Oil Storage Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Oil Storage Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

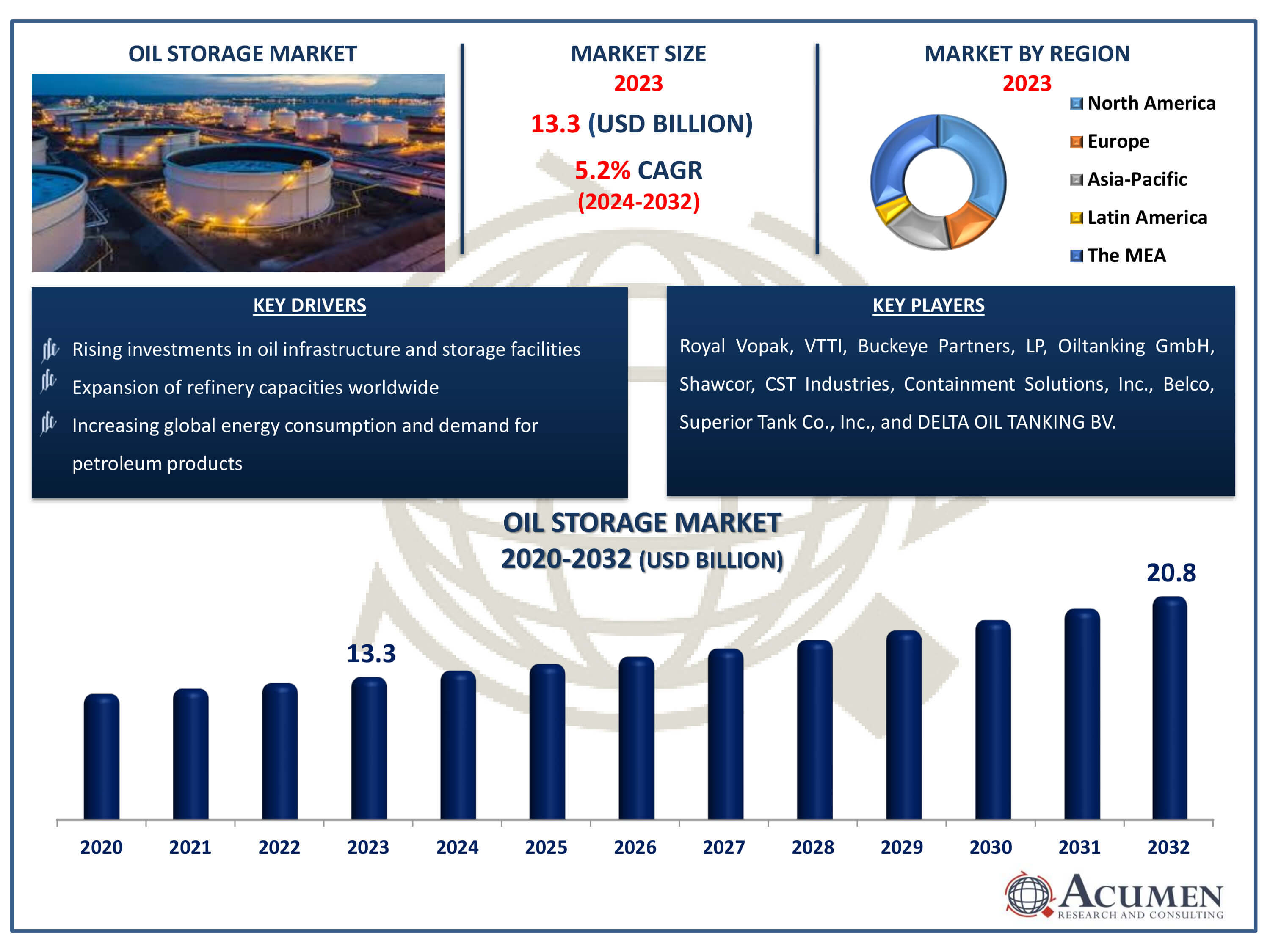

The Oil Storage Market Size accounted for USD 13.3 Billion in 2023 and is estimated to achieve a market size of USD 20.8 Billion by 2032 growing at a CAGR of 5.2% from 2024 to 2032.

