Cinnamaldehyde Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Cinnamaldehyde Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

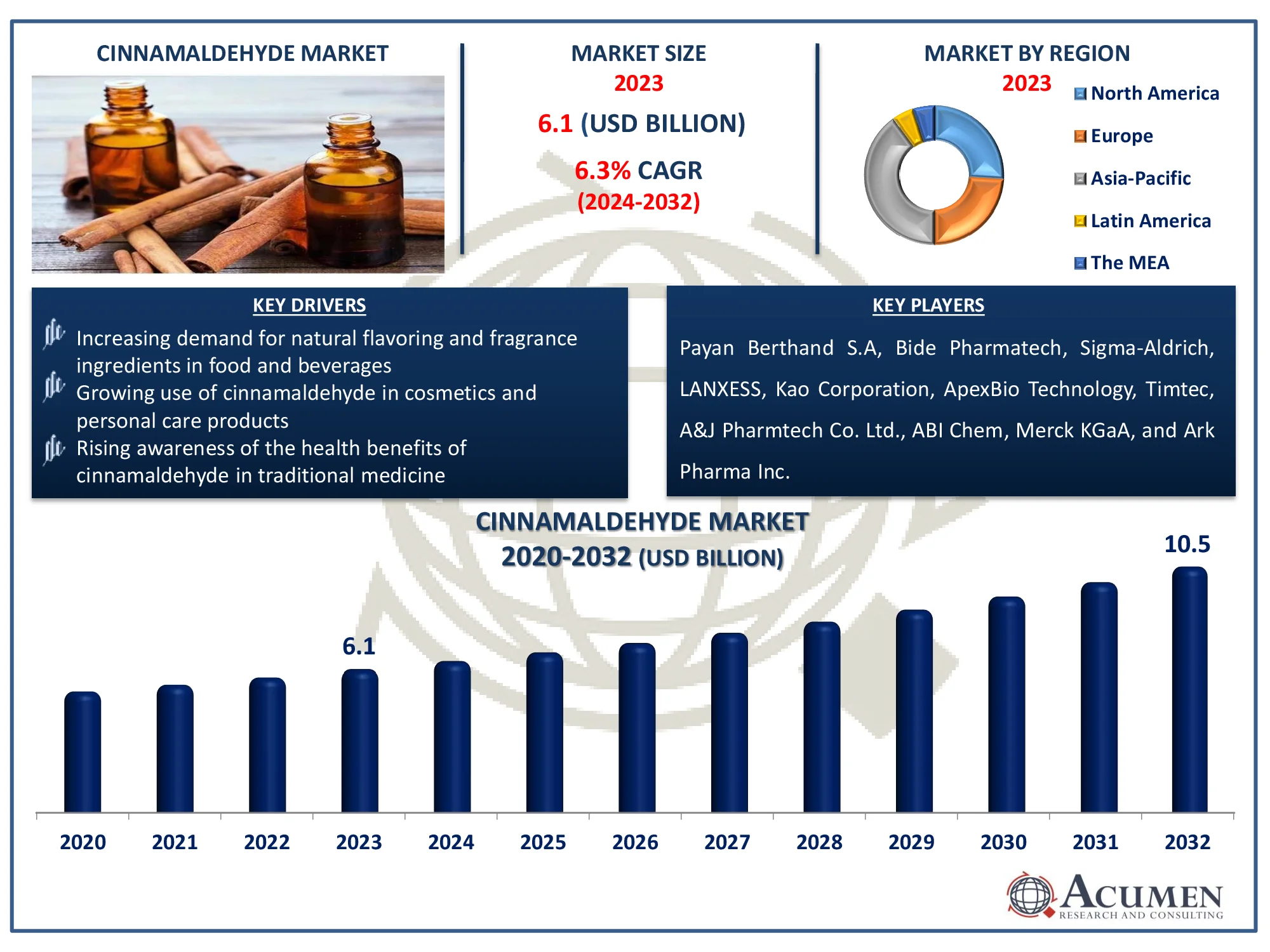

The Global Cinnamaldehyde Market Size accounted for USD 6.1 Billion in 2023 and is estimated to achieve a market size of USD 10.5 Billion by 2032 growing at a CAGR of 6.3% from 2024 to 2032.

