Medical Robotic System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Medical Robotic System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

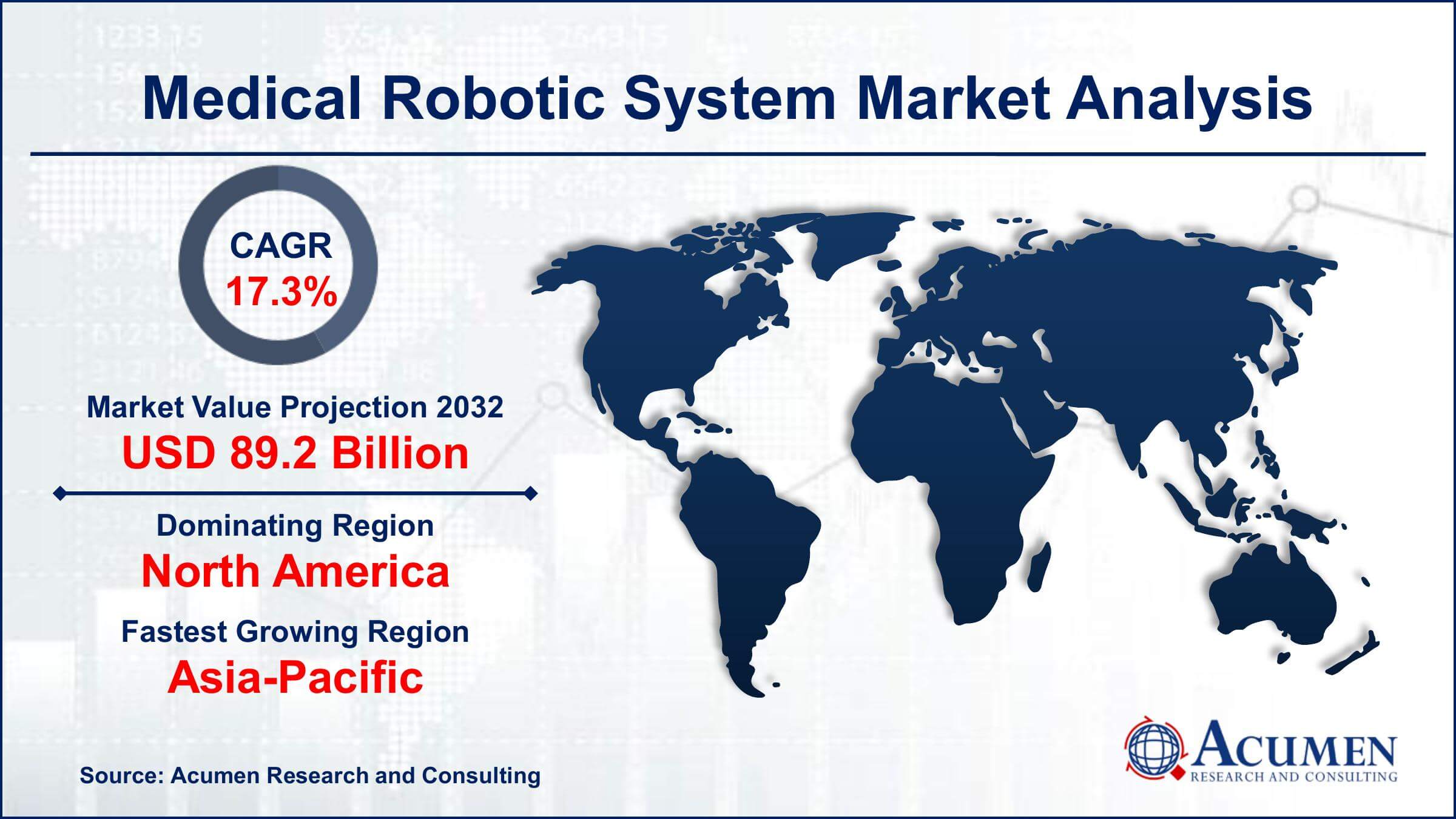

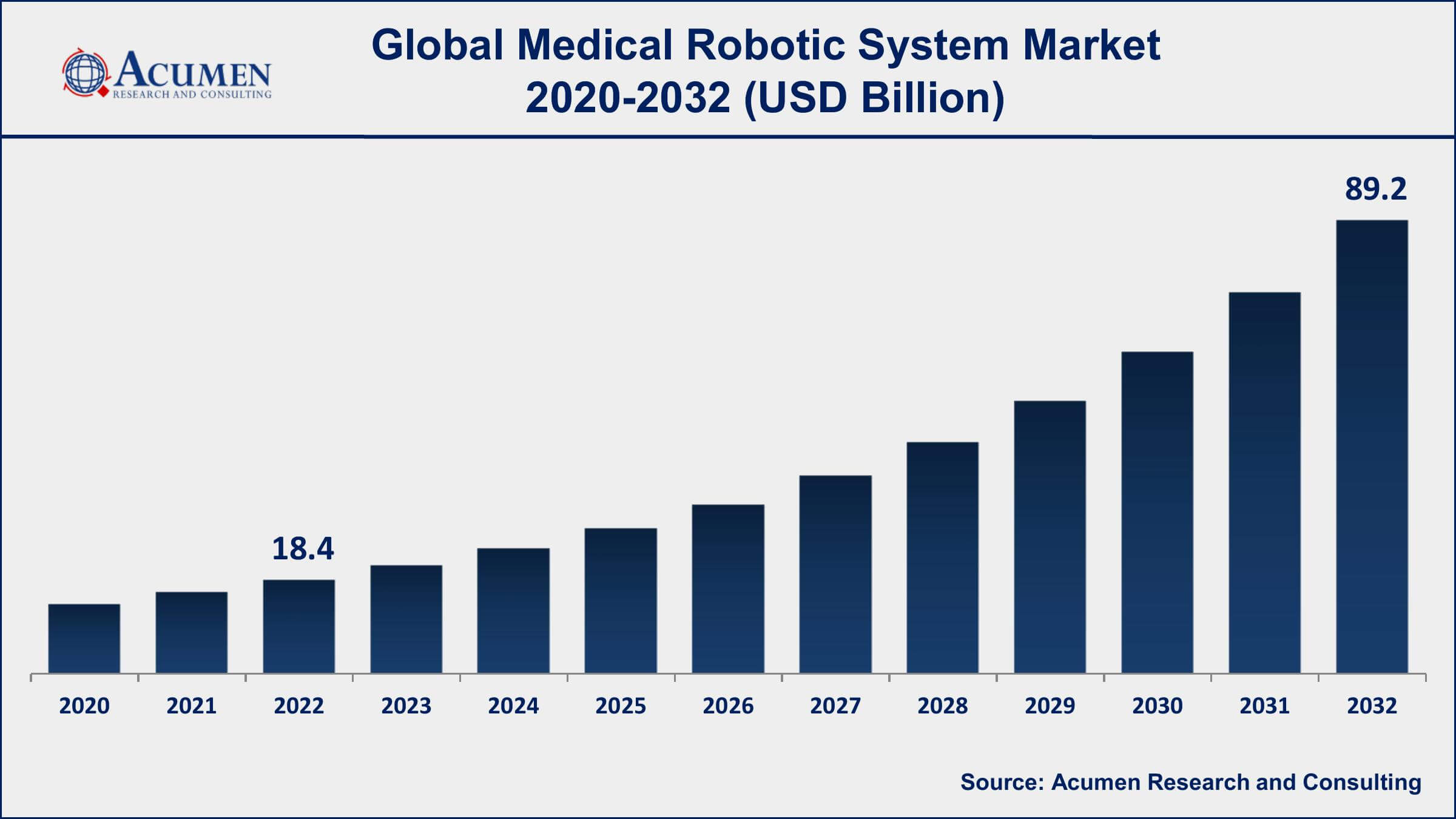

The Global Medical Robotic System Market Size accounted for USD 18.4 Billion in 2022 and is projected to achieve a market size of USD 89.2 Billion by 2032 growing at a CAGR of 17.3% from 2023 to 2032.

