Biomass Power Generation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Biomass Power Generation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

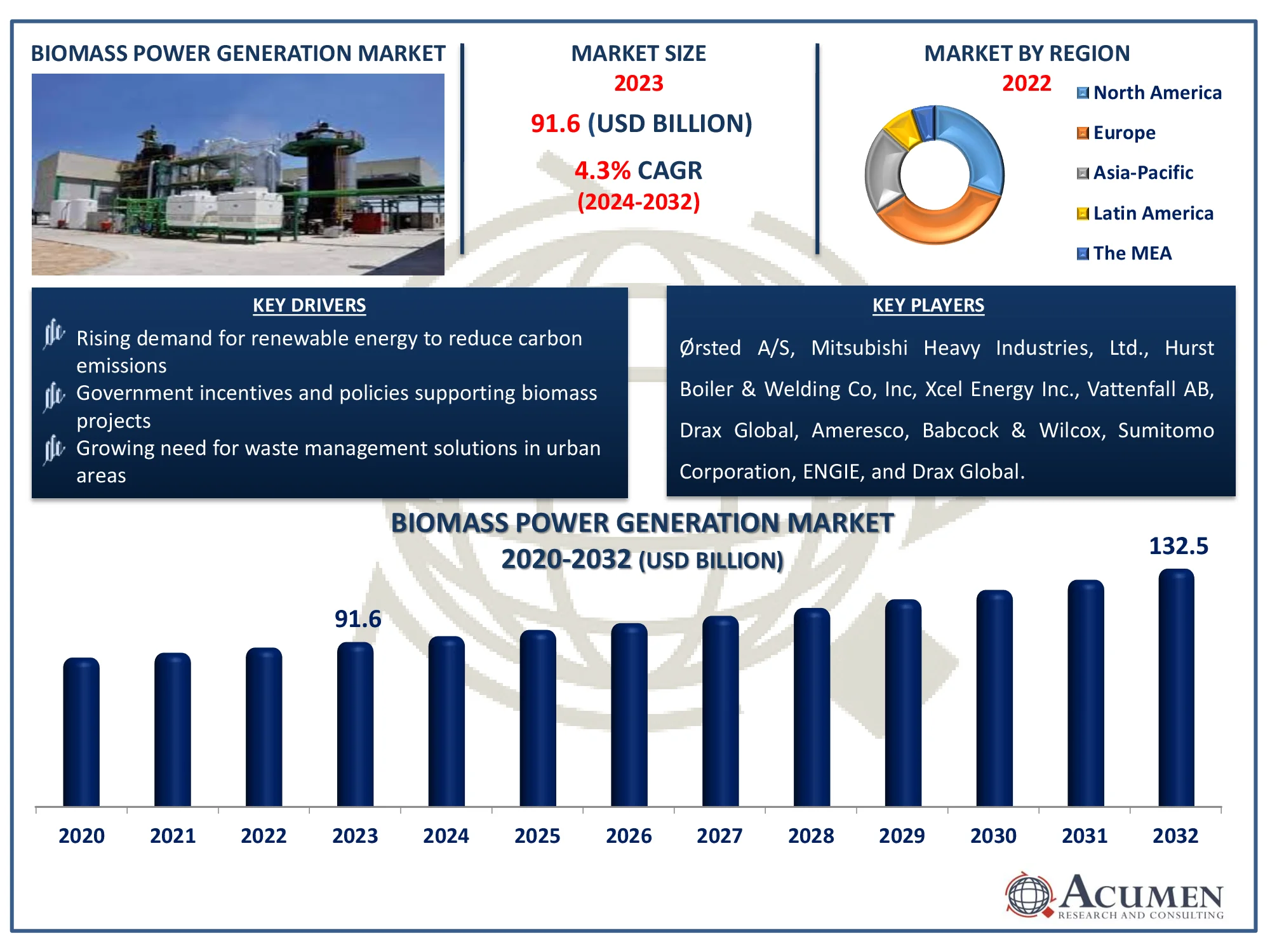

The Global Biomass Power Generation Market Size accounted for USD 91.6 Billion in 2023 and is estimated to achieve a market size of USD 132.5 Billion by 2032 growing at a CAGR of 4.3% from 2024 to 2032.

