Image-Guided & Robot-Assisted Surgical Procedures Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Image-Guided & Robot-Assisted Surgical Procedures Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

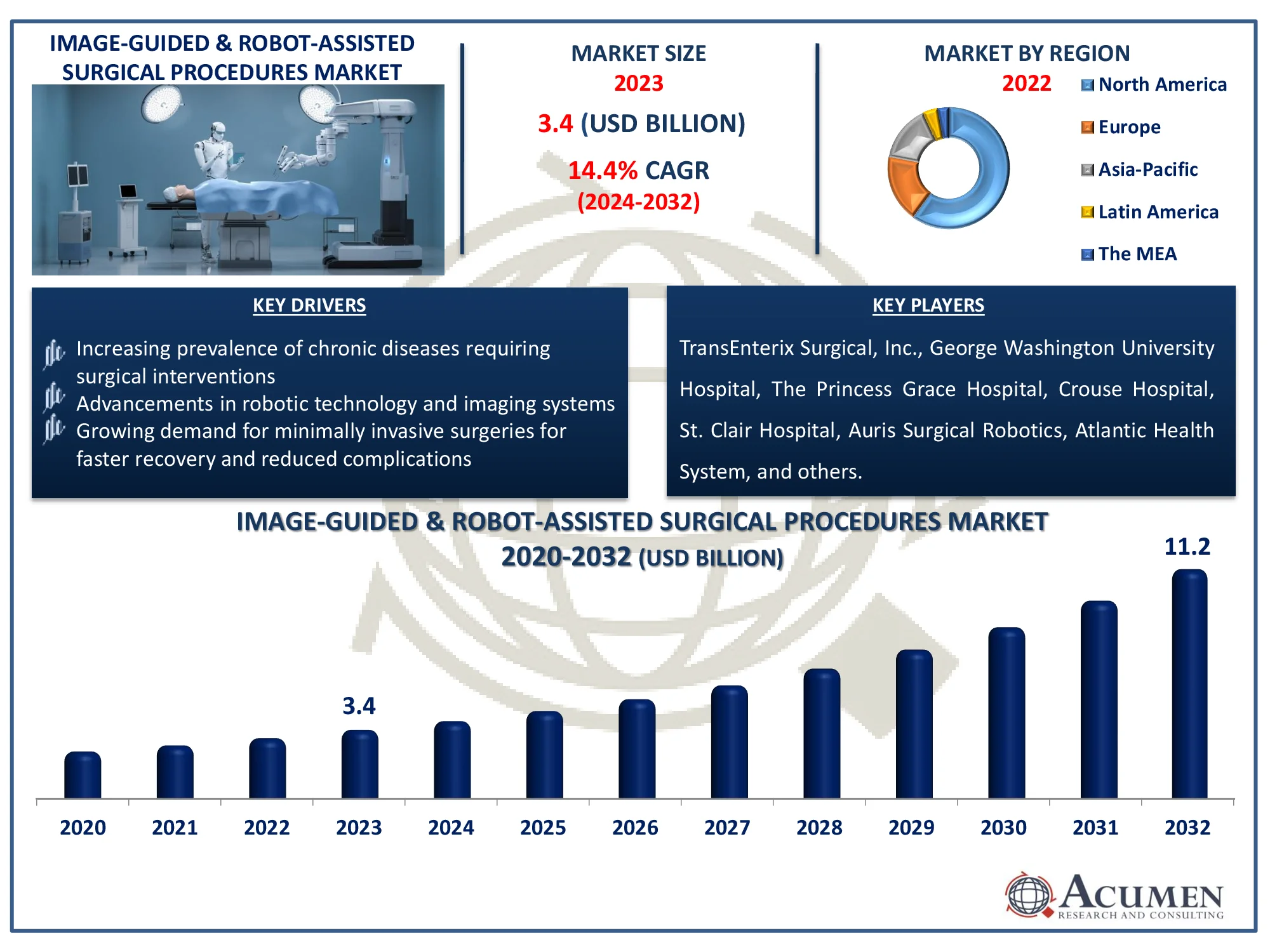

The Global Image-Guided & Robot-Assisted Surgical Procedures Market Size accounted for USD 3.4 Billion in 2023 and is estimated to achieve a market size of USD 11.2 Billion by 2032 growing at a CAGR of 14.4% from 2024 to 2032.

