Battery-as-a-Service Market | Acumen Research and Consulting

Battery-as-a-Service Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

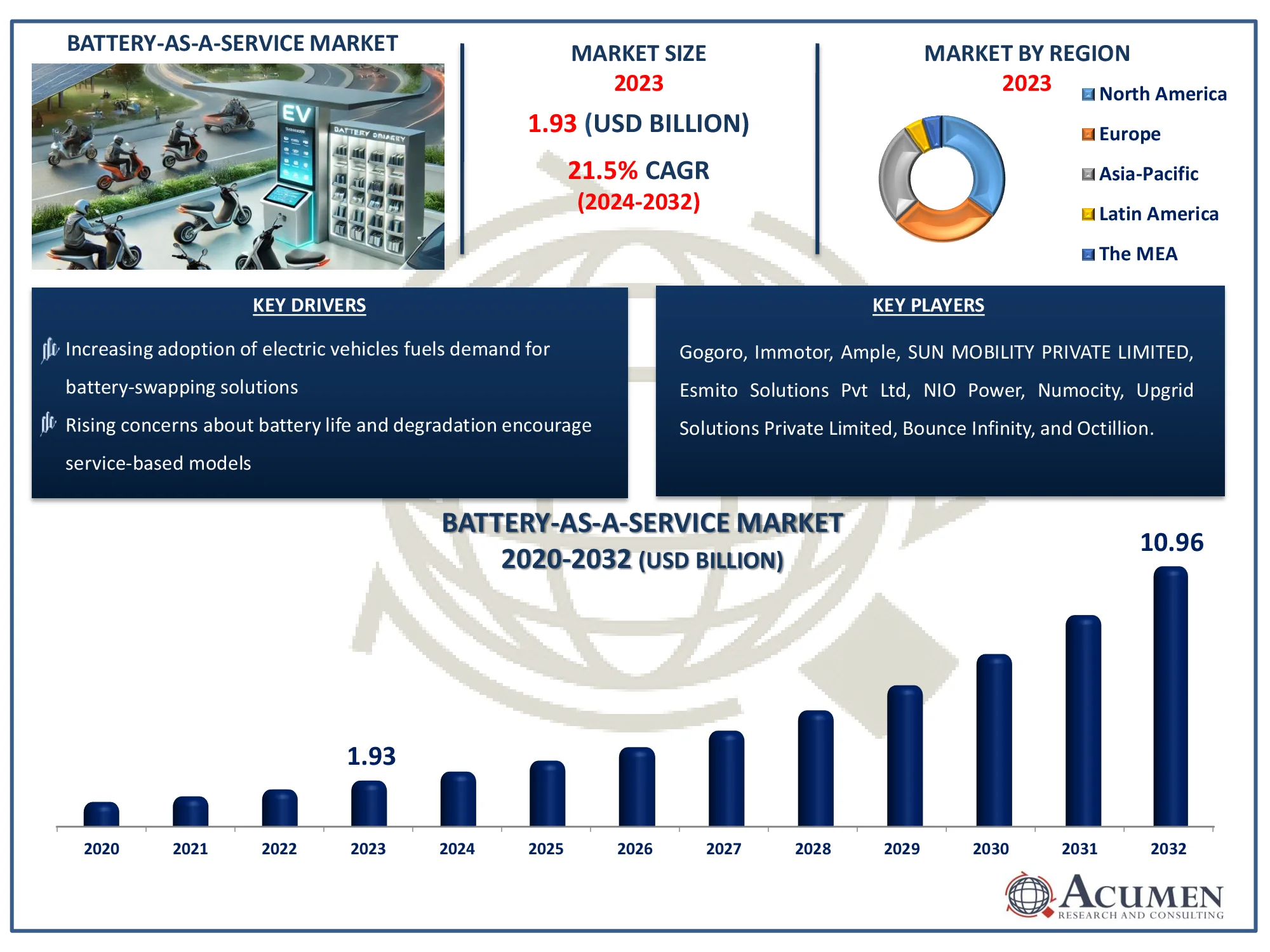

The Global Battery-as-a-Service Market Size accounted for USD 1.93 Billion in 2023 and is estimated to achieve a market size of USD 10.96 Billion by 2032 growing at a CAGR of 21.5% from 2024 to 2032.