Biomass Power Generation Market Highlights

- The global biomass power generation market revenue is projected to reach USD 132.5 billion by 2032, growing at a CAGR of 4.3% from 2024 to 2032

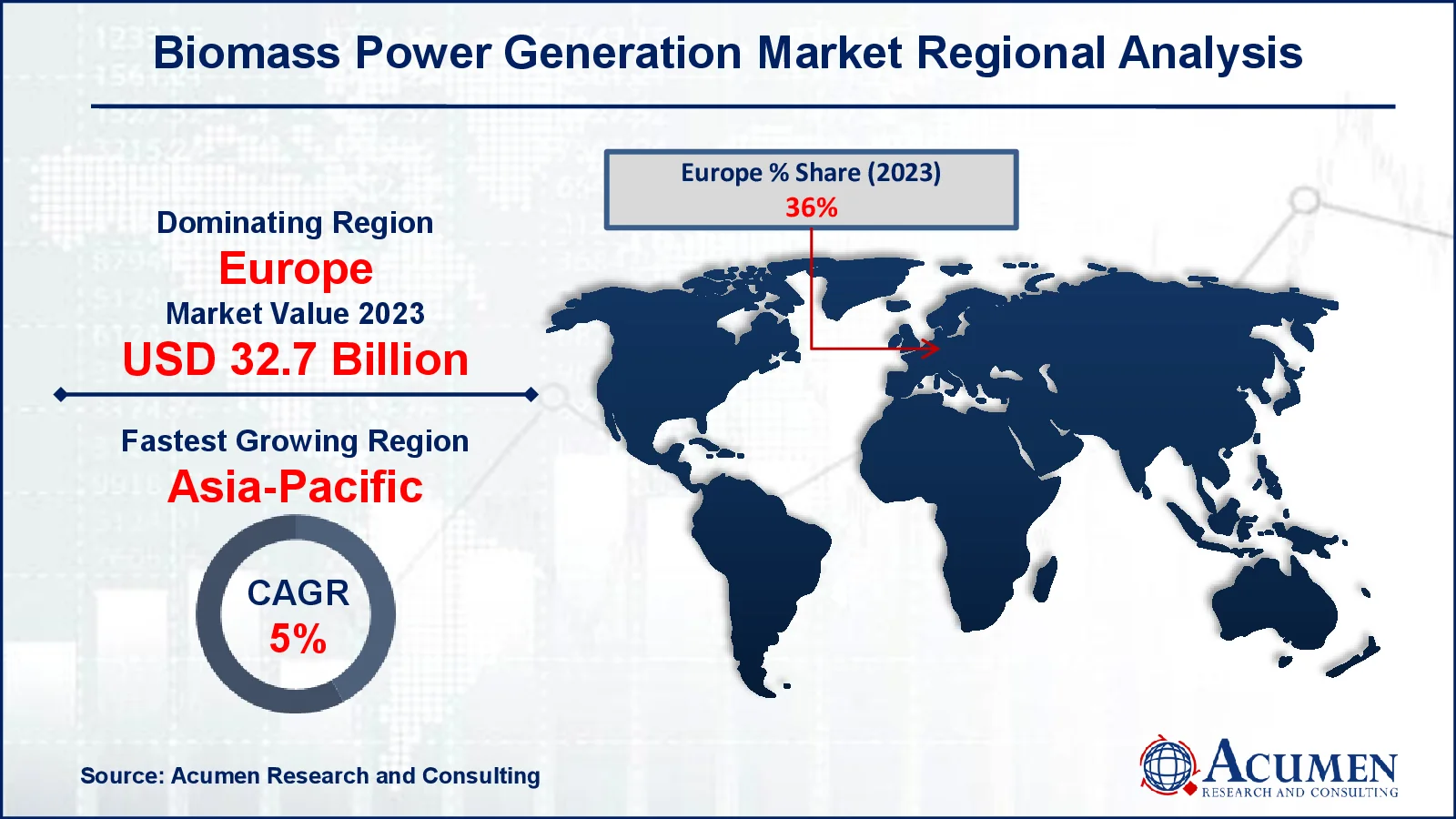

- In 2023, the Europe biomass power generation market was valued at approximately USD 32.7 billion

- The Asia-Pacific biomass power generation market is expected to grow at a CAGR of over 5% from 2024 to 2032

- Solid fuel accounted for 72% of the biomass power generation market share in 2023

- The combustion technology sub-segment captured 74% of the market share in 2023

- Expansion of biomass supply chains to improve feedstock availability and sustainability is the biomass power generation market trend that fuels the industry demand

Biomass power generation is the conversion of organic materials such as agricultural waste, forest residues, animal manure, and municipal solid waste into electricity. It generates energy and heat using a variety of processes such as combustion, gasification, anaerobic digestion, and pyrolysis. Biomass is a renewable energy source that reduces reliance on fossil fuels and greenhouse gas emissions by capturing carbon during the growth of the plants used as feedstock. Biomass power generation is used in a variety of industries, including household heating and utility power. Additionally, biomass is used in Combined Heat and Power (CHP) facilities, which improve total energy efficiency by producing both electricity and useable heat energy from a single fuel source. For instance, according to U.S Energy Information Administration, in terms of energy content and percentage share, the industrial sector consumed the most biomass in the United States in 2023. The wood products and paper industries use biomass in combined heat and power plants (CHP) to create process heat as well as electricity for their own needs.

