Hard Seltzer Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Hard Seltzer Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

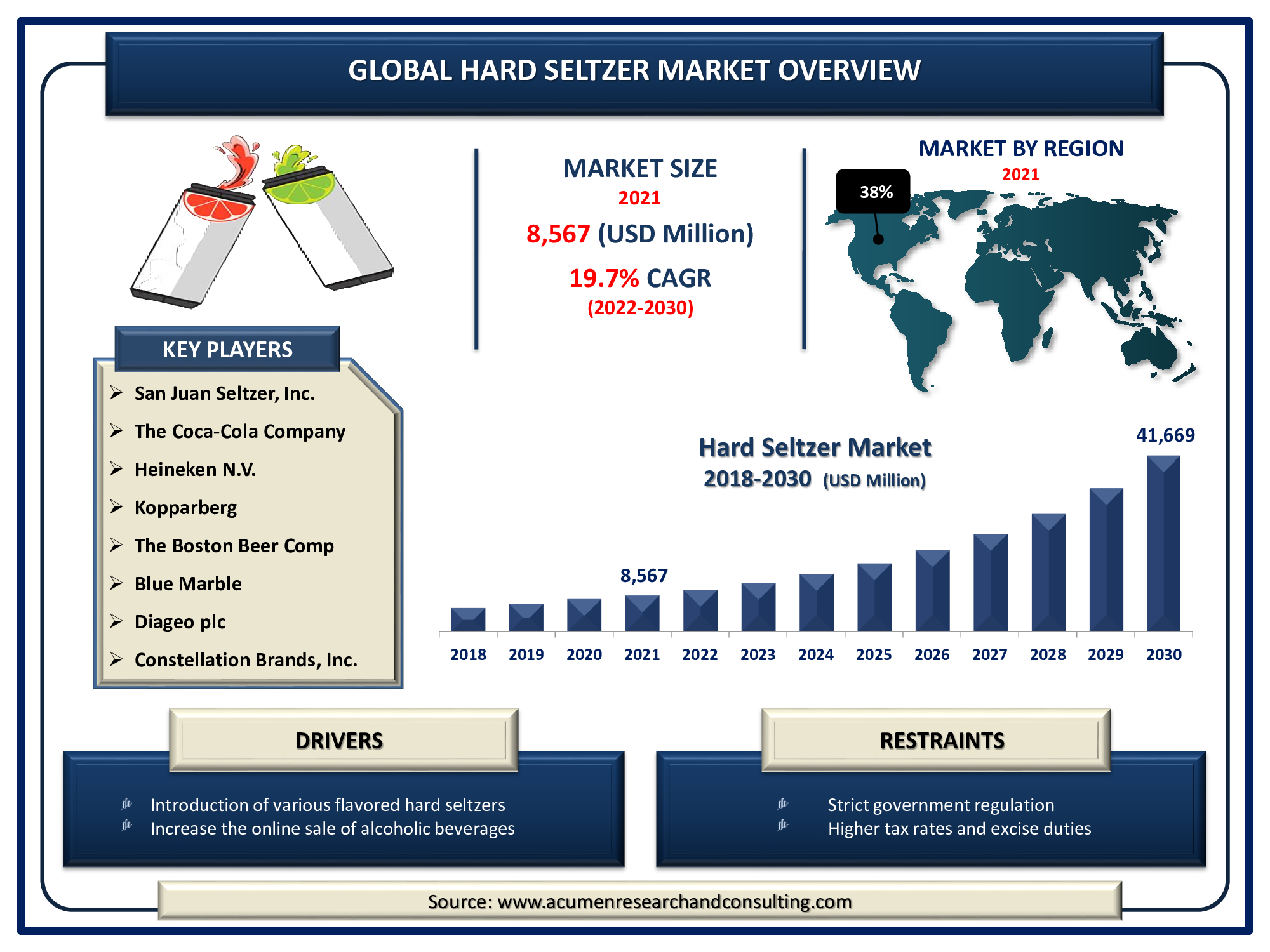

The Global Hard Seltzer Market size accounted for USD 8,567 Million in 2021 and is expected to reach the market value of USD 41,669 Million by 2030 growing at a CAGR of 19.7% during the forecast period from 2022 to 2030.

