Construction Equipment Market Size - Global Industry Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Construction Equipment Market Size - Global Industry Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Construction Equipment Market Size is valued at USD 205 Billion in 2021 and is estimated to achieve a market size of USD 302 Billion by 2030; growing at a CAGR of 4.6%.

The world construction equipment market has prior confronted stoppage because of the drowsy monetary conditions and moderate development of construction business; however the market is relied upon to develop at a relentless development rate in the coming years. Expanding modern, private, and business development exercises, worldwide financial development, and rising open private organizations is relied upon to drive the market growth. However, stringent government regulations for carbon release and fluctuations in oil costs limit the market growth. Further, steady rise in the prices of residential properties coupled with increase in demand for residential homes is driving the demand for new investments in the sector. Supporting government initiatives in developing countries is a leading aspect that is driving the global construction equipment market revenue.

Global Construction Equipment Market DRO�s:

Market Drivers:

- Growing investments in the construction industry

- Increase of technologically advanced construction machinery

- Increasing urbanization and supportive government initiatives in emerging countries

Market Restraints:

- Lack of availability of skilled and qualified equipment operators

- High ownership and maintenance costs

Market Opportunities:

- Rising investments in mining projects

- Increasing focus on electric and automated construction equipment

Construction Equipment Market Report Coverage

| Market | Construction Equipment Market |

| Construction Equipment Market�Size�2021 | USD 205 Billion |

| Construction Equipment Market�Forecast�2030 | USD 302 Billion |

| Construction Equipment Market�CAGR | 4.6% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Equipment Type, By Application, By End-User,�And By Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | CNH Industrial N.V., Liebherr Group, AB Volvo, Komatsu Ltd., J C Bamford Excavators Ltd., Atlas Copco AB, Hitachi Construction Machinery Co., Ltd, Doosan Heavy Industries & Construction Co., Ltd, Caterpillar Inc., and John Deere. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Growing investments in the construction industry are majorly driving the growth of this market. According to the India Brand Equity Fund (IBEF), India will require USD 777.7 billion in infrastructure investment by 2022 to ensure the country's long-term development. In addition, India intends to spend USD 1.4 trillion on infrastructure over the next five years through the 'National Infrastructure Pipeline.' The expansion of the construction industry has coincided with the expansion of the construction sector. Aside from government investments, the industry has experienced rapid growth in the last five years as a result of increased urbanization and population. Several ongoing and upcoming government projects, such as the construction of roads, national highways, airports, ports, and other infrastructure, are expected to boost the industry in the coming years. In India, the construction equipment industry sees a bright future. Aside from the rapid growth, the industry is adapting to changing trends and technology in order to smoothen and accelerate construction processes.

The proliferation of technologically advanced construction machinery is one of the construction equipment market trends that are fueling industry demand. Then again, growing industrial and infrastructure projects all across the world are also supporting the construction equipment market share. In addition, rapid urbanization and rising demand from developing countries are some of the factors contributing to the growth of this market. However, the construction industry is regulated by many governments across the world. Therefore, stringent government regulations are restraining the growth of this market. In addition, the emission of carbon is also a major factor hindering the growth of the construction equipment market. Development in infrastructure worldwide and advancement of product quality are expected to foresee growth in the near future.

Construction Equipment Market Segmentation

The market can be bifurcated on the basis of equipment type, application, end-user, and region.

Construction Equipment Market by Equipment Type

- Loaders

- Cranes

- Forklifts

- Excavators

- Dozers

- Dump Trucks

- Others

According to our construction equipment industry analysis, the loaders have created a significant position in the market. Loaders are observed to have exponential growth due to the expansion of existing and new manufacturing facilities, rising demand for households, increasing disposable income, and government subsidies. On top of that, the demand for automated loaders is gaining traction as they are incorporated with intelligent devices such as cellular, Bluetooth, and other advanced tools. This feature reduces manpower handling and helps to record the efficiency and performance of the loaders.

Construction Equipment Market by Application

- Earthmoving

- Excavation and Mining

- Lifting and Material Handling

- Recycling and Waste Management

- Tunneling

- Others

Earthmoving applications held a significant market share of the total construction equipment market in 2021 and are expected to maintain their dominance throughout the forecast period of 2022 to 2030. The growing urban population, as well as the demand for better infrastructure, are creating significant growth opportunities for earthmoving construction equipment. Excavators, motor graders, and loaders are examples of earthmoving equipment. However, the lifting and material handling sub-segment is expected to grow at a rapid pace in the coming years.

