Flow Battery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Flow Battery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

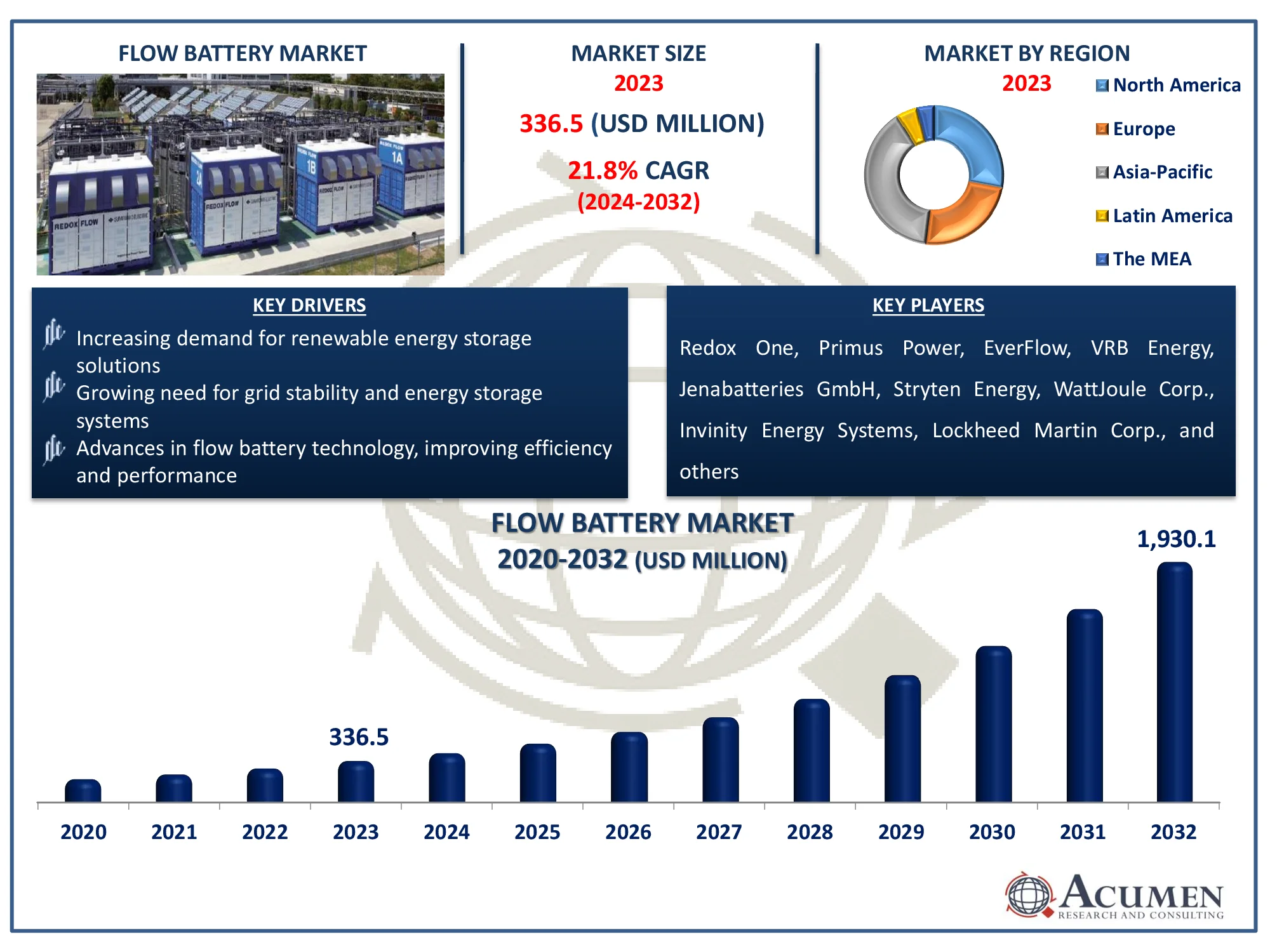

Request Sample Report

The Global Flow Battery Market Size accounted for USD 336.5 Million in 2023 and is estimated to achieve a market size of USD 1,930.1 Million by 2032 growing at a CAGR of 21.8% from 2024 to 2032.

