Minimally Invasive Surgery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Minimally Invasive Surgery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

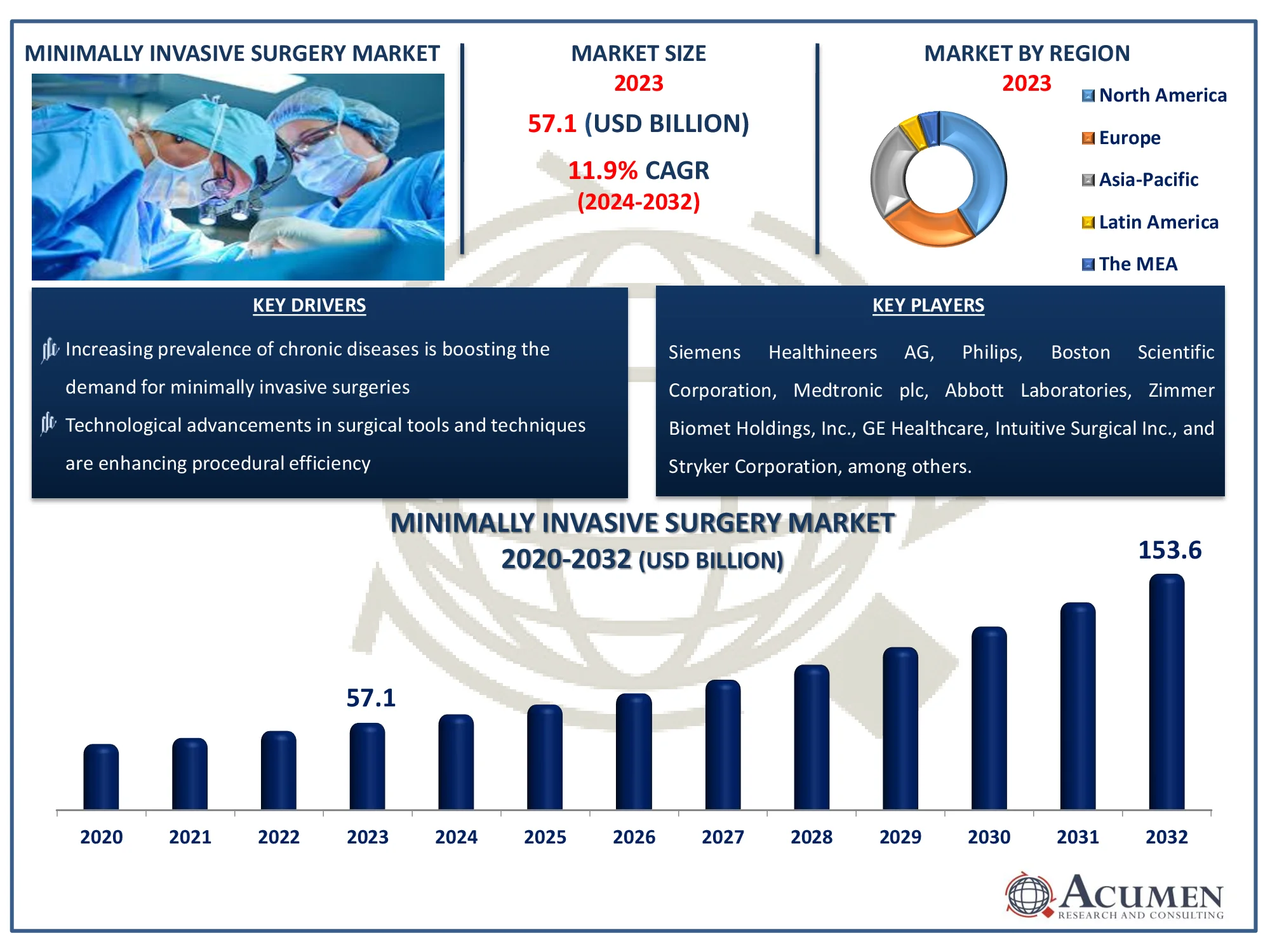

The Global Minimally Invasive Surgery Market Size accounted for USD 57.1 Billion in 2023 and is estimated to achieve a market size of USD 153.6 Billion by 2032 growing at a CAGR of 11.9% from 2024 to 2032.

