Battery Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Battery Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

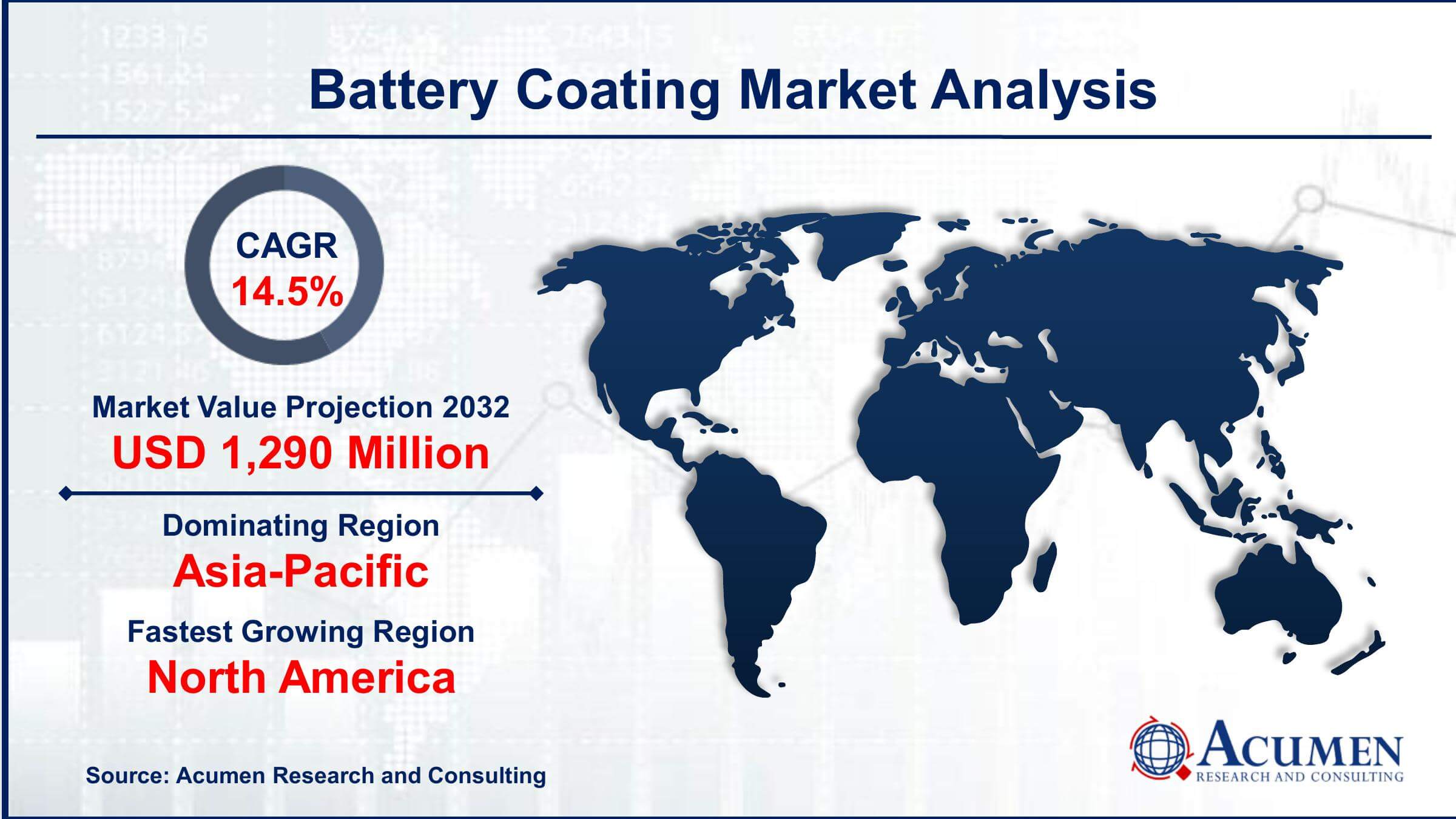

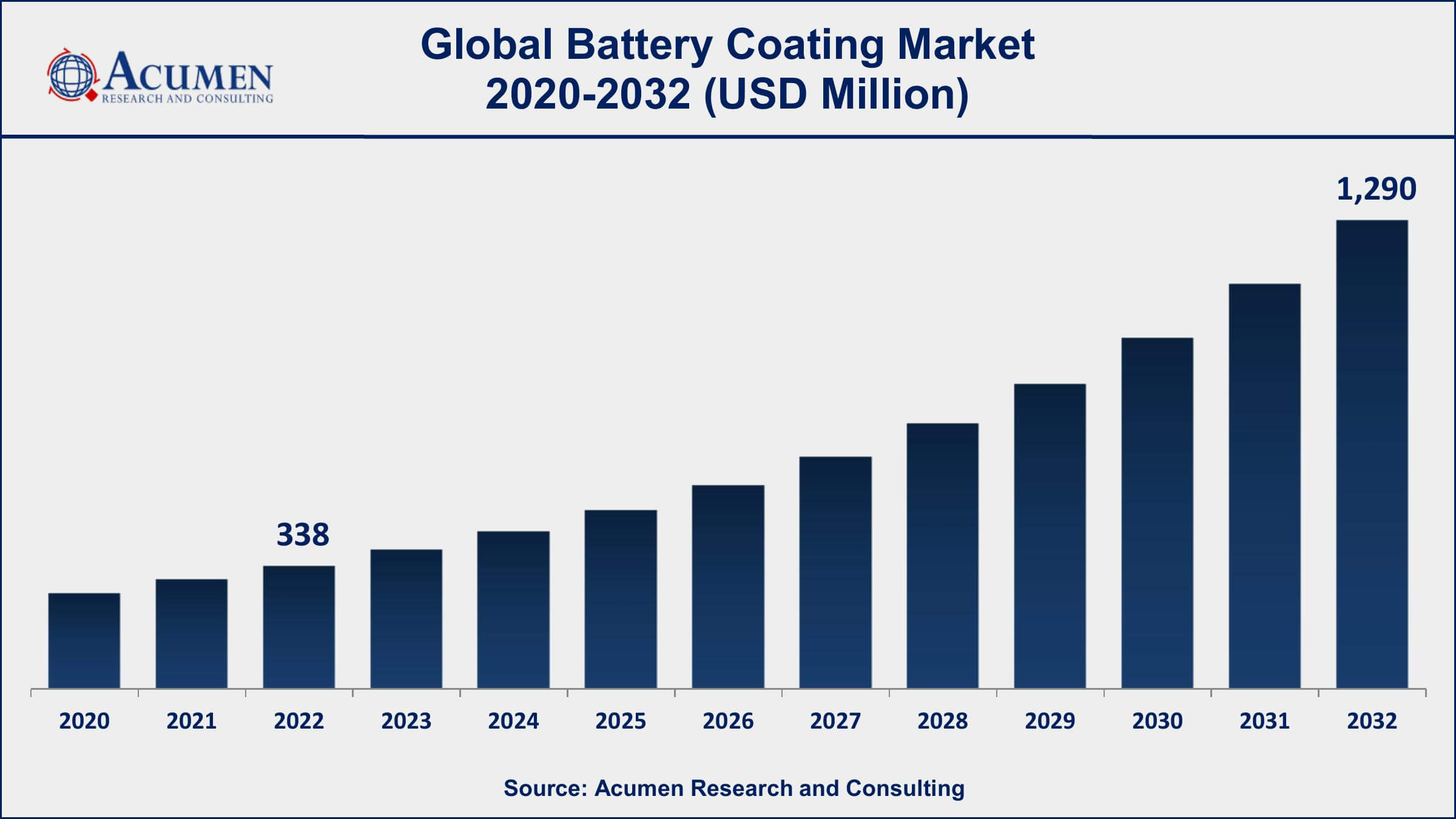

The Global Battery Coating Market Size accounted for USD 338 Million in 2022 and is projected to achieve a market size of USD 1,290 Million by 2032 growing at a CAGR of 14.5% from 2023 to 2032.

Battery Coating Market Highlights

- Global battery coating market revenue is expected to increase by USD 1,290 Million by 2032, with a 14.5% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 37% of battery coating market share in 2022

- North America battery coating market growth will record a CAGR of around 15% from 2023 to 2032

- By battery type, the lithium-ion segment is the largest segment in the market, accounting for over 47% of the market share in 2022

- By components, the electrode segment has recorded more than 38% of the revenue share in 2022

- Growing demand for electric vehicles and renewable energy storage systems, drives the battery coating market value

Battery coating is a process that involves applying a thin layer of coating material onto the electrodes of a battery to improve its performance, durability, and stability. The coating material can be made of various materials such as ceramics, metals, polymers, and composites, and it helps to prevent degradation of the battery components due to the harsh chemical reactions that occur during charging and discharging cycles. Battery coating also helps to improve the energy density, cycle life, and safety of batteries, making them suitable for a wide range of applications such as electric vehicles, renewable energy storage, consumer electronics, and more.

