Smart Bottles Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Smart Bottles Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

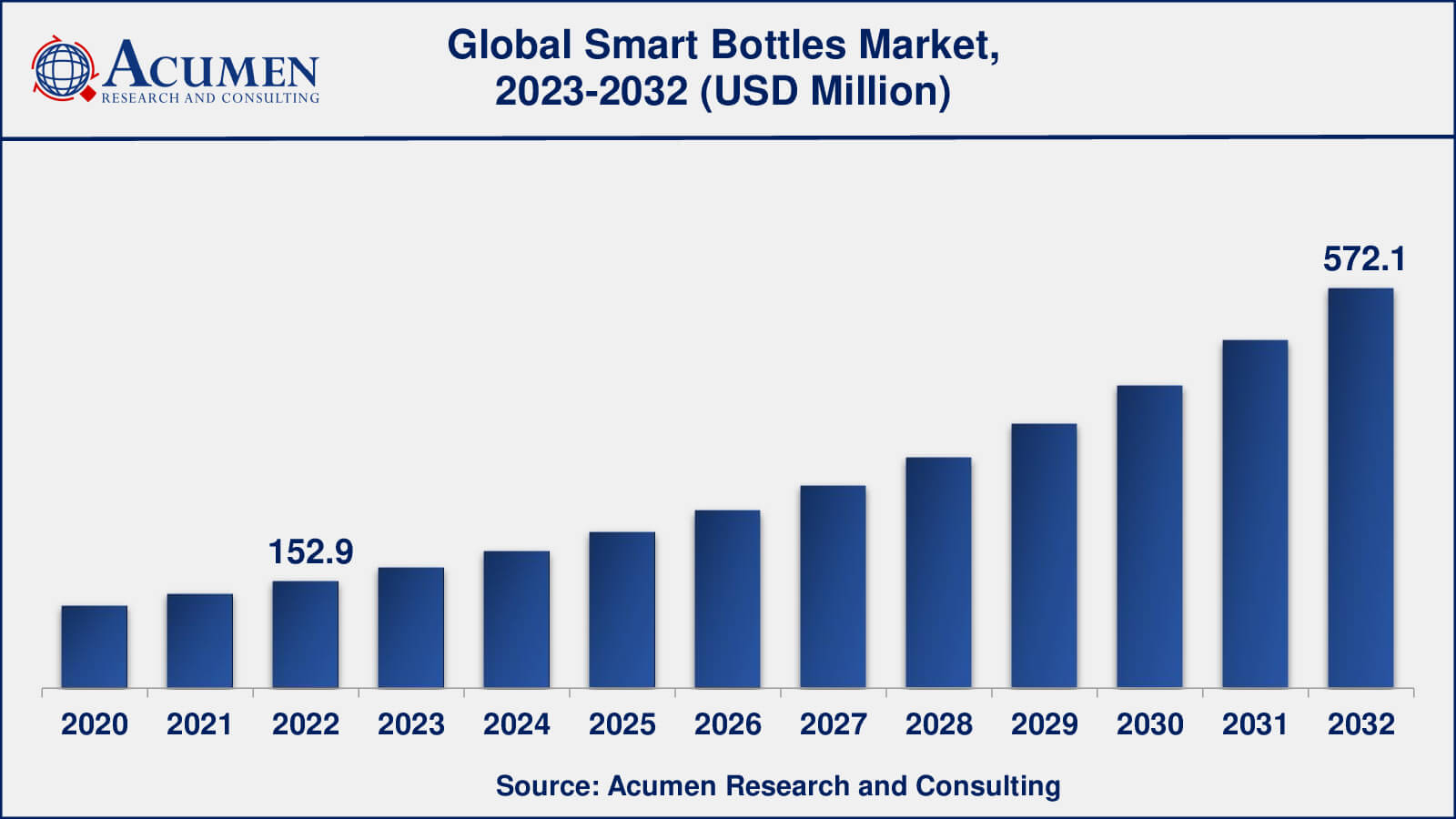

The Global Smart Bottles Market Size accounted for USD 152.9 Million in 2022 and is estimated to achieve a market size of USD 572.1 Million by 2032 growing at a CAGR of 14.2% from 2023 to 2032.