Flow Battery Market Highlights

- The global flow battery market revenue is projected to reach USD 1,930.1 million by 2032, growing at a CAGR of 21.8% from 2024 to 2032

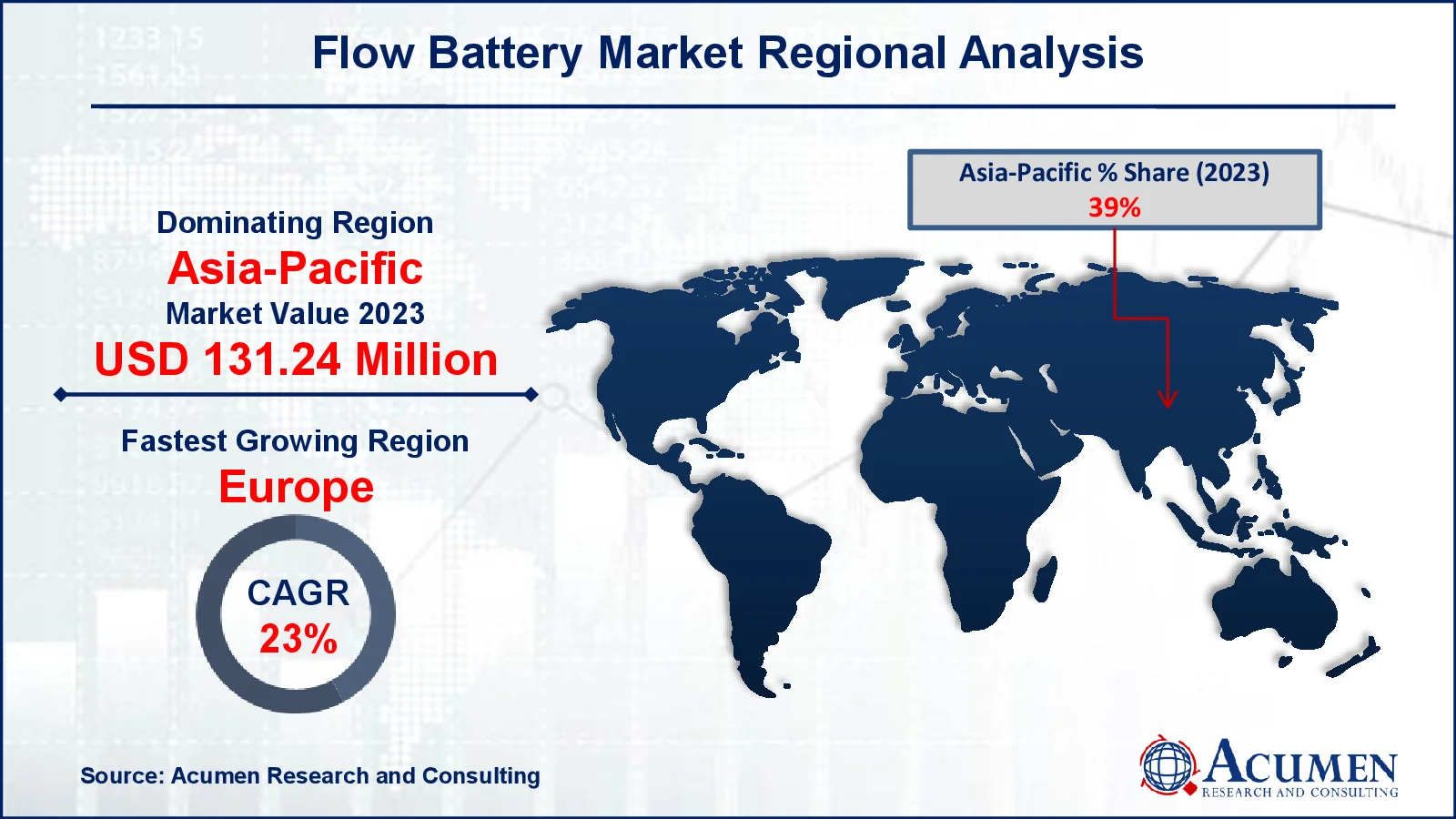

- The Asia-Pacific flow battery market was valued at approximately USD 131.24 million in 2023

- The Europe flow battery market is expected to grow at a CAGR exceeding 23% from 2024 to 2032

- By type, the redox sub-segment accounted for 78% of the market share in 2023

- Based on material, the vanadium sub-segment captured 63% of the market share in 2023

- In terms of storage, the large-scale sub-segment held 61% of the market share in 2023

- The grid/utility application dominated the flow battery market with a 58% share in 2023

- Advancements in electrolyte materials and membrane technology enhancing efficiency is the flow battery market trend that fuels the industry demand

A flow battery is a form of rechargeable energy storage technology that uses liquid electrolytes stored in external tanks. They are ideal for large-scale applications, including as grid energy storage, due to their ability to discharge for extended periods of time. Flow batteries are more efficient, last longer, and have greater energy capacity flexibility.