Minimally Invasive Surgery Market Highlights

- Global minimally invasive surgery market revenue is poised to garner USD 153.6 billion by 2032 with a CAGR of 11.9% from 2024 to 2032

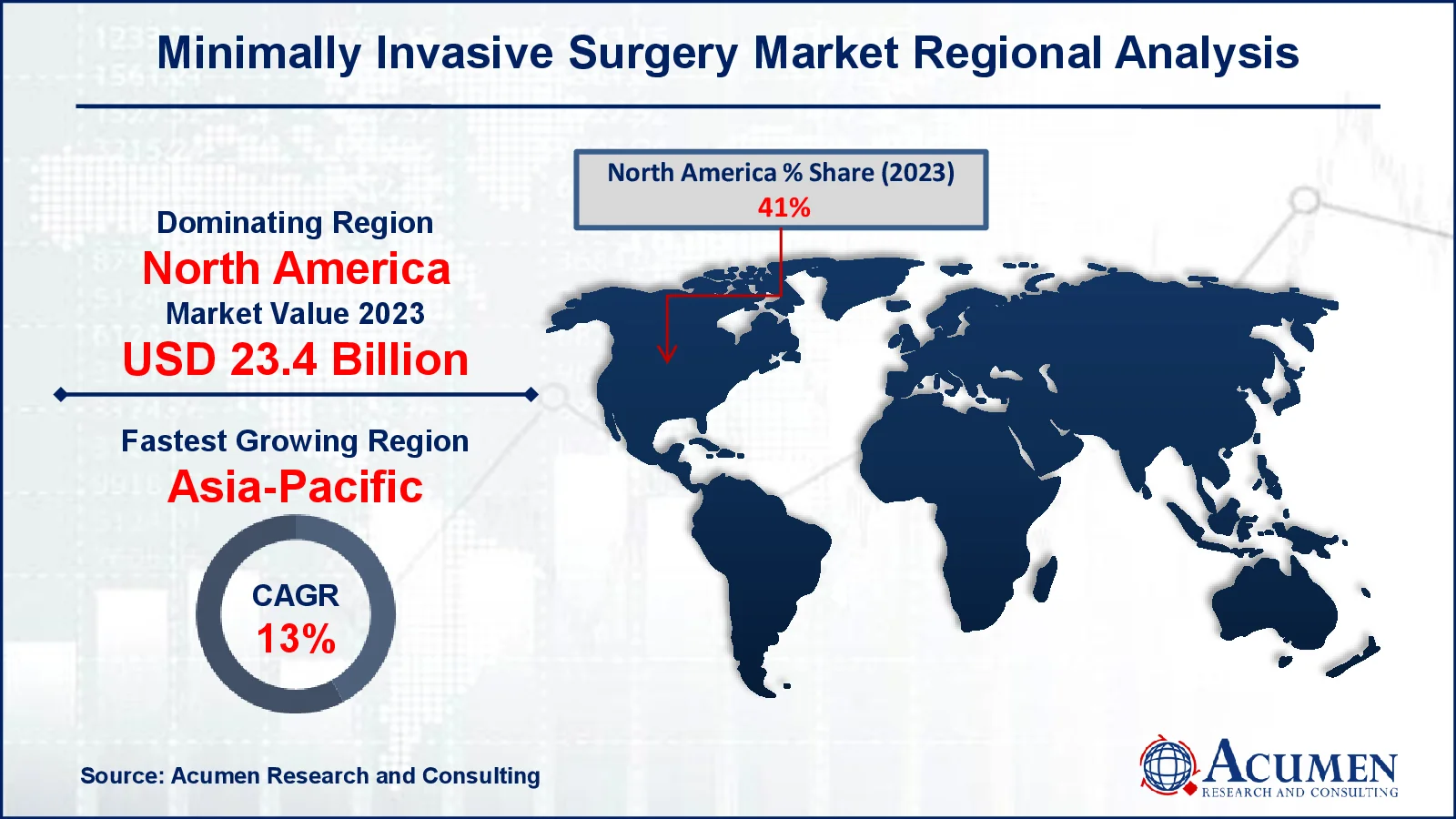

- North America minimally invasive surgery market value occupied around USD 23.4 billion in 2023

- Asia-Pacific minimally invasive surgery market growth will record a CAGR of more than 13% from 2024 to 2032

- Among product, the handheld instruments sub-segment generated notable revenue in 2023

- Based on application, the orthopedic sub-segment generated significant minimally invasive surgery market share in 2023