Smart Bottles Market Highlights

- Global smart bottles market revenue is poised to garner USD 572.1 million by 2032 with a CAGR of 14.2% from 2023 to 2032

- North America smart bottles market value occupied almost USD 54 million in 2022

- Asia-Pacific smart bottles market growth will record a CAGR of around 15% from 2023 to 2032

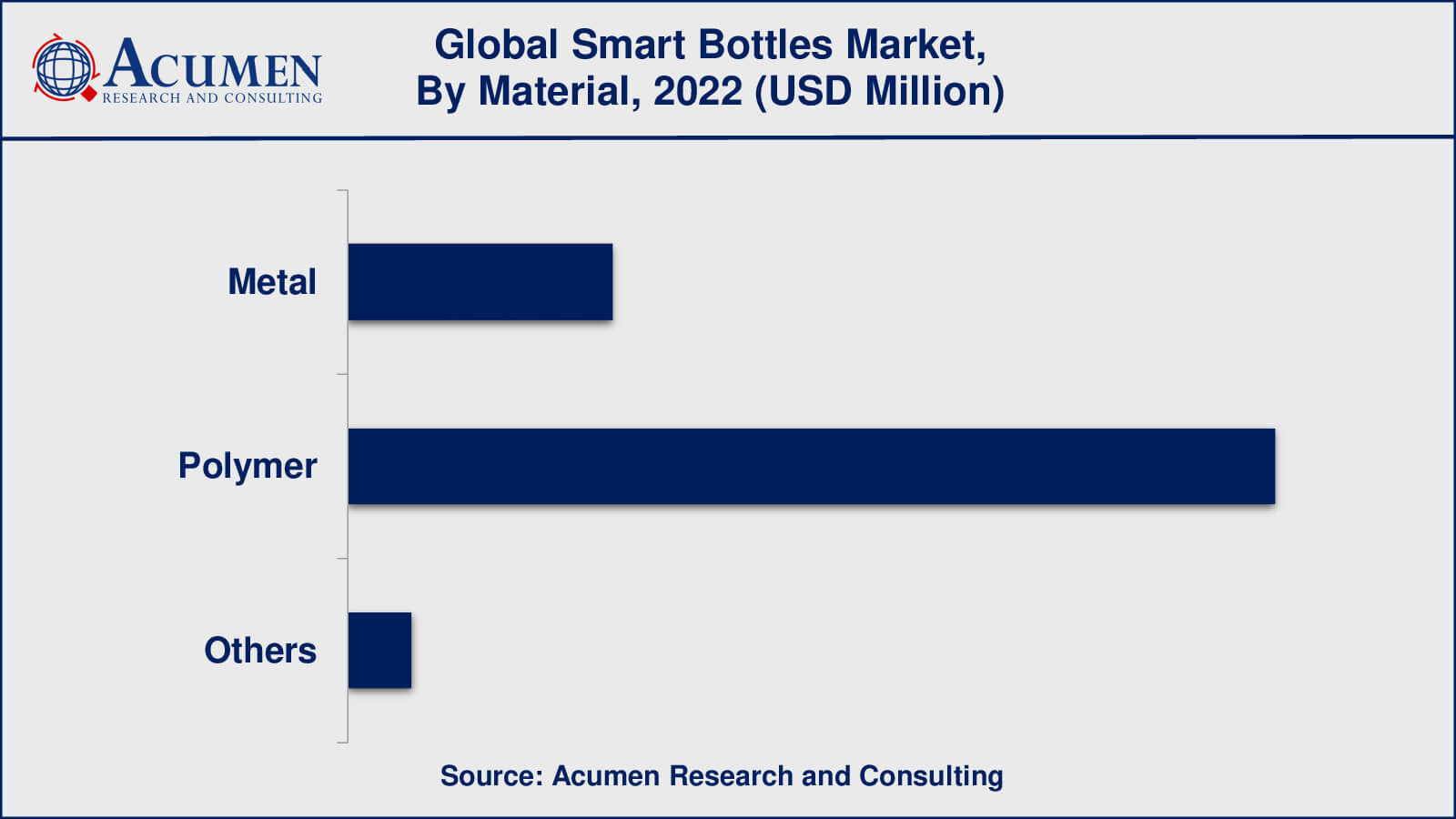

- Among material, the polymer sub-segment generated over US$ 113 million revenue in 2022