Report Key Highlights

- Global medical robotic system market revenue is expected to increase by USD 89.2 Billion by 2032, with a 17.3% CAGR from 2023 to 2032

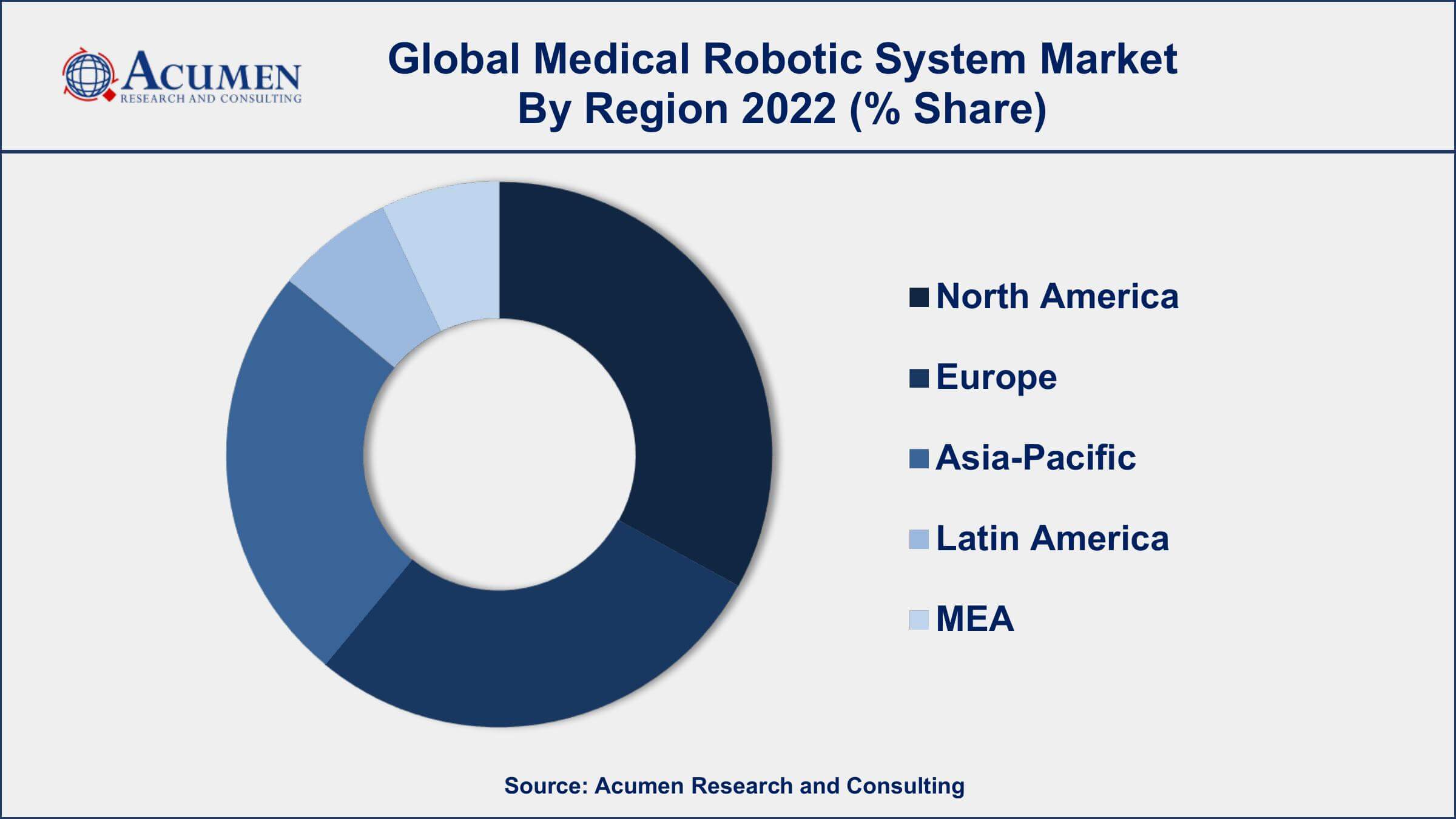

- North America region led with more than 38% of medical robotic system market share in 2022

