Lithium-Ion Battery Dispersant Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Lithium-Ion Battery Dispersant Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

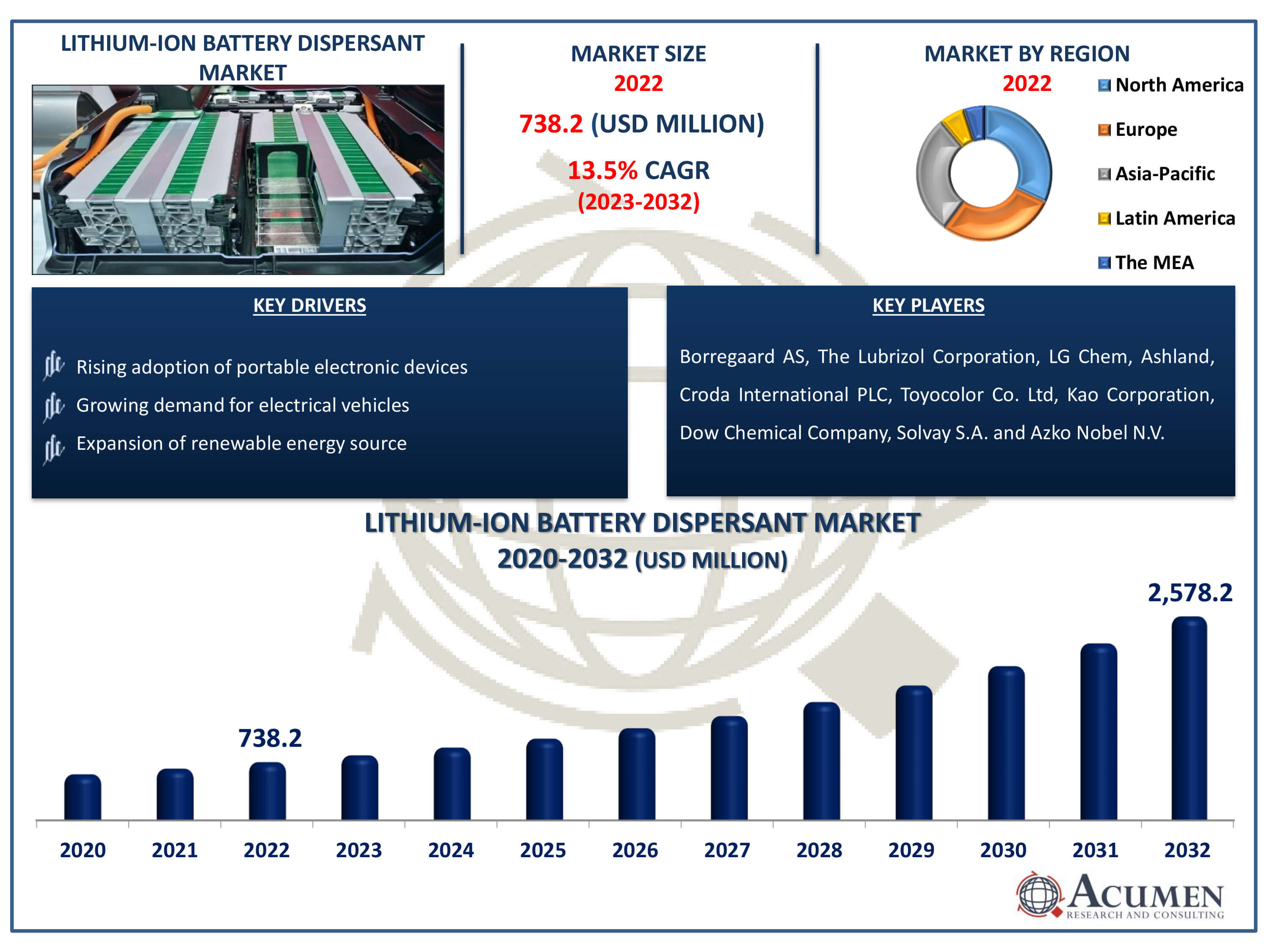

The Lithium-Ion Battery Dispersant Market Size accounted for USD 738.2 Million in 2022 and is estimated to achieve a market size of USD 2,578.2 Million by 2032 growing at a CAGR of 13.5% from 2024 to 2032.

