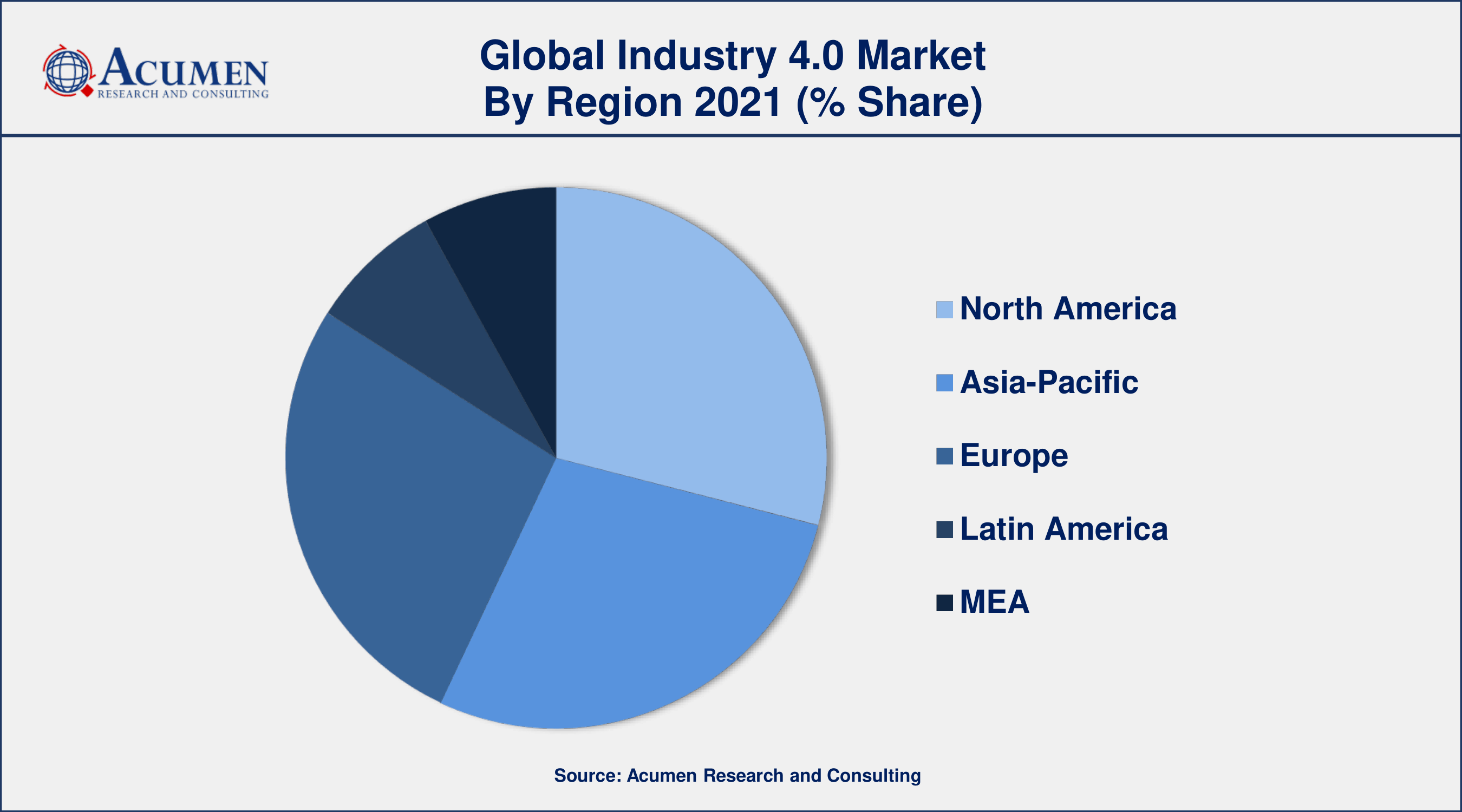

- North America industry 4.0 market share accounted for over 29% shares in 2021

- Asia-Pacific industry 4.0 market growth will observe fastest CAGR from 2022 to 2030