Image-Guided & Robot-Assisted Surgical Procedures Market Highlights

- Global image-guided & robot-assisted surgical procedures market revenue is poised to garner USD 11.2 billion by 2032 with a CAGR of 14.4% from 2024 to 2032

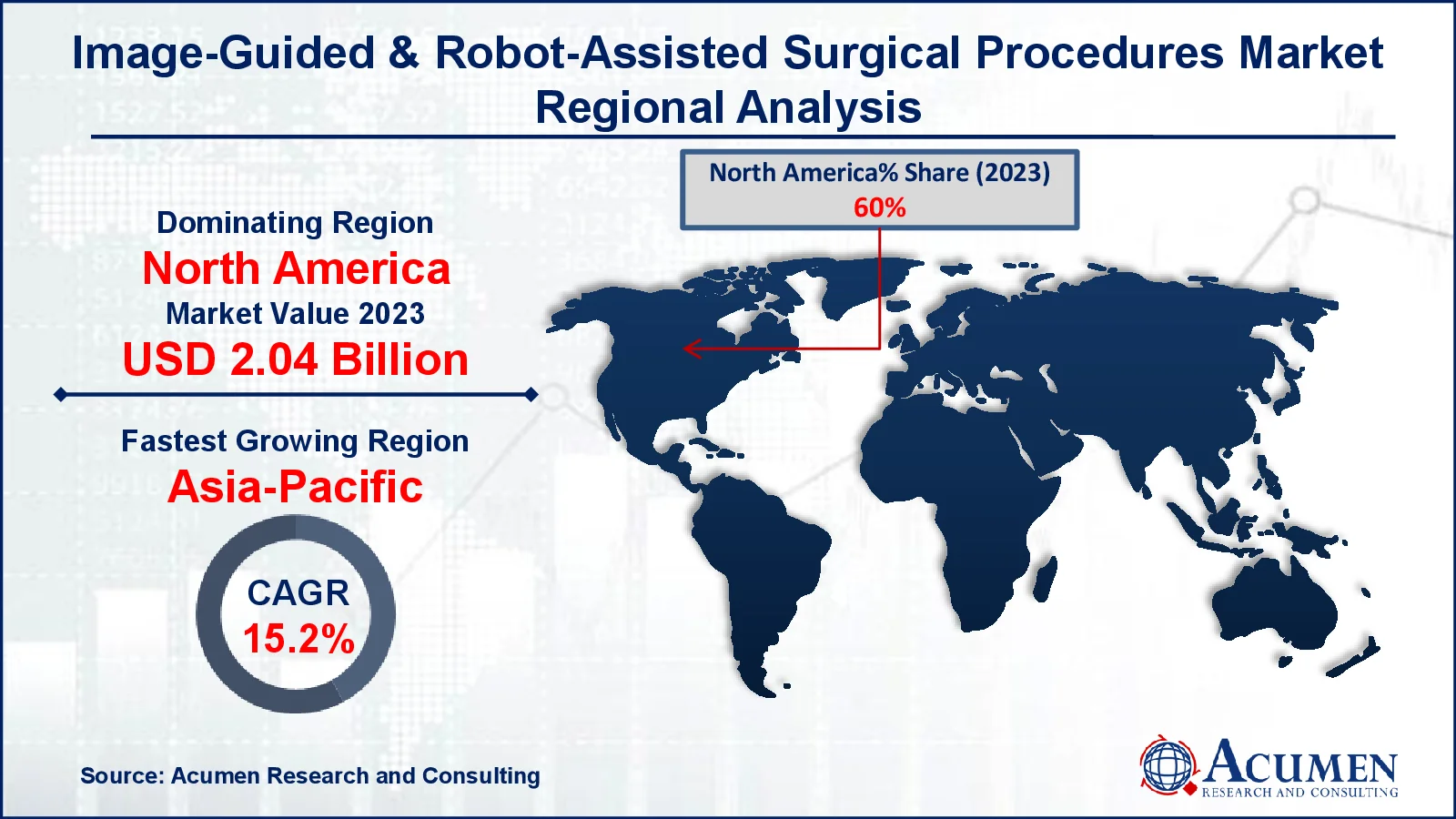

- North America image-guided & robot-assisted surgical procedures market value occupied around USD 2.04 billion in 2023

- Asia-Pacific image-guided & robot-assisted surgical procedures market growth will record a CAGR of more than 15.2% from 2024 to 2032

- Based on specialty type, the gynecologic surgery sub-segment expected to generated 40% market share in 2023

- Based on end-user, the hospitals sub-segment shows notable growth in 2023

- Integration of robotics to improve surgical outcomes and reduce human error is the image-guided & robot-assisted surgical procedures market trend that fuels the industry demand

Rapid technological advancements in medical robotics are projected to result in greater acceptance of robots in medical treatments. The increasing number of complex medical procedures and injury occurrences are required to further drive the market.

