Autonomous Forklift Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Autonomous Forklift Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

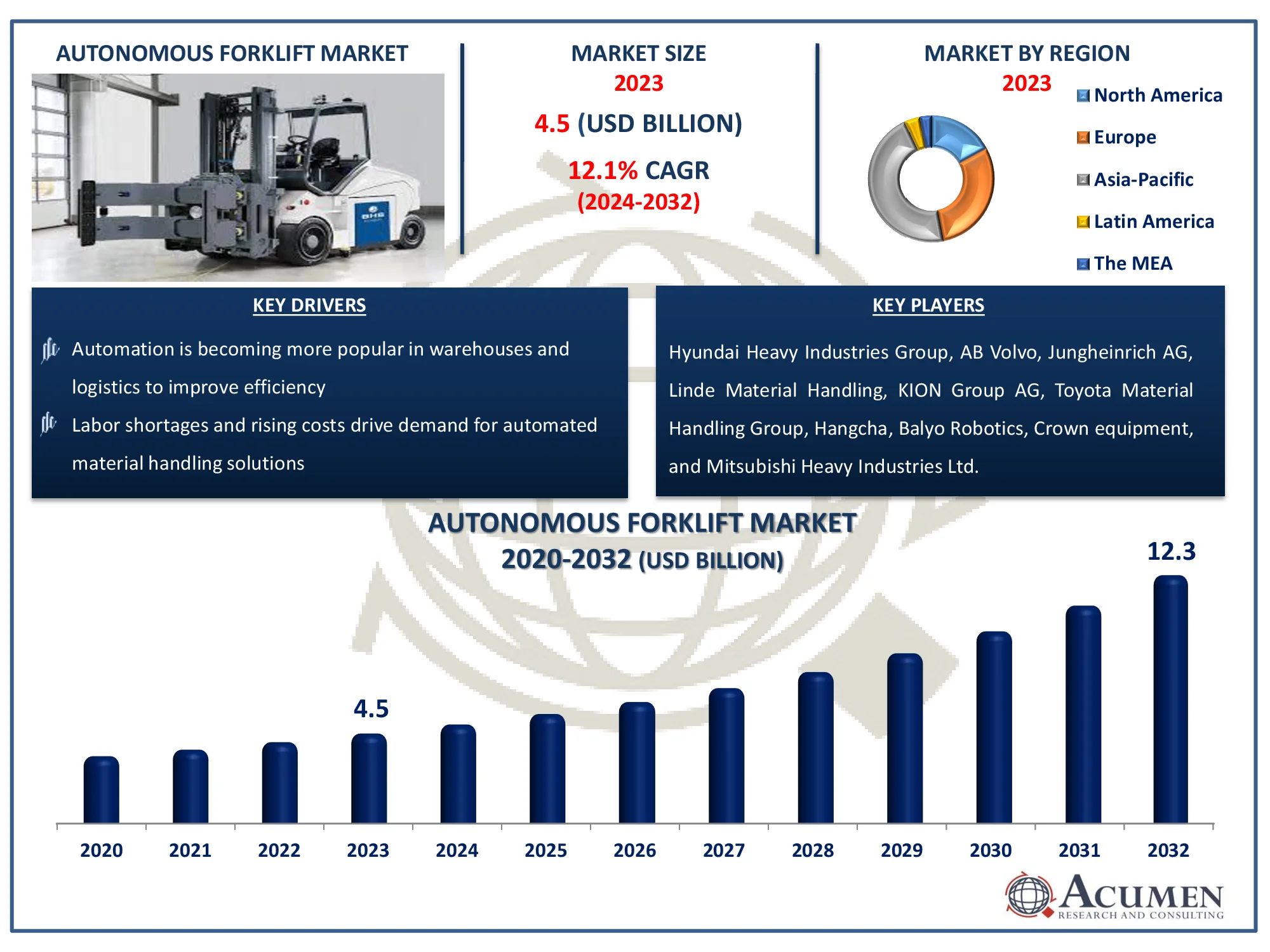

The Global Autonomous Forklift Market Size accounted for USD 4.5 Billion in 2023 and is estimated to achieve a market size of USD 12.3 Billion by 2032 growing at a CAGR of 12.1% from 2024 to 2032.