Flow batteries offer several technical advantages over traditional rechargeable batteries with solid electroactive materials. These include the ability to independently scale power (dictated by the size of the stack) and energy (determined by the size of the tanks), extended cycle and calendar life, and the potential for a lower total cost of ownership. Supporting this growth, notable projects like the 400 MWh, 100 MW vanadium flow battery that began operations in Dalian, China, in 2022 the largest of its kind at the time demonstrate the scalability and viability of flow battery technology for large-scale energy storage, further driving market adoption.

Global Flow Battery Market Dynamics

Market Drivers

- Increasing demand for renewable energy storage solutions

- Growing need for grid stability and energy storage systems

- Advances in flow battery technology, improving efficiency and performance

Market Restraints

- High initial capital costs for installation

- Limited energy density compared to other battery technologies

- Complexity and space requirements for large-scale systems

Market Opportunities

- Expansion in electric vehicle (EV) charging infrastructure

- Development of more cost-effective materials for flow batteries

- Growing investments in energy storage for smart grid applications

Flow Battery Market Report Coverage

|

Market |

Flow Battery Market |

|

Flow Battery Market Size 2023 |

USD 336.5 Million |

|

Flow Battery Market Forecast 2032 |

USD 1,930.1 Million |

|

Flow Battery Market CAGR During 2024 - 2032 |

21.8% |

|

Flow Battery Market Analysis Period |

2020 - 2032 |

|

Flow Battery Market Base Year |

2023 |

|

Flow Battery Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Material, By Storage, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Redox One, Primus Power, EverFlow, VRB Energy, Jenabatteries GmbH, Stryten Energy, WattJoule Corp., Invinity Energy Systems, Lockheed Martin Corp., Largo Inc., Cell Cube (Enerox GmbH), Elestor, Sumitomo Electric Industries, Ltd., Redflow Ltd., ViZn Energy Systems, and ESS Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Flow Battery Market Insights

The transition to renewable energy sources like solar and wind has created a need for efficient energy storage. For instance, according to International Energy Agency (IEA), renewable energy consumption across the power, heat, and transport sectors is expected to grow by nearly 60% from 2024 to 2030 in main-case forecast. This growth will raise the share of renewable in total energy consumption to almost 20% by 2030, compared to 13% in 2023. The expected growth in renewable energy consumption, particularly in the power, heat, and transport sectors, will drive the demand for flow batteries, as they offer efficient, long-duration storage solutions to balance intermittent renewable generation and ensure grid stability.

As power grids incorporate more intermittent renewable sources, grid stability becomes crucial. For instance, the U.S. electric grid is featuring over 9,200 power generation units with a combined capacity exceeding 1 million megawatts, all linked by more than 600,000 miles of transmission lines. Due to the growing complexity of the electric grid and the need for reliable energy storage solutions, the demand for flow batteries is expected to rise as they provide long-duration storage to enhance grid stability.

The upfront costs associated with flow battery systems can be a significant barrier to widespread adoption. While their long-term benefits are clear, the capital required to deploy these systems is often higher than other storage solutions. This cost challenge can hinder adoption, especially in developing markets.

With the rise of electric vehicles, there is an increasing need for reliable and scalable energy storage solutions at EV charging stations. For instance, International Energy Agency states that in 2023, nearly 14 million new electric cars were registered worldwide, bringing the total number of electric vehicles on the road to 40 million, in line with the sales forecast from the 2023 Global EV Outlook (GEVO-2023). Electric car sales in 2023 were 3.5 million higher than in 2022, marking a 35% year-on-year growth. This increase is more than six times the number of sales in 2018, just five years prior. This presents a promising market for flow battery applications.

With the growing adoption of EVs, the proportion of charging from private and public charging stations (measured by electricity delivered to vehicles) is projected to increase over time. By 2035, nearly 45% of electricity for EV charging is expected to come from sources other than home chargers, up from less than 35% in 2023. As the expansion of public and private EV charging infrastructure requires scalable and efficient energy storage solutions to manage high-demand charging loads drives growth of flow battery market.

Flow Battery Market Segmentation

The worldwide market for flow battery is split based on type, material, storage, application, and geography.

Flow Battery Market By Type

- Redox

- Hybrid

According to the flow battery industry analysis, redox flow batteries lead due to their scalability, long cycle life, and high efficiency. They use liquid electrolytes kept in separate tanks, which allows for easy energy capacity modifications by changing tank size. This makes them excellent for large-scale energy storage applications like grid stabilization and renewable energy integration. Furthermore, advances in vanadium-based and other redox chemistries have improved their performance, reinforcing their market leadership.

