Automotive Safety System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Safety System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

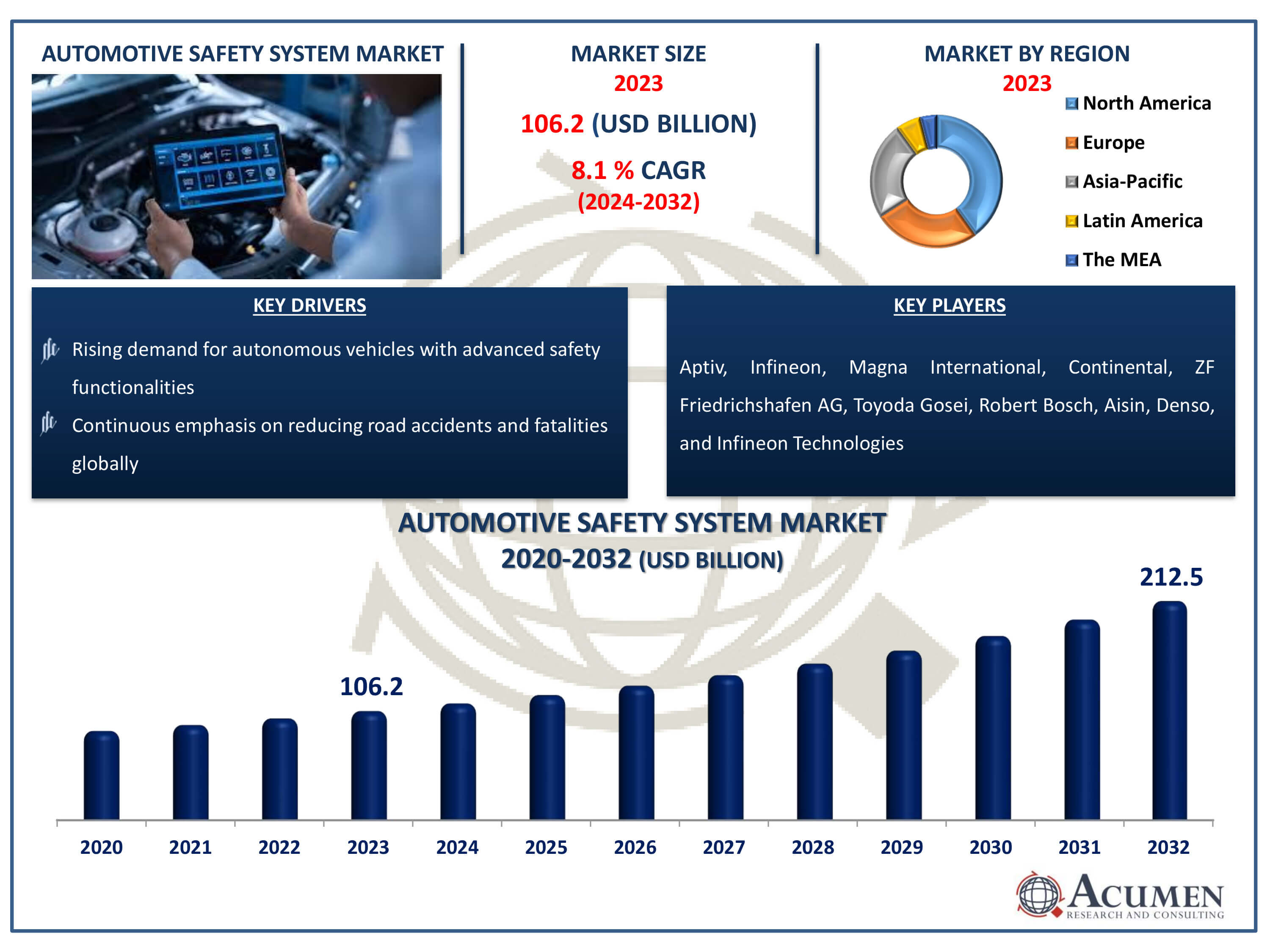

The Automotive Safety System Market Size accounted for USD 106.2 Billion in 2023 and is estimated to achieve a market size of USD 212.5 Billion by 2032 growing at a CAGR of 8.1% from 2024 to 2032.

Automotive Safety System Market Highlights

- Global automotive safety system market revenue is poised to garner USD 212.5 billion by 2032 with a CAGR of 8.1% from 2024 to 2032

- North America automotive safety system market value occupied around USD 42.5 billion in 2023

- Asia-Pacific automotive safety system market growth will record a CAGR of more than 9% from 2024 to 2032

- Among vehicle, the passenger cars sub-segment generated more than USD 58.4 billion revenue in 2023

- Based on type, the active sub-segment generated around 60% market share in 2023

- Rising demand for subscription-based safety services and solutions is a popular automotive safety system market trend that fuels the industry demand

The safety system for the automotive industry is designed to ensure the safety of car passengers by minimizing sudden injuries or accidents. Such systems are split into two parts: active security and passive protection systems. An active protection device is an important way of mitigating injuries and collisions by assisting the driver in controlling the car. Much of the device is computer-controlled and mechanical. A passive protection feature helps to shield car occupants by reducing potential injuries during a crash. The passive protection devices in automobiles include seat belts and airbags.

Global Automotive Safety System Market Dynamics

Market Drivers

- Rising demand for autonomous vehicles with advanced safety functionalities

- Continuous emphasis on reducing road accidents and fatalities globally

- Growing consumer awareness regarding vehicle safety features

- Adoption of vehicle-to-vehicle (V2V) communication technologies to enhance collision avoidance capabilities

Market Restraints

- Limited availability of skilled workforce proficient in developing and maintaining advanced safety technologies for automobiles

- Complexity in integrating safety systems with existing vehicle architectures

- Resistance to change from traditional automotive safety norms and practices

Market Opportunities

- Collaboration opportunities between automotive manufacturers and technology companies to innovate safety solutions

- Increasing adoption of electric vehicles, providing opportunities for safety system integration

- Development of smart infrastructure and vehicle-to-everything (V2X) communication, enhancing safety capabilities

Automotive Safety System Market Report Coverage

| Market | Automotive Safety System Market |

| Automotive Safety System Market Size 2022 | USD 106.2 Billion |

| Automotive Safety System Market Forecast 2032 |

USD 212.5 Billion |

| Automotive Safety System Market CAGR During 2024 - 2032 | 8.1% |

| Automotive Safety System Market Analysis Period | 2020 - 2032 |

| Automotive Safety System Market Base Year |

2022 |

| Automotive Safety System Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Vehicle, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aptiv, Infineon, Magna International, Continental, ZF Friedrichshafen AG, Toyoda Gosei, Robert Bosch, Aisin, Denso, and Infineon Technologies. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Safety System Market Insights

The rise in demand for high-speed cars, along with an increasing population of youthful drivers, has resulted in an increase in accident rates. To address this critical safety issue, contemporary automobiles are increasingly outfitted with innovative safety technology. Blind spot detection systems, lane assist devices, and anti-lock braking systems are just a few examples of collision-prevention technologies. In compliance with the Safety Standard for Federal Motor Vