Heavy Construction Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Heavy Construction Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

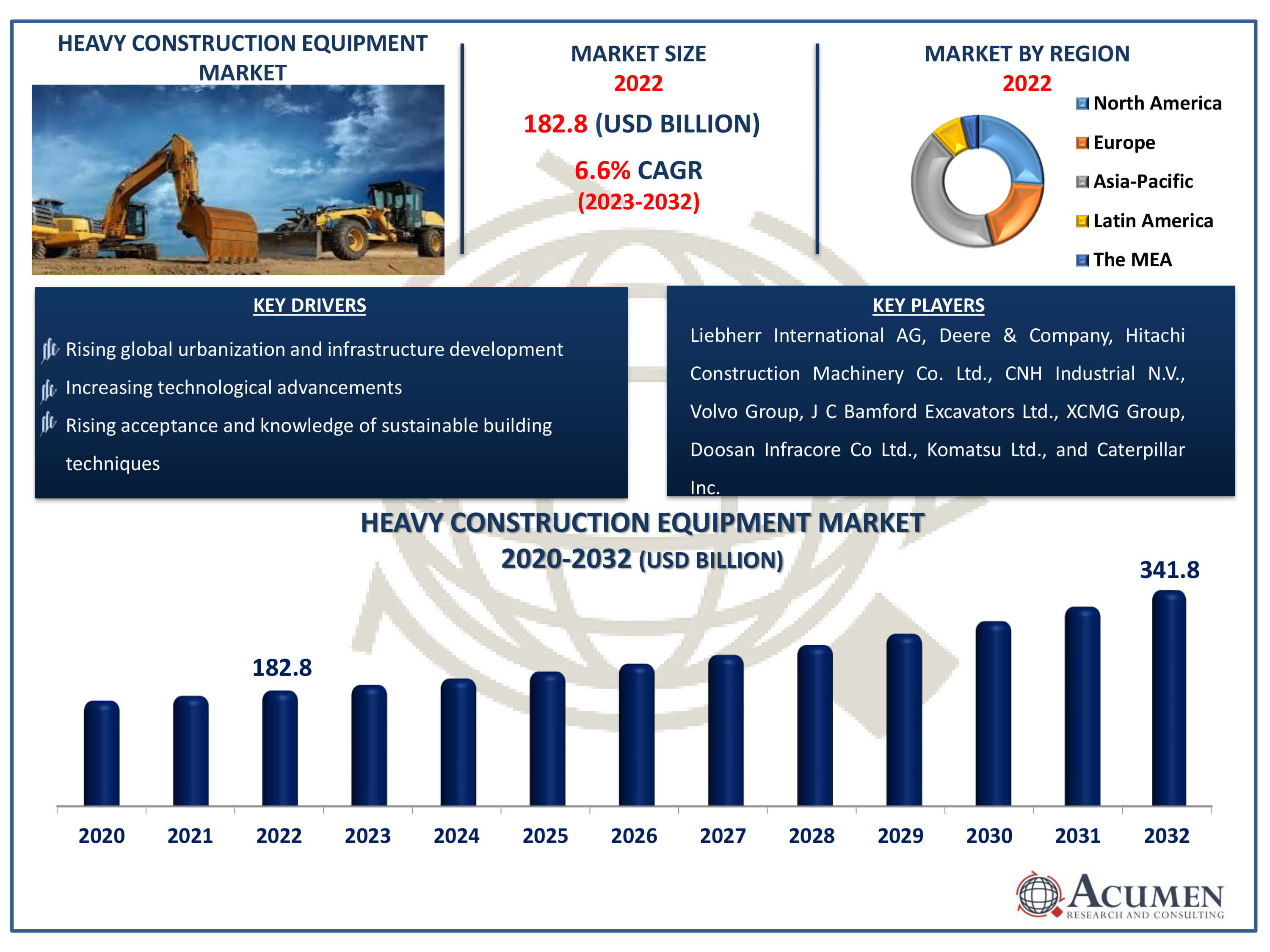

The Heavy Construction Equipment Market Size accounted for USD 182.8 Billion in 2022 and is estimated to achieve a market size of USD 341.8 Billion by 2032 growing at a CAGR of 6.6% from 2023 to 2032.