- According to the study, first-wave IIoT adopters might obtain a 30% improvement in productivity

- In comparison to 2016, the proportion of manufacturers predicted to be highly digitalized by 2020 increased from 33% to 72%

- Growing adoption of blockchain technology within the manufacturing industry, drive the industry 4.0 market size

Industry 4.0 is the fourth development to be fuelled by technology and machine learning in the manufacturing industry. Industry 4.0 provides state-of-the-art technologies for automation and data sharing. It also offers producers the chance to develop their activities quickly and efficiently. The variety of applications in Industry 4.0 includes, for instance, sensors, robotics control, product design, and logistics.

Global Industry 4.0 Market Dynamics

Market Drivers

- Increased demand for industrial automation

- Upsurge SMEs engagement in digital transformation initiatives

- Growing adoption of blockchain technology within the manufacturing industry

- Rising government activities in 3D printing and additive manufacturing

Market Restraints

- Lack of skilled workforce

- High implementation and maintenance costs

Market Opportunities

- Increasing application of IoT and artificial intelligence in the healthcare system

- The growing popularity of 5G in the cloud robotics market

Industry 4.0 Market Report Coverage

| Market | Industry 4.0 Market |

| Industry 4.0 Market Size 2021 | USD 68.2 Billion |

| Industry 4.0 Market Forecast 2030 | USD 261.9 Billion |

| Industry 4.0 Market CAGR During 2022 - 2030 | 16.3% |

| Industry 4.0 Market Analysis Period | 2018 - 2030 |

| Industry 4.0 Market Base Year | 2021 |

| Industry 4.0 Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Technology, By Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Maschinenfabrik Reinhausen GmbH, General Electric Company, SAS, Siemens AG, osch Rexroth AG, Wittenstein AG, Festo AG & Co. KG, Wittenstein AG, Klöckner & Co. SE, Daimler AG, and TRUMPF GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Industry 4.0 includes technology, computing resources, communication, research and knowledge, the relationship between human and digital devices, and physical conversion. The industry digitized and vertically combines operations across the business, from product design and sourcing to production, logistics, and operation. Cloud technology, technology advancements in the electronics industry, the introduction of the smart factory principle, automation technologies in manufacturing, and regulatory policies in different countries are all factors leading to demand development. Digital technology and convergence of vertical and horizontal supply chain goods, product digitization, and service networks are both the main factors for industry 4.0. Smart factories are becoming increasingly common in terms of fast, scalable, and productive production, digital business models, and customer access. The study shows that the major threat to the market of industry 4.0 is cyber security risks.

Industrial IoT (IIoT) To Gain Momentum During The Forecast Period

The sector is defined as commercial, intelligent, and automotive IoT depending upon the use. IoT incorporates the results of two transformative developments within the manufacturing industry (Manufacturing IoT). Many electronic equipment suppliers were inspired by the future advantages of implementing IoT. The manufacturers are capable of determining the existing condition of devices, improving their performance, and identifying possible problems when preparing repair programs, using a wireless connection, and processing sensor data from the equipment. Intelligent plants allow competitive fulfillment of any customer's requirements. In Industry 4.0, complex market and development systems allow final manufacturing operations to react flexibly to disturbances and defects rather than suppliers.

Industry 4.0 Market Segmentation

The worldwide industry 4.0 market segmentation is based on the technology, vertical, and geography.

Industry 4.0 Market By Technology

- Industrial Robotics

- Industrial Internet of Things (IIoT)

- Cybersecurity

- Advanced Human–Machine Interface (HMI)

- Big Data

- Artificial Intelligence

- 3D Printing

- Augmented Reality & Virtual Reality

According to the industry 4.0 market forecast, the IIoT segment would be the largest contributor to the global market throughout the anticipated time. The potential benefits of IIoT have encouraged several industrial machinery makers to embrace IoT. The manufacturers can accurately establish the current situation of machines, optimize their performance, predict future faults, and plan routine maintenance by connecting industrial machinery via wireless communication and collecting sensor readings from the system.