Autonomous Forklift Market Highlights

- Global autonomous forklift industry revenue is poised to garner USD 12.3 billion by 2032 with a CAGR of 12.1% from 2024 to 2032

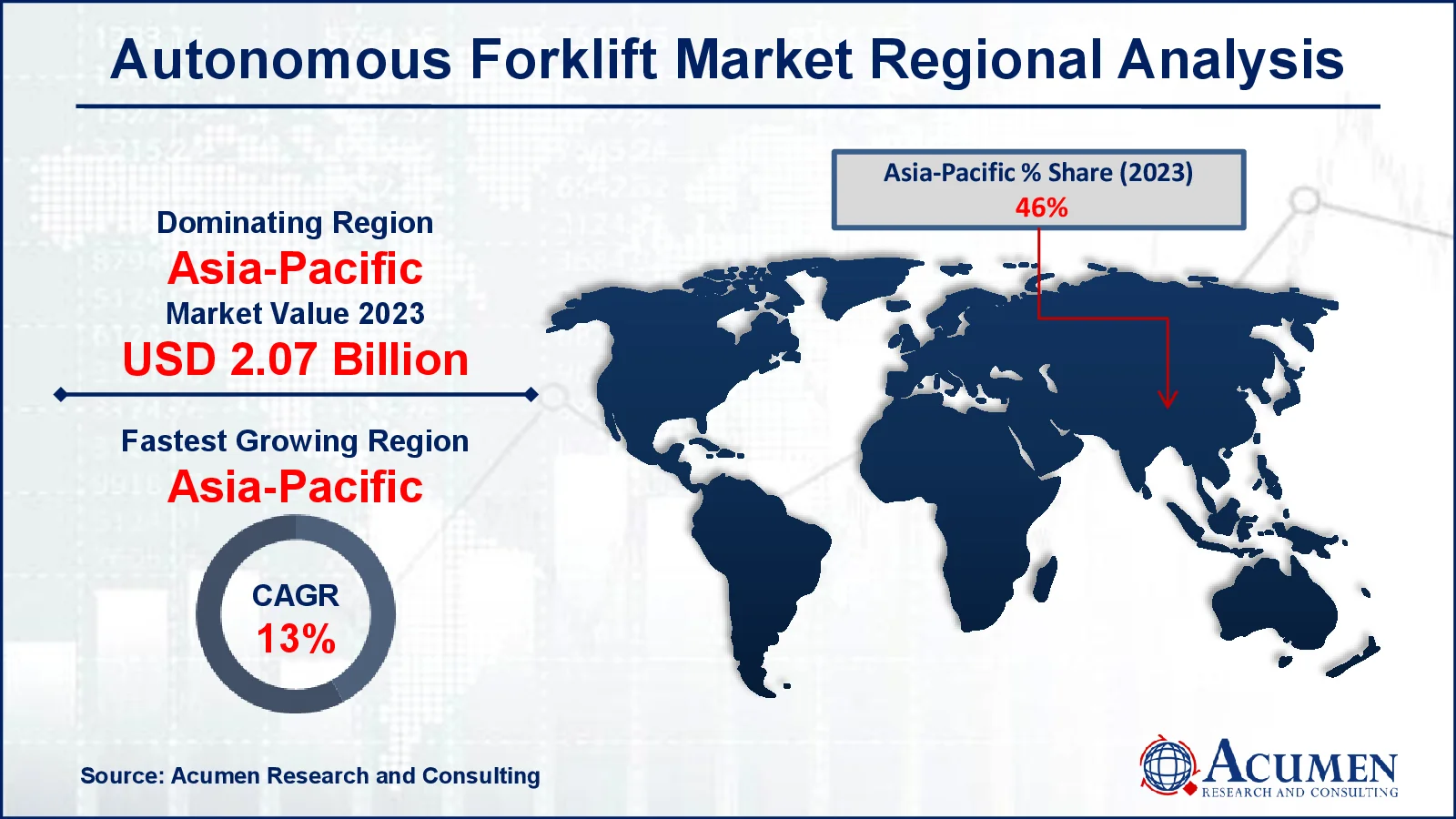

- Asia-Pacific autonomous forklift market value occupied around USD 2.07 billion in 2023

- Asia-Pacific autonomous forklift market growth will record a CAGR of more than 13% from 2024 to 2032

- Among navigation technology, the laser sub-segment generated noteworthy of the autonomous forklift market share in 2023

- Based on type, the counterbalance sub-segment generated 38% market share in 2023

- Increasing adoption of green technologies promoting energy-efficient solutions is the autonomous forklift market trend that fuels the industry demand

Forklifts are commonly used in warehouses and distribution centers as powered industrial trucks designed to lift and move materials over short distances. The wide applicability of autonomous forklifts across various industries, such as transportation and logistics, manufacturing, the paper industry, and the wood industry, is a major factor expected to drive the growth of the global autonomous forklift market. With rising automation in various industries, manufacturers are focused on increasing operational efficiency. Forklifts help reduce injuries to staff, prevent damage to goods and infrastructure, and improve transportation quality.