Global Biomass Power Generation Market Dynamics

Market Drivers

- Rising demand for renewable energy to reduce carbon emissions

- Government incentives and policies supporting biomass projects

- Growing need for waste management solutions in urban areas

Market Restraints

- High initial investment costs for biomass power plants

- Limited feedstock availability and seasonal variability

- Competition from other renewable energy sources like solar and wind

Market Opportunities

- Technological advancements in biomass conversion efficiency

- Expansion of biomass power in developing regions with abundant agricultural residues

- Increasing corporate interest in sustainable and eco-friendly energy solutions

Biomass Power Generation Market Report Coverage

|

Market |

Biomass Power Generation Market |

|

Biomass Power Generation Market Size 2023 |

USD 91.6 Billion |

|

Biomass Power Generation Market Forecast 2032 |

USD 132.5 Billion |

|

Biomass Power Generation Market CAGR During 2024 - 2032 |

4.3% |

|

Biomass Power Generation Market Analysis Period |

2020 - 2032 |

|

Biomass Power Generation Market Base Year |

2023 |

|

Biomass Power Generation Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Feedstock, By Fuel, By Technology, By End-Use Industry, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Ørsted A/S, Mitsubishi Heavy Industries, Ltd., Hurst Boiler & Welding Co, Inc, Xcel Energy Inc., Vattenfall AB, Drax Global, Ameresco, Babcock & Wilcox Enterprises, Inc., Sumitomo Corporation, ENGIE, and Drax Global. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Biomass Power Generation Market Insights

The growing global focus on lowering carbon emissions is driving demand for renewable energy sources, such as biomass power generation. For instance, according to Climate Action Tracer, India intends to develop a domestic carbon market and has published draft rules for a compliant carbon market. Biomass, obtained from organic materials, is a low-carbon alternative to fossil fuels that produces energy while emitting much less greenhouse gas. This shift toward cleaner energy sources strengthens biomass power's position as a vital actor in meeting climate targets and offering sustainable energy solutions.

The fast expansion of urban areas has resulted in an increase in waste generation, highlighting the critical need for effective waste management systems. For instance, according to Systems Change Lab, in 2023, more than half of the world's population resided in cities, and urbanization is accelerating, particularly in developing countries. Global garbage creation rates are predicted to double the rate of population growth between now and 2050, owing to rising income levels and increased consumerism. Biomass power generation is a potential solution that converts organic waste into electricity while minimizing landfill reliance and environmental degradation. This strategy not only handles waste, but it also helps to sustainable energy production, hence promoting the growth of the biomass power generation industry. However, the large initial investment necessary for biomass power plants, which includes equipment, infrastructure, and feedstock management, is a considerable financial barrier for new projects.

Furthermore, increasing corporate interest in sustainable and eco-friendly energy solutions becomes opportunity for biomass power generation market. For instance, International Energy Agency (IEA) estimated that around USD 2.8 trillion will be invested in energy by 2023. More than USD 1.7 trillion will be allocated to clean energy, which includes renewable electricity, nuclear, grids, storage, low-emission fuels, efficiency improvements, and end-use renewable and electrification. As businesses prioritize sustainable and environmentally friendly energy sources, the need for renewable energy sources such as biomass power is growing. This transition brings up new prospects in the biomass power generation business.

Biomass Power Generation Market Segmentation

The worldwide market for biomass power generation is split based on feedstock, fuel, technology, end-use industry, and geography.

Biomass Power Generation Feedstocks

- Urban Residue

- Municipal Solid Waste (MSW)

- Agricultural and Forest Residue

- Energy Crops

- Woody Biomass

- Others

According to the biomass power generation industry analysis, agricultural and forest residue are often used as the principal feedstock. This is owing to the amount and availability of these residues, which are byproducts of agriculture and forestry operations.

Additionally, Municipal solid waste (MSW) is also gaining popularity as a major source of biomass, particularly in urban areas where waste management solutions are required. For instance, according to U.S Energy Information Administration (EIA), biomass materials account for approximately 61% of the weight of combustible MSW and generate around 45% of the electricity. This shows the importance of biomass in waste-to-energy systems. This trend represents an increasing acknowledgment of MSW as a promising resource for biomass power generation.