Factors driving hard seltzer market growth include rising millennial preference for hard seltzers over beer or alcohol drinks, increased consumer awareness in the on-trade channel, and increased product promotion on social media outlets. Furthermore, increasing Internet penetration is increasing product awareness, which is projected to increase hard seltzer market value during the forecast period.

Hard seltzer is a well-known alcoholic drink that integrates flavored fizzy water with alcohol. It's a convenient mixture of alcohol, carbonated water, and fruit flavoring that comes in cans and bottles. Hard seltzer flavors range from the traditional lime, strawberry, black cherry, and ruby citrus fruits to the more elevated peach agave hibiscus, melon basil, and cucumber plum. The alcohol by volume (ABV) of hard seltzer ranges from 4% to 6%, which is comparable to the ABV of most beers. The alcoholic content varies by brand, but also most hard seltzers are made through the fermentation of cane sugar and fruit flavors.

Hard Seltzer Market Dynamics

Hard Seltzer Market Drivers

- The increasing rate of alcohol consumption

- Soft drink consumption is increasing among younger generations

- Introduction of various flavored hard seltzers

- Increase the online sale of alcoholic beverages

Hard Seltzer Market Restraints

- Strict government regulation

- Higher tax rates and excise duties

Hard Seltzer Market Opportunity

- Growing demand from all age brackets to reduce hard drink consumption

Report Coverage

| Market | Hard Seltzer Market |

| Market Size 2021 | USD 8,567 Million |

| Market Forecast 2030 | USD 41,669 Million |

| CAGR During 2022 - 2030 | 19.7% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By ABV Content, By Packaging, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Mark Anthony Brands International, San Juan Seltzer, Inc., The Coca-Cola Company, Heineken N.V., Kopparberg, Molson Coors Beverage Company, The Boston Beer Company, Blue Marble, Diageo plc, Constellation Brands, Inc., Anheuser-Busch InBev, and Kona Brewing Co. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Hard seltzer is carbonated alcohol that ferments with artificial sweeteners and has fewer calories and carbohydrates than other alcoholic beverages. High disposable income, growing urbanization, changes in sedentary lifestyle, and an increase in the rate of consumption of alcoholic beverages in men and women, as well as the young generation's preference for hard seltzer, are all factors driving the hard seltzer market trend. Despite the fact that alcoholic beverages are becoming increasingly popular among both younger and older generations, the global hard seltzer market is seeing an increase in consumer preference for different flavors of alcoholic beverages. The introductions of new fermentation processes by several large corporations, as well as the evolution of fermented and fruity flavors, a combination of sweeteners, new innovative flavors, and artificial flavors, are the major factors driving the growth of the global seltzer market size. Strong carbonated drinks are popular among the younger generation, as well as those who prefer strong alcoholic beverages. As a result of these factors, the global hard seltzer industry is expected to expand in the coming years.

In developed countries such as the United States, Japan, and Australia, demand for low-calorie, low-alcohol, and low-carbohydrate beverages is expected to rise, increasing demand for the hard seltzer market. Furthermore, as people with celiac disease or allergies become more aware of the potential benefits of gluten-free beverages, gluten-free hard seltzer soft drink is growing in popularity among wellness consumers, and gluten-free hard seltzer soft drink has been shown to be beneficial for people suffering from inflammatory and autoimmune conditions.

Hard Seltzer Market Segmentation

The global hard seltzer market segmentation is based on ABV content, packaging, distribution channel, and region.

