Isosorbide Market | Acumen Research and Consulting

Isosorbide Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

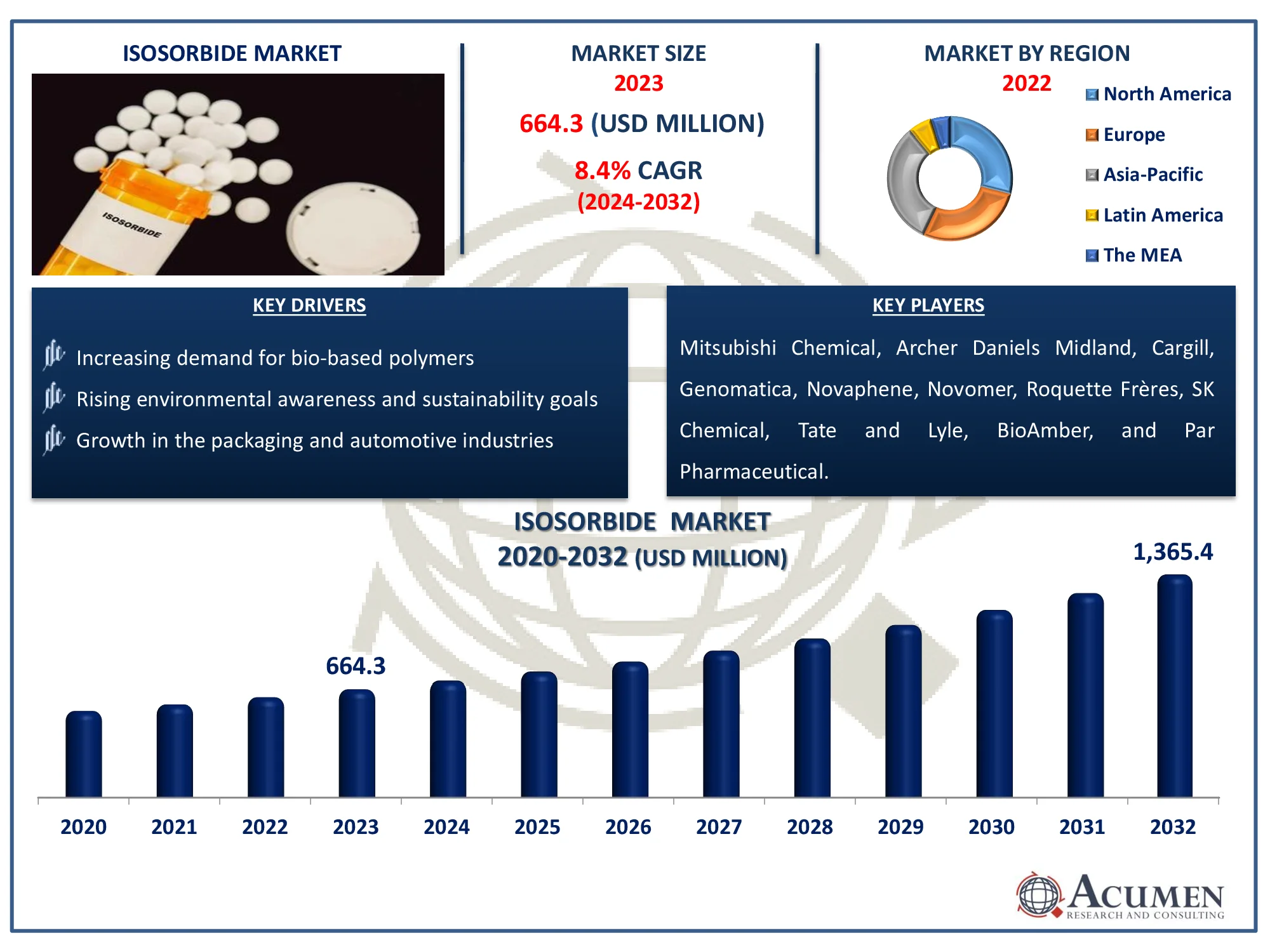

The Global Isosorbide Market Size accounted for USD 664.3 Million in 2023 and is estimated to achieve a market size of USD 1,365.4 Million by 2032 growing at a CAGR of 8.4% from 2024 to 2032.

