Manufacturing Execution System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Manufacturing Execution System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

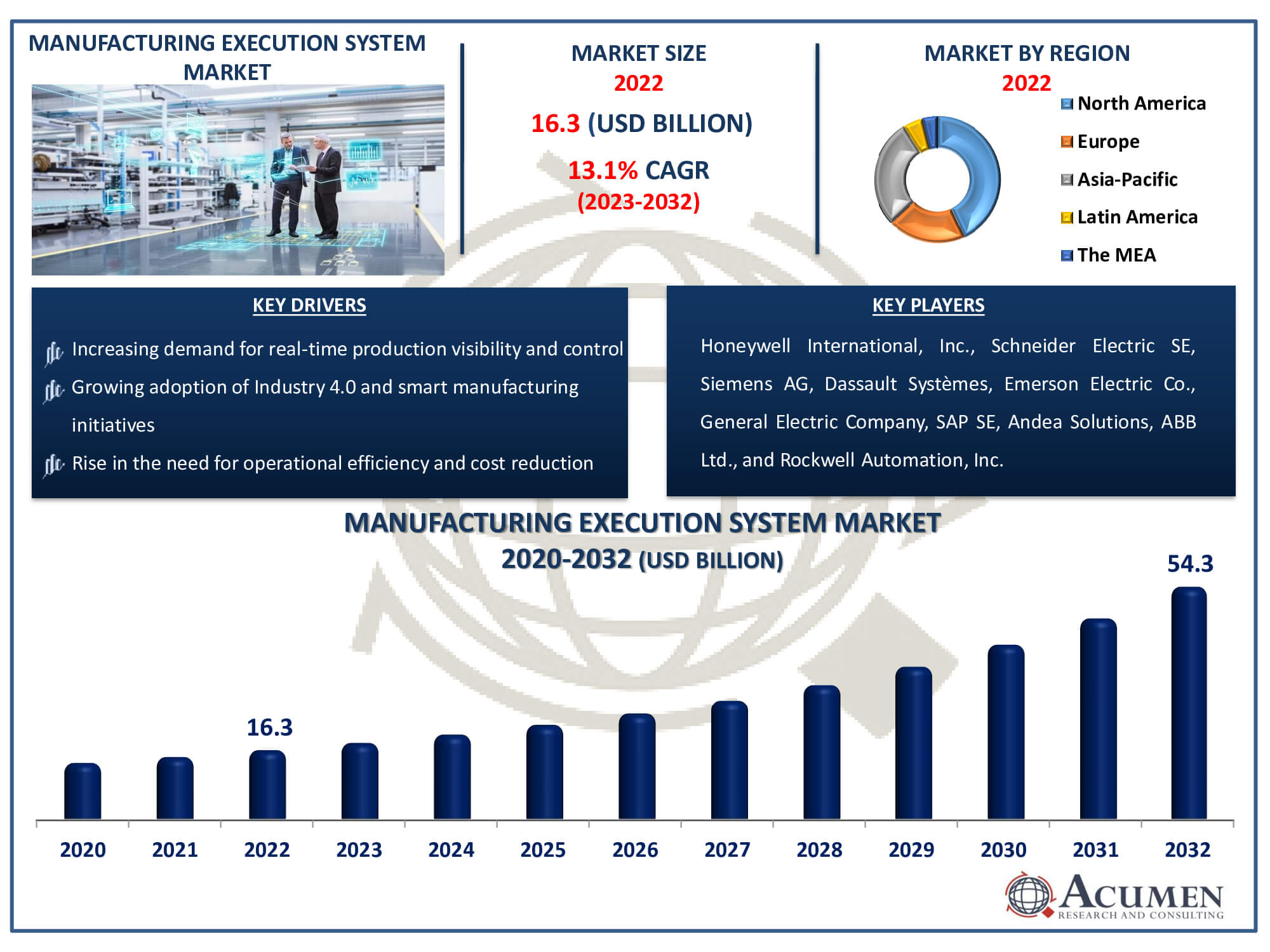

The Manufacturing Execution System Market Size accounted for USD 16.3 Billion in 2022 and is estimated to achieve a market size of USD 54.3 Billion by 2032 growing at a CAGR of 13.1% from 2023 to 2032.