Hard Seltzer Market By ABV Content

- ABV Less Than 5%

- ABV More Than 5%

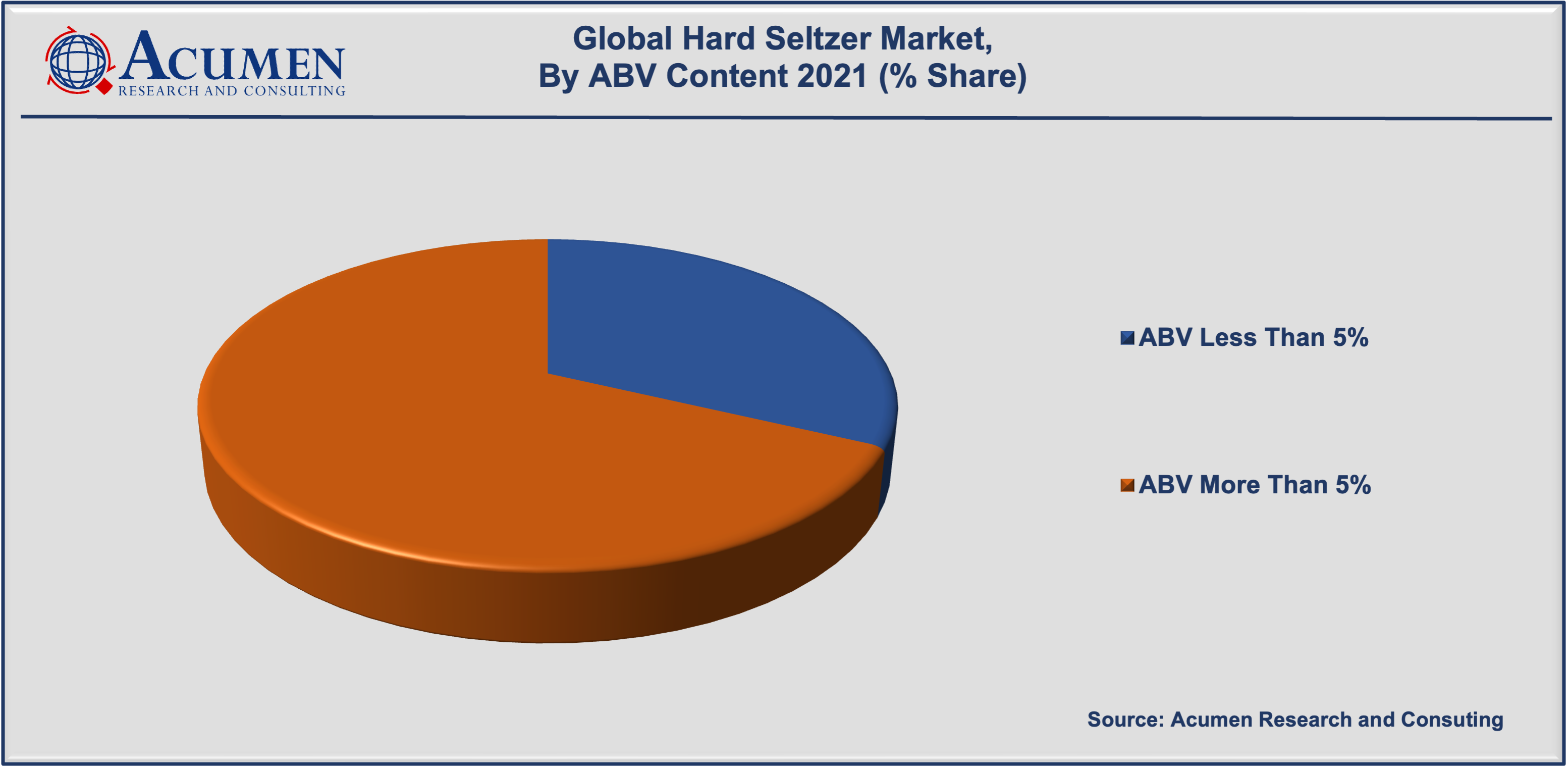

Based on the ABV content, more than 5% is expected to hold a significant market share in 2021. This is primarily due to a shift in consumer preference away from alcoholic beverages like beer, spirits, and wine and toward hard seltzer with more than 5%. Furthermore, hard seltzer with 5% is considered the most appropriate ratio, which is the ingredient ratio that is primarily produced by manufacturers. Furthermore, the premise of moderation is a thriving trend, especially in the United States, which is driving demand over the forecast period. Many players in the alcohol industry are looking to expand their product portfolio of low-alcohol beverages in such categories.

Furthermore, the less than 5% content segment is expected to grow at the fastest rate during the forecast period, owing to an increasing customer focus on health and wellness as people of all age backgrounds try to reduce their alcohol consumption.

Hard Seltzer Market By Packaging

- Metal Cans

- Plastic Bottles

- Glass Bottles

Based on packaging, the metal can segment is expected to lead the market in 2021. Metal cans have a greater market share and are continuing to gain market share in the global Hard Seltzer Market. Metal cans are widely used as beverage containers and offer numerous advantages such as durability, convenience, multi-color printing, and environmental stewardship. Furthermore, beverages in metal packaging do not require any active ingredients, do not forfeit their taste and nourishing properties, and retain their unique flavor for an extended period of time.

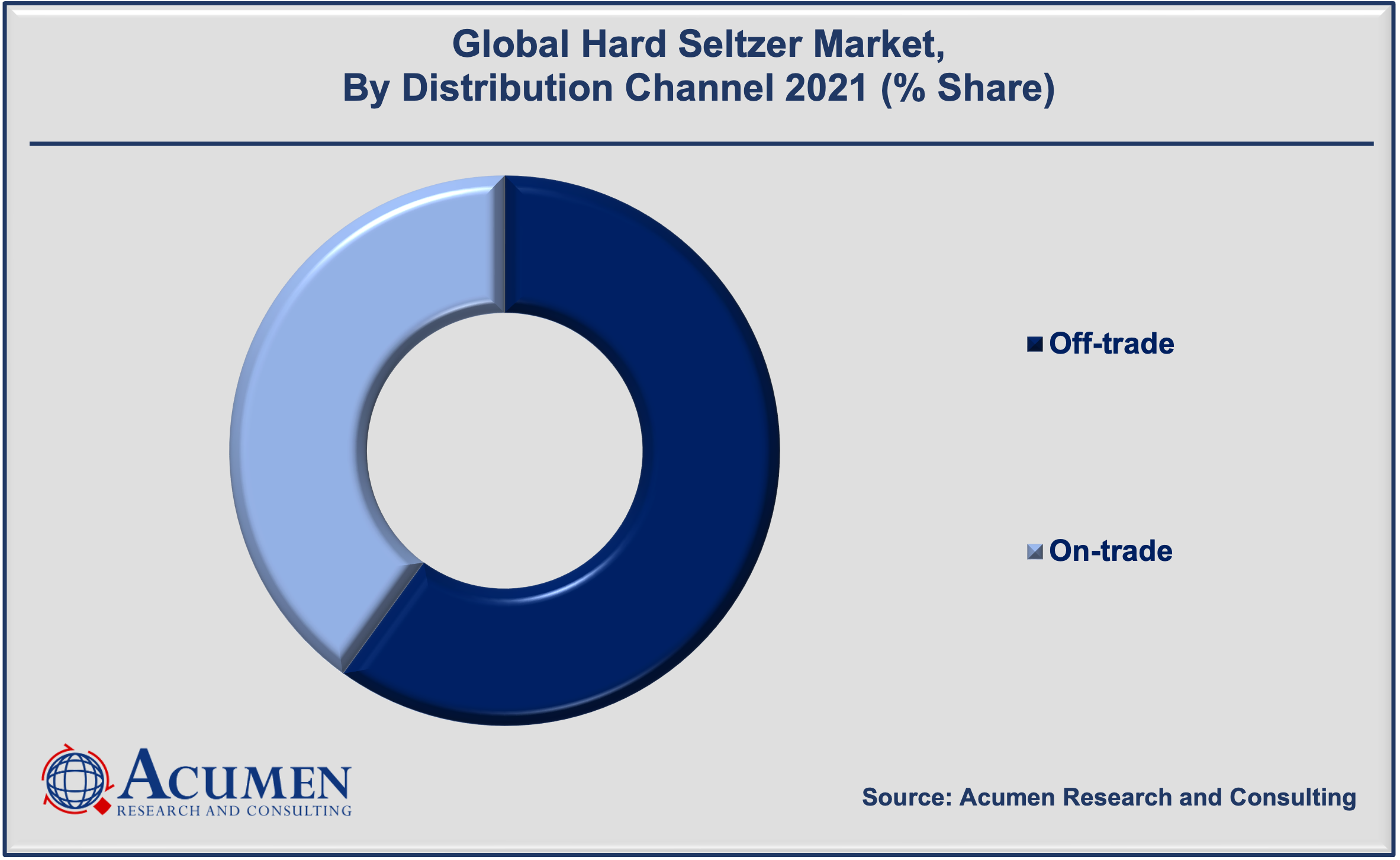

Hard Seltzer Market By Distribution Channel

- Off-trade

- On-trade

According to the hard seltzer market forecast, the off-trade segment will dominate the market in 2021. This segment includes all major retailers, including supermarkets, commercial outlets, hypermarkets, convenience stores, and wine and spirit stores. People prefer these distribution centers because they offer significant promotions and discounts. Furthermore, in order to reach as many consumers as possible, the majority of manufacturers launch their product lines through supermarket chains such as Target, Walmart, and others. Furthermore, business owners are significantly increasing off-trade sales of hard seltzer during the pandemic. The closure and benefits of online stores, such as door-to-door delivery and large quantity discounts, are driving significant growth in off-trade sales in the United States and other countries.

Hard Seltzer Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America Is expected to dominate the hard seltzer market in 2021 and is anticipated to do so for the foreseeable future. Consumption patterns for low-calorie, alcohol-free, and gluten-free beverages are propelling the region's hard seltzer market forward. Furthermore, millennial are becoming much more interested in flavored alcoholic