Isosorbide Market Highlights

- The global isosorbide market is projected to reach USD 1,365.4 million by 2032, with a CAGR of 8.4% from 2024 to 2032

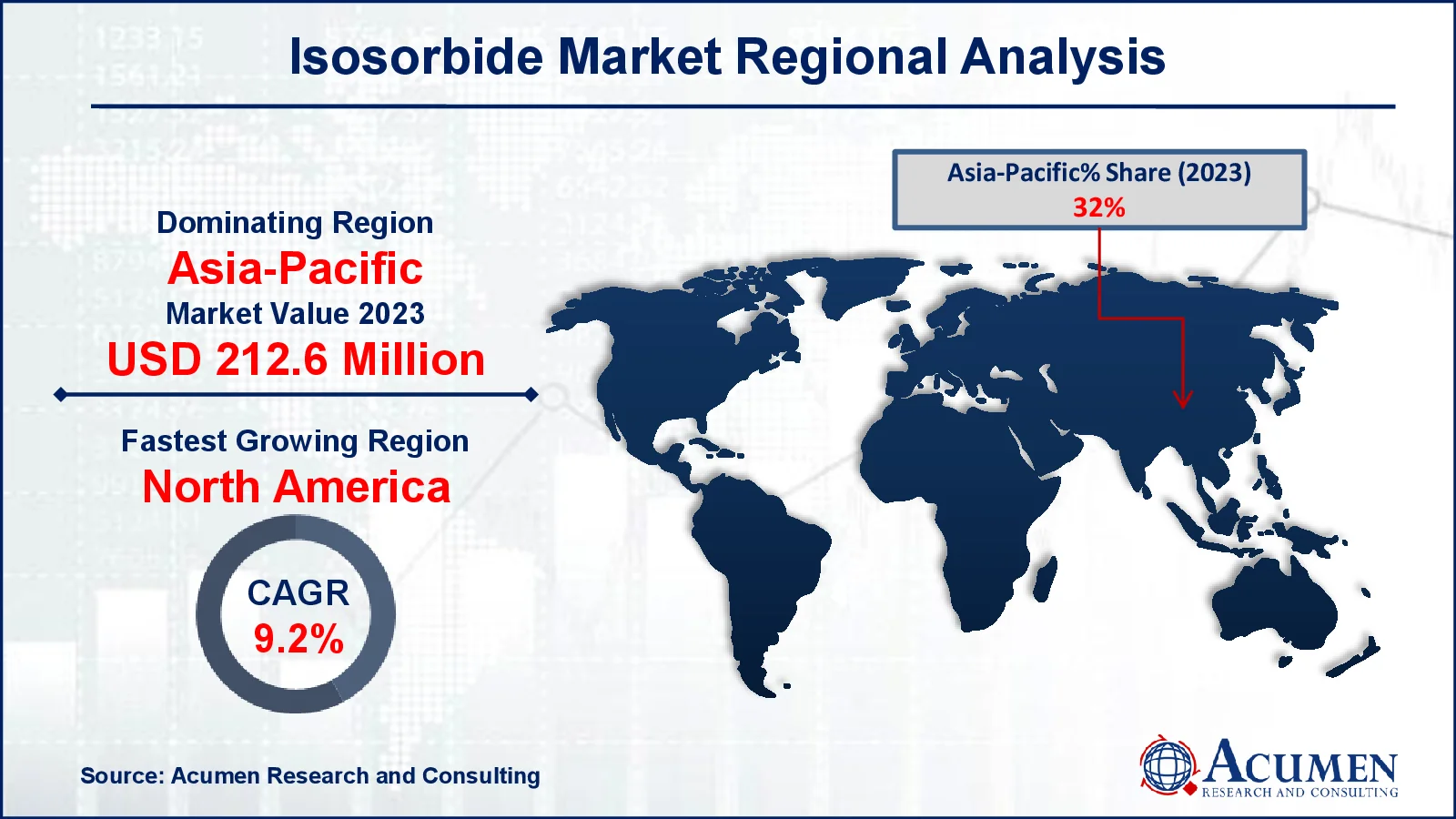

- The Asia-Pacific isosorbide market was valued at approximately USD 212.6 million in 2023