- The da Vinci Surgical System is the most widely used medical robotic system, with over 5,000 units installed worldwide as of 2021

- The global market for surgical robots is dominated by Intuitive Surgical, the manufacturer of the da Vinci Surgical System, which has a market share of around 80%

- By product type, surgical robots held 56% of the total market share in 2022

- Some of the major players in the medical robotics market include Intuitive Surgical, Stryker Corporation, Medtronic, and Zimmer Biomet

- Increasing adoption of renewable energy and energy storage solutions, drives the medical robotic system market size

Medical robotic systems are advanced technological tools designed to assist physicians in performing complex surgical procedures with precision and accuracy. These systems consist of a range of advanced technologies, including sensors, imaging systems, and robotic arms that allow surgeons to operate with greater control and precision. Medical robotic systems are used in a variety of medical fields, including neurosurgery, orthopedics, and cardiology.

The market for medical robotic systems has been growing rapidly in recent years, driven by the increasing demand for minimally invasive surgical procedures and the need for more accurate and precise surgical tools. The growth of the medical robotic systems market value is also being fueled by the increasing prevalence of chronic diseases, such as cancer and cardiovascular diseases, and the rising geriatric population worldwide. Additionally, advancements in technology, such as the development of 3D printing and artificial intelligence, are expected to further drive the medical robotic systems market growth in the coming years.

Global Medical Robotic System Market Trends

Market Drivers

- Increasing demand for minimally invasive surgical procedures

- Growing prevalence of chronic diseases, such as cancer and cardiovascular diseases

- Rising geriatric population worldwide

- Advancements in technology, such as the development of 3D printing and artificial intelligence

- Increasing adoption of medical robotics systems by hospitals and healthcare facilities

Market Restraints

- High cost of medical robotic systems

- Lack of skilled professionals to operate and maintain the systems

Market Opportunities

- Development of modular robotic systems that can be easily customized and scaled

- Integration of medical robotic systems with digital health technologies

Medical Robotic System Market Report Coverage

| Market | Medical Robotic System Market |

| Medical Robotic System Market Size 2022 | USD 18.4 Billion |

| Medical Robotic System Market Forecast 2032 | USD 89.2 Billion |

| Medical Robotic System Market CAGR During 2023 - 2032 | 17.3% |

| Medical Robotic System Market Analysis Period | 2020 - 2032 |

| Medical Robotic System Market Base Year | 2022 |

| Medical Robotic System Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Intuitive Surgical Inc., Stryker Corporation, Accuray Incorporated, TransEnterix Surgical Inc., Mazor Robotics Ltd., Hansen Medical Inc., Medrobotics Corporation, Smith & Nephew plc, Renishaw plc, Zimmer Biomet Holdings Inc., Medtronic plc, and Auris Health, Inc. (a subsidiary of Johnson & Johnson). |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Inventions of a robot aren’t anything new; neither their innovations nor the modified version of robots. Over a century now robotics has created a new definition in the advancement of medical technologies. It shall astonish us even more in the future. The medical robotic system is the preeminent and most expedient aid in the medical research and healthcare industry. The medical robotic system is the most innovative technology in the healthcare industry and is witnessing increased acceptance among hospitals and other healthcare facilities. It is anticipated that the market for medical robotic systems would grow considerably in near future owing to its growing number of applications in the healthcare sector.

Robots can support, assist and extend the services that health workers are currently offering. Deployment of medical robots can result in around a 70% drop in hospital-acquired infections. Hospital-acquired infections (HAIs) such as MRSA (methicillin-resistant Staphylococcus aureus) and C. diff (Clostridium difficile) resulted in 1 out of 10 deaths in 2015. These were the extreme concerns that were eradicated by the medical robots. These medical robots are also capable of carrying more than 400 kilograms of medications and can lift patients out of beds 40 times a day. Microbots of less than a millimeter in size can deliver drugs through our bloodstream. There are even animal-shaped robots to reduce the stress of patients.

Medical Robotic System Market Segmentation

The global medical robotic system market segmentation is based on product type, end user, and geography.