Cinnamaldehyde Market Highlights

- The global cinnamaldehyde market is projected to reach USD 10.5 billion by 2032, with a CAGR of 6.3% from 2024 to 2032

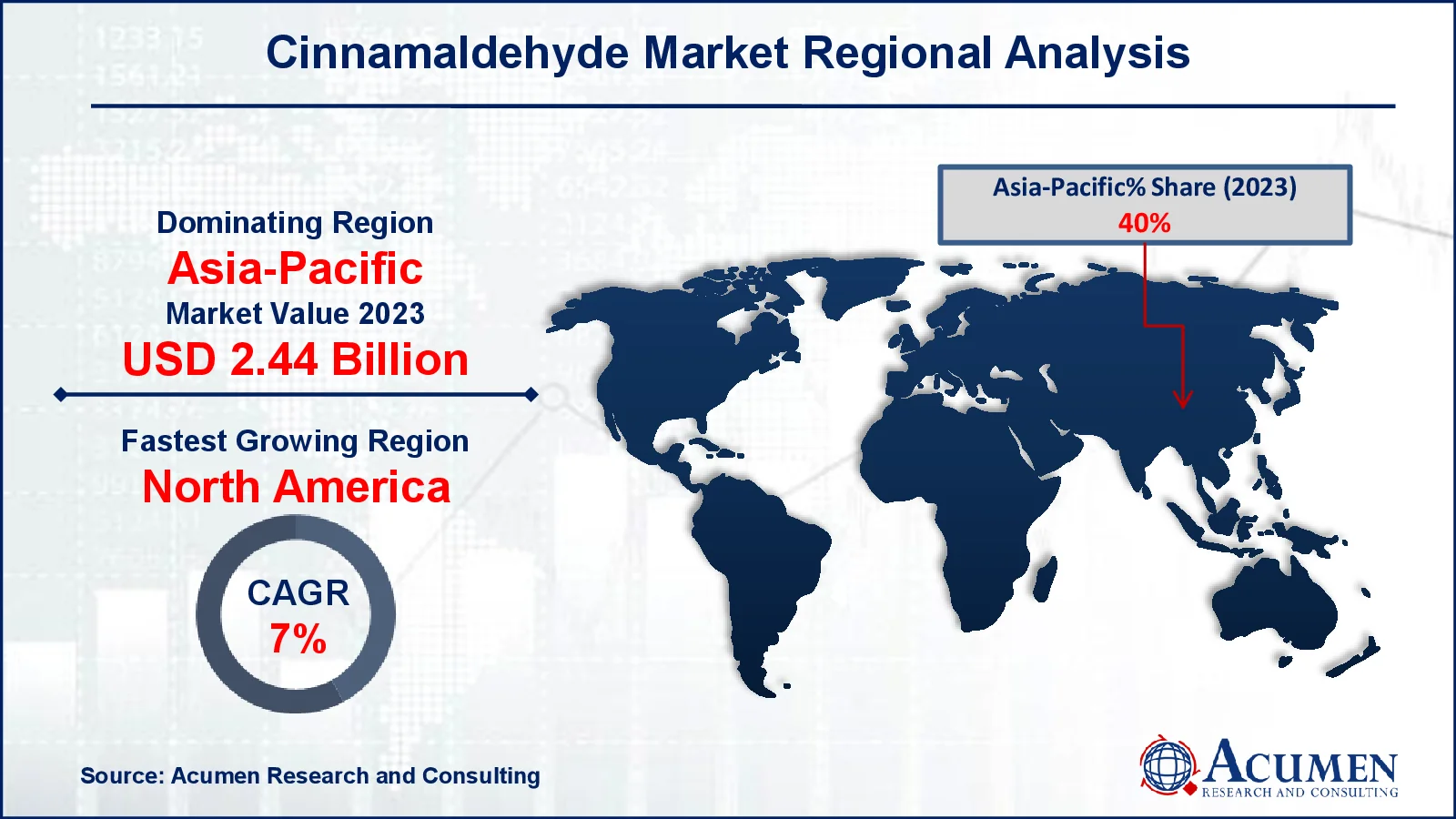

- In 2023, the Asia-Pacific cinnamaldehyde market held a value of approximately USD 2.44 billion

- The North America region is expected to grow at a CAGR of over 7% from 2024 to 2032

- The natural source accounted for 59% of the market share in 2023

- High demand in the global aromatherapy market due to its distinctive fragrance is the cinnamaldehyde market trend that fuels the industry demand

Cinnamaldehyde is also referred to as 3-phenyl-2-propenal, cinnamic, phenylalacrolein, cinnamal, cinnamyl aldehyde, and transcinnamaldehyde. It is a yellowish oily liquid with a sweet taste and a cinnamon aroma that is similar to the taste and smell of cinnamon spice. It is also used as fungicide. Cinnamaldehyde’s bioactive qualities make it potentially useful in treating illnesses such as diabetes and inflammation. For instance, according to National Institute of Health, cinnamaldehyde prevents the severity of hypertension (high blood pressure) in both type 1 and type 2 diabetes by slowing the contraction of blood vessels. It also has an insulinotropic action, which means it can stimulate insulin secretion, which is useful in cases of insulin insufficiency (a feature of diabetescinnamonaldehyde may assist diabetics regulate their excessive blood pressure and insulin levels.