Heavy Construction Equipment Market Highlights

- Global heavy construction equipment market revenue is poised to garner USD 341.8 billion by 2032 with a CAGR of 6.6% from 2023 to 2032

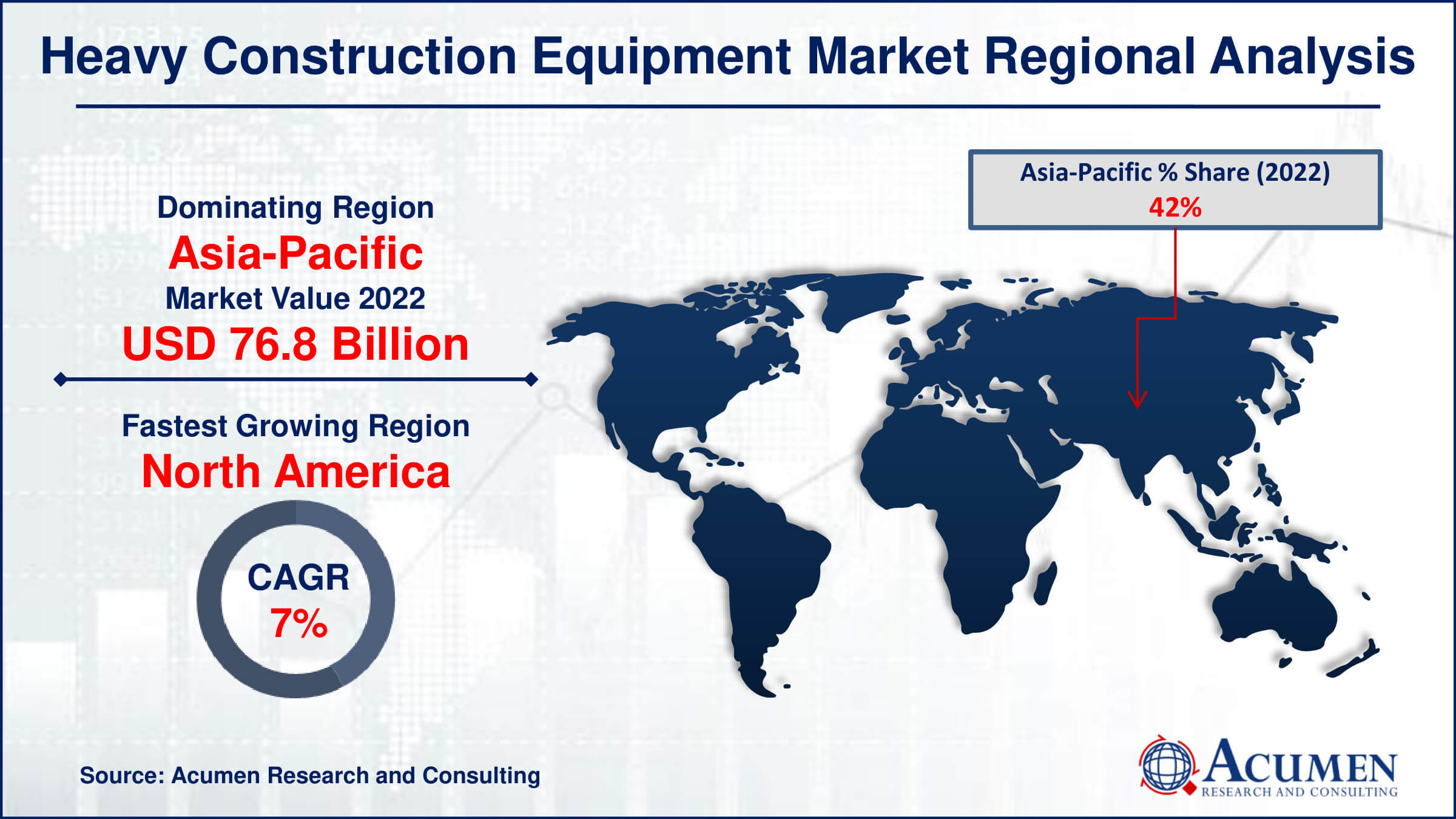

- Asia-Pacific heavy construction equipment market value occupied around USD 76.8 billion in 2022

- North America heavy construction equipment market growth will record a CAGR of more than 7% from 2023 to 2032

- Among type, the heavy construction vehicles sub-segment generated revenue more than USD 106 Billion in 2022