Battery-as-a-Service Market Highlights

- Global battery-as-a-service market revenue is poised to garner USD 10.96 billion by 2032 with a CAGR of 21.5% from 2024 to 2032

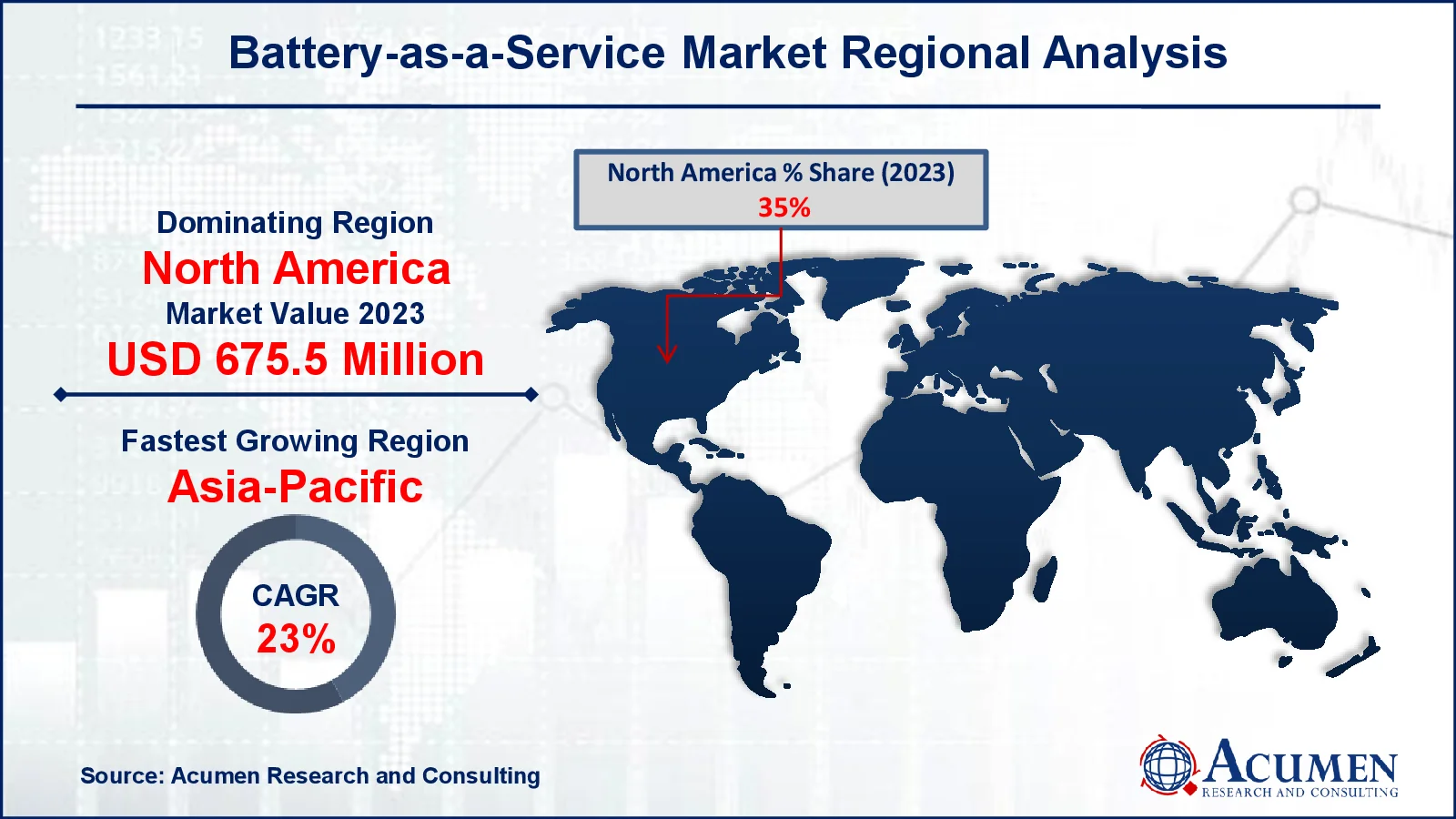

- North America battery-as-a-service market value occupied around USD 675.5 million in 2023