Biomass Power Generation Fuel Type

- Solid

- Liquid

- Gaseous

According to the biomass power generation industry analysis, solid fuels dominate market, owing to their high energy density and availability. Solid biomass fuels, including wood pellets, agricultural leftovers, and energy crops, are commonly used in power plants to generate heat and electricity. This preference for solid fuels arises from their infrastructure, efficient conversion methods, and capacity to use a variety of feedstocks, making them a dependable option for sustainable energy generation.

Biomass Power Generation Technologies

- Combustion

- Gasification

- Anaerobic Digestion

- Pyrolysis

- Co-firing

- LFG

- Others

According to the biomass power generation market forecast, combustion technology dominates market due to its simplicity and efficiency in converting solid biomass into energy. This method includes burning biomass resources to generate steam, which then powers turbines to generate energy. For instance, according to Development of e-course for B.sc Agriculture, biomass combustion is mainly used for heat production in small and medium scale units such as wood stoves, log wood boilers, pellet burners, automatic wood chip furnaces, and straw-fired furnaces. Its established infrastructure and capacity to handle a wide range of feedstocks make combustion the favored choice for many biomass power plants.

Biomass Power Generation End-Use Industry

- Residential

- Industrial

- Commercial

According to the biomass power generation market forecast, the industrial sector anticipated to dominates industry, owing to high energy demands for manufacturing operations and heating applications. Industries use biomass as a sustainable alternative to fossil fuels, including it into Combined Heat and Power (CHP) systems to enhance energy efficiency and lower carbon emissions. This heavy reliance on biomass not only sustains industrial operations, but also makes a substantial contribution to overall renewable energy output.

Biomass Power Generation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Biomass Power Generation Market Regional Analysis

For several reasons, Europe leads the biomass power generation industry due to its strong commitment to renewable energy and sustainability objectives. The region benefits from well-established infrastructure, supporting legislation, and major investments in biomass technologies, which allow for the efficient utilization of a variety of feedstocks. For instance, during November 2022, Ameresco, Inc., a sustainable technology integrator, has acquired a wind farm in West County Cork, Ireland. The company prioritizes energy efficiency and renewable energy. This three-turbine system is designed to generate five megawatts of renewable energy. Wärtsilä and EDF Renewables UK and Ireland have agreed to develop a grid-scale energy storage plant in Sundon, Bedfordshire, UK. The 50 MW/100 MWh project will support the UK's transition to net zero energy and a decarbonized electricity system. The project is part of a larger Energy Superhub planned for the area. Countries such as Sweden, Germany, and the United Kingdom are at the forefront of using biomass to reduce dependency on fossil fuels while meeting climate targets.

The Asia-Pacific biomass power generation market is predicted to increase significantly, owing to rising energy demands and a focus on renewable energy sources. Countries such as China and India are making significant investments in biomass technologies to address waste management challenges and improve energy security. For instance, in December 2022, G.E. will commission its first two 300 MW pumped storage units at the Jinzhai hydropower project in China. Growing awareness of environmental sustainability, as well as government incentives, are driving the adoption of biomass power in this region.

Biomass Power Generation Market Players

Some of the top biomass power generation companies offered in our report include Ørsted A/S, Mitsubishi Heavy Industries, Ltd., Hurst Boiler & Welding Co, Inc, Xcel Energy Inc., Vattenfall AB, Drax Global, Ameresco, Babcock & Wilcox Enterprises, Inc., Sumitomo Corporation, ENGIE, and Drax Global.

Frequently Asked Questions

How big is the biomass power generation market?

The biomass power generation market size was valued at USD 91.6 billion in 2023.

What is the CAGR of the global biomass power generation market from 2024 to 2032?

The CAGR of biomass power generation is 4.3% during the analysis period of 2024 to 2032.

Which are the key players in the biomass power generation market?

The key players operating in the global market are including Ørsted A/S, Mitsubishi Heavy Industries, Ltd., Hurst Boiler & Welding Co, Inc, Xcel Energy Inc., Vattenfall AB, Drax Global, Ameresco, Babcock & Wilcox Enterprises, Inc., Sumitomo Corporation, ENGIE, and Drax Global.

Which region dominated the global biomass power generation market share?

Europe held the dominating position in biomass power generation industry during the analysis period of 2024 to 2032.

Which region registered fastest growing CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of biomass power generation during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global biomass power generation industry?

The current trends and dynamics in the biomass power generation industry include rising demand for renewable energy to reduce carbon emissions, government incentives and policies supporting biomass projects, and growing need for waste management solutions in urban areas.

Which fuel held the maximum share in 2023?

The solid fuel held the maximum share of the biomass power generation industry.