Manufacturing Execution System Market Highlights

- Global manufacturing execution system market revenue is poised to garner USD 54.3 billion by 2032 with a CAGR of 13.1% from 2023 to 2032

- North America manufacturing execution system market value occupied around USD 7 billion in 2022

- Asia-Pacific manufacturing execution system market growth will record a CAGR of more than 14% from 2023 to 2032

- Among offering, the services sub-segment generated over US$ 11.7 billion revenue in 2022

- Based on deployment, the hybrid sub-segment generated around 54% share in 2022

- Integration of artificial intelligence (AI) and analytics for advanced insights is a popular manufacturing execution system market trend that fuels the industry demand

An information system that monitors, integrates, and manages dynamic data flows and processing machinery in the workplace is known as a process execution system. The primary objective of the manufacturing sector is to ensure the efficient execution of processing processes and enhance processing efficiency. For example, AVEVA Group PLC provides hybrid and batch processing execution systems, aiming to improve performance efficiency, productivity, and conformity. Manufacturing technologies are utilized in various ways in production to increase productivity, reduce labor costs, and simplify production processes. The United States and Japan were among the first pioneers in this field and soon gained prominence in other nations. The growth and implementation of output execution system technologies have also gained significant traction in Europe.

Global Manufacturing Execution System Market Dynamics

Market Drivers

- Increasing demand for real-time production visibility and control

- Growing adoption of Industry 4.0 and smart manufacturing initiatives

- Enhanced focus on quality management and regulatory compliance

- Rise in the need for operational efficiency and cost reduction

Market Restraints

- High initial investment and implementation costs

- Integration challenges with existing legacy systems

- Concerns about cybersecurity and data privacy

Market Opportunities

- Expanding applications in small and medium-sized enterprises (SMEs)

- Advancements in cloud-based Manufacturing Execution Systems (MES)

- Rising opportunities in emerging markets

Manufacturing Execution System Market Report Coverage

| Market | Manufacturing Execution System Market |

| Manufacturing Execution System Market Size 2022 | USD 16.3 Billion |

| Manufacturing Execution System Market Forecast 2032 | USD 50.7 Billion |

| Manufacturing Execution System Market CAGR During 2023 - 2032 | 13.1% |

| Manufacturing Execution System Market Analysis Period | 2020 - 2032 |

| Manufacturing Execution System Market Base Year |

2022 |

| Manufacturing Execution System Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Offering, By Deployment, By Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Honeywell International, Inc., Schneider Electric SE, Siemens AG, Dassault Systèmes, Emerson Electric Co., General Electric Company, SAP SE, Andea Solutions, ABB Ltd., and Rockwell Automation, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Manufacturing Execution System Market Insights

The increasing global demand for manufacturing execution systems (MES) is anticipated to rise, addressing emerging challenges in the production sector. Many organizations encounter difficulties in integrating hardware modules with cloud infrastructure. A cloud-based manufacturing facility assigns an Internet Protocol (IP) or Transmission Control Protocol (TCP) to connect specific hardware components. The integration of factory execution with other ERP processes in the organization is expected to contribute to the worldwide growth of the MES industry. This incorporation of ERP programs into MES reduces the need for separate applications, provides clearer insights into expected timeframes for order fulfillment, and enhances decision-making. However, the dynamic complexity of technology may pose challenges to the global MES market's development.

In terms of manufacturing execution system market analysis, one significant possibility is the continuous integration of Industry 4.0 technology with MES. MES can improve real-time monitoring, predictive maintenance, and overall operational efficiency by using the potential of IoT, big data analytics, and artificial intelligence. By integrating Industry 4.0 with MES, manufacturers may optimize resource utilization, gain more insight into their manufacturing processes, and make data-driven choices. This raises productivity and establishes MES as a key player in the transition to smart manufacturing.

The need for MES solutions is rising as the manufacturing sectors in emerging economies keep growing over the manufacturing execution system industry forecast period. The adoption of manufacturing enterprise systems (MES) is accelerating in regions like Asia-Pacific and Latin America due to the need for effective production processes, quality control, and adherence to industry standards. Manufacturers in these areas are realizing how important MES is for optimizing workflows, cutting down on mistakes, and guaranteeing legal compliance. This offers MES suppliers a huge chance to capitalize on the expanding manufacturing industries of emerging economies and support the expansion of the global market.

Manufacturing Execution System Market Segmentation

The worldwide market for manufacturing execution system is split based on offering, deployment, vertical, and geography.

