Electric Vehicle Market Growing at a CAGR of 17.6% from 2024 to 2032

Published :

Report ID:

Pages :

Format :

Electric Vehicle Market Growing at a CAGR of 17.6% from 2024 to 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

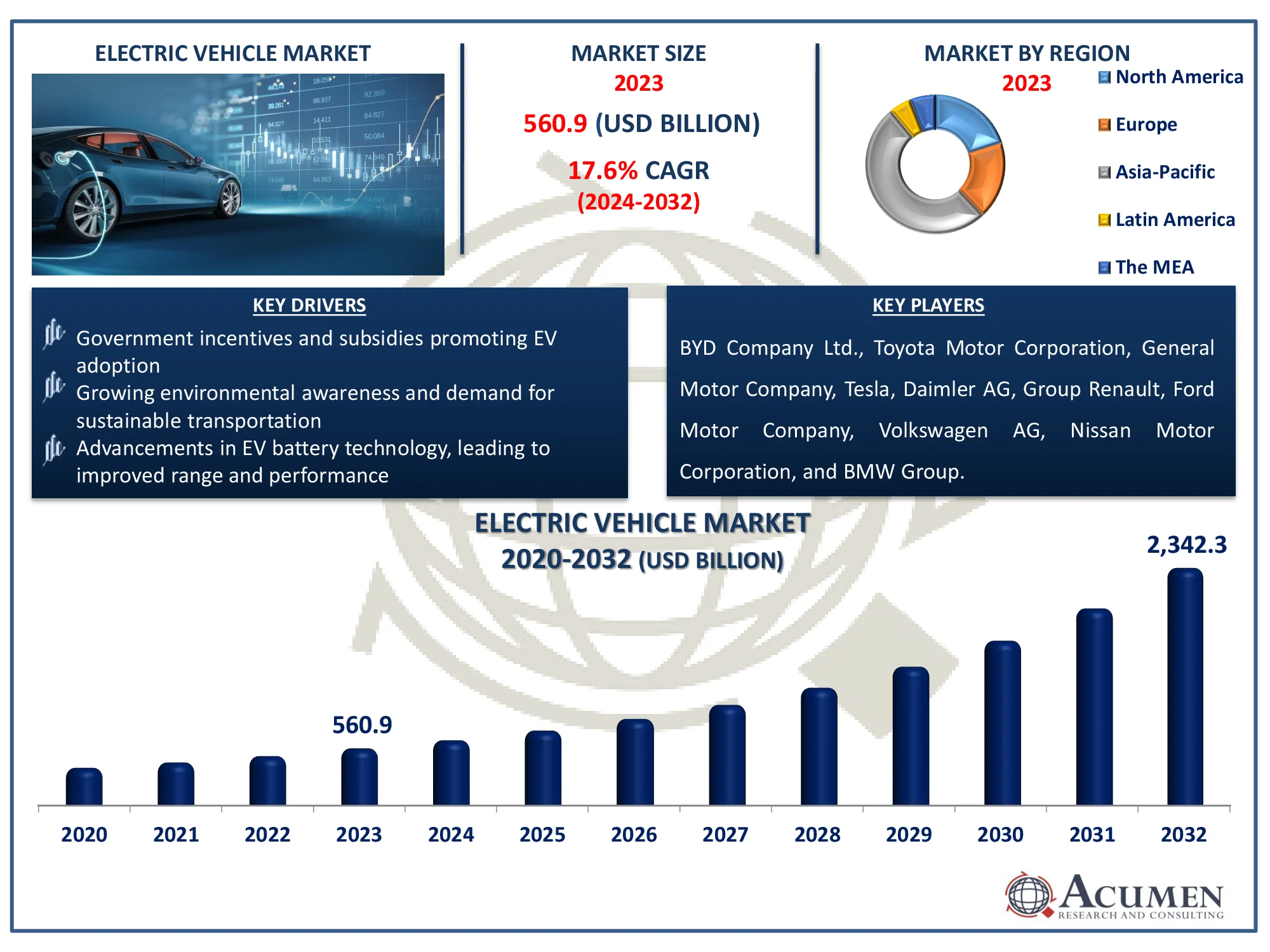

Request Sample Report

The Global Electric Vehicle Market Size accounted for USD 560.9 Billion in 2023 and is estimated to achieve a market size of USD 2,342.3 Billion by 2032 growing at a CAGR of 17.6% from 2024 to 2032.