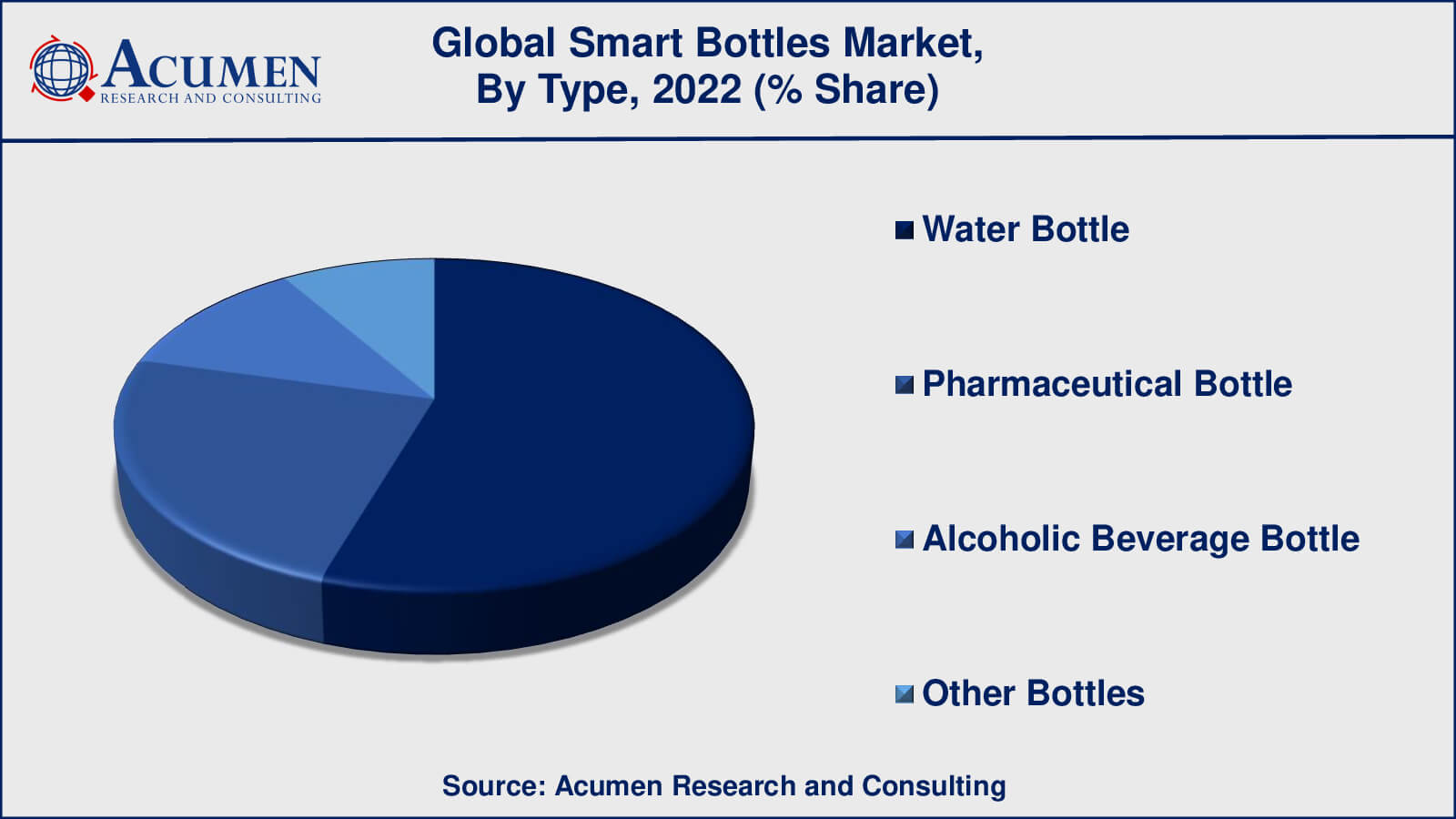

- Based on type, the water bottle sub-segment generated over 55% share in 2022

- Integration with internet of things (IoT) and connectivity is a popular smart bottles market trend that fuels the industry demand