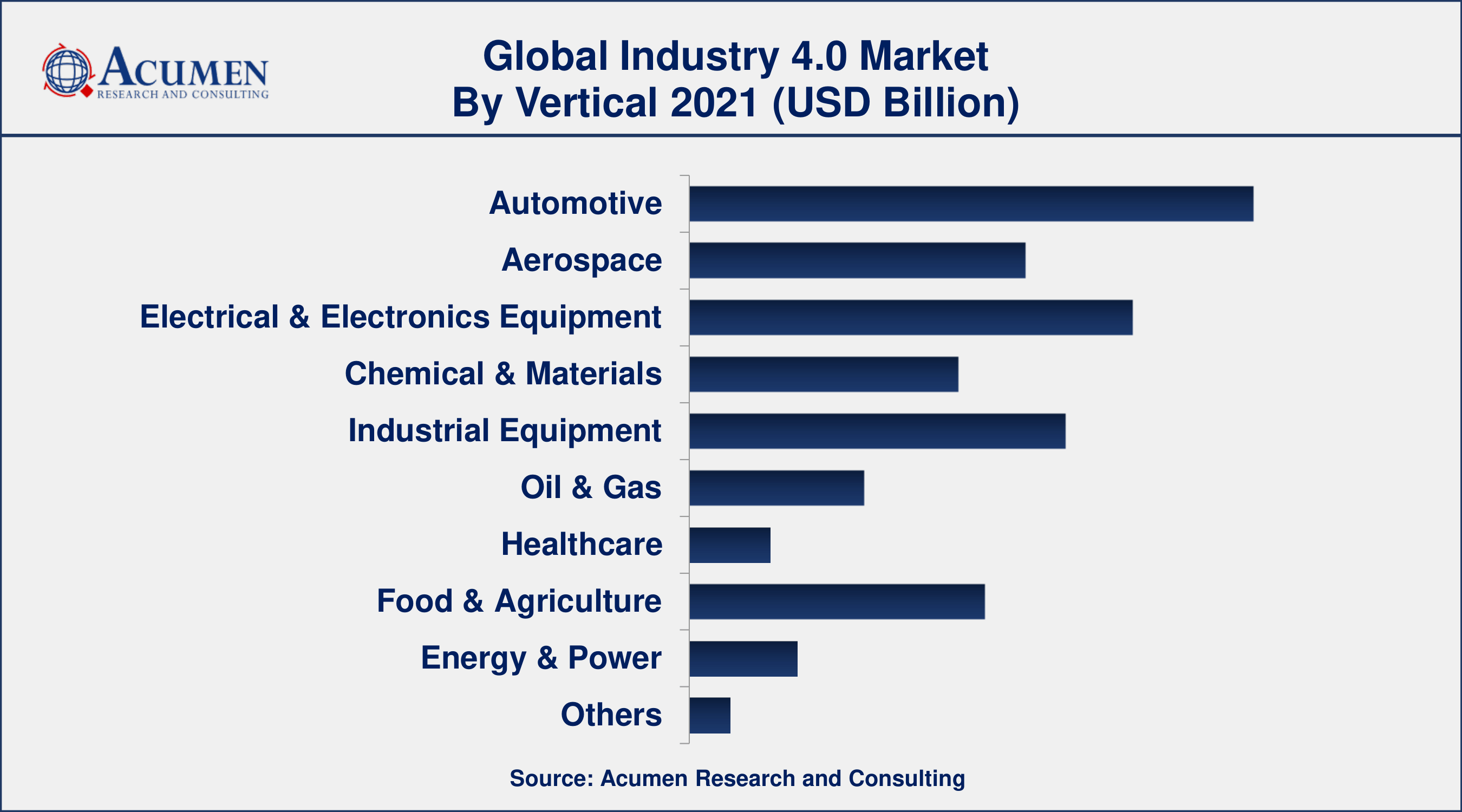

Industry 4.0 Market By Vertical

- Automotive

- Aerospace

- Electrical & Electronics Equipment

- Chemical & Materials

- Industrial Equipment

- Oil & Gas

- Healthcare

- Food & Agriculture

- Energy & Power

- Others

According to the Industry 4.0 industry analysis, the automotive segment will have the largest market share in 2021. The deployment of intelligent robots and machines in the automobile industry has grown in recent years. Furthermore, the adoption of sophisticated solutions in the automobile sector will be considered during the projected timeframes. Due to Industry 4.0, the prospect of self-driving automobiles has become a realization. To remain competitive in an environment of rapid technological developments, companies throughout the automobile ecosystem are spending extensively on manufacturing and product process improvements.

Industry 4.0 Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific Region Is Expected To Lead The Global Industry 4.0 Market

Asia Pacific Industry 4.0 is governed in Japan, China, and South Korea by methodical actions to implement industrial automation and innovative technology in the supply chain of manufacturing processes. In 2015, China's government unveiled "Made in China" for 10 years until 2025. This plan covers the top ten sectors, including semiconductors, advanced robotic systems, electric cars, and artificial intelligence. This state-led industrial policy seeks to rule China in global high-tech manufacturing and has been inspired by the development plan of the German government Industry 4.0. Japan launched the Society 5.0 Initiative to overcome the problems of environment, culture, and business. Policy policies and the importance of the introduction of emerging technology to the world economy promote the fourth industrial revolution in Latin America and the Middle East and Africa. In September 2017, for instance, at the annual cabinet meetings, the UAE government launched the UAE I4.0 plan. The plan is planned as a global hub for Industry 4.0 and as a global hub to improve its support for the domestic economy. In Brazil, too, top teams have partnered to boost technological asset deployment in order to speed up industry 4.0.

Industry 4.0 Market Players