Lithium-Ion Battery Dispersant Market Highlights

- Global lithium-ion battery dispersant market revenue is poised to garner USD 2,578.2 million by 2032 with a CAGR of 13.5% from 2024 to 2032

- North America lithium-ion battery dispersant market value occupied around 32% market share in 2022

- Asia-Pacific lithium-ion battery dispersant market growth will record a CAGR of more than 14% from 2024 to 2032

- Among type, the block co-polymers sub-segment generated notable share 37% in 2022

- Based on end-use, the consumer electronics sub-segment occupied USD 236.2 million revenue in 2022

- Growing demand of electrical vehicles is becoming a popular lithium-ion battery dispersant market trend

The lithium-ion battery, also known as a rechargeable battery, is used to store energy by intercalating lithium ions into an electrically conducting solid. These batteries have diverse applications due to their elevated energy efficiency, specific energy, and energy density. Primarily, they are utilized for power storage in electric vehicles, renewable energy generation equipment, smartphones, and other devices. Additionally, dispersants are substances used to settle and separate particles by adding them to liquid or solid suspensions. Dispersants find various industrial applications such as in salad dressings, paints, and ferrofluids. Moreover, dispersants in lithium-ion batteries improve productivity, reduce environmental impact, and decrease solvent usage.

Global Lithium-Ion Battery Dispersant Market Dynamics

Market Drivers

- Rising adoption of portable electronic devices

- Growing demand for electrical vehicles

- Expansion of renewable energy source

Market Restraints

- Safety related to battery uses

- Maintaining regulation and consistent quality

- Environmental impact of certain dispersant used in the batteries

Market Opportunities

- Declining battery cost

- Increasing demand of lithium-ion batteries in automotive sector

- Rising investments in energy storage

Lithium-Ion Battery Dispersant Market Report Coverage

| Market | Lithium Ion Battery Dispersant Market |

| Lithium Ion Battery Dispersant Market Size 2022 | USD 738.2 Million |

| Lithium Ion Battery Dispersant Market Forecast 2032 |

USD 2,578.2 Million |

| Lithium Ion Battery Dispersant Market CAGR During 2023 - 2032 | 13.5% |

| Lithium Ion Battery Dispersant Market Analysis Period | 2020 - 2032 |

| Lithium Ion Battery Dispersant Market Base Year |

2022 |

| Lithium Ion Battery Dispersant Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Borregaard AS, The Lubrizol Corporation, LG Chem, Ashland, Croda International PLC, Toyocolor Co. Ltd, Kao Corporation, Dow Chemical Company, Solvay S.A. and Azko Nobel N.V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Lithium-Ion Battery Dispersant Market Insights

The growing demand for electric vehicles is driving the growth of the lithium-ion battery dispersant market. Lithium-ion batteries play a pivotal role in electric vehicles, being widely used due to their low mass relative to other electrical energy storage systems and their high energy density. Additionally, they exhibit high-temperature performance, a high power-to-weight ratio, short self-discharge, and high energy efficiency. Overall, due to these properties, lithium-ion batteries are preferred over nickel-metal hydride or silver-zinc batteries. Furthermore, the rising adoption of portable electronic devices and the expansion of renewable energy sources further boost market demand. For instance, there has been a 92% growth in smartphone users in the United States in 2023.

Additionally, safety concerns related to battery usage are expected to impede market growth in the coming years. Firstly, lithium-ion batteries have some disadvantages such as being highly fragile, requiring greater protection, being unsafe at higher temperatures, and experiencing performance degradation over time. For instance, electrical devices can become exposed to hazards due to battery overheating, rendering lithium-ion batteries unsuitable for portable devices. Furthermore, maintaining consistent quality regulations and addressing the environmental impact of certain dispersants used in the batteries further hampers market growth. For instance, some dispersants are harmful to marine organisms.

Additionally, the decline in battery costs has become an opportunity for the lithium-ion battery dispersant market. In recent years, battery costs have decreased, a trend supported by automotive and lithium-ion battery manufacturers. Several factors contribute to the decline in lithium-ion battery costs, including the adoption of new technologies, increased manufacturing efficiency, and decreasing component prices. Moreover, Tesla Motors Inc. initiated the construction of Gigafactory 1, which has helped reduce lithium-ion battery costs. Furthermore, the growing demand for lithium-ion batteries in the automotive sector and increased investments in energy storage further create opportunities for market growth.