Polymer smart bottles help in maintaining the optimum hydration level in the body. Rising health awareness among consumers across the globe is expected to lead to the growth of the smart bottle market. Different governmental initiatives namely ‘Swachh Bharat Abhiyan’ by the Indian government to lower the generation of plastic waste as well as to promote the use of reusable substances are on the rise. Various advancements in the field of materials and chemicals have resulted in the production of Bisphenol A (BPA)-free polymer ‘Tritan’, which is being adopted in industries for the manufacturing of bottles. The growing awareness of the importance of staying hydrated and living a healthy lifestyle is driving demand for smart water bottles that can track water intake, remind users to drink water, and monitor their hydration levels. The growing emphasis on preventive healthcare and wellness is driving demand for smart bottles that can assist users in monitoring their water intake, setting hydration goals, and tracking their progress, thereby promoting better health outcomes.

Global Smart Bottles Market Dynamics

Market Drivers

- Increasing awareness about health and fitness

- Rising adoption of advanced sensors

- Growing focus on preventive healthcare

Market Restraints

- High cost

- Limited battery life

- Privacy and security concerns

Market Opportunities

- Focus on sustainability and eco-friendly materials

- Surging proliferation of health monitoring and wellness features

- Focus on aesthetics and design

Smart Bottles Market Report Coverage

| Market | Smart Bottles Market |

| Smart Bottles Market Size 2022 | USD 152.9 Million |

| Smart Bottles Market Forecast 2032 | USD 572.1 Million |

| Smart Bottles Market CAGR During 2023 - 2032 | 14.2% |

| Smart Bottles Market Analysis Period | 2020 - 2032 |

| Smart Bottles Market Base Year | 2022 |

| Smart Bottles Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Thermos LLC, Open-2, Ecomo, Caktus, Inc., HydraCoach, Inc., Moikit, LLC, Out of Galaxy, Inc., Hidrate Inc., Trago, Inc., Groking Lab Limited, Kuvée, H2Opal, Ozmo, Aquio, LifeFuels, and Ulla. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Smart Bottles Market Insights

The market is expected to catapult owing to the latest technological advancements in the fields of machine learning and the internet which has led to the innovative development of certain mobile apps linked to digital watches that provide information to the consumer about their daily hydration limits and requisite water intake. These applications play an important role in keeping gymnasts and athletes updated about their hydration levels throughout the day. Rising disposable income and better living standards are expected to drive the global polymer smart water bottle market in the coming years. Furthermore, fitness enthusiasts are also opting for products that enhance their exercising experience, subsequently increasing the demand for polymer smart bottles.

Smart Bottles Market, By Segmentation

The worldwide market for smart bottles is split based on material, type, distribution channel, and geography.

Smart Bottle Materials

- Metal

- Polymer

- Others

According to our smart bottles industry research, polymer-based smart bottles are popular due to their lightweight, durability, and versatility in design. They are also inexpensive and easily moulded into various shapes and sizes to accommodate various smart bottle features and functionalities, such as sensors, connectivity components, and other electronic components. BPA-free plastics, Tritan, and other food-grade plastics are common polymer materials used in smart bottles.

Metal-based smart bottles, such as stainless steel or aluminium, are also popular in the market, thanks to their durability, insulation properties, and premium appearance and feel. Users who prioritise sustainability often prefer metal-based smart bottles because they are reusable and have a lower environmental impact than single-use plastic bottles. Metal-based smart bottles, on the other hand, are typically heavier and less flexible in design than polymer-based smart water bottles.

Due to their fragility and weight, other materials, such as glass or ceramic, are less commonly used in the smart bottle market. Users who value aesthetics, sustainability, and the absence of potential chemical leaching from plastic materials may prefer glass or ceramic smart bottles.