Medical Robotic System Market By Product Type

- Surgical Robotic Systems

- Rehabilitative Robotic Systems

- Non-invasive Radiosurgery Robots

- Others

In terms of product types, the surgical robotic systems segment has seen significant growth in the medical robotic system market in recent years. These systems are used to perform minimally invasive surgical procedures with the help of robotic arms controlled by a surgeon. The surgical robotic systems segment includes both fully robotic systems and robot-assisted surgical systems. Fully robotic surgical systems are self-contained systems that can perform complex surgical procedures with minimal human intervention. These systems typically consist of a robotic arm that holds surgical instruments, a camera system that provides a 3D view of the surgical site, and a console where the surgeon sits and controls the robotic arm. The surgical robotic systems segment has seen significant growth in recent years, driven by the increasing demand for minimally invasive surgical procedures and the benefits of surgical robotic systems, such as reduced blood loss, shorter hospital stays, and faster recovery times.

Medical Robotic System Market By End User

- Hospitals

- Ambulatory Surgery Centers

- Rehabilitation Centers

- Others

According to the medical robotic system market forecast, the hospital segment is expected to witness significant growth in the coming years. The use of medical robotic systems in hospitals has grown significantly in recent years, driven by a variety of factors, such as the need for improved patient outcomes, the increasing demand for minimally invasive surgical procedures, and the growing focus on reducing healthcare costs. Robotic systems are being used in hospitals for a wide range of applications, including surgical procedures, rehabilitation, diagnosis, and drug delivery. These systems can help hospitals to improve patient outcomes by enabling more precise and accurate movements and interactions, reducing the risk of human error, and improving the efficiency of medical procedures.

Medical Robotic System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Robotic System Market Regional Analysis

North America is the largest market for medical robotic systems globally and dominates the market for several reasons. One of the primary factors contributing to the dominance of North America in the medical robotic system market is the strong presence of major market players in the region, including Intuitive Surgical, Stryker Corporation, and Zimmer Biomet. These companies have made significant investments in research and development of medical robotic systems, and have established a strong network of distribution channels and partnerships, which has helped to drive growth in the market. Another factor contributing to the dominance of North America in the medical robotic system market is the high level of adoption of advanced medical technologies in the region, particularly in the United States. The United States has a highly developed healthcare system, with a strong focus on technological innovation and the adoption of advanced medical technologies. As a result, medical robotic systems have been widely adopted in the region, particularly in the fields of surgery and rehabilitation.

Medical Robotic System Market Player

Some of the top medical robotic system market companies offered in the professional report include Intuitive Surgical Inc., Stryker Corporation, Accuray Incorporated, TransEnterix Surgical Inc., Mazor Robotics Ltd., Hansen Medical Inc., Medrobotics Corporation, Smith & Nephew plc, Renishaw plc, Zimmer Biomet Holdings Inc., Medtronic plc, and Auris Health, Inc. (a subsidiary of Johnson & Johnson).

Frequently Asked Questions

What was the market size of the global medical robotic system in 2022?

The market size of medical robotic system was USD 18.4 Billion in 2022.

What is the CAGR of the global medical robotic system market from 2023 to 2032?

The CAGR of medical robotic system is 17.3% during the analysis period of 2023 to 2032.

Which are the key players in the medical robotic system market?

The key players operating in the global market are including Intuitive Surgical Inc., Stryker Corporation, Accuray Incorporated, TransEnterix Surgical Inc., Mazor Robotics Ltd., Hansen Medical Inc., Medrobotics Corporation, Smith & Nephew plc, Renishaw plc, Zimmer Biomet Holdings Inc., Medtronic plc, and Auris Health, Inc. (a subsidiary of Johnson & Johnson).

Which region dominated the global medical robotic system market share?

North America held the dominating position in medical robotic system industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical robotic system during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global medical robotic system industry?

The current trends and dynamics in the medical robotic system industry include growing prevalence of chronic diseases, such as cancer and cardiovascular diseases.

Which product type held the maximum share in 2022?

The surgical robotic systems product type held the maximum share of the medical robotic system industry.