Building And Construction Plastics Market | Acumen Research and Consulting

Building and Construction Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

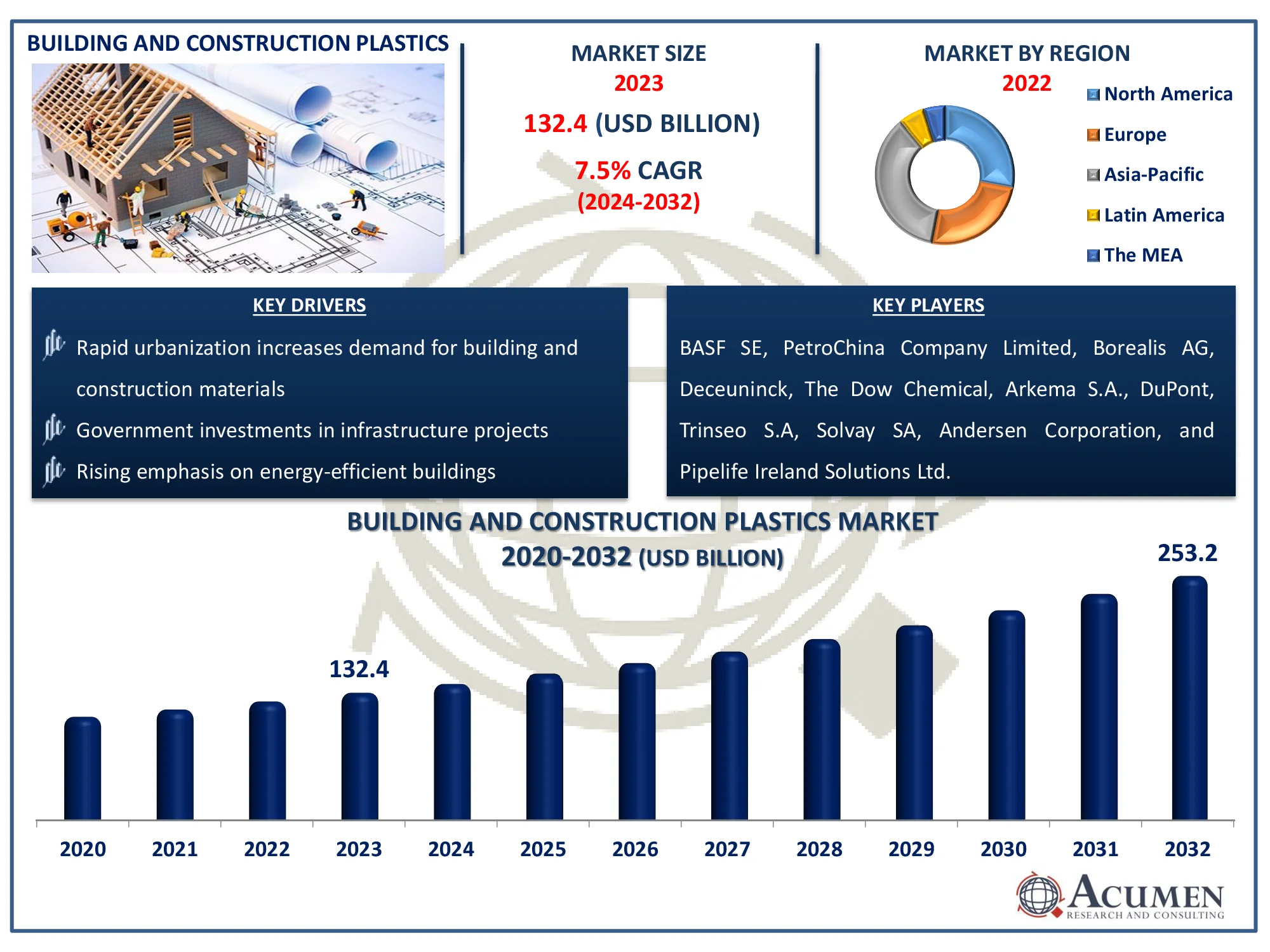

The Global Building and Construction Plastics Market Size accounted for USD 132.4 Billion in 2023 and is estimated to achieve a market size of USD 253.2 Billion by 2032 growing at a CAGR of 7.5% from 2024 to 2032.