Oil Storage Market Highlights

- Global oil storage market revenue is poised to garner USD 20.8 billion by 2032 with a CAGR of 5.2% from 2024 to 2032

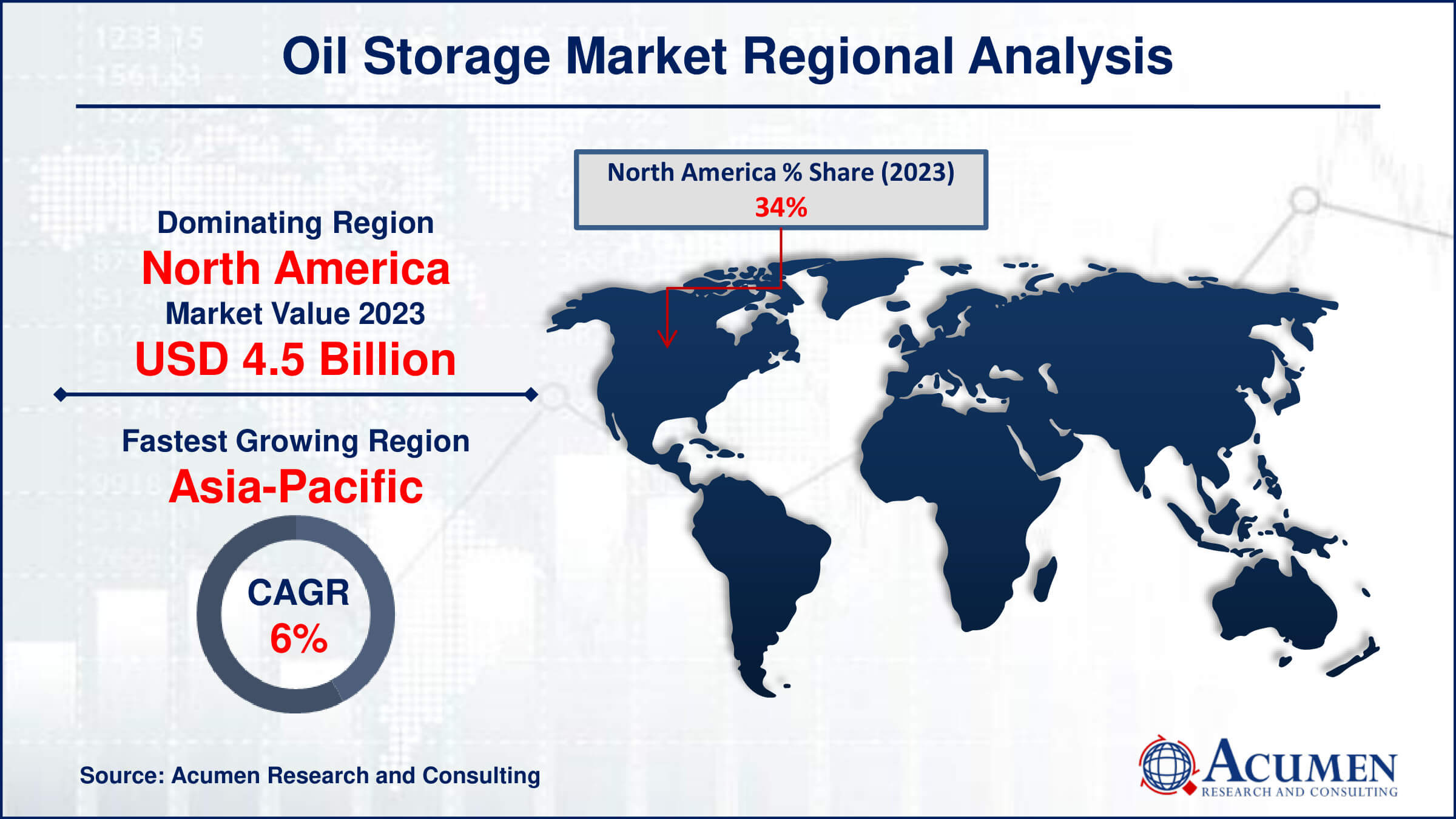

- North America oil storage market value occupied around USD 4.5 billion in 2023

- Asia-Pacific oil storage market growth will record a CAGR of more than 6% from 2024 to 2032

- Among product, the floating roof sub-segment generated more than USD 6.4 billion revenue in 2023

- Based on application, the crude oil sub-segment generated around 34% market share in 2023

- Strategic collaborations and partnerships to expand market presence and diversify service offerings is a popular oil storage market trend that fuels the industry demand

Oil storage is the practice of storing crude or refined petroleum products in tanks or containers for later use or delivery. It is critical to the global energy supply chain because it acts as a buffer against supply and demand changes, allowing production and distribution to continue uninterrupted. Oil storage facilities range in size and construction, from modest tanks near refineries to massive terminals that may hold millions of barrels. These facilities are strategically positioned near refineries, ports, or key transit routes to ensure efficient transportation and distribution. Effective oil storage management is critical for providing energy security, stabilizing prices, and satisfying the needs of businesses and consumers globally.