- Asia-Pacific battery-as-a-service market growth will record a CAGR of more than 23% from 2024 to 2032

- Among service type, the subscription-based service sub-segment generated noteworthy revenue in 2023

- Based on battery type, the lithium-ion batteries sub-segment generated significant battery as a service market share in 2023

- Technological advancements in modular batteries enhance swapping efficiency is a popular battery-as-a-service market trend that fuels the industry demand

Battery-as-a-Service (BaaS) is a revolutionary business concept in which users can lease or subscribe to battery services rather than buy them altogether. BaaS is primarily meant for electric vehicles (EVs), and it allows for quick battery replacement, removing the downtime associated with charging. Users can select among subscription-based plans or pay-per-use services, which offer greater flexibility and lower pricing. This technique addresses challenges such as costly battery replacements, range anxiety, and limited charging infrastructure. BaaS is especially popular in markets with robust electric mobility ecosystems, which encourages EV adoption by lowering initial costs. It extends beyond the automotive industry to include industrial, marine, and other businesses that require energy storage. BaaS also promotes sustainability by supporting proper battery lifecycle management, such as recycling and repurposing.

Global Battery-as-a-Service Market Dynamics

BaaS Market Drivers

- Increasing adoption of electric vehicles fuels demand for battery-swapping solutions

- Rising concerns about battery life and degradation encourage service-based models

- Government incentives and policies support EV infrastructure expansion

- Cost-effectiveness and reduced downtime attract fleet operators to BaaS solutions

BaaS Market Restraints

- High initial investment in infrastructure development hinders market growth

- Lack of standardization across battery systems creates compatibility challenges

- Limited awareness and trust in subscription-based models affect adoption rates

BaaS Market Opportunities

- Growing urbanization and e-mobility trends create a vast market for BaaS

- Partnerships with automakers and energy providers can expand service networks

- Emerging markets offer untapped potential for expanding battery-as-a-service solutions

Battery-as-a-Service Market Report Coverage

| Market | Battery-as-a-Service (BaaS) Market |

| Battery As A Service Market Size 2022 |

USD 1.93 Billion |

| Battery As A Service Market Forecast 2032 | USD 10.96 Billion |

| Battery As A Service Market CAGR During 2023 - 2032 | 21.5% |

| Battery As A Service Market Analysis Period | 2020 - 2032 |

| Battery As A Service Market Base Year |

2022 |

| Battery As A Service Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Service Type, By Vehicle Type, By Battery Type, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Gogoro, Immotor, Ample, SUN MOBILITY PRIVATE LIMITED, Esmito Solutions Pvt Ltd, NIO Power, Numocity, Upgrid Solutions Private Limited, Bounce Infinity, and Octillion. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Battery-as-a-Service Market Insights

There is noticeable increase in air pollution across the globe majorly from automotive sector. Rising fuel demand along with the surging oil & gas prices is impacting the economy. This is resulting in government approach towards lowering the dependency on fossil fuel as power source for vehicle. Inclination towards electric vehicle with high power and better life is gaining attraction. Consumers in developed countries are accepting the shift towards electric vehicles. According to International Energy Agency, Europe overtook China as the centre of the global electric car market. Electric car registrations in Europe more than doubled to 1.4 million, while in China they increased 9% to 1.2 million. Consumer spending on electric cars increased another 50% last year to reach US$ 120 billion. With the changing perspective towards vehicle adoption hurdles related to infrastructure and vehicle charging are popping heads-up.