beverages, which will drive up demand for hard seltzer over the forecasted time frame. In recent, the hard seltzer company White Claw successfully launched hard seltzer flavors which are lemon, watermelon, and tangerine. Furthermore, with new features and functionality, manufacturers can attract customers while expanding their ecological footprint in international economies. As a result, the North American hard seltzers market share is predicted to grow rapidly in the coming years.

Hard Seltzer Market Players

Some of the prominent global hard seltzer market companies are Mark Anthony Brands International, San Juan Seltzer, Inc., The Coca-Cola Company, Heineken N.V., Kopparberg, Molson Coors Beverage Company, The Boston Beer Company, Blue Marble, Diageo plc, Constellation Brands, Inc., Anheuser-Busch InBev, and Kona Brewing Co.

Frequently Asked Questions

How big was the global hard seltzer market in 2021?

The global hard seltzer market size accounted for USD 8,567 Million in 2021.

What will be the projected CAGR for global hard seltzer market during forecast period of 2022 to 2030?

The projected CAGR of hard seltzer during the analysis period of 2022 to 2030 is 19.7%.

Which are the prominent competitors operating in the market?

The prominent players of the global hard seltzer market involve Mark Anthony Brands International, San Juan Seltzer, Inc., The Coca-Cola Company, Heineken N.V., Kopparberg, Molson Coors Beverage Company, The Boston Beer Company, Blue Marble, Diageo plc, Constellation Brands, Inc., Anheuser-Busch InBev, and Kona Brewing Co.

Which region held the dominating position in the global hard seltzer market?

North America held the dominating share for hard seltzer during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for hard seltzer during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global hard seltzer market?

The increasing rate of alcohol consumption, and soft drink consumption is increasing among younger generations are the prominent factors that fuel the growth of global hard seltzer market.

By segment ABV content, which sub-segment held the maximum share?

Based on ABV content, ABV more than 5%segment held the maximum share for hard seltzer market in 2021.