Global Oil Storage Market Dynamics

Market Drivers

- Increasing global energy consumption and demand for petroleum products

- Growth in oil production and exploration activities

- Expansion of refinery capacities worldwide

- Rising investments in oil infrastructure and storage facilities

Market Restraints

- Environmental concerns related to oil spills and contamination risks

- Stringent regulations regarding emissions and safety standards

- Volatility in oil prices impacting investment decisions and project viability

Market Opportunities

- Adoption of advanced technologies for enhanced storage capacity and efficiency

- Emerging markets offering lucrative opportunities for storage infrastructure development

- Integration of renewable energy solutions with oil storage facilities

Oil Storage Market Report Coverage

| Market | Oil Storage Market |

| Oil Storage Market Size 2022 | USD 13.3 Billion |

| Oil Storage Market Forecast 2032 |

USD 20.8 Billion |

| Oil Storage Market CAGR During 2023 - 2032 | 5.2% |

| Oil Storage Market Analysis Period | 2020 - 2032 |

| Oil Storage Market Base Year |

2022 |

| Oil Storage Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Material, By Reserve Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Royal Vopak, VTTI, Buckeye Partners, LP, Oiltanking GmbH, Shawcor, CST Industries, Containment Solutions, Inc., Belco, Superior Tank Co., Inc., and DELTA OIL TANKING BV. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Oil Storage Market Insights

The rising global demand for oil, coupled with the increasing need for safe and reliable storage units, is a major factor expected to drive the growth of the global market. Additionally, government initiatives aimed at increasing oil inventory further support this growth. Increasing oil extraction activities in emerging economies and rising import-export operations are expected to drive demand for storage units capable of withstanding harsh environments. In 2019, the United States imported approximately 9.10 million barrels per day (MMb/d) of petroleum from nearly 90 countries, with crude oil imports accounting for about 75% of total gross petroleum imports. High investments in the sector and the strategic expansion approach of major players through partnerships and agreements are also expected to positively impact market growth.

For instance, in 2019, Holly Energy Partners LP, a service provider of petroleum product and crude oil transportation, partnered with Plains All American Pipeline to develop and construct a new 160,000 barrel per day crude oil pipeline. Additionally, increasing merger and acquisition activities aimed at expanding customer bases and enhancing profits are expected to further bolster market growth.

In 2019, Prostar Capital acquired NuStar Energy L.P.'s oil storage terminal facility, aiming to expand its business and increase profit. Furthermore, Secure Energy Services Inc. acquired oil storage infrastructure in North America, strengthening its market position and revenue share.

However, factors such as the high cost of tanks and uncertain economic conditions in certain countries may hinder the growth of the global oil storage market. Additionally, lower demand for oil poses a challenge to market growth. Nevertheless, the high global demand for oil and major players' efforts to develop cost-effective storage tanks are expected to create new opportunities for market players. Furthermore, major players' focus on developing economies to expand business presence is expected to further support revenue traction in the market.

Oil Storage Market Segmentation

The worldwide market for oil storage is split based on product, material, reserve type, application, and geography.

Oil Storage Products

- Open Top

- Fixed Roof

- Floating Roof

- Others

According to oil storage industry analysis, the floating roof category leads the market due to its capacity to reduce evaporation losses, emissions, and contamination. Its flexibility and versatility make it suited for a wide range of liquid storage applications, which contributes to its dominance. Meanwhile, the fixed roof segment becomes the second largest sub-segment because to its durability and cost-effectiveness. Fixed roof tanks have a permanent construction that provides great environmental protection, making them ideal for storing crude oil and petroleum products. Their simplicity and longevity make them popular alternatives, especially in areas with moderate weather conditions. Overall, both kinds are vital to guaranteeing the safety and security of oil storage activities across the world.

