Waste Management Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Waste Management Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

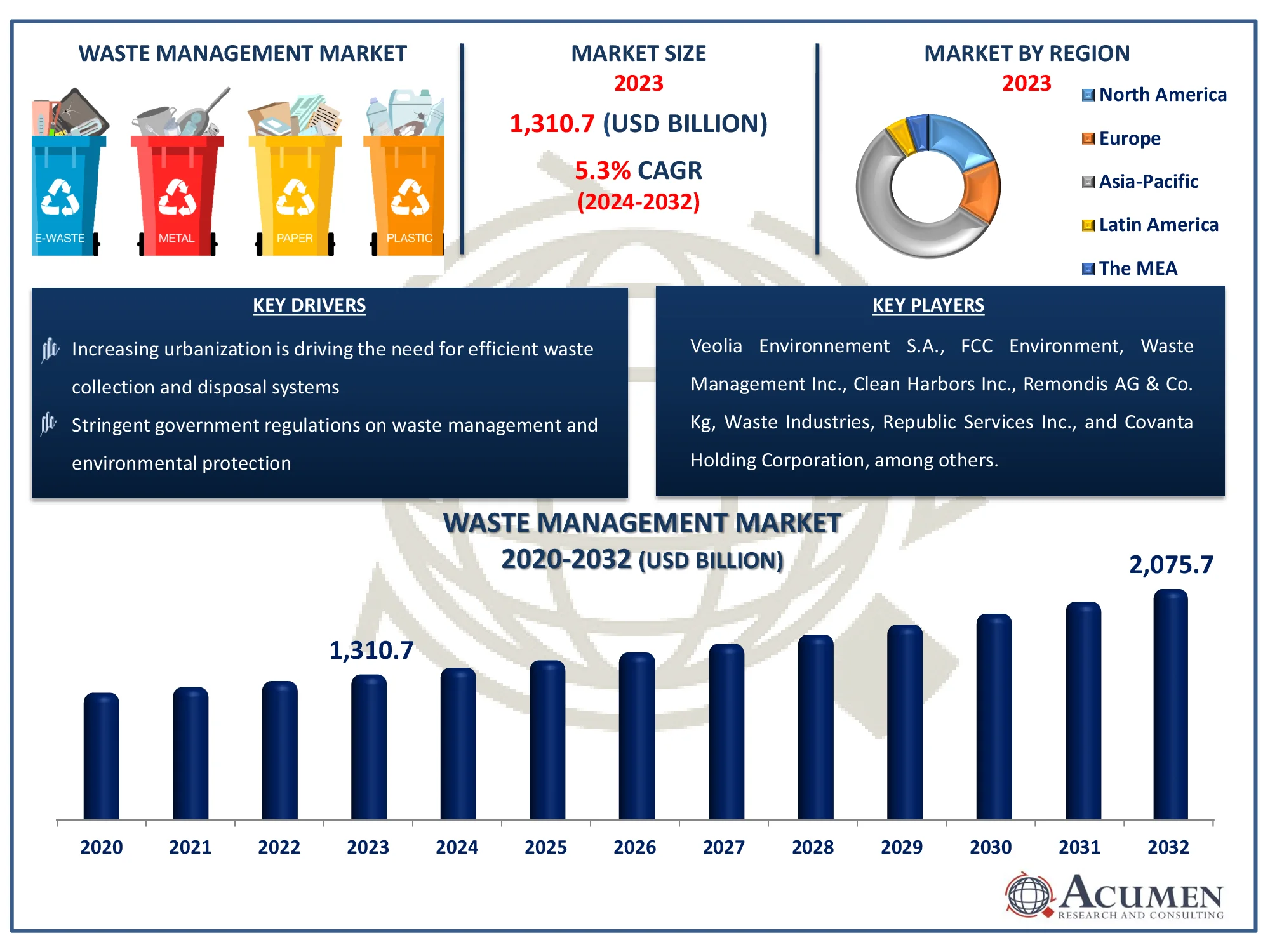

The Global Waste Management Market Size accounted for USD 1,310.7 Billion in 2023 and is estimated to achieve a market size of USD 2,075.7 Billion by 2032 growing at a CAGR of 5.3% from 2024 to 2032.