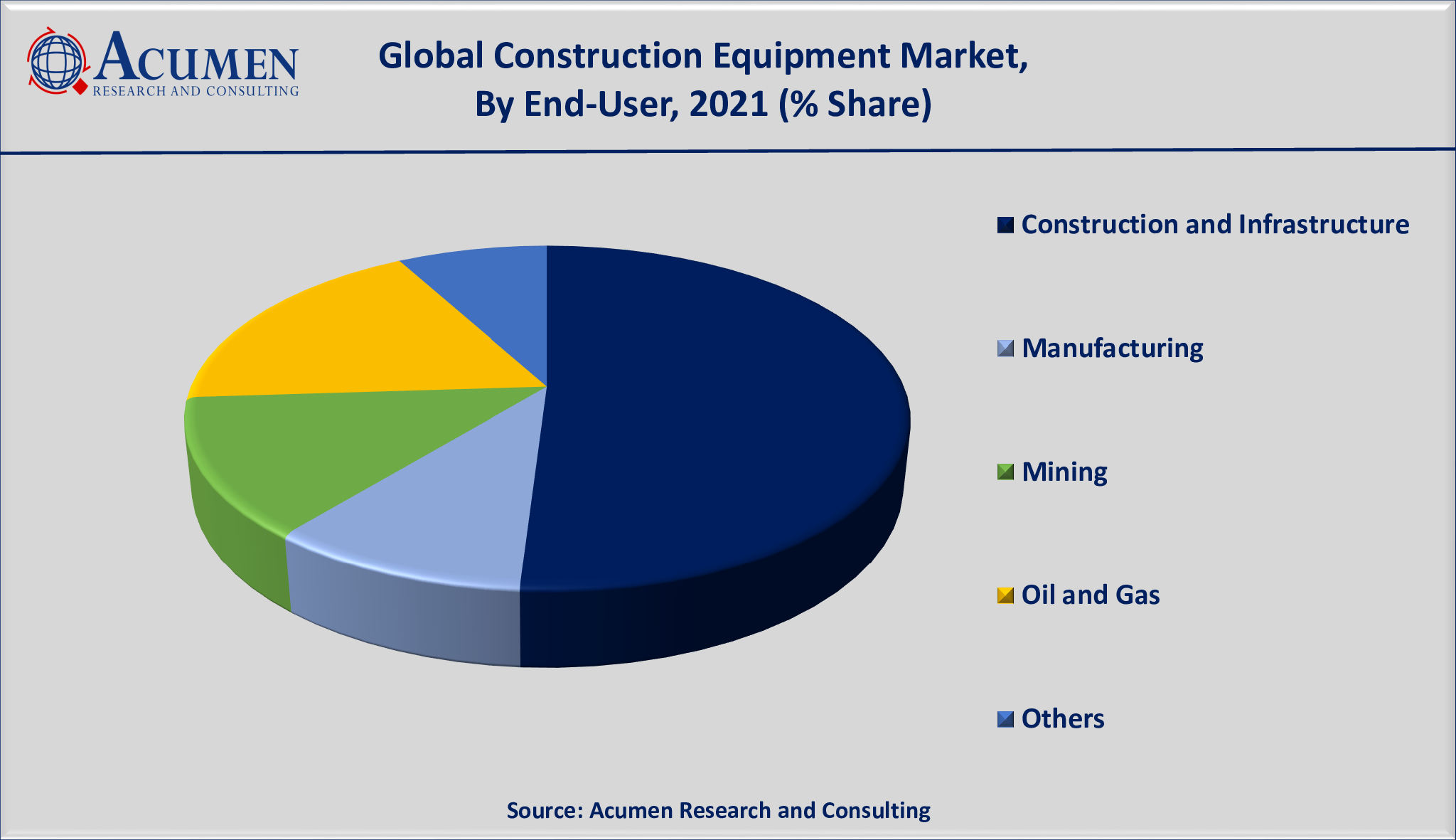

Construction Equipment Market by End-User

- Construction and Infrastructure

- Manufacturing

- Mining

- Oil and Gas

- Others

According to our construction equipment market forecast, the construction and infrastructure sub-segment achieved a significant market share in 2021 and is expected to continue to do so in the future. Rising construction and infrastructure spending, particularly in emerging markets, has resulted in impressive construction equipment market sales. Construction equipment sales are expected to rise by double digits in the coming years as a result of increased government spending on infrastructure projects, primarily in rural areas.

Construction Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Growing investments in construction and infrastructure sectors in Asian countries fuels the Asia-Pacific construction equipment market

Among all the regions, the Asia-Pacific region accounted for the majority of the share in 2021 and is expected to continue its dominance throughout the projected years 2022 to 2030. The Asia-Pacific market is expected to experience a boom in construction and infrastructure activities in near future. Construction projects are the backbone of the development in countries like China and India. Rapidly growing investments in construction and infrastructure activities are fueling the Asia-Pacific construction equipment market growth. However, North America will witness a noteworthy growth rate in the coming years owing to the demand for technologically advanced equipment, rapid adoption of automated construction equipment, and low-interest rate loans to procure this equipment.

Construction Equipment Market Players

Among the player operating in the global construction equipment market, some profiled in the report include Atlas Copco AB,AB Volvo, Caterpillar Inc., Doosan Heavy Industries & Construction Co., Ltd, CNH Industrial N.V., J C Bamford Excavators Ltd., Hitachi Construction Machinery Co., Ltd, Komatsu Ltd., John Deere, and Liebherr Group among others.

Frequently Asked Questions

How much was the size of the global construction equipment market in 2021?

The global construction equipment market size in 2021 was accounted to be USD 205 Billion.

What will be the projected CAGR for global construction equipment market during forecast period of 2022 to 2030?

The projected CAGR construction equipment market during the analysis period of 2022 to 2030 is 4.6%.

Which are the prominent competitors operating in the market?

The prominent players of the global Construction Equipment market are AB Volvo, Atlas Copco AB, Caterpillar Inc., CNH Industrial N.V., Doosan Heavy Industries & Construction Co., Ltd, Hitachi Construction Machinery Co., Ltd, J C Bamford Excavators Ltd., John Deere, Komatsu Ltd., and Liebherr Group.

Which region held the dominating position in the global construction equipment market?

Asia-Pacific held the dominating construction equipment during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for construction equipment during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global construction equipment market?

Growing investments in construction industry, increase of technologically advanced construction machinery, and increasing urbanization and supportive government initiatives in emerging countries drives the growth of global construction equipment market.

By Equipment Type segment, which sub-segment held the maximum share?

Based on equipment type, loaders segment held the maximum share construction equipment market in 2021.