Lithium-Ion Battery Dispersant Market Segmentation

The worldwide market for lithium-ion battery dispersant is split based on type, end-use, and geography.

Li-Ion Battery Dispersant Market By Type

- Block Co-Polymers

- Naphthalene Sulphonate

- Lignosulphonates

- Others

According to lithium-ion battery dispersant industry analysis, based on the type the block co-polymers dominated the market. Block copolymers have a linear arrangement of blocks and it is a primary choice for dispersants. This is used to form pigment dispersions. It is used in solvent-borne coating compositions and then used in lithium-ion batteries. Additionally, this is widely used in the oil additives and paint formulation as pigment dispersants. Moreover, block co-polymers are highly effective for the high solid contents and in organic liquids. In essence, due to these vast applications block co-polymer dominates the market.

Li-Ion Battery Dispersant Market By End-Use

- Consumer Electronics

- Industrial

- Electric Vehicles

- Military

- Others

According to lithium-ion battery dispersant market forecast, consumer electronics is expected to lead the market in coming years. Firstly, lithium-ion batteries are mostly used in consumer electronics devices such as laptops, smartphones, tablets, wearable devices, and cameras. These batteries also have diverse applications in electronics long lifespan, high energy density, and lightweight devices. Additionally, due to increasing rate of internet users further boosts the demand for lithium-ion batteries. For instance, China reached 1.09 billion internet users in 2024 which increased by 11 million from January 2023. So, this growing graph of internet users automatically increases the demand for electronic devices which significantly dominates the market in the coming years.

Lithium-Ion Battery Dispersant Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

.jpg)

Lithium-Ion Battery Dispersant Market Regional Analysis

In terms of lithium-ion battery dispersant market analysis, regional segmentation includes North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the lithium-ion battery dispersant market due to increasing demand for electronic devices in the region. For instance, as of January 2024, the United States alone had 331 million internet users, with 90% accessing the internet via mobile phones. Moreover, the growing demand for electric vehicles in countries such as the U.S., Canada, and Mexico further boosts the market in North America. Additionally, increasing investments in electric vehicle manufacturing in the United States will contribute to a larger market share. For example, announcements of over $150 billion in investments in EVs have led to a 40% growth in electric vehicle sales since 2021. Consequently, the North America lithium-ion battery dispersant market is experiencing significant growth.

Furthermore, Asia-Pacific is the fastest-growing region in the lithium-ion battery dispersant market due to growing investments in the electric vehicle sector. For instance, the Chinese government supports the EV industry by investing $57 billion in the manufacturing of 3.76 million EVs between 2016 and 2022. Moreover, lithium-ion batteries have diverse applications in electronic devices, and China's rising adoption of electronic devices further drives the market. For instance, in 2022, China had 1.04 billion smartphone users. In essence, the growing end-users in electronic devices dominate this region in the lithium-ion battery dispersant market.

Lithium-Ion Battery Dispersant Market Players

Some of the top lithium-ion battery dispersant companies offered in our report include Borregaard AS, The Lubrizol Corporation, LG Chem, Ashland, Croda International PLC, Toyocolor Co. Ltd, Kao Corporation, Dow Chemical Company, Solvay S.A. and Azko Nobel N.V.

Frequently Asked Questions

How big is the lithium-ion battery dispersant market?

The lithium-ion battery dispersant market size was valued at USD 738.2 million in 2022.

What is the CAGR of the global lithium-ion battery dispersant market from 2024 to 2032?

The CAGR of lithium-ion battery dispersant is 13.5% during the analysis period of 2024 to 2032.

Which are the key players in the lithium-ion battery dispersant market?

The key players operating in the global market are including Borregaard AS, The Lubrizol Corporation, LG Chem, Ashland, Croda International PLC, Toyocolor Co. Ltd, Kao Corporation, Dow Chemical Company, Solvay S.A. and Azko Nobel N.V.

Which region dominated the global lithium-ion battery dispersant market share?

North America held the dominating position in lithium-ion battery dispersant industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of lithium-ion battery dispersant during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global lithium-ion battery dispersant industry?

The current trends and dynamics in the lithium-ion battery dispersant market are raising adoption of portable electronic devices, growing demand for electrical vehicles, and expansion of renewable energy source.

Which type held the maximum share in 2022?

Block co-polymers type held the maximum share of the lithium-ion battery dispersant market.