- North America's isosorbide market is expected to grow at a CAGR of over 9.2% from 2024 to 2032

- The polyethylene isosorbide terephthalate (PEIT) segment accounted for a 26% market share in 2023, based on application

- The resins and polymers end-use segment achieved 51% growth in 2023

- Rising adoption in cosmetics due to its moisturizing properties is the isosorbide market trend that fuels the industry demand

Isosorbide, which is derived from bio-based feedstock, can substitute for various synthetic polymers. Capabilities for replacing synthetic plastics with bio-based polymers have been added. This trend has grown in relevance in recent years as environmental worries about the toxicity of synthetic materials have led to a shift in customer preference toward green solutions. The continual supply of critical raw materials due to their overlap with other essential applications, which has limited the producers' profit margins, has had a substantial impact on the isosorbid market.

Global Isosorbide Market Dynamics

Market Drivers

- Increasing demand for bio-based polymers

- Rising environmental awareness and sustainability goals

- Growth in the packaging and automotive industries

Market Restraints

- High production costs of isosorbide

- Limited raw material availability

- Competitive alternatives like petrochemical-based products

Market Opportunities

- Expansion in biodegradable plastics

- Growing use in pharmaceuticals and cosmetics

- Advancements in production technologies reducing costs

Isosorbide Market Report Coverage

| Market | Isosorbide Market |

| Isosorbide Market Size 2022 |

USD 664.3 Million |

| Isosorbide Market Forecast 2032 | USD 1,365.4 Million |

| Isosorbide Market CAGR During 2023 - 2032 | 8.4% |

| Isosorbide Market Analysis Period | 2020 - 2032 |

| Isosorbide Market Base Year |

2022 |

| Isosorbide Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Mitsubishi Chemical, Genomatica, Novaphene, Novomer, Roquette Frères, SK Chemical, Cargill, Tate and Lyle, BioAmber, Archer Daniels Midland, and Par Pharmaceutical. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Isosorbide Market Insights

The increasing demand from the cosmetics and pharmaceutical sectors, the expanding bioplastics industry, and the growing application in elastomers and polymers are all critical market considerations. Another expected positive influence on economic development is an increase in consumer environmental awareness of sustainability and technical advancements in this area. Furthermore, shifting customer preferences for bioplastics are expected to drive market growth in the coming years, aided by increased awareness of green product usage.

Raw materials are sourced through manufacturing partnerships with farmers in areas where processing facilities are located. Roquette manufactures starch, isosorbide, and isosorbide-based biopolymers for a variety of end users. The continuous availability of crucial raw materials is a significant effect of the isosorbid market due to the overlap of other essential uses, which has hampered manufacturer profit margins. The novel usage of isosorbids in PET, polycarbonate, and polyurethane was viewed as an essential opportunity for manufacturing enterprises to expand.

Bioplastics market expansion, together with technical advancement and regulatory assistance, will most likely lead to an increase in isosorbide manufacturing capacity. To increase polymer resistance, PEIT is copolymerized with polyethylene terenphthalate (PET) and ethylene glycol. It is employed in the thermoplastics market, where high temperature efficiency is required, such as stiff containers and bottles for thermal filling applications, to help the sector grow.

Product demand is predicted to rise in the coming years due to isosorbide's strong potential as an alternative for synthetic intermediates. Isosorbide may also be used in polycarbonate plastics to replace bisphenol-A (BPA). Isosorbide diesters are employed in polymers like PVC and have excellent plasticisation and replacement potential in the next years.

However, the bad health consequences of isosorbid derivatives are expected to worsen over time, including erratic heart rate, severe headache, and angina discomfort. The focus on BIC is expected to open up new avenues for market growth in the coming years, resulting in increased investments in R&D and product innovation with environmentally friendly attributes.

Furthermore, it is expected that the shift towards the replacement of synthetic oil plastics will accelerate future regulatory changes in isosorbides. The Energy Department of the United States identified isosorbide as a developing bio-based chemical platform. A crucial challenge, which is expected to boost market expansion in the next years, is the supply of raw materials at reasonable prices. The basic ingredients for isosorbid manufacturing are maize, wheat, sorbitol, and vegetables.

Isosorbide Market Segmentation

The worldwide market for isosorbide is split based on application, end-use, and geography.