Innovative advancements have transformed operations over the last few decades as a result of updates such as minute cameras, three-dimensional imaging frameworks, movement sensors, and remote route and automated catheter control frameworks. The Da Vinci Surgical System, developed by Intuitive Surgical, Inc., is the most widely recognized framework for sophisticated methods. This PC-upgraded framework is suited to accommodate advanced laparoscopic methods. This innovatively driven structure reduces careful errors and provides a better patient outcome.

Global Image-Guided & Robot-Assisted Surgical Procedures Market Dynamics

Market Drivers

- Increasing prevalence of chronic diseases requiring surgical interventions

- Advancements in robotic technology and imaging systems

- Growing demand for minimally invasive surgeries for faster recovery and reduced complications

Market Restraints

- High costs associated with robotic surgical systems and imaging equipment

- Limited availability of skilled professionals to operate advanced surgical technologies

- Stringent regulatory requirements for device approvals and compliance

Market Opportunities

- Expansion of robotic surgery applications in new medical fields and procedures

- Rising adoption of image-guided systems in emerging markets due to improved healthcare infrastructure

- Technological advancements in AI and machine learning to enhance surgical precision and outcomes

Image-Guided & Robot-Assisted Surgical Procedures Market Report Coverage

|

Market |

Image-Guided & Robot-Assisted Surgical Procedures Market |

|

Image-Guided & Robot-Assisted Surgical Procedures Market Size 2023 |

USD 3.4 Billion |

|

Image-Guided & Robot-Assisted Surgical Procedures Market Forecast 2032 |

USD 11.2 Billion |

|

Image-Guided & Robot-Assisted Surgical Procedures Market CAGR During 2024 - 2032 |

14.4% |

|

Image-Guided & Robot-Assisted Surgical Procedures Market Analysis Period |

2020 - 2032 |

|

Image-Guided & Robot-Assisted Surgical Procedures Market Base Year |

2023 |

|

Image-Guided & Robot-Assisted Surgical Procedures Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Specialty Type, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

TransEnterix Surgical, Inc., George Washington University Hospital, The Princess Grace Hospital, Crouse Hospital, St. Clair Hospital, Auris Surgical Robotics, Atlantic Health System, Apollo Hospitals Enterprise Ltd., Atlantic Health System, and Medanta the Medicity. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Image-Guided & Robot-Assisted Surgical Procedures Market Insights

Hospitals' high spending on medical devices and equipment is expected to boost the market for image-guided and robot-assisted surgical operations. The Da Vinci System is being used to conduct a wide range of medical treatments. Though robots, like as Rosa spine and Rosa mind, are used to execute spinal and neurological functions individually. When compared to traditional methods, this reduces the likelihood of errors. Ascend in spinal and neurological wounds are required to further fuel market growth throughout the projected time period. Emerging economies, such as North America and Europe, now have a larger share of the overall business in terms of income, owing to the proliferation of technologically advanced medical robots propelled therapeutic robots and the necessity for minimally intrusive medical procedures.

Robotic surgical systems and imaging equipment are prohibitively expensive, making them difficult for many institutions to purchase and use. The costs of obtaining, maintaining, and updating these technology are significant. This is especially challenging for smaller hospitals and those with limited finances. Furthermore, insurance typically does not cover all of the costs, making it difficult for patients to obtain these treatments. Because of these costs, fewer institutions can offer these advanced therapies, limiting their market expansion.

The expanding usage of robotic surgery in many medical sectors, as well as new types of operations, is opening up new potential for the image-guided and robot-assisted surgery industry. For instance, in May 2022, CMR Surgical, a global surgical robotics firm, announced the launch of its Versius Surgical Robotic Technology in Brazil, marking the company's first foray into Latin America. The Hospital e Maternidade Sao Luiz Itaim, Rede D'Or in São Paulo is the first in Brazil to use Versius as part of a multi-specialty robotic surgical strategy. As robotic systems progress, they are being employed in a broader range of surgeries, including brain, bone, and women's health procedures. This makes procedures more precise and less invasive, resulting in better patient outcomes. These advancements make procedures safer and more efficient.