Some of the top industry 4.0 market companies offered in the professional report include Maschinenfabrik Reinhausen GmbH, General Electric Company, SAS, Siemens AG, osch Rexroth AG, Wittenstein AG, Festo AG & Co. KG, Wittenstein AG, Klöckner & Co. SE, Daimler AG, and TRUMPF GmbH.

Industry 4.0 Market Strategies

Some of the key strategies in global market:

- General Electric (GE) has modified its corporate strategy to rely more on the evolving IIoT market environment. Within its subsidiary Intelligent Platforms, the company has been designing business tech applications leveraging big data. GE is also a founding member of the Industrial Internet Consortium which has been established for the advancement of the Collaborative IIoT Project.

- ABB Ltd (Switzerland), which is a significant part of Industry 4.0 market trend, is offering technological tools and applications such as human-machine interaction, communication systems, and industrial robotics. The company's wide-ranging automated control systems and technologies have been built across numerous vertical platforms and other equipment such as power sector products, electrical products, and drives so that the HMI market expands effectively.

Frequently Asked Questions

What is the size of global industry 4.0 market in 2021?

The estimated value of global industry 4.0 market in 2021 was accounted to be USD 68.2 Billion.

What is the CAGR of global industry 4.0 market during forecast period of 2022 to 2030?

The projected CAGR industry 4.0 market during the analysis period of 2022 to 2030 is 16.3%.

Which are the key players operating in the market?

The prominent players of the global industry 4.0 markets are Maschinenfabrik Reinhausen GmbH, General Electric Company, SAS, Siemens AG, osch Rexroth AG, Wittenstein AG, Festo AG & Co. KG, Wittenstein AG, Kl�ckner & Co. SE, Daimler AG, and TRUMPF GmbH.

Which region held the dominating position in the global industry 4.0 market?

North America held the dominating industry 4.0 during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for industry 4.0 during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global industry 4.0 market?

Increased demand for industrial automation, and upsurge SMEs engagement in digital transformation initiatives, drives the growth of global industry 4.0 market.

By vertical segment, which sub-segment held the maximum share?

Based on vertical, automotive segment is expected to hold the maximum share of the industry 4.0 market.