- Increasing awareness about minimally invasive procedures among patients is a popular minimally invasive surgery market trend that fuels the industry demand

Minimally invasive surgery uses techniques to operate with less incision or damage to the body than open surgery. Hence, it is associated with less pain, fewer postoperative complications, and shorter hospital stays. Some of the minimally invasive surgeries are done by using robotic technology that allows more control over the surgery. Surgeons are performing various surgeries using a minimally invasive technique such as adrenalectomy, cancer surgery, colectomy, ear, nose, and throat surgery, heart surgery, kidney transplant, gynecology surgery, endovascular surgery, orthopedic surgery, urologic surgery, splenectomy, and thoracic surgery. Minimally invasive surgeries are majorly performed at government and private hospitals, ambulatory surgical centers, and research institutes.

Global Minimally Invasive Surgery Market Dynamics

Market Drivers

- Increasing prevalence of chronic diseases is boosting the demand for minimally invasive surgeries

- Technological advancements in surgical tools and techniques are enhancing procedural efficiency

- Growing preference for shorter hospital stays and faster recovery times is driving adoption

- Rising healthcare expenditure globally supports access to advanced surgical methods

Market Restraints

- High costs associated with minimally invasive surgical devices can limit adoption

- Lack of skilled professionals in emerging regions hinders market growth

- Stringent regulatory requirements slow down product approvals and innovation

Market Opportunities

- Expanding healthcare infrastructure in developing countries creates new growth avenues

- Integration of robotics and AI in surgeries enhances precision and market prospects

- Partnerships between medical device companies and healthcare providers drive innovation and adoption

Minimally Invasive Surgery Market Report Coverage

|

Market |

Minimally Invasive Surgery Market |

|

Minimally Invasive Surgery Market Size 2023 |

USD 57.1 Billion |

|

Minimally Invasive Surgery Market Forecast 2032 |

USD 153.6 Billion |

|

Minimally Invasive Surgery Market CAGR During 2024 - 2032 |

11.9% |

|

Minimally Invasive Surgery Market Analysis Period |

2020 - 2032 |

|

Minimally Invasive Surgery Market Base Year |

2023 |

|

Minimally Invasive Surgery Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Application, By End User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Siemens Healthineers AG, Philips, Boston Scientific Corporation, Medtronic plc, Smith & Nephew plc, Abbott Laboratories, Olympus Corporation, Johnson & Johnson, Zimmer Biomet Holdings, Inc., GE Healthcare, Intuitive Surgical Inc., and Stryker Corporation. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Minimally Invasive Surgery Market Insights

The minimally invasive surgery market is growing due to innovative advancements, in the fields of orthopedic, cardiac, neurological, ophthalmic, and robotic surgical procedures. The constant technological advancements in MIS provide innovative and higher-quality instruments that enable the surgeons to execute surgical interventions efficiently with the highest patient safety. Investment by market players to develop advanced product designs that provide a high level of accuracy and control in the operating room are likely to boost the market growth. For instance the WHO and the World Bank have jointly released the 2023 Universal Health Coverage (UHC) Global Monitoring Report, which reveals a worrying stall in progress toward providing excellent, cheap, and accessible health care to people everywhere.

The cost of MIS is significantly lesser than open surgeries with better outcomes resulting in a significant increase in the demand from the lower-income countries as well. Investment by market players in the developing regions due to the presence of the largest targeted patient population is likely to propel the market growth. Ambulatory centers prefer performing MIS as they facilitate same-day-discharge to patients and an increasing number of ambulatory surgery centers across the world to decrease the burden on hospitals is anticipated to boost the market in the coming years. For instance according to the Health Industry Distributors Association In 2023, the market for ambulatory surgery centers (ASCs) is estimated to be $43.1 billion. The movement of treatment from inpatient to outpatient settings, technological developments, and the conversion of hospital outpatient departments (HOPD) to ASCs all contribute to the growth of the ASC industry. As of June 2023, there were 6,223 Medicare-certified ASCs in the United States.

Minimally Invasive Surgery Market Segmentation

Minimally Invasive Surgery Market Segmentation

The worldwide market for minimally invasive surgery is split based on product, application, end user, and geography.