Image-Guided & Robot-Assisted Surgical Procedures Market Segmentation

The worldwide market for image-guided & robot-assisted surgical procedures is split based on specialty type, end-user, and geography.

Image-Guided & Robot-Assisted Surgical Procedures Specialty Type

- Gynecologic Surgery

- Urologic Surgery

- General Surgery

- Cardiothoracic Surgery

- Head and Neck Specialties

According to the image-guided & robot-assisted surgical procedures industry analysis, gynecologic surgery leads the market due to its need for precision and minimally invasive techniques. These technologies offer enhanced visualization and control, improving outcomes in complex procedures like hysterectomies. The success in gynecology sets a high standard, driving further adoption and innovation in this field. As a result, gynecologic surgery remains a dominant segment in this market.

Image-Guided & Robot-Assisted Surgical Procedures End-User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

According to the image-guided & robot-assisted surgical procedures market forecast, hospitals are main users of image-guided and robot-assisted surgery tools. They have the strong finacial resources and facilities needed to maintain and use these advanced technologies. Since hospitals perform many surgeries, they use these tools often. They also train new surgeons, which helps them adopt and use these technologies effectively. Because of these reasons, hospitals are the top users of these surgical systems.

Image-Guided & Robot-Assisted Surgical Procedures Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Image-Guided & Robot-Assisted Surgical Procedures Market Regional Analysis

For several reasons, North America dominates the image-guided and robot-assisted surgery market for several reasons. The region has top-notch hospitals and medical centers that use the latest technologies. There is a lot of investment in research and development, leading to new and improved surgical tools. For instance, in 2022, the United States is estimated to spend $885.6 billion on research and development (R&D) in current dollars. This is a 12% gain over 2021 in current (nominal) dollars, as well as a 5% increase in constant (inflation-adjusted) dollars. Additionally, major companies and insurance coverage support the widespread use of these technologies in the region.

Asia Pacific is expected to develop at a CAGR of 15.2% over the forecast period, driven by factors such as improved human services infrastructure in countries such as China and India. Japan, on the other hand, has one of the most developed medical services frameworks and widespread adoption of computerization in all fields. This has created a lucrative opportunity for therapeutic mechanical autonomy producers. These elements are expected to add to the local market demand in the next years.

Emerging economies, such as Latin America, the Middle East, and Africa, have fewer image-guided robots since they are more expensive and less accepted.

Image-Guided & Robot-Assisted Surgical Procedures Market Players

Some of the top image-guided & robot-assisted surgical procedures companies offered in our report include TransEnterix Surgical, Inc., George Washington University Hospital, The Princess Grace Hospital, Crouse Hospital, St. Clair Hospital, Auris Surgical Robotics, Atlantic Health System, Apollo Hospitals Enterprise Ltd., Atlantic Health System, and Medanta the Medicity.

Frequently Asked Questions

How big is the image-guided & robot-assisted surgical procedures market?

The image-guided & robot-assisted surgical procedures market size was valued at USD 3.4 billion in 2023.

What is the CAGR of the global image-guided & robot-assisted surgical procedures market from 2024 to 2032?

The CAGR of image-guided & robot-assisted surgical procedures is 14.4% during the analysis period of 2024 to 2032.

Which are the key players in the image-guided & robot-assisted surgical procedures market?

The key players operating in the global market are including TransEnterix Surgical, Inc., George Washington University Hospital, The Princess Grace Hospital, Crouse Hospital, St. Clair Hospital, Auris Surgical Robotics, Atlantic Health System, Apollo Hospitals Enterprise Ltd., Atlantic Health System, and Medanta the Medicity.

Which region dominated the global image-guided & robot-assisted surgical procedures market share?

North America held the dominating position in image-guided & robot-assisted surgical procedures industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of image-guided & robot-assisted surgical procedures during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global image-guided & robot-assisted surgical procedures industry?

The current trends and dynamics in the image-guided & robot-assisted surgical procedures industry include increasing prevalence of chronic diseases requiring surgical interventions, advancements in robotic technology and imaging systems, and growing demand for minimally invasive surgeries for faster recovery and reduced complications

Which specialty type held the maximum share in 2023?

The gynecologic surgery held the maximum share of the image-guided & robot-assisted surgical procedures industry.