Waste Management Market Highlights

- Global waste management market revenue is poised to garner USD 2,075.7 billion by 2032 with a CAGR of 5.3% from 2024 to 2032

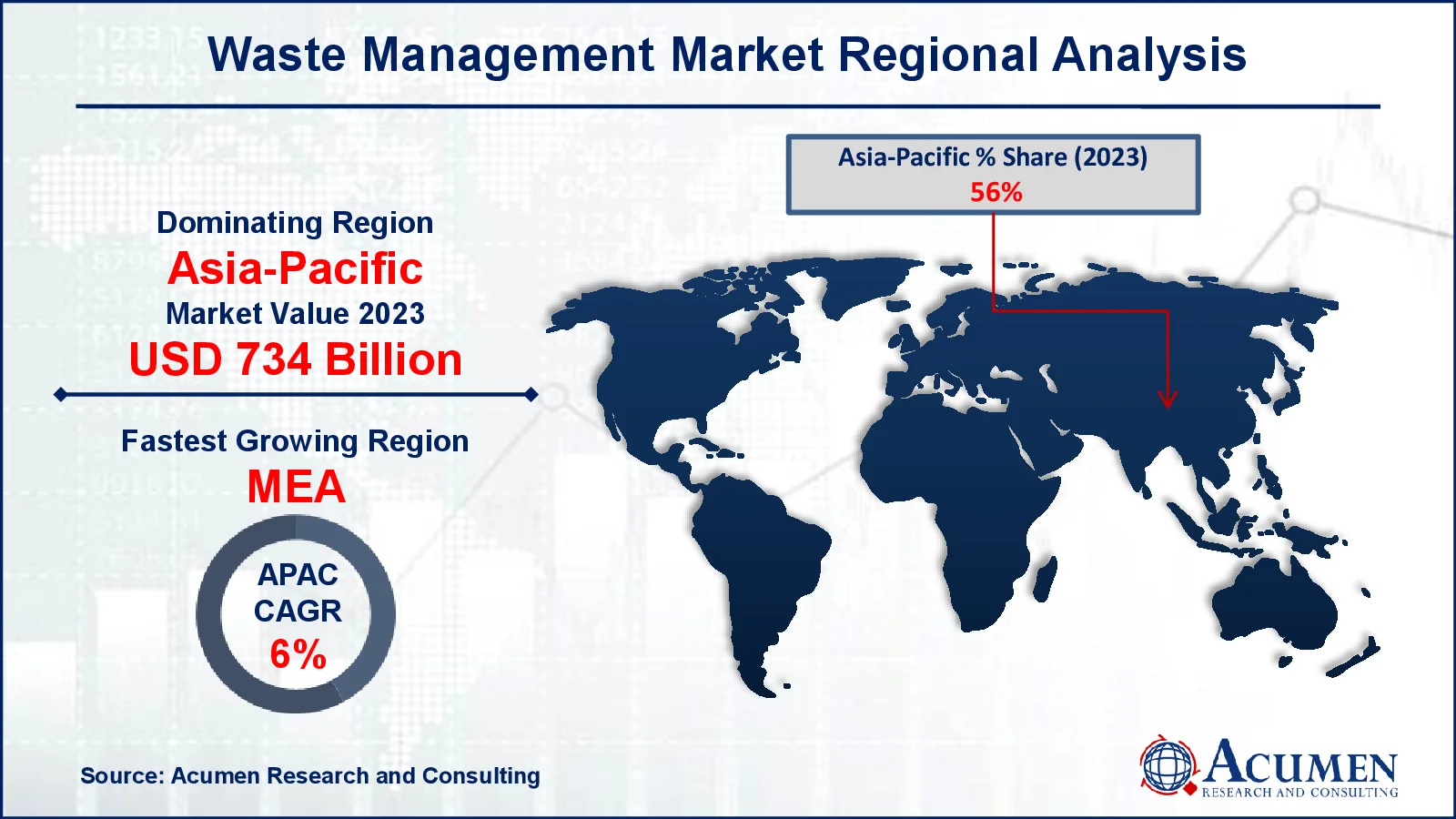

- Asia-Pacific waste management market value occupied around USD 734 billion in 2023