Global Autonomous Forklift Market Dynamics

Market Drivers

- Automation is becoming more popular in warehouses and logistics to improve efficiency

- Labor shortages and rising costs drive demand for automated material handling solutions

- AI and sensor technology improve forklift navigation and safety

- Growth of e-commerce and just-in-time delivery systems is driving adoption of autonomous forklifts

Market Restraints

- High initial investment costs limiting adoption among small and medium-sized enterprises

- Lack of standardized regulations for autonomous material handling equipment

- Technical challenges in integrating autonomous forklifts with existing warehouse management systems

Market Opportunities

- Expanding use of autonomous forklifts in emerging markets with growing industrial sectors

- Development of flexible leasing or rental models to lower upfront costs for businesses

- Integration of autonomous forklifts with Industry 4.0 technologies to streamline supply chains

Autonomous Forklift Market Report Coverage

| Market | Autonomous Forklift Market |

| Autonomous Forklift Market Size 2022 |

USD 4.5 Billion |

| Autonomous Forklift Market Forecast 2032 | USD 12.3 Billion |

| Autonomous Forklift Market CAGR During 2023 - 2032 | 12.1% |

| Autonomous Forklift Market Analysis Period | 2020 - 2032 |

| Autonomous Forklift Market Base Year |

2022 |

| Autonomous Forklift Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Tonnage, By Navigation Technology, By Application, By Sales Channel, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Hyundai Heavy Industries Group, AB Volvo, Jungheinrich AG, Linde Material Handling, KION Group AG, Toyota Material Handling Group, Hangcha, Balyo Robotics, Crown equipment, and Mitsubishi Heavy Industries Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Autonomous Forklift Market Insights

Flourishing e-commerce sector across the globe, along with distributors and suppliers inclination towards adoption of autonomous forklift in order to speed up productivity and logistical process is another factor expected to augment the growth of global market. Distributors are focused on increasing the productivity due to rising competition and rising fragmented goods flows. Autonomous forklift tend to work as a skilled workforce and critical work can be accomplished with high reliability and without human intervention.

In addition, manufacturers approach towards strategic business development through merger and acquisitions in order to increase the customer base and enhance the product portfolio this is another factor expected to support the growth of target market. Inclination towards increasing the production capacity in order to meet the growing demand is another factor impacting the growth positively.

However, factors such as a high initial investment and availability of rental services are expected to hamper the growth of global market. Availability of rental services is a major advantage to the manufactures as it lowers the ownership of products. In addition, unavailability of required infrastructure in developing countries in order to support the advanced products is another factor expected to challenge the growth of target market. High investments by major players for product development and innovative product offerings are factors expected to create new opportunities for players over the autonomous forklift market forecast period. In addition, increasing merger and acquisition activities in order to increase the business presence are factors expected to further support the target market traction.

Autonomous Forklift Market Segmentation

The worldwide market for autonomous forklift containers is split based on type, tonnage, navigation technology, sales channel, end-use, and geography.

Autonomous Forklift Market By Type

- Counterbalance

- Pallet Mover

- Reach Truck

- Outrigger

According to the autonomous forklift industry analysis, the counterbalance sector is predicted to lead the market, owing to its versatility and broad use across several industries. Counterbalance forklifts, unlike other varieties, can manage a wide range of load sizes without the need for support arms or other supplementary equipment, making them suitable for both indoor and outdoor applications. Their simple design enables them to efficiently handle big objects and navigate a variety of industrial situations, from factory floors to enormous warehouses. Counterbalance forklifts are an excellent alternative for firms looking for dependable, all-purpose automated solutions due to their adaptability and ability to handle a variety of activities.

Autonomous Forklift Market By Tonnage

- 5-10 tons

- Below 5 tons

- More than 10 tons

The more than 10 tons sector is the largest in the autonomous forklift market, thanks to its ability to perform heavy-duty applications in industries like as manufacturing, construction, and logistics. These forklifts are designed to transport heavy, bulky materials with greater load-bearing capacity than smaller ones. With the growth of automation, industries dealing with heavy goods benefit from autonomous forklifts, which cut labor costs, increase productivity, and improve safety by reducing human interaction. Their strong performance and capacity to work in tough settings make them the ideal choice for large-scale industrial activities.