Electric Vehicle Market Highlights

- The global electric vehicle industry is expected to reach USD 2,342.3 billion by 2032, growing at a CAGR of 17.6% from 2024 to 2032

- According to International Energy Agency, in 2023, about 14 million new electric vehicles were registered globally, raising the total number on the road to 40 million

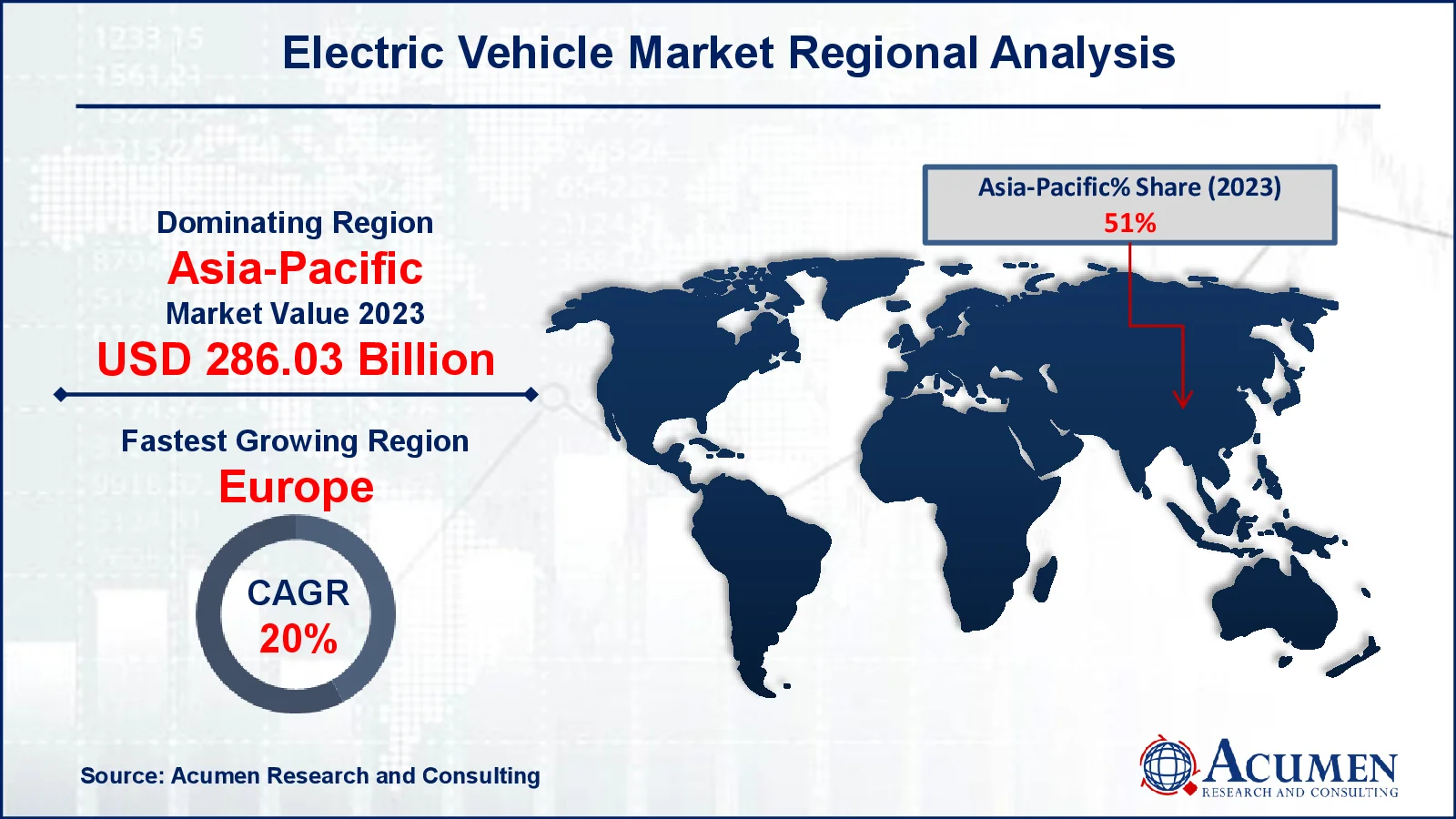

- The Asia-Pacific electric vehicle market was valued at approximately USD 286.03 billion in 2023

- In China, the number of new electric car registrations reached 8.1 million in 2023, up by 35% from 2022, as per International Energy Agency stats

- The North American electric vehicle market is projected to grow at a CAGR of over 20% from 2024 to 2032

- International Energy Agency states that in the United States, new electric car registrations totaled 1.4 million in 2023, up by more than 40% from 2022

- The BEV (battery electric vehicle) sub-segment accounted for 85% of the market share in 2023, leading among propulsion types

- The front-wheel drive (FWD) sub-segment held 58% of the market share based on drive type in 2023

- Vehicles with a maximum speed between 100 MPH and 125 MPH captured 68% of the market share in 2023

- The low-priced vehicle class represented 47% of the market share in 2023

- Personal end-users dominated the electric vehicle market, contributing to 91% of the notable growth

- Increased government support through subsidies, tax breaks, and emissions regulations the electric vehicle market trend that fuels the industry demand

An electric vehicle (EV) is a vehicle powered by one or more electric motors that use energy stored in rechargeable batteries instead of an internal combustion engine. Electric vehicles (EVs) are noted for producing zero tailpipe emissions, making them more ecologically friendly than regular gasoline-powered vehicles. They come in a variety of configurations, including completely electric cars (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles. Electric vehicles (EVs) are utilized for personal transportation, commercial fleets, and public transportation, providing a greener option to reduce pollution and reliance on fossil fuel.