Flow Battery Market By Material

- Vanadium

- Zinc Bromine

- Iron

- Others

According to the flow battery industry analysis, vanadium dominates as the material of choice in flow batteries due to its unique ability to exist in multiple oxidation states, enabling efficient energy storage and transfer. Vanadium redox flow batteries (VRFBs) offer high reliability, long cycle life, and minimal cross-contamination, as the same element is used in both electrolyte tanks. This chemistry is particularly suited for large-scale applications, such as renewable energy storage and grid balancing. Moreover, ongoing research to reduce vanadium costs and enhance its availability further strengthens its dominance in the flow battery market.

Flow Battery Market By Storage

- Large Scale

- Small Scale

The flow battery sector is propelled by the need for large-scale energy storage, which is critical for managing renewable energy integration and grid reliability. Flow batteries, with their scalable design and long-duration storage capacity, are suited for utility-scale applications. Their distinct energy and power components enable cost-effective scaling, making them ideal for balancing supply and demand during peak usage. As the demand for dependable, grid-scale storage develops, flow batteries continue to lead the market in satisfying these needs.

Flow Battery Market By Application

- Grid/Utility

- Commercial & Industrial

- EV Charging Stations

- Residential

According to the flow battery market forecast, the grid and utility sector is expected to see significant growth as renewable energy sources become more integrated. Flow batteries provide long-term storage capacity and excellent scalability, making them ideal for grid stabilization and energy supply management. Their ability to store and discharge excess renewable energy during peak demand improves grid stability and efficiency. With increased investment in renewable energy and infrastructure modernization, flow batteries are becoming the preferred choice for utility-scale energy storage.

Flow Battery Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Flow Battery Market Regional Analysis

For several reasons, the Asia-Pacific dominates the flow battery market. Countries like China, Japan, and South Korea are investing heavily in grid-scale energy storage to support their expanding renewable energy capacity and manufacturers collaboration further enhance industry’s growth in Asian Region. For instance, in November 2022, Tdafoq Energy, based in Riyadh, Saudi Arabia, announced a distribution and manufacturing license agreement with Delectrik Systems, an Indian company. Under this partnership, Tdafoq Energy will distribute vanadium redox flow batteries produced by Delectrik in India across the Gulf countries, including Kuwait, Bahrain, Oman, Saudi Arabia, Qatar, and the UAE. Additionally, Tdafoq plans to establish a local flow battery manufacturing plant in Saudi Arabia, expected to begin producing gigawatt-hours (GWh) of electricity by 2025 to serve the Gulf region. Additionally, the region’s rapid industrialization and growing electricity demand drive the adoption of flow batteries for large-scale storage applications.

Europe shows robust growth in the flow battery market as the region focuses on decarbonizing its energy sector and enhancing grid stability. As per European Environment Agency, in 2023, the power sector saw the fastest growth in renewable energy adoption, with 44.3% of all electricity generated from renewable sources. This was followed by the heating and cooling sector at 25.4%, and the transport sector at 10.1%. As the increasing share of renewable energy in the power sector creates a greater need for reliable energy storage solutions like flow batteries to manage the intermittent nature of renewable generation and ensure grid stability which further boosts market growth in European region.

Flow Battery Market Players

Some of the top flow battery companies offered in our report include Redox One, Primus Power, EverFlow, VRB Energy, Jenabatteries GmbH, Stryten Energy, WattJoule Corp., Invinity Energy Systems, Lockheed Martin Corp., Largo Inc., Cell Cube (Enerox GmbH), Elestor, Sumitomo Electric Industries, Ltd., Redflow Ltd., ViZn Energy Systems, and ESS Inc.

Frequently Asked Questions

How big is the Flow Battery market?

The flow battery market size was valued at USD 336.5 Million in 2023.

What is the CAGR of the global Flow Battery market from 2024 to 2032?

The CAGR of flow battery is 21.8% during the analysis period of 2024 to 2032.

Which are the key players in the Flow Battery market?

The key players operating in the global market are including Redox One, Primus Power, EverFlow, VRB Energy, Jenabatteries GmbH, Stryten Energy, WattJoule Corp., Invinity Energy Systems, Lockheed Martin Corp., Largo Inc., Cell Cube (Enerox GmbH), Elestor, Sumitomo Electric Industries, Ltd., Redflow Ltd., ViZn Energy Systems, and ESS Inc.

Which region dominated the global Flow Battery market share?

Asia-Pacific held the dominating position in flow battery industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of flow battery during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Flow Battery industry?

The current trends and dynamics in the flow battery industry include increasing demand for renewable energy storage solutions, growing need for grid stability and energy storage systems, and advances in flow battery technology, improving efficiency and performance.

Which type held the maximum share in 2023?

The redox type held the maximum share of the flow battery industry.