Rising environmental concern, inclination toward adoption of electric vehicles from consumers and manufacturer focus toward lowering the operational cost are major factors expected to drive the growth of global battery as a service (BaaS) market. For instance, as reported by EV Volumes, 14.2 million new battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) were delivered globally in 2023, reflecting a 35% increase. Of this total, 10 million were fully electric BEVs, while 4.2 million consisted of plug-in hybrids (PHEVs) and range extender EVs (EREVs). Also, Automotive lithium-ion (Li-ion) battery demand climbed by around 65% to 550 GWh in 2022, from about 330 GWh in 2021, mostly due to increases in electric passenger car sales, with new registrations increasing by 55% in 2022 compared to 2021.

Government of developed and developing countries is spending high on the development of electric charging infrastructure with the focus to deliver better electric service to consumer. This is attracting major players operating in the market with innovative solution. Players are focused towards enhancing the business and increase the customer base through innovative product and service launch. This is expected to augment the growth of battery as a service market.

In 2021, Ample, global electric vehicle service provider launched a new electric vehicle charging system “Ample Swap”. The system works by having robots quickly replace small modular battery packs in electric cars. Swap offers solutions for mid-day charging, battery decline, the use of renewable power and extending vehicle life.

In 2020, Nio, electric vehicle solution provider, launched battery as a service (BaaS) under “Nio-Power”. The service offers charging and swapping of batteries for EV owners. This product launch is expected to help the company to enhance the business and increase the revenue share.

Battery-as-a-Service Market Segmentation

The worldwide battery-as-a-service market is split based on service type, vehicle type, battery type, application, end-user, and geography.

Battery as a Service Market By Service Type

- Subscription-Based Service

- Pay-Per-Use Service

According to battery-as-a-service industry analysis, the subscription-based service segment in the market is the dominant service model. This approach allows consumers, particularly electric vehicle (EV) owners, to pay a fixed monthly fee for access to fully charged batteries. It offers the advantage of reducing upfront costs associated with purchasing a battery and provides users with the convenience of battery replacement or swapping as needed. Subscription-based services also include ongoing maintenance, ensuring battery performance and longevity, which is crucial for EV owners. The segment is growing rapidly due to the increasing adoption of electric vehicles and the desire for cost-effective, hassle-free battery management solutions. It appeals to both individual consumers and fleet operators looking to optimize operational costs.

Battery as a Service Market By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Two-Wheelers

- Electric Three-Wheelers

The passenger cars segment is the major contributor to the battery-as-a-service (BaaS) market. This segment benefits significantly from the increasing adoption of electric vehicles (EVs), as consumers are seeking more affordable and flexible battery solutions. BaaS offers a cost-effective alternative to owning and maintaining EV batteries, which is particularly appealing for passenger vehicle owners. By providing battery swapping or leasing options, BaaS helps mitigate concerns about high initial costs and battery degradation. Furthermore, the growing focus on reducing carbon emissions and the increasing number of EV models available in the market contribute to the expansion of this segment. As electric passenger vehicles become more mainstream, the demand for battery-as-a-service market is expected to continue to rise.

Battery as a Service Market By Battery Type

- Lithium-Ion Batteries

- Nickel-Metal Hydride Batteries

- Solid-State Batteries

- Lead-Acid Batteries

Lithium-ion batteries are expected to lead the battery-as-a-service market. This is mostly because to its high energy density, long cycle life, and adaptability. They are widely used in a number of applications, such as electric vehicles, energy storage systems, and portable electronics. The increasing demand for electric vehicles, combined with advances in lithium-ion battery technology, is moving the sector forward. Furthermore, the expanding utilization of renewable energy sources, as well as the necessity for effective energy storage solutions, is strengthening lithium-ion batteries' position in the BaaS market.