- Based on end use, the construction sub-segment generated around 42% share in 2022

- The focus on environmentally friendly machinery and sustainable building solutions is a popular heavy construction equipment market trend that fuels the industry demand

The term heavy construction equipment describes massive, strong vehicles used for earthmoving, infrastructure development, and building. Excavators, loaders, cranes, bulldozers, and other heavy-duty construction equipment are among the machines in this category. Urbanization, infrastructure development, and technical improvements are the driving forces behind the dynamic global market for heavy construction equipment. Major players with diversified product lines, such Volvo, Komatsu, and Caterpillar, control the market. The global construction boom and the growing need for high-capacity, effective equipment are driving the market's expansion. However, the industry's trajectory is impacted by things like high beginning prices and regulatory challenges, thus innovation and sustainable practices are essential for future improvements.

Global Heavy Construction Equipment Market Dynamics

Market Drivers

- Rising global urbanization and infrastructure development

- Increasing technological advancements

- Growing government investments in large-scale construction

- Increasing acceptance and knowledge of sustainable building techniques

Market Restraints

- High initial costs and maintenance expenses

- Regulatory challenges and compliance issues

- Economic downturns impact construction budgets

Market Opportunities

- Increasing demand for rental and leasing services

- Expansion in emerging markets with rising construction activities

- Integration of IoT and telematics for real-time equipment monitoring enhances operational efficiency

Heavy Construction Equipment Market Report Coverage

| Market | Heavy Construction Equipment Market |

| Heavy Construction Equipment Market Size 2022 | USD 182.8 Billion |

| Heavy Construction Equipment Market Forecast 2032 | USD 341.8 Billion |

| Heavy Construction Equipment Market CAGR During 2023 - 2032 | 6.6% |

| Heavy Construction Equipment Market Analysis Period | 2020 - 2032 |

| Heavy Construction Equipment Market Base Year |

2022 |

| Heavy Construction Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Liebherr International AG, Deere & Company, Hitachi Construction Machinery Co. Ltd., CNH Industrial N.V., Volvo Group, J C Bamford Excavators Ltd., XCMG Group, Doosan Infracore Co Ltd., Komatsu Ltd., and Caterpillar Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Heavy Construction Equipment Market Insights

The heavy construction equipment industry is being propelled by increasing collaboration and global economic development, primarily fueled by residential, business, and industrial growth. While there is a variety of heavy construction equipment available in the market, selecting the best type is crucial. Industries focus on criteria such as project complexity, cost, material, time, and strength when choosing heavy construction equipment. Key drivers for business growth include heightened private sector involvement, growth in urbanization, improved economic conditions, and the establishment of residential and commercial infrastructure in emerging economies. The industry's expansion is further supported by evolving approaches to infrastructure development and increasing public-private collaborations, particularly in countries like India and China.

The Indian Government's substantial investments in the construction and utilization of excavators, loaders, and similar heavy machines for bridges, highways, airports, and general infrastructure contribute significantly to industry growth. However, challenges such as fluctuating energy prices and the rising carbon footprint pose key concerns for the target market. A number of variables affect the heavy construction equipment market's dynamics and determine its future course. Technological developments are changing the industry landscape. One example is the integration of IoT and telematics for real-time monitoring. Innovation is also being fueled by the focus on environmentally friendly machinery and sustainable building solutions. As companies look for more affordable options, rental and leasing services are becoming more popular and are helping to keep the industry dynamic.

Variations in energy costs and the state of the global economy present obstacles that force industry participants to implement robust strategies. One of the most important dynamics in the market is its response to government and private sector initiatives; these partnerships will continue to shape the industry's future. The heavy construction equipment market is expected to grow steadily as long as rising economies keep investing in infrastructure. This expansion will be fueled by a variety of factors, including obstacles that will require strategic adaptation.

Heavy Construction Equipment Market Segmentation

The worldwide market for heavy construction equipment is split based on type, application, end use, and geography.