Autonomous Forklift Market By Navigation Technology

- Laser

- Vision

- Optical Tape

- Magnetic

- Inductive Guidance

Laser-based navigation technology dominates the autonomous forklift market because to its better precision and dependability in complicated warehouse environments. Laser navigation uses reflecting markings and laser scanners to precisely establish the forklift's location and path, allowing it to move efficiently without relying on physical guidance such as wires or tapes. This technology allows for flexible pattern changes and is extremely successful at avoiding obstructions, making it ideal for dynamic, fast-paced businesses. Laser navigation is the favored choice for autonomous forklifts due to its capacity to improve operating efficiency and safety while also requiring less maintenance.

Autonomous Forklift Navigation Market By Application

- Manufacturing

- Warehousing

- Freight and Logistics

- Others

The warehouse category is expected to have the greatest share of the autonomous forklift market, driven by the growing demand for better storage management and speedier products movement. As e-commerce and retail enterprises expand, warehouses become crucial hubs for managing enormous inventories. Autonomous forklifts provide a seamless solution for handling, arranging, and transferring products within these spaces, enabling for more efficient operations. Their capacity to increase production while eliminating manual intervention and boosting accuracy makes them an indispensable tool in modern warehousing, where speed, efficiency, and precision are critical for satisfying client needs.

Autonomous Forklift Market By Sales Channel

- In-house Purchase

- Leasing

The leasing segment is likely to take a sizable proportion of the autonomous forklift market as organizations seek flexible and cost-effective options. Leasing helps businesses to avoid the large upfront costs associated with purchase, making it an appealing choice, particularly for small and medium-sized businesses. Furthermore, leasing allows you to gain access to cutting-edge technology without having to worry about ownership, upkeep, or depreciation. As industries progressively implement automation, leasing provides the flexibility to scale operations as needed while reducing long-term financial commitments, establishing it as the preferred option in a continuously changing market.

Autonomous Forklift Market By End Use

- Retail and Wholesale

- Logistics

- Automotive

- Food Industry

- Others

Autonomous forklifts are widely used in the retail and wholesale industries due to the need for speedier inventory handling and order fulfillment. As customer demand for speedy deliveries grows, businesses rely on these forklifts to quickly transport merchandise through warehouses and distribution centers. Autonomous forklifts assist businesses in handling huge amounts of items more efficiently by lowering labor costs and boosting accuracy. Their capacity to quickly adjust to changing warehouse requirements makes them perfect for retail and wholesale businesses, where speed and efficiency are key to staying competitive.

Autonomous Forklift Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Autonomous Forklift Market Regional Analysis

Asia Pacific is the largest region and it is expected to witness faster growth in the near future owing to flourishing e-commerce sector and rising demand from distributors and suppliers. In addition, major players inclination towards developing countries in order to enhance the profit ratio is another factor expected to support the regional autonomous forklift market traction.

The market in Europe is expected to account for notable revenue share owing to increasing demand from various end use industries such as wood industry, construction, automotive food and beverages, etc. In addition, availability of required infrastructure in order to facilitate the adoption of advanced devices, coupled with new product offerings are factors expected to further support the growth of target market.

Autonomous Forklift Market Players

Some of the top autonomous forklift companies offered in our report include Hyundai Heavy Industries Group, AB Volvo, Jungheinrich AG, Linde Material Handling, KION Group AG, Toyota Material Handling Group, Hangcha, Balyo Robotics, Crown equipment, and Mitsubishi Heavy Industries Ltd.

Frequently Asked Questions

How big is the autonomous forklift market?

The autonomous forklift market size was valued at USD 54.2 billion in 2023.

What is the CAGR of the global autonomous forklift market from 2024 to 2032?

The CAGR of Autonomous Forklift is 12.1% during the analysis period of 2024 to 2032.

Which are the key players in the autonomous forklift market?

The key players operating in the global market are including Hyundai Heavy Industries Group, AB Volvo, Jungheinrich AG, Linde Material Handling, KION Group AG, Toyota Material Handling Group, Hangcha, Balyo Robotics, Crown equipment, and Mitsubishi Heavy Industries Ltd.

Which region dominated the global autonomous forklift market share?

Asia-Pacific held the dominating position in autonomous forklift market during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of autonomous forklift during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global autonomous forklift industry?

The current trends and dynamics in the autonomous forklift market include automation is becoming more popular in warehouses and logistics to improve efficiency, labor shortages and rising costs drive demand for automated material handling solutions, AI and sensor technology improve forklift navigation and safety, and growth of e-commerce and just-in-time delivery systems is driving adoption of autonomous forklifts.

Which navigation technology held the maximum share in 2023?

The laser navigation technology held the notable share of the autonomous forklift containers industry.