Global Cinnamaldehyde Market Dynamics

Market Drivers

- Increasing demand for natural flavoring and fragrance ingredients in food and beverages

- Growing use of cinnamaldehyde in cosmetics and personal care products

- Rising awareness of the health benefits of cinnamaldehyde in traditional medicine

Market Restraints

- Limited availability of raw cinnamon and price volatility

- Regulatory challenges regarding the use of cinnamaldehyde in food and cosmetics

- Potential allergic reactions and health concerns among consumers

Market Opportunities

- Expansion of the organic cinnamaldehyde market due to increasing consumer preference for natural products

- Innovations in the pharmaceutical sector utilizing cinnamaldehyde for therapeutic applications

- Growth in the demand for cinnamaldehyde-based insect repellents and antimicrobial agents

Cinnamaldehyde Market Report Coverage

| Market | Cinnamaldehyde Market |

| Cinnamaldehyde Market Size 2022 |

USD 6.1 Billion |

| Cinnamaldehyde Market Forecast 2032 | USD 10.5 Billion |

| Cinnamaldehyde Market CAGR During 2023 - 2032 | 6.3% |

| Cinnamaldehyde Market Analysis Period | 2020 - 2032 |

| Cinnamaldehyde Market Base Year |

2023 |

| Cinnamaldehyde Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Source, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Payan Berthand S.A, Bide Pharmatech, Sigma-Aldrich, LANXESS, Kao Corporation, ApexBio Technology, Timtec, A&J Pharmtech Co. Ltd., ABI Chem, Merck KGaA, and Ark Pharma Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cinnamaldehyde Market Insights

The growing personal care, household, and food and beverage industries around the world, increasing cinnamaldehyde uses in the flavor and fragrance sectors, and easy access to cinnamaldehyde raw material sources are all driving the growth of the cinnamic aldehyde market. According to India Brand Equity Foundation, the Indian food and beverage packaged business is rapidly expanding, with the market size expected to rise from US$ 33.7 billion in 2023 to US$ 46.3 billion by 2028. Furthermore, if undiluted, the property of cinnamaldehyde may stymie market growth. Because of the availability of superior market and distribution channels, home care and personal care goods with a high degree of penetration in emerging nations may present many potential opportunities during the projection period. For instance, as per Invest India, the Indian government authorizes 100% FDI in single-brand retail and 51% in multi-brand retail, making it possible for international beauty firms to enter and expand in the Indian market. Overall, because the Indian government encourages foreign investment in retail, international cosmetic companies can develop, resulting in increasing demand for chemicals such as cinnamaldehyde in their products.

Furthermore, development in cinnamaldehyde is being pushed by the developing cosmetics and personal care sector, which is seeing increased consumer awareness and per capita disposable income. Consumption of personal care goods is rapidly expanding due to rising demand for items such as detergents, shampoos, deodorants, and cleansers with varying requirements.

The organic cinnamaldehyde market is expanding as consumers seek natural products, creating opportunities for the cinnamaldehyde sector. For instance, according to CAS Organization, the expanding market for natural ingredients, which is expected to grow from USD $642 million in 2022 to USD $1,095 million by 2030, demonstrates the cosmetics industry's trend toward sustainability. The increased consumer desire for natural products presents an opportunity for the cinnamic aldehyde market, as cinnamon is a popular natural ingredient used in cosmetics for its scent and antioxidant capabilities.

Cinnamaldehyde Market Segmentation

The worldwide market for cinnamaldehyde is split based on type, source, application, and geography.

Cinnamaldehyde Market By Type

- Flavor Agent

- Aroma Agent

- Antimicrobial Agent

- Other Types

According to the cinnamaldehyde industry analysis, the flavor agent segment will have considerable expansion during the projected period due to the increased use of cinnamaldehyde in the food and pharmaceutical industries. Cinnamaldehyde is the most commonly used substance to improve the aroma and flavor of foods and pharmaceuticals. It is used as a flavoring agent in beverages, ice creams, chewing gum, and sweets. It is used in perfumes to recreate the charm of fruity and intriguing smell combinations. In addition to its herbal uses, cinnamaldehyde is commonly used as a food additive to improve the flavor and/or odor of food products. The most common applications include cake mixes, chewing gums, chocolate products, synthetic oils for cinnamon, cola beverages, ice creams, soft drinks, and vermouth. The chemical is also used to enhance the smell of a variety of cosmetics and home care items. These products include deodorants, detergents, mouthwashes, perfumes, napkins, soaps, and toothpastes.