Building and Construction Plastics Market Highlights

- Global building and construction plastics market revenue is poised to garner USD 253.2 billion by 2032 with a CAGR of 7.5% from 2024 to 2032

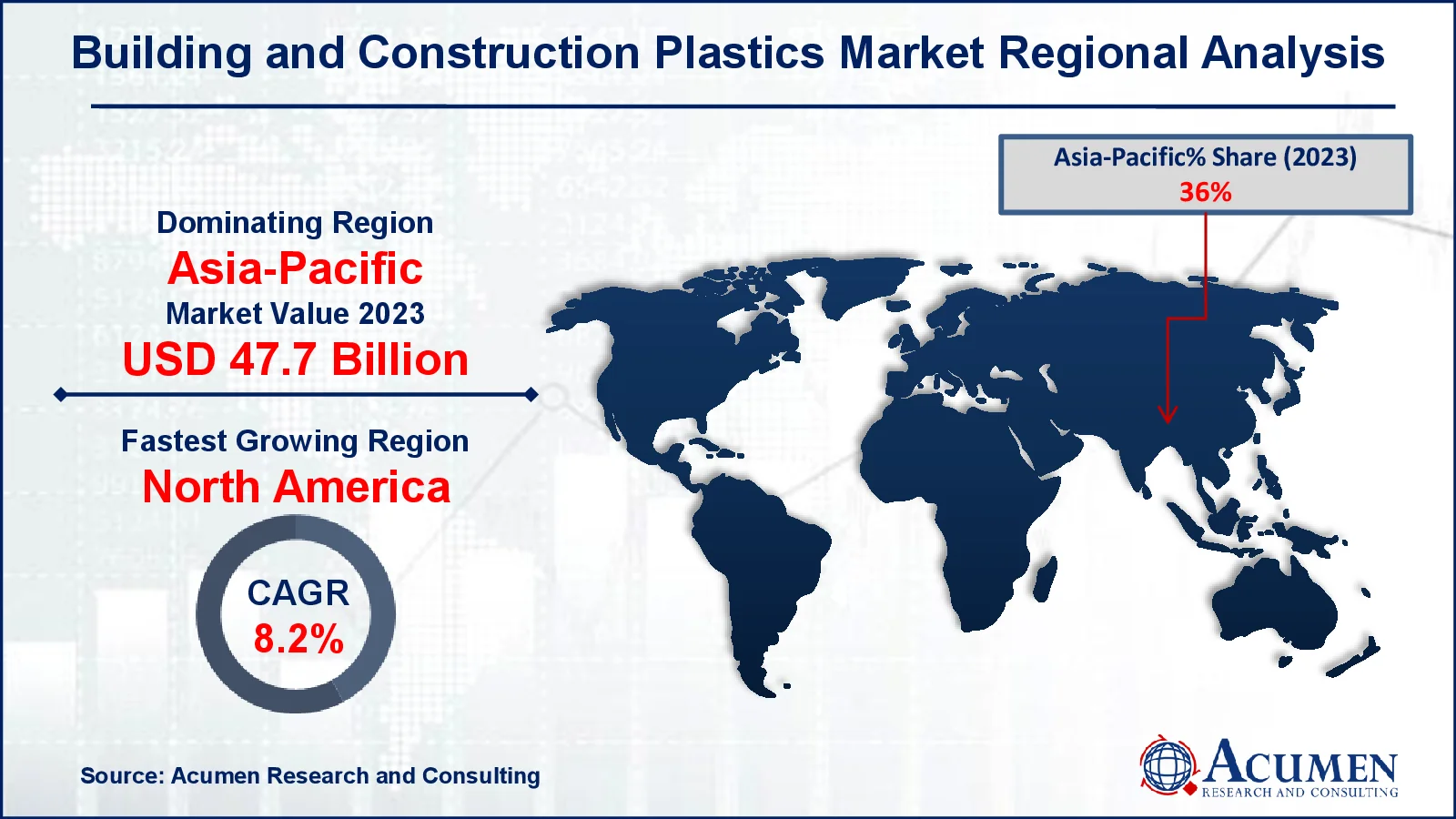

- Asia-Pacific building and construction plastics market value occupied around USD 47.6 billion in 2023