- The MEA waste management market growth will record a CAGR of more than 6% from 2024 to 2032

- Among service type, the collection sub-segment generated around USD 799.5 billion revenue in 2023

- Based on waste type, the industrial waste sub-segment generated 84% waste management market share in 2023

- Rising demand for biodegradable and sustainable waste management materials in packaging and other industries is a popular waste management market trend that fuels the industry demand

Waste management is the systematic collection, transportation, processing, and disposal of waste products to reduce their environmental impact. It includes a variety of actions such as recycling, composting, landfill disposal, and incineration. Effective waste management strives to decrease pollution, protect natural resources, and encourage environmentally friendly activities by reusing and recycling items whenever possible. Waste segregation at the source, efficient waste transportation, and the implementation of environmentally friendly disposal solutions are all critical operations. Governments, companies, and individuals all have a crucial role in ensuring responsible waste management. With rising urbanization and industrialization, waste management has become critical in addressing challenges such as overflowing landfills, hazardous waste disposal, and climate change, hence promoting a cleaner, healthier environment for future generations.

Global Waste Management Market Dynamics

Market Drivers

- Increasing urbanization is driving the need for efficient waste collection and disposal systems

- Stringent government regulations on waste management and environmental protection

- Rising awareness of recycling and sustainable practices among industries and individuals

- Growing adoption of advanced technologies like AI and IoT in waste management solutions

Market Restraints

- High initial investment costs for waste management infrastructure and technology adoption

- Limited awareness and participation in waste segregation at the source among populations

- Challenges in managing hazardous and e-waste due to complex regulatory frameworks

Market Opportunities

- Expanding focus on circular economy practices creates opportunities for innovative recycling solutions

- Increased investment in smart waste management technologies by emerging economies

- Growth of renewable energy projects utilizing waste-to-energy technologies

Waste Management Market Report Coverage

|

Market |

Waste Management Market |

|

Waste Management Market Size 2023 |

USD 1,310.7 Billion |

|

Waste Management Market Forecast 2032 |

USD 2,075.7 Billion |

|

Waste Management Market CAGR During 2024 - 2032 |

5.3% |

|

Waste Management Market Analysis Period |

2020 - 2032 |

|

Waste Management Market Base Year |

2023 |

|

Waste Management Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Service Type, By Waste Type, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Veolia Environnement S.A., FCC Environment, Waste Management Inc., Clean Harbors Inc., Remondis AG & Co. Kg, Waste Industries, Republic Services Inc., Covanta Holding Corporation, Biffa Group Limited, Waste Connections Inc., Casella Waste Systems Inc., and Stericycle Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Waste Management Market Insights

The increasing amount of waste especially industrial waste day by day is the major factor supporting the market value. The rising environmental concern and associated favorable efforts made by the governmental and non-governmental bodies to combat the emerging environmental issues are driving the market value. The increasing focus of manufacturers towards the recycle or reuse of the generated waste from different industrial and commercial sectors is boosting the market growth. The changing lifestyle coupled with the increasing disposable income results in the purchase of abundant and unnecessary products or can say luxury and comfort products are contributing to the amount of waste generation.

Additionally, the increasing use of disposables in almost every sector especially the medical and food service sector is majorly contributing to the waste management market growth. Furthermore, the technological advancement for the disposal of waste as well as the requirement for the effective disposable technique for hazardous waste is projected to create potential opportunity over the forecast timeframe from 2024 to 2032. On the other side, lack of awareness in emerging countries and a dearth of investments in solid waste management framework are some of the factors projected to hamper the growth over the estimated period from 2024 to 2032.

Waste Management Market Segmentation

Waste Management Market Segmentation

The worldwide market for waste management is split based on product, application, and geography.