Heavy Construction Equipment Types

- Heavy Construction Vehicles

- Material Handling

- Earthmoving

- Others

In the heavy construction equipment market, the heavy construction vehicles segment is dominant and has a significant influence on the direction of the industry. These sturdy devices, which include cranes, bulldozers, and excavators, are essential for a variety of construction-related jobs. Their significant contributions to large-scale infrastructure projects are attributed to their adaptability, high capacity, and efficiency. Heavy construction vehicles are in high demand because of their versatility in addressing a range of construction-related tasks, such as material delivery and excavation. The Heavy Construction Vehicles segment remains a driving force behind the global upsurge in urbanisation and infrastructure development, guaranteeing the efficient execution of intricate projects and reinforcing its dominant market position.

Heavy Construction Equipment Applications

- Recycling and Waste Management

- Transportation

- Excavation and Demolition

- Tunneling

- Heavy Lifting

- Material Handling

According to the heavy construction equipment industry analysis, the market leader is the excavation and demolition category. This section contains equipment vital to urban development, such as digging, trenching, and building demolition tools. The market is driven by the growing need for infrastructure development and the global urbanisation trend, which puts excavation and demolition equipment at the forefront. Excavators, bulldozers, and wrecking balls are a few examples of the machinery that are essential to building projects and sculpting landscapes. This market segment's dominance is driven by the need for effective and adaptable equipment to manage excavation and demolition jobs. The excavation and demolition category is anticipated to hold its dominant position in the heavy construction equipment market due to ongoing urbanisation and the demand for infrastructure renewal, which will spur innovation and growth.

Heavy Construction Equipment End Uses

- Infrastructure

- Construction

- Mining

- Oil and Gas

- Manufacturing

- Public Work and Rail Road

- Others

In the market, the construction segment leads due to its crucial involvement in various construction projects and it is expected to grow during the heavy construction equipment industry forecast period. Excavators, bulldozers, and cranes are just a few examples of the heavy machinery that fall under the crucial end-use category of construction. These machines are essential for jobs like foundation installation, building construction, and earthmoving. The necessity for large-scale construction projects, continued global infrastructure development, and urbanisation activities are driving the solid demand. This industry is essential because of the diversity of construction equipment, which guarantees accuracy and efficiency in a range of construction applications. The construction segment is well-positioned to hold onto its leading position due to the ongoing demand for new urban spaces and infrastructure. This will drive the heavy construction equipment market towards technical breakthroughs that are specifically suited to the changing needs of the construction industry as well as sustainable growth.

Heavy Construction Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Heavy Construction Equipment Market Regional Analysis

In 2022, Asia-Pacific held a significant market share and is projected to continue dominating the market in the heavy construction equipment market forecast period. This is attributed to increased governmental funding and extensive infrastructure development initiatives in the region. The substantial investment in infrastructure is expected to drive the demand for heavy construction equipment, particularly in countries like China and India. Additionally, the Middle East & Africa are experiencing a surge in demand for heavy construction machinery due to substantial industrial growth, especially in the construction of large oil refineries and the transportation sector. These factors contribute to the momentum of the market in the region.

Heavy Construction Equipment Market Players

Some of the top heavy construction equipment companies offered in our report includes Liebherr International AG, Deere & Company, Hitachi Construction Machinery Co. Ltd., CNH Industrial N.V., Volvo Group, J C Bamford Excavators Ltd., XCMG Group, Doosan Infracore Co Ltd., Komatsu Ltd., and Caterpillar Inc.

Frequently Asked Questions

How big is the heavy construction equipment market?

The heavy construction equipment market size was valued at USD 182.8 billion in 2022.

What is the CAGR of the global heavy construction equipment market from 2023 to 2032?

The CAGR of heavy construction equipment is 6.6% during the analysis period of 2023 to 2032.

Which are the key players in the heavy construction equipment market?

The key players operating in the global market are including Liebherr International AG, Deere & Company, Hitachi Construction Machinery Co. Ltd., CNH Industrial N.V., Volvo Group, J C Bamford Excavators Ltd., XCMG Group, Doosan Infracore Co Ltd., Komatsu Ltd., and Caterpillar Inc.

Which region dominated the global heavy construction equipment market share?

Asia-Pacific held the dominating position in heavy construction equipment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of heavy construction equipment during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global heavy construction equipment industry?

The current trends and dynamics in the heavy construction equipment industry include rising global urbanization and infrastructure development, increasing technological advancements, growing government investments in large-scale construction, and increasing acceptance and knowledge of sustainable building techniques.

Which end use held the maximum share in 2022?

The construction end use held the maximum share of the heavy construction equipment industry.