Smart Bottle Types

- Water Bottle

- Pharmaceutical Bottle

- Alcoholic Beverage Bottle

- Other Bottles

According to our smart bottles market forecast, water bottles are the most commonly used type of bottles, and smart water bottles have gained popularity due to the increasing awareness about the importance of hydration for health and wellness. Smart water bottles are intended to assist users in tracking their water intake, setting hydration goals, and receiving reminders to drink water at regular intervals. These features are especially appealing to fitness enthusiasts, athletes, and health-conscious people who want to track and improve their hydration habits.

Pharmaceutical bottles, which are used to store medications, may also have a presence in the market for smart bottles, particularly for specialised use cases. Smart pharmaceutical bottles can remind patients to take their medications on time, track adherence to prescribed dosages, and send notifications to carers or healthcare providers. However, due to regulatory requirements and safety concerns in the pharmaceutical industry, the adoption of smart features in pharmaceutical bottles may be more limited than in water bottles.

Smart wine bottles and smart cocktail shakers, for example, may have a niche presence in the smart bottles market. For an enhanced drinking experience, these smart bottles may include features such as temperature monitoring, serving recommendations, or personalised cocktail recipes.Other types of bottles, such as sports drink bottles, baby bottles, or protein shaker bottles, may have a presence in the smart bottle market, but their dominance is likely to be less than that of water bottles.

Smart Bottle Distribution Channels

- Online

- Offline

Online distribution channels, such as e-commerce websites, online marketplaces, and direct-to-consumer (DTC) sales via brand websites, have grown in popularity in recent years due to the convenience, ease of access, and diverse product selection they provide to consumers. Many smart bottle manufacturers and retailers have established an online presence in order to meet the growing demand for smart bottles and reach a larger global customer base.

Offline distribution channels, such as retail stores, specialty stores, and department stores, may also play an important role in the smart bottles market, particularly in local or regional markets. Offline channels offer consumers a physical shopping experience in which they can see, touch, and feel the products before purchasing them. Offline channels may also offer personalised customer service and support, which may appeal to specific consumer segments.

Smart Bottles Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Smart Bottles Market Regional Analysis

A significant market for smart bottles is anticipated in North America because of the region's widespread adoption of smart technologies, growing awareness of fitness and health issues, and expanding use of connected devices. The United States, in particular, is expected to dominate the North American smart bottle market, owing to smart bottle manufacturers' strong presence, rising consumer demand for health and wellness products, and technological advancements.

Because of rising urbanization, changing lifestyle patterns, and rising disposable incomes, the Asia-Pacific region is expected to experience rapid growth in the smart bottle market. China, Japan, and South Korea are anticipated to be key markets for smart bottles in Asia-Pacific, owing to a large consumer base, rising health awareness, and increasing adoption of smart technologies.

Smart Bottles Market Players

Some of the top smart bottles companies offered in the professional report are Thermos LLC, Open-2, Ecomo, Caktus, Inc., HydraCoach, Inc., Moikit, LLC, Out of Galaxy, Inc., Hidrate Inc., Trago, Inc., Groking Lab Limited, Kuvée, H2Opal, Ozmo, Aquio, LifeFuels, and Ulla.

Frequently Asked Questions

What was the market size of the global smart bottles in 2022?

The market size of smart bottles was USD 152.9 million in 2022.

What is the CAGR of the global smart bottles market from 2023 to 2032?

The CAGR of smart bottles is 14.2% during the analysis period of 2023 to 2032.

Which are the key players in the smart bottles market?

The key players operating in the global smart bottles market is includes Thermos LLC, Open-2, Ecomo, Caktus, Inc., HydraCoach, Inc., Moikit, LLC, Out of Galaxy, Inc., Hidrate Inc., Trago, Inc., Groking Lab Limited, Kuv�e, H2Opal, Ozmo, Aquio, LifeFuels, and Ulla.

Which region dominated the global smart bottles market share?

North America held the dominating position in smart bottles industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of smart bottles during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global smart bottles industry?

The current trends and dynamics in the smart bottles industry include increasing awareness about health and fitness, rising adoption of advanced sensors, and growing focus on preventive healthcare.

Which type held the maximum share in 2022?

The water bottle types held the maximum share of the smart bottles industry.