Global Electric Vehicle Market Dynamics

Market Drivers

- Government incentives and subsidies promoting EV adoption

- Growing environmental awareness and demand for sustainable transportation

- Advancements in EV battery technology, leading to improved range and performance

Market Restraints

- High initial purchase cost compared to traditional vehicles

- Limited charging infrastructure in certain regions

- Range anxiety and long charging times for some consumers

Market Opportunities

- Expansion of EV charging infrastructure globally

- Rising demand for electric fleets in commercial transportation

- Innovation in solid-state batteries for faster charging and longer life

Electric Vehicle Market Report Coverage

| Market | Electric Vehicle Market |

| Electric Vehicle Market Size 2022 |

USD 560.9 Billion |

| Electric Vehicle Market Forecast 2032 | USD 2,342.3 Billion |

| Electric Vehicle Market CAGR During 2023 - 2032 | 17.6% |

| Electric Vehicle Market Analysis Period | 2020 - 2032 |

| Electric Vehicle Market Base Year |

2022 |

| Electric Vehicle Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Propulsion Type, By Drive Type, By Vehicle Speed, By Vehicle Class, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BYD Company Ltd., Toyota Motor Corporation, General Motor Company, Tesla, Daimler AG, Group Renault, Ford Motor Company, Volkswagen AG, Nissan Motor Corporation, and BMW Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Electric Vehicle Market Insights

According to the IEEE research, the majority of countries rely heavily on the automotive industry. Vehicles, on the other hand, are generally bad for the environment since they require a lot of fossil fuels. Furthermore, worries about climate change and energy security are driving a move toward the usage of renewable energy systems (RES) rather than traditional energy sources. As a result, electric vehicles come pre-programmed with environmental sustainability features. EVs are the best alternative for sustainability and clean mobility because their energy usage is comparable to that of other electric devices.