- North America building and construction plastics market growth will record a CAGR of more than 8.2% from 2024 to 2032

- Based on product, the polyvinyl chloride sub-segment generated 42% market share in 2023

- Based on application, the pipes & ducts sub-segment shows 37% share in 2023

- Increased use of advanced polymer composites for enhanced durability and energy efficiency in construction applications is the building and construction plastics market trend that fuels the industry demand

Building and construction plastics are essential materials used in various applications within the construction industry. These plastics include PVC, polyethylene, polystyrene, and polycarbonate, known for their durability, versatility, and cost-effectiveness. They are employed in piping, insulation, flooring, windows, and roofing due to their resistance to corrosion, weathering, and chemicals. Additionally, construction plastics contribute to energy efficiency through their insulating properties, reducing heating and cooling costs. Innovations in this field focus on enhancing sustainability by incorporating recycled materials and improving the recyclability of plastic components. This drive towards greener solutions aligns with the industry's goals of reducing environmental impact while maintaining performance and safety standards.

Global Building and Construction Plastics Market Dynamics

Market Drivers

- Rapid urbanization increases demand for building and construction materials

- Government investments in infrastructure projects boost the market

- Rising emphasis on energy-efficient buildings drives the adoption of advanced plastics

Market Restraints

- Increasing regulatory pressure due to environmental impact of plastics

- Fluctuating prices of raw materials affect cost structures

- Difficulty in recycling construction plastics hampers market growth

Market Opportunities

- Growing demand for eco-friendly and biodegradable plastics in construction

- Innovations in plastic manufacturing technologies offer new applications

- Expanding construction activities in emerging economies provide growth potential

Building and Construction Plastics Market Report Coverage

| Market | Building and Construction Plastics Market |

| Building and Construction Plastics Market Size 2022 |

USD 132.4 Billion |

| Building and Construction Plastics Market Forecast 2032 | USD 253.2 Billion |

| Building and Construction Plastics Market CAGR During 2023 - 2032 | 7.5% |

| Building and Construction Plastics Market Analysis Period | 2020 - 2032 |

| Building and Construction Plastics Market Base Year |

2022 |

| Building and Construction Plastics Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, PetroChina Company Limited, Borealis AG, Deceuninck, The Dow Chemical, Arkema S.A., DuPont, Trinseo S.A, Solvay SA, Andersen Corporation, and Pipelife Ireland Solutions Ltd (Cork Plastics). |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Building and Construction Plastics Market Insights

Rapid urbanization is fueling the demand for building and construction materials, leading to a significant rise in the building and construction plastics market. For instance, according to World Bank Group, by 2036, India will need to invest $840 billion in infrastructure, which averages to $55 billion per year or 1.2 percent of its GDP annually. As cities expand, the need for durable, lightweight, and cost-effective materials such as PVC, polyethylene, and polystyrene grows. These plastics are essential for various applications, including piping, insulation, and window frames, due to their versatility and performance. Furthermore, advancements in plastic technology enhance their sustainability and energy efficiency, making them more appealing for modern construction needs. Consequently, the surge in urban development projects directly drives the demand for these construction plastics.

The building and construction plastics market faces increasing restraints due to rising regulatory pressures aimed at mitigating the environmental impact of plastics. For instance, at the United Nations Environmental Assembly (UNEA) in March 2022, the United States, along with other countries, adopted a resolution addressing plastic pollution. This resolution initiated the development of a new international agreement on plastic pollution, with the goal of completing negotiations by the end of 2024. These regulations, driven by concerns over plastic waste, pollution, and sustainability, mandate stricter usage guidelines and encourage the adoption of eco-friendly alternatives. Compliance with these regulations often results in higher costs and reduced flexibility for manufacturers. Consequently, the market is compelled to innovate and shift towards more sustainable materials to align with environmental standards.