Minimally Invasive Surgeries Market By Product

- Handheld Instruments

- Electrosurgical Instruments

- Guiding Devices

- Inflation Systems

- Monitoring & Visualization Devices

- Auxiliary Instruments

- Cutter Instruments

According to minimally invasive surgery industry analysis, based on the product, the minimally invasive surgery market is divided into handheld instruments, electrosurgical instruments, guiding devices, inflation systems, auxiliary instruments, and cutter instruments. The handheld instrument segment accounted for the largest share of the market in 2023. Technological advancement, low cost devices, and ability to ensure easier access during surgery without damage to patient’s body are the key factors for the high demand of handheld instruments. Application of these instruments in wide range of minimally invasive surgeries is anticipated to boost the market in coming years as well.

Minimally Invasive Surgeries Market By Application

- Gastrointestinal

- Cardiac

- Orthopedic

- Gynecological

- Vascular

- Urological

- Cosmetic

- Thoracic

- Dental

- Others

Based on the application, the market has been segmented into cardiothoracic surgery, gastrointestinal surgery, orthopedic surgery, gynecological surgery, vascular surgery, cosmetic/bariatric surgery, urological surgery, and others. Orthopedic surgeries accounted for the maximum share of the market in 2023 due to large volume of surgeries, development of various minimally invasive surgeries for orthopedic injuries, and introduction of MIS approach in knee and hip replacement process. However, increasing number of cardiothoracic disease patients is expected to propel the minimally invasive surgery market at the fastest rate.

Minimally Invasive Surgeries Market By End User

- Hospitals

- Ambulatory Surgery Centers

- Research Institutes

Based on the end user, the market has been categorized into hospitals, ambulatory surgery centers, and research institutes. Hospitals accounted for the major share of the market in 2023. However, ambulatory surgery centers are expected to observe the fastest growth during the forecast period as these centers offer surgeries at greater flexibility of scheduling and lower costs as compared to hospitals.

Minimally Invasive Surgery Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Minimally Invasive Surgery Market Regional Analysis

Minimally Invasive Surgery Market Regional Analysis

Geographically, North America held the largest share of the market in 2023 and is anticipated to maintain its dominance during the minimally invasive surgery market forecast period. This can be attributed to high adoption of minimally invasive surgeries due to technological advancement, more awareness about minimally invasive surgery’s advantages such as reducing surgery time, minimal or no surgical incision, lesser chance of surgical site infection, and decreased in overall healthcare cost, presence of abundant ambulatory surgery centers, local presence of market players, and availability of reimbursement for these surgeries.

However, Asia-Pacific is expected to witness the fastest growth during the forecast period due to large volume of targeted patients, investment by market players, increasing healthcare expenditure and technological adoption, supportive government regulations for the approval & commercialization of noninvasive devices, and growing disposable income. For instance, in 2022-23, Net National Income (NNI) at current prices reached ₹234.39 lakh crore, up from ₹206.53 lakh crore in 2021-22. This is a 13.5% increase over the previous year's growth of 19.7%.

Minimally Invasive Surgery Market Players

Some of the top minimally invasive surgery companies offered in our report includes Siemens Healthineers AG, Philips, Boston Scientific Corporation, Medtronic plc, Smith & Nephew plc, Abbott Laboratories, Olympus Corporation, Johnson & Johnson, Zimmer Biomet Holdings, Inc., GE Healthcare, Intuitive Surgical Inc., and Stryker Corporation.

Frequently Asked Questions

How big is the minimally invasive surgery market?

The minimally invasive surgery market size was valued at USD 57.1 Billion in 2023.

What is the CAGR of the global minimally invasive surgery market from 2024 to 2032?

The CAGR of minimally invasive surgery is 11.9% during the analysis period of 2024 to 2032.

Which are the key players in the minimally invasive surgery market?

The key players operating in the global market are including Siemens Healthineers AG, Philips, Boston Scientific Corporation, Medtronic plc, Smith & Nephew plc, Abbott Laboratories, Olympus Corporation, Johnson & Johnson, Zimmer Biomet Holdings, Inc., GE Healthcare, Intuitive Surgical Inc., and Stryker Corporation.

Which region dominated the global minimally invasive surgery market share?

North America held the dominating position in minimally invasive surgery industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of minimally invasive surgery during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global minimally invasive surgery industry?

The current trends and dynamics in the minimally invasive surgery industry include increasing prevalence of chronic diseases is boosting the demand for minimally invasive surgeries, and technological advancements in surgical tools and techniques are enhancing procedural efficiency.

Which end user held the maximum share in 2023?

The hospitals end user held the maximum share of the minimally invasive surgery industry.