According to the IEA report, the Electric Vehicle Initiative (EVI), a multi-government policy forum, was established to expedite the global introduction and uptake of EVs. EVI was launched during the Clean Energy Ministerial (CEM), a high-level dialogue of Energy Ministers from the world's leading economies. According to the AFDC report, the US Department of Energy (DOE) is working with public and private sector partners to research, develop, and implement technologies that improve the performance of electric vehicles. According to the National Renewable Energy Laboratory and Idaho National Laboratory report, Levelized Cost of Charging Electric Vehicles in the United States, driving an electric vehicle instead of a comparable conventional vehicle saves the driver approximately US$14,500 in fuel costs over a 15-year period. Furthermore, the Autonomie model states that an electric car is more than three times more efficient than a conventional vehicle. Such government involvement and initiatives contribute to the growth of the electric vehicle (EV) market.

Furthermore, increasing environmental awareness and demand for sustainable transportation will boost electric vehicle (EV) market expansion in the forecast year. For instance, in November 2023, Alexander Dennis, a subsidiary of NFI Group Inc., a well-known worldwide bus manufacturer, unveiled its current fleet of battery-electric buses designed specifically for the United Kingdom and Ireland. The launch features the Enviro100EV small bus and the Enviro400EV double-decker, both of which demonstrate considerable performance improvements. These models represent a significant move toward zero-emission transportation and are key components of a larger family of next-generation electric buses. Overall, by demonstrating meaningful progress in zero-emission technology and promoting adoption through innovative and practical EV solutions targeted to public transportation requirements. Key manufacturers are seeking for zero-emission transportation, which will drive demand for the electric vehicle market in the forecast period.

Electric Vehicle Market Segmentation

The worldwide market for electric vehicle containers is split based on type, propulsion type, drive type, speed, class, end-use, and geography.

Electric Vehicle EV Market By Type

- Trucks

- Passenger Cars

- Motorcycles

- Buses

- Three-Wheelers

- Scooters

According to the electric vehicle (EV) industry analysis, based on vehicle type, the passenger car category will have the biggest revenue share in the worldwide market. As per India Brand Equity Foundation, in April 2024, the total output of passenger vehicles, three-wheelers, two-wheelers, and quadricycles was 23,58,041 growing at rapid space. Furthermore, the passenger car segment of the EV industry is expanding, driven by rising adoption, and buildings are assisting this growth by investing in charging infrastructure to simplify the transition. For instance, according to International Energy Agency (IEA), private passenger use is one of the most mature EV sectors, and buildings assist this organic shift by investing in charging infrastructure. Furthermore, as per our electric vehicle charging station market analysis, the industry is expected to reach more than USD 320 billion by 2032, with an exponential CAGR of 31% throughout 2024 to 2032. Such factors contribute to the growth of the global electric vehicle market.

Electric Vehicle EV Market EV Market By Propulsion Type

- BEV

- FCEV

- PHEV

According to the industry analysis, based on type, the plug-in hybrid electric vehicle (PHEV) category will dominate the worldwide electric vehicle (EV) market market. As per IEA, in the United States, first-quarter sales were over 350,000, nearly 15% higher than the same period the previous year. As with other large markets, PHEV sales grew even faster, by 50%. On the other hand, BEV vehicles are biased towards larger vehicle classes, resulting in a larger revenue share. As a result, battery electric vehicles (BEV) accounted for the vast majority of electric vehicle registrations in 2023 for cars and vans, rather than plug-in hybrid vehicles.

Electric Vehicle EV Market By Drive Type

- FWD

- AWD

- RWD

According to the electric vehicle industry analysis, front-wheel drive (FWD) dominates sector due to its low cost and simplicity of design, making it a popular choice among manufacturers. The layout improves energy efficiency by concentrating the powertrain at the front, decreasing drive train complexity and weight. FWD also delivers stable handling and improved traction, particularly in urban and mild driving conditions. As the industry focuses economy and practicality, FWD remains the default drive mode for the vast majority of EV cars.