The increasing emphasis on sustainability in construction is driving demand for eco-friendly and biodegradable plastics, presenting a significant opportunity for the building and construction plastics market. For instance, in April 2024, Tucson officials announced that a new facility at the Los Reales Sustainability Campus, designed to transform plastic waste into construction-grade building blocks, is expected to begin operations in the summer of 2025. During the city council's upcoming meeting on Thursday, they will receive an update on the progress of constructing this new building, which will support the city's recycling program activities. These materials offer a viable alternative to traditional plastics, which are often criticized for their environmental impact. As regulatory pressures and consumer preferences shift towards greener options, the market for these innovative plastics is expanding rapidly. This trend not only supports environmental goals but also opens new avenues for growth and development in the construction sector.

Building and Construction Plastics Market Segmentation

The worldwide market for building and construction plastics is split based on product, application, and geography.

Building and Construction Plastic Market By Product

- Polyvinyl Chloride

- Polystyrene

- Polyethylene

- Polyurethanes

- Others

According to the building and construction plastics industry analysis, polyvinyl chloride (PVC) dominates the market due to its excellent durability, low cost, and versatility. It offers resistance to weathering, chemicals, and fire, making it ideal for a wide range of applications from pipes and siding to flooring and window frames. Its ease of installation and low maintenance requirements further enhance its appeal in construction. Additionally, advancements in PVC formulations have improved its performance and environmental footprint, reinforcing its market leadership.

Building and Construction Plastic Market By Application

- Roofing

- Insulation

- Pipes & Ducts

- Wall Coverings

- Windows

- Others

According to the building and construction plastics market forecast, pipes and ducts is expected to hold a dominant position due to their essential role in infrastructure. These components are critical for efficient water, sewage, and air distribution systems, offering durability, resistance to corrosion, and cost-effectiveness. The widespread adoption of PVC and other plastic materials in these applications is driven by their ease of installation and maintenance. As construction projects grow in scale and complexity, the demand for reliable, high-performance plastic pipes and ducts continues to rise.

Building and Construction Plastics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Building and Construction Plastics Market Regional Analysis

For several reasons, the Asia-Pacific region leads the building and construction plastics market due to its rapid industrialization and urbanization. For instance, in 2023, China's industrial output accelerated, with the equipment manufacturing sector seeing a 253.2 percent year-on-year growth, surpassing the average rate of industrial production expansion. Countries like China and India are investing heavily in infrastructure development, driving high demand for plastics in construction. Additionally, growing population and increasing construction activities further reinforce Asia-Pacific's dominance in this sector.

North America is the fastest-growing region in the building and construction plastics market due to a combination of increasing infrastructure development and renovation projects. The collaboration between key players and rising urbanization drive demand for innovative and durable plastic solutions. For instance, in 2023, LyondellBasell collaborated with Borealis to introduce Circuler PP Black, a recycled polypropylene tailored for construction uses. Additionally, advancements in manufacturing technologies and sustainability initiatives boost the adoption of high-performance plastics in construction.

Building and Construction Plastics Market Players

Some of the top building and construction plastics companies offered in our report include BASF SE, PetroChina Company Limited, Borealis AG, Deceuninck, The Dow Chemical, Arkema S.A., DuPont, Trinseo S.A, Solvay SA, Andersen Corporation, and Pipelife Ireland Solutions Ltd (Cork Plastics).

Frequently Asked Questions

How big is the building and construction plastics market?

The building and construction plastics market size was valued at USD 132.4 billion in 2023.

What is the CAGR of the global building and construction plastics market from 2024 to 2032?

The CAGR of building and construction plastics is 7.5% during the analysis period of 2024 to 2032.

Which are the key players in the building and construction plastics market?

The key players operating in the global market are including BASF SE, PetroChina Company Limited, Borealis AG, Deceuninck, The Dow Chemical, Arkema S.A., DuPont, Trinseo S.A, Solvay SA, Andersen Corporation, and Pipelife Ireland Solutions Ltd (Cork Plastics).

Which region dominated the global building and construction plastics market share?

Asia-Pacific held the dominating position in building and construction plastics industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of building and construction plastics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global building and construction plastics industry?

The current trends and dynamics in the building and construction plastics industry include rapid urbanization increases demand for building and construction materials, government investments in infrastructure projects, and rising emphasis on energy-efficient buildings drives the adoption of advanced plastics

Which product held the maximum share in 2023?

The polyvinyl chloride expected to hold the maximum share of the building and construction plastics industry.