Battery as a Service Market By Application

- Automotive

- Electric Vehicles (EVs)

- Hybrid Electric Vehicles (HEVs)

- Marine

- Industrial

- Others (e.g., aerospace)

The industrial segment is expected to increase significantly in the battery-as-a-service market forecast period. Automation, robots, and IoT devices are increasingly being used in numerous industries, which is driving this trend. These applications require dependable and efficient power sources, and BaaS offers a versatile and cost-effective solution. Furthermore, the growing demand for energy storage solutions in industrial settings, such as backup power and grid stabilization, is driving the industrial segment of the battery-as-a-service market. As industries embrace digital transformation and sustainable practices, demand for BaaS solutions is projected to increase.

Battery as a Service Market By End-User

- Individual Users

- Fleet Operators

- Logistics Providers

- Public Transport

Fleet operators generate the largest revenue in the battery-as-a-service market due to the extensive usage of battery-swapping systems for commercial electric vehicles. This user group benefits significantly from reduced downtime and operational costs as a result of the quick and seamless replacement of low batteries. The scalability of BaaS is perfect for fleet operators who manage large vehicle inventories, such as those in ride-hailing, delivery services, and corporate transportation. Furthermore, government incentives for electrification and tough emissions regulations are propelling the usage of BaaS in this space. As the market for dependable and cost-effective energy solutions grows, fleet operators continue to be the most profitable end customer in the business.

Battery-as-a-Service Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Battery-as-a-Service Market Regional Analysis

North America dominates the global battery-as-a-service market due to its advanced infrastructure, broad adoption of electric vehicles (EVs), and strong emphasis on energy sustainability. Countries like the United States and Canada are at the forefront of EV adoption, aided by government subsidies and tough rules geared at lowering carbon emissions. The region's large network of battery switching stations, combined with agreements between EV manufacturers and battery service providers, all contribute significantly to its dominance. Furthermore, the large number of major companies in the EV and energy industries promotes innovation in BaaS technology. North America's high disposable income and expanding public awareness of EVs increase demand for battery-as-a-service options.

Asia-Pacific has emerged as the fastest-growing region in the battery-as-a-service market, owing to rapid urbanization, government initiatives to promote EV use, and an increased demand for sustainable transportation. China, as the world's leading producer of electric vehicles, is critical to the region's growth, with enormous investments in battery-swapping infrastructure and legislation that promote green technologies. For instance, in China, plug-in hybrid electric cars (PHEVs) made for approximately one-third of all electric vehicle sales in 2023, as well as 18% of battery demand. This represents an increase from one-quarter of total sales in 2022 to 17% in 2021.

Furthermore, countries such as India and Japan are making significant advances in EV infrastructure, aided by growing environmental concerns and government subsidies. The region's massive population, burgeoning economy, and growing demand for low-cost, easy solutions like battery switching all contribute to its rapid battery-as-a-service market expansion.

Battery-as-a-Service Market Players

Some of the top battery-as-a-service market companies offered in our report include Gogoro, Immotor, Ample, SUN MOBILITY PRIVATE LIMITED, Esmito Solutions Pvt Ltd, NIO Power, Numocity, Upgrid Solutions Private Limited, Bounce Infinity, and Octillion.

Frequently Asked Questions

How big is the battery-as-a-service market?

The battery-as-a-service market size was valued at USD 1.93 billion in 2023.

What is the CAGR of the global battery-as-a-service market from 2024 to 2032?

The CAGR of battery-as-a-service is 21.5% during the analysis period of 2024 to 2032.

Which are the key players in the battery-as-a-service market?

The key players operating in the global market are including Gogoro, Immotor, Ample, SUN MOBILITY PRIVATE LIMITED, Esmito Solutions Pvt Ltd, NIO Power, Numocity, Upgrid Solutions Private Limited, Bounce Infinity, and Octillion.

Which region dominated the global battery-as-a-service market share?

North America held the dominating position in battery-as-a-service industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of battery-as-a-service during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global battery-as-a-service industry?

The current trends and dynamics in the battery-as-a-service industry include increasing adoption of electric vehicles fuels demand for battery-swapping solutions, and rising concerns about battery life and degradation encourage service-based models.

Which service type held the maximum share in 2023?

The subscription-based service type held the maximum share of the battery-as-a-service industry.