Electric Vehicle EV Market By Speed

- 100MPH to 125MPH (Max. Speed)

- Less Than 100 MPH (Max. Speed)

- Above 125 MPH (Max. Speed)

According to the electric vehicle (EV) market analysis, electric vehicles with a maximum speed range of 100MPH to 125MPH dominate the market due to their balance of performance and energy efficiency, meeting the expectations of ordinary consumers. This speed range is appropriate for urban, housing, and highway driving, ensuring practicality without excessive energy use. It also appeals to people looking for vehicles that outperform regular internal combustion engine vehicles. As EV technology progresses, this range remains a growing for performance and value.

Electric Vehicle EV Market By Class

- Low Priced

- High Price

- Mid-Price

According to the electric vehicle (EV) market forecast, the low-priced vehicle class sector is positioned for strong growth in industry as it becomes more affordable and accessible to a wider customer base. Government incentives and subsidies for low-cost EVs bolster this segment's appeal. Advanced battery technology has also decreased production costs, allowing manufacturers to provide competitive prices. As more consumers seek sustainability while remaining affordable, this category is likely to grow significantly globally.

Electric Vehicle EV Market By End Use

- Personal

- Commercial

According to the electric vehicle industry analysis, personal end users dominate the EV business, as more people choose EVs for daily commuting and personal use, motivated by environmental concerns and fuel cost reductions. This segment benefits from government incentives, decreased maintenance costs, and increased availability of charging infrastructure. As customers become more conscious of the need of sustainability, they are turning to electric vehicles as a cleaner and more cost-effective mode of transportation. As a result, personal end users represent the largest and fastest-growing segment of the EV industry.

Electric Vehicle Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Electric Vehicle Market Regional Analysis

For several reasons, in the future years, Asia Pacific will account for the vast majority of the electric car market. China leads Asia Pacific provinces in electric car sales, with Korea joining the market. Strong demand in nations such as China, Japan, and India, as well as significant government backing and expanding infrastructure will leads to increase market growth. For instance, in July 2023, NITI Aayog released a roadmap for the expansion of electric transportation in India, connecting it with the Indian government's goal of reaching net zero emissions by 2070. The NITI Aayog has set particular targets for vehicle types in order to attain 30% EV sales penetration by 2030. As a result, government initiatives and growing urbanization add to its lead in EV adoption.

Europe is accounting for a notable share in region in the EV market, due to strict environmental legislation, government incentives, and rising consumer demand for sustainable transportation. Additionally, in February 2023, BYD has added two new dealer corporations to its network in the Europe region. Motor Distributors Ltd (MDL) is active in Ireland and will offer BYD models at select locations including Dublin and Cork. RSA is a dealer with whom BYD already works in Norway, and it will offer EVs of Chinese-make in Finland and Iceland. BYD initially launched three EV models in select European countries at the end of 2022. Two more series could follow in 2023. Overall, increasing EV adoption in Europe by extending BYD's dealer network and introducing Chinese-made EVs to new regions, making electric vehicles more accessible to European consumers.

Electric Vehicle Market Players

Some of the top electric vehicle companies offered in our report include BYD Company Ltd., Toyota Motor Corporation, General Motor Company, Tesla, Daimler AG, Group Renault, Ford Motor Company, Volkswagen AG, Nissan Motor Corporation, and BMW Group.

Frequently Asked Questions

How big is the electric vehicle market?

The electric vehicle market size was valued at USD 560.9 billion in 2023.

What is the CAGR of the global electric vehicle market from 2024 to 2032?

The CAGR of electric vehicle is 17.6% during the analysis period of 2024 to 2032.

Which are the key players in the electric vehicle market?

The key players operating in the global market are including BYD Company Ltd., Toyota Motor Corporation, General Motor Company, Tesla, Daimler AG, Group Renault, Ford Motor Company, Volkswagen AG, Nissan Motor Corporation, and BMW Group.

Which region dominated the global electric vehicle market share?

Asia-Pacific held the dominating position in electric vehicle market during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of electric vehicle during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global electric vehicle industry?

The current trends and dynamics in the electric vehicle market include government incentives and subsidies promoting EV adoption, growing environmental awareness and demand for sustainable transportation, and advancements in ev battery technology, leading to improved range and performance.

Which Speed held the maximum share in 2023?

The 100MPH to 125MPH (max. speed) held the maximum share of the electric vehicle industry.