Cinnamaldehyde Market By Source

- Synthetic

- Natural

The natural category dominates the cinnamaldehyde market as the cosmetics and fragrance sectors desire cleaner, more environmentally friendly, and sustainable products. Consumers are becoming more aware of the substances in their personal care products, preferring natural and plant-based alternatives. Cinnamaldehyde, obtained from cinnamon bark, meets this demand by providing natural aroma, antibacterial, and antioxidant properties. As the trend toward sustainability and natural products rises, so will the demand for cinnamaldehyde in the cosmetics and food industries.

Cinnamaldehyde Market By Application

- Food and Beverages

- Household & Personal Care Industry

- Agriculture

- Healthcare

- Others

According to the cinnamaldehyde market forecast, cinnamaldehyde's antibacterial properties, which are commonly utilized in food, are driving significant growth in the food and beverage application area. Cinnamaldehyde can also be more effective as an addition when kept in a refrigerator at short-degree Celsius temperatures to control the growth of food-borne pathogens with psychrotrophic strains. An alternate method of producing cinnamaldehyde as an essential oil in edible films and wrapping presents a new technique for improving the timeframe for realistic usability and safety in the food business.

Cinnamaldehyde Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cinnamaldehyde Market Regional Analysis

For several reasons, Asia-Pacific dominates cinnamic aldehyde market. Increasing economic and population trends in China, Japan, and India will drive demand for luxury consumer goods. Furthermore, the household and personal care development businesses will make major contributions to business growth.

North America growing significantly in cinnamaldehyde market due to rising demand for packaged goods and beverages. Drink product consumption in this region is increasing as demand for health and energy beverages rises. For instance, according to the IFIC 2023 Food & Health Survey, 74% of Americans believe their food and drink choices have an impact on their mental health, while 61% believe their mental health influences these decisions. This demonstrates an increasing demand for beverages that promote mental wellness, resulting in increased consumption in the United States. The increasing usage of cinnamaldehyde in agriculture is also driving market expansion, particularly in the United States.

Europe is expected to expand during the forecast period due to increased consumption of packaged food and beverages for comfort. Increased investment in the healthcare industry leads to increased product demand as the senior population grows.

Latin America is expected to have significant growth in terms of changing consumption patterns and increased demand for packaged foods and beverages. Furthermore, the presence of luxury brands in Brazil, such as Natura Cosmeticos and Avon, is fueling market growth in this region.

The cinnamic aldehyde market in the Middle East and Africa is driven not only by vanity, but also by factors such as rising consumerism, more private money, and a greater emphasis on beauty improvement products.

Cinnamaldehyde Market Players

Some of the top cinnamaldehyde companies offered in our report include Payan Berthand S.A, Bide Pharmatech, Sigma-Aldrich, LANXESS, Kao Corporation, ApexBio Technology, Timtec, A&J Pharmtech Co. Ltd., ABI Chem, Merck KGaA, and Ark Pharma Inc.

Frequently Asked Questions

How big is the Cinnamaldehyde market?

The cinnamaldehyde market size was valued at USD 6.1 billion in 2023.

What is the CAGR of the global Cinnamaldehyde market from 2024 to 2032?

The CAGR of cinnamaldehyde is 6.3% during the analysis period of 2024 to 2032.

Which are the key players in the Cinnamaldehyde market?

The key players operating in the global market are including Payan Berthand S.A, Bide Pharmatech, Sigma-Aldrich, LANXESS, Kao Corporation, ApexBio Technology, Timtec, A&J Pharmtech Co. Ltd., ABI Chem, Merck KGaA, and Ark Pharma Inc.

Which region dominated the global Cinnamaldehyde market share?

Asia-Pacific held the dominating position in cinnamaldehyde industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of cinnamaldehyde during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Cinnamaldehyde industry?

The current trends and dynamics in the cinnamaldehyde industry include increasing demand for natural flavoring and fragrance ingredients in food and beverages, growing use of cinnamaldehyde in cosmetics and personal care products, and rising awareness of the health benefits of cinnamaldehyde in traditional medicine.

Which source held the maximum share in 2023?

The natural source held the maximum share of the cinnamaldehyde industry.