Isosorbide Market By Application

- Polyethylene Isosorbide Terephthalate (PEIT)

- Polycarbonate

- Polyurethane

- Polyester Polyisosorbide

- Isosorbide Diesters

- Others

According to the isosorbide industry analysis, increased heat resilience, increased food and beverage consumption, and expanding opportunities in the pharmaceutical business have pushed the PEIT sector to dominate the market. Furthermore, increased awareness and success rates are expected to drive global industrial demand for this application, as the chemical sector focuses more on bio-based products. High demand from industries such as electronics, medical devices, and automobiles is driving global market growth. Roquette, for example, boosted its manufacturing scale after successfully growing isosorbid polycarbonate on a pilot scale. Polyurethane-based isosorbids have higher heat stability and lower polydispersibility. PIS has properties suitable for powder coating applications, including as glass transition temperature and molecular weight.

Isosorbide Market By End-Use

- Resins & Polymers

- Additives

- Others

According to the isosorbide market forecast, key end-use areas covered include resins and polymers, additives, and other industries such as pharmaceuticals and medical devices. In 2023, resins and polymers continued to be the dominant end-use segment. Bio-based items are becoming increasingly popular in the polymer business, which is driving worldwide industry growth. In the projection period, additives are expected to grow at the fastest rate and with the greatest CAGR. There is a strong policy on hazardous BPA policies, rising awareness about the toxic effects of synthetic chemical substances, and the commercialization of biobased isosorbides, which are driving general industrial development.

Isosorbide Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Isosorbide Market Regional Analysis

For several reasons, Asia-Pacific had the largest market share in 2023, with the highest CAGR. This is mostly due to low raw material and labor costs; nevertheless, the cause for worldwide market growth is a rise in demand for bioplastics. For example, major chemical and biotechnology companies such as Roquette have transferred their manufacturing bases to low-cost countries such as China, India, Thailand, and Indonesia.

The usage of petroleum plastics is also expected to drive high CAGR growth in Europe. One of Europe's primary market drivers is promising regulatory frameworks that support viable chemistry. Demand for biologically based polymers such as PET, polycarbonate, and polyurethane produced of isosorbide is expected to rise due to increased demand in North America. Isosorbide was developed by ADM, one of the world's major food-processing companies, in response to rapidly expanding demand.

Extensive R&D efforts will boost PEIT demand. According to tests conducted by the Iowa Maize Promotion Board, using polyethylene isosorbide improves its rigidity and strength. The growing emphasis on bio-based chemicals results in significant investments in environmentally friendly attributes in research, development, and product creation. Over time, it is expected to grow profitably in the rest of the world, including Central and Southern America, the Middle East, and Africa. Brazil is one of the world's largest maize manufacturers, ranking among the top five. Furthermore, many organic plastic companies are paying particular attention to maize, which is a key raw ingredient in the creation of isosorbides and bioplastics.

Isosorbide Market Players

Some of the top isosorbide companies offered in our report include Mitsubishi Chemical, Genomatica, Novaphene, Novomer, Roquette Frères, SK Chemical, Cargill, Tate and Lyle, BioAmber, Archer Daniels Midland, and Par Pharmaceutical.

Frequently Asked Questions

How big is the isosorbide market?

The isosorbide market size was valued at USD 664.3 million in 2023.

What is the CAGR of the global isosorbide market from 2024 to 2032?

The CAGR of Isosorbide is 8.4% during the analysis period of 2024 to 2032.

Which are the key players in the isosorbide market?

The key players operating in the global market are including Mitsubishi Chemical, Genomatica, Novaphene, Novomer, Roquette Frères, SK Chemical, Cargill, Tate and Lyle, BioAmber, Archer Daniels Midland, and Par Pharmaceutical.

Which region dominated the global isosorbide market share?

Asia-Pacific held the dominating position in isosorbide industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of isosorbide during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global isosorbide industry?

The current trends and dynamics in the isosorbide industry include increasing demand for bio-based polymers, rising environmental awareness and sustainability goals, and growth in the packaging and automotive industries

Which application held the maximum share in 2023?

The polyethylene isosorbide terephthalate (PEIT) expected to hold the maximum share of the isosorbide industry.