The battery coating market has been witnessing significant growth in recent years, driven by the increasing demand for high-performance and durable batteries across various industries. The growing adoption of electric vehicles and renewable energy systems has been a major driver for the market, as these applications require high-performance batteries that can withstand harsh operating conditions. Additionally, the rising demand for consumer electronics such as smartphones, laptops, and tablets has also contributed to the growth of the battery coating industry, as these devices require smaller, lighter, and more efficient batteries.

Global Battery Coating Market Trends

Market Drivers

- Growing demand for electric vehicles and renewable energy storage systems

- Increasing need for high-performance batteries with longer lifespans and better efficiency

- Rising adoption of consumer electronics, such as smartphones and laptops

- Technological advancements in battery materials and coating processes

Market Restraints

- High cost of advanced battery coating materials

- Stringent regulations and standards for battery safety and performance

Market Opportunities

- Emerging markets for electric vehicles and renewable energy storage systems

- Growing demand for high-performance batteries in aerospace and defense industries

Battery Coating Market Report Coverage

| Market | Battery Coating Market |

| Battery Coating Market Size 2022 | USD 338 Million |

| Battery Coating Market Forecast 2032 | USD 1,290 Million |

| Battery Coating Market CAGR During 2023 - 2032 | 14.5% |

| Battery Coating Market Analysis Period | 2020 - 2032 |

| Battery Coating Market Base Year | 2022 |

| Battery Coating Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology Type, By Component, By Material, By Battery Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Arkema Group, Solvay SA, Mitsubishi Chemical Holdings Corporation, UBE Industries Ltd., Showa Denko K.K., Kansai Paint Co. Ltd., NEI Corporation, Nano One Materials Corp., Amprius Inc., Targray Technology International Inc., and Bühler AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Battery coating is used in a wide range of applications, including electric vehicles, consumer electronics, and renewable energy storage systems. In electric vehicles, battery coating is critical for improving the performance and safety of the battery. Electric vehicles require high-performance batteries that can deliver high power and energy densities, with fast charging capabilities. Battery coating can improve the efficiency of the battery by reducing the internal resistance, allowing it to deliver more power and energy. In consumer electronics, battery coating is used to improve the durability and safety of the batteries in devices like smartphones, laptops, and tablets. The coating can prevent the battery from overheating, which can cause damage to the device and pose a safety risk to the user. In renewable energy storage systems, battery coating is used to improve the efficiency and durability of the batteries used to store energy from renewable sources like solar and wind power.

The automotive industry is a major contributor to the growth of the battery coating market, driven by the increasing adoption of electric vehicles (EVs) around the world. According to the International Energy Agency (IEA), global EV sales exceeded 3 million in 2020, despite the COVID-19 pandemic. This trend is expected to continue in the coming years, driven by government incentives, rising fuel prices, and growing awareness of the environmental benefits of EVs. As a result, battery manufacturers are investing heavily in R&D activities to develop more efficient and durable batteries, which is driving the market growth. In addition to the automotive industry, the consumer electronics and renewable energy sectors are also driving the growth of the battery coating market.

Battery Coating Market Segmentation

The global battery coating market segmentation is based on technology type, component, material, battery type, and geography.

Battery Coating Market By Technology Type

- Atomic Layer Deposition (ALD)

- Dry Powder Coating

- Plasma Enhanced Chemical Vapor Deposition (PECVD)

- Physical Vapor Deposition

- Chemical Vapor Deposition (CVD)

According to the battery coating industry analysis, the atomic layer deposition segment accounted for the largest market share in 2022. The growth of this segment is attributed to the increasing adoption of Atomic layer deposition (ALD) in battery production and research activities. ALD is a type of thin film deposition technique that has gained significant attention in the market due to its ability to create highly uniform and precise coatings on battery electrodes. ALD can deposit coatings with thicknesses of a few nanometers with exceptional conformality, which can improve the performance and longevity of batteries. The automotive industry is a significant contributor to the growth of the ALD segment, driven by the growing demand for electric vehicles and the need for high-performance batteries with longer lifespans and improved safety features.