Manufacturing Execution System (MES) Market By Offering

- Software

- Services

According to manufacturing execution system industry analysis, the services category has held the largest position in the MES market, continually dominating the market. This tendency can be explained by the crucial role services play in maintaining continuous operational efficiency and a successful MES deployment. System integration, customisation, training, and support are just a few of the critical elements that make up MES services and are necessary for their smooth implementation in a variety of manufacturing settings. Because manufacturers frequently need support and specialised knowledge to match MES solutions to their unique production processes, the services sector is essential to the efficient use of MES software. The industry's realisation of the value of a comprehensive approach to MES deployment is shown in the emphasis on comprehensive service offerings, which has greatly contributed to the segment's market domination.

Manufacturing Execution System (MES) Market By Deployment

- On-premise

- On-demand

- Hybrid

The manufacturing execution system (MES) industry is dominated by the hybrid deployment strategy because of its clever combination of on-premise and on-demand capabilities. By combining the benefits of both deployment strategies, this novel strategy gives manufacturers more scalability and flexibility. Hybrid MES systems combine the flexibility and accessibility of on-demand or cloud-based components with the essential on-premise control over sensitive data and processes that organisations need to maintain. Due to its ability to meet a variety of manufacturing needs, this dual approach is particularly attractive to businesses that are switching from traditional to cloud-based systems or have complicated organisational structures. Because of its agility, the hybrid deployment model is the recommended option for modern production environments. This helps it maintain its leading position in the MES industry.

Manufacturing Execution System (MES) Market By Vertical

- Food & Beverages

- Automotive

- Oil & Gas

- Pulp & Paper

- Aerospace & Defense

- Pharmaceutical

- Chemical

- Electronics and Semiconductor

- Consumer Packaged Goods

- Others

With a sizeable proportion, the automotive industry is expected to stand out as a manufacturing execution systems MES market leader. The industry's growing emphasis on automation, precision production, and strict quality control is responsible for its popularity. Through the optimisation of production workflows, assurance of real-time visibility, and improvement of overall operational efficiency, MES plays a crucial role in the automotive manufacturing process. The automotive industry's need for just-in-time manufacturing, efficient procedures, and compliance with stringent regulations is what's driving the demand for MES solutions. MES is the main vertical in the MES market because it plays a crucial role in satisfying the complicated requirements of the automotive industry, which is constantly evolving with technological breakthroughs.

Manufacturing Execution System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Manufacturing Execution System Market Regional Analysis

North America is poised to dominate the industry, holding a market share of 43% during the manufacturing execution system market forecast period. The region's supremacy can be attributed to the increased technical advances in machinery and heavy equipment production. The presence of numerous manufacturing companies and a growing start-up community are key factors driving the demand growth for manufacturing systems. However, the Asia-Pacific region closely mirrors the industrial process network trend in North America, with global demand expanding in emerging countries such as China and India due to robust production operations. In the Middle East, the oil and gas industry, including UAE, Qatar, and Iraq, presents substantial business prospects for the competitive execution sector, driven by expanded penetration in the region. MES markets in South America are fueled by the latest crude oil processing facilities in the Gulf of Mexico and industrialization in Brazil.

Manufacturing Execution System Market Players

Some of the top manufacturing execution system companies offered in our report includes Honeywell International, Inc., Schneider Electric SE, Siemens AG, Dassault Systèmes, Emerson Electric Co., General Electric Company, SAP SE, Andea Solutions, ABB Ltd., and Rockwell Automation, Inc.

Frequently Asked Questions

How big is the manufacturing execution system market?

The manufacturing execution system market size was USD 16.3 billion in 2022.

What is the CAGR of the global manufacturing execution system market from 2023 to 2032?

The CAGR of manufacturing execution system is 13.1% during the analysis period of 2023 to 2032.

Which are the key players in the manufacturing execution system market?

The key players operating in the global market are including Honeywell International, Inc., Schneider Electric SE, Siemens AG, Dassault Syst�mes, Emerson Electric Co., General Electric Company, SAP SE, Andea Solutions, ABB Ltd., and Rockwell Automation, Inc.

Which region dominated the global manufacturing execution system market share?

North America held the dominating position in manufacturing execution system industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of manufacturing execution system during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global manufacturing execution system industry?

The current trends and dynamics in the manufacturing execution system industry include increasing demand for real-time production visibility and control, growing adoption of industry 4.0 and smart manufacturing initiatives, enhanced focus on quality management and regulatory compliance, and rise in the need for operational efficiency and cost reduction.

Which offering held the maximum share in 2022?

The services offering held the maximum share of the manufacturing execution system industry.