Oil Storage Materials

- Steel

- Carbon Steel

- Fiberglass-reinforced Plastic (FRP)

Carbon steel leads the oil storage market as the largest category because to its broad availability, durability, and cost-effectiveness. Carbon steel tanks are well-known for their durability and dependability in holding huge quantities of oil and petroleum products. They have great corrosion resistance and can survive extreme weather conditions, making them ideal for long-term storage applications. Furthermore, carbon steel tanks are easily customizable to suit a variety of capacities and specifications, giving them the flexibility to fulfill a wide range of business requirements. Despite the rising popularity of alternative materials such as fiberglass-reinforced plastic (FRP), carbon steel is still the chosen material for many storage facilities across the world, highlighting its critical role in maintaining safe and effective oil storage operations.

Oil Storage Reserve Types

- Strategic Petroleum Reserve

- Commercial Petroleum Reserve

In terms of oil storage market analysis, for a variety of reasons, the commercial petroleum reserve category is expected to dominate the industry. Commercial petroleum reserves are largely owned and maintained by private companies, and they serve as critical hubs for storing oil products for commercial use. These reserves are critical in guaranteeing a consistent supply of oil to fulfil market demand, which includes refining, distribution, and retailing. With rising global demand for petroleum products and the growth of oil-related businesses, commercial storage facilities are in high demand. Additionally, commercial petroleum reserves provide flexibility and efficiency in storage operations, resulting in considerable expenditures from oil corporations and dealers. As a consequence, this category is expected to dominate the oil storage market, owing to its critical role in sustaining oil supply chains and market stability.

Oil Storage Applications

- Crude Oil

- Aviation Fuel

- Gasoline

- Middle Distillates

- Others

The crude oil segment is likely to capture the greatest share and it is expected to grow over the oil storage industry forecast period, because of its critical position in global energy supply chains. Crude oil is a key component in a variety of industries, including transportation, manufacturing, and power production, making it an essential commodity for global economies. The demand for crude oil storage facilities derives from the necessity to preserve strategic reserves, accommodate production and consumption changes, and permit efficient transportation and distribution networks. With rising oil production and consumption levels throughout the world, the demand for crude oil storage grows. Furthermore, geopolitical tensions and supply interruptions highlight the need of strong crude oil storage infrastructure, presenting this sector as the most important contributor to the oil storage market's development and stability.

Oil Storage Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Oil Storage Market Regional Analysis

North America and the Middle East and Africa area maintain dominance in the oil storage industry, bolstered by powerful government programs targeted at increasing oil and gas extraction operations to satisfy rising demand. With sophisticated infrastructure and established industry participants, these areas have a mature market landscape that promotes consistent growth and innovation. Meanwhile, the Asia-Pacific region emerges as the pinnacle of vitality, with unprecedented growth potential fuelled by significant government investments in the oil and gas sector expansion. As the region's economy grow, so does the desire for effective storage solutions, driving storage tank demand to record heights. This trio of regional dynamics creates a comprehensive global oil storage market environment marked by leadership, innovation, and rapid growth.

Oil Storage Market Players

Some of the top oil storage companies offered in our report includes Royal Vopak, VTTI, Buckeye Partners, LP, Oiltanking GmbH, Shawcor, CST Industries, Containment Solutions, Inc., Belco, Superior Tank Co., Inc., and DELTA OIL TANKING BV.

Frequently Asked Questions

How big is the oil storage market?

The oil storage market size was valued at USD 13.3 billion in 2023.

What is the CAGR of the global oil storage market from 2024 to 2032?

The CAGR of oil storage is 5.2% during the analysis period of 2024 to 2032.

Which are the key players in the oil storage market?

The key players operating in the global market are including Royal Vopak, VTTI, Buckeye Partners, LP, Oiltanking GmbH, Shawcor, CST Industries, Containment Solutions, Inc., Belco, Superior Tank Co., Inc., and DELTA OIL TANKING BV.

Which region dominated the global oil storage market share?

North America held the dominating position in oil storage industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of oil storage during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global oil storage industry?

The current trends and dynamics in the oil storage industry include increasing global energy consumption and demand for petroleum products, growth in oil production and exploration activities, expansion of refinery capacities worldwide, and rising investments in oil infrastructure and storage facilities.

Which product held the maximum share in 2023?

The floating roof product held the maximum share of the oil storage industry.