Battery Coating Market By Component

- Electrode

- Separator

- Battery Pack

In terms of components, the electrode segment is expected to witness significant growth in the coming years. The growth of this segment is attributed to the increasing adoption of advanced electrode materials, such as silicon, graphene, and carbon nanotubes, which require specialized coatings to improve their performance. Battery electrodes are a critical component of batteries, responsible for storing and releasing electrical energy. Coating the electrodes with thin films can improve their performance and durability, which is driving the demand for electrode coatings in the battery industry.

Battery Coating Market By Material

- Carbon

- Ceramic

- Alumina

- Oxide

- PVDF (Polyvinylidene Fluoride)

- Others

According to the battery coating market forecast, the polyvinylidene fluoride segment is expected to witness significant growth in the coming years. The growth of this segment is attributed to the increasing adoption of lithium-ion batteries in various applications, including electric vehicles, consumer electronics, and renewable energy storage systems. Polyvinylidene fluoride (PVDF) is a thermoplastic fluoropolymer that has been widely used as a binder material in battery coatings due to its high chemical resistance, thermal stability, and mechanical strength. PVDF is used in lithium-ion batteries to bind the active materials in the electrode and to improve the adhesion between the electrode and the separator. As a result, the PVDF segment is expected to experience significant growth in the coming years.

Battery Coating Market Type

- Lithium-Ion

- Lead-acid

- Nickle-Cadmium

- Graphene

Based on the battery type, the lithium-ion segment is expected to continue its growth trajectory in the coming years. The growth of this segment is attributed to the increasing adoption of lithium-ion batteries in various applications, which is driving the need for advanced materials, including coatings, that can improve the performance and durability of the batteries. Lithium-ion batteries are widely used in these applications due to their high energy density, long cycle life, and low self-discharge rate. Coating the electrodes of lithium-ion batteries with advanced materials can improve their performance and durability, which is driving the demand for lithium-ion battery coatings. The automotive industry is a significant contributor to the growth of the lithium-ion segment, driven by the increasing demand for electric vehicles and the need for high-performance batteries with longer lifespans and improved safety features.

Battery Coating Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Battery Coating Market Regional Analysis

The Asia-Pacific region dominates the battery coating market, accounting for the largest share of the market in terms of both value and volume. This dominance is attributed to several factors, including the presence of major battery manufacturers in the region, the increasing adoption of electric vehicles and renewable energy storage systems, and the availability of low-cost labor and raw materials. The Asia-Pacific region is home to several major battery manufacturers, including CATL, BYD, LG Chem, and Panasonic, which are driving the demand for advanced battery coatings. These companies are investing heavily in research and development to develop high-performance and cost-effective battery technologies, which is driving the need for advanced materials and coatings. The increasing adoption of electric vehicles and renewable energy storage systems in the Asia-Pacific region is also driving the demand for battery coatings.

Battery Coating Market Player

Some of the top battery coating market companies offered in the professional report include Arkema Group, Solvay SA, Mitsubishi Chemical Holdings Corporation, UBE Industries Ltd., Showa Denko K.K., Kansai Paint Co. Ltd., NEI Corporation, Nano One Materials Corp., Amprius Inc., Targray Technology International Inc., and Bühler AG.

Frequently Asked Questions

What was the market size of the global battery coating in 2022?

The market size of battery coating was USD 338 Million in 2022.

What is the CAGR of the global battery coating market from 2023 to 2032?

The CAGR of battery coating is 14.5% during the analysis period of 2023 to 2032.

Which are the key players in the battery coating market?

The key players operating in the global market are including Arkema Group, Solvay SA, Mitsubishi Chemical Holdings Corporation, UBE Industries Ltd., Showa Denko K.K., Kansai Paint Co. Ltd., NEI Corporation, Nano One Materials Corp., Amprius Inc., Targray Technology International Inc., and B�hler AG.

Which region dominated the global battery coating market share?

Asia-Pacific held the dominating position in battery coating industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of battery coating during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global battery coating industry?

The current trends and dynamics in the battery coatingindustry include growing demand for electric vehicles and renewable energy storage systems, and increasing need for high-performance batteries with longer lifespans and better efficiency.

Which component held the maximum share in 2022?

The electrode component held the maximum share of the battery coating industry.