Waste Management Service Types

- Transportation

- Collection

- Disposal

According to waste management industry analysis, collection emerges as the industry's largest and most important sector, accounting for a sizable portion of its operations and revenues. This component consists of the systematic collection of waste from residential, commercial, and industrial properties. The expanding urban population, along with tougher waste segregation rules, has increased demand for effective collection services. Advanced approaches, such as automated curbside collection and smart bin technology, are streamlining the process, increasing efficiency, and lowering operational costs. Furthermore, governments and commercial groups are making significant investments in waste collection infrastructure to ensure long-term waste management practices. Collection services are the foundation of the waste management sector, driving environmental compliance and public health gains.

Waste Management Waste Type

- Medical Waste

- Municipal Waste

- E-waste

- Industrial Waste

In 2023, the industrial waste segment registered maximum share in the global waste management market forecast period. The rapidly increasing industrial activities and production across the globe and especially in emerging and developed economies is supporting the segmental market value. The industrial segment includes oil and gas, agriculture, electronics, automobile, building & construction, textile & clothing, pharmaceutical, and others. In the aforementioned industrial sector building & construction are generating a substantial amount of solid waste due to increasing construction activities across the globe. The increasing infrastructure activities particularly renovation and demolition of old structures generate a large amount of waste in emerging economies.

Waste Management Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Waste Management Market Regional Analysis

Waste Management Market Regional Analysis

The Asia-Pacific region dominates the worldwide waste management market, with the highest share. This significance is due to rising urbanization, industrialization, and population increase in nations such as China, India, and Japan. The region creates a significant amount of municipal and industrial trash, needing innovative waste management technologies. Government measures such as trash segregation and recycling legislation, as well as increased environmental awareness among businesses and individuals, are driving market growth in Asia-Pacific. Furthermore, the availability of multiple recycling and waste-to-energy plants helps the region maintain its market leadership.

Meanwhile, the waste management business is increasing rapidly across the Middle East and Africa. Investments in contemporary waste management systems have been driven by increased economic activity, notably in Gulf Cooperation Council (GCC) countries, as well as a growing emphasis on sustainability. Governments in the MEA region are rapidly implementing methods to limit landfill consumption while also encouraging recycling and energy recovery from garbage. Rapid urbanization, combined with major infrastructure development, amplifies waste generation and creates prospects for market expansion. International collaborations and the arrival of major garbage management corporations have further accelerated progress in this region.

Thus, while Asia-Pacific remains the largest contributor, the Middle East and Africa exhibit the highest growth potential in the waste management market.

Waste Management Market Players

Some of the top waste management companies offered in our report include Veolia Environnement S.A., FCC Environment, Waste Management Inc., Clean Harbors Inc., Remondis AG & Co. Kg, Waste Industries, Republic Services Inc., Covanta Holding Corporation, Biffa Group Limited, Waste Connections Inc., Casella Waste Systems Inc., and Stericycle Inc.

Frequently Asked Questions

How big is the waste management market?

The waste management market size was valued at USD 1,310.7 Billion in 2023.

What is the CAGR of the global waste management market from 2024 to 2032?

The CAGR of waste management is 5.3% during the analysis period of 2024 to 2032.

Which are the key players in the waste management market?

The key players operating in the global market are including Veolia Environnement S.A., FCC Environment, Waste Management Inc., Clean Harbors Inc., Remondis AG & Co. Kg, Waste Industries, Republic Services Inc., Covanta Holding Corporation, Biffa Group Limited, Waste Connections Inc., Casella Waste Systems Inc., and Stericycle Inc.

Which region dominated the global waste management market share?

Asia-Pacific held the dominating position in waste management industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

MEA region exhibited fastest growing CAGR for market of waste management during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global waste management industry?

The current trends and dynamics in the waste management industry include increasing urbanization is driving the need for efficient waste collection and disposal systems, and stringent government regulations on waste management and environmental protection.

Which waste type held the maximum share in 2023?

The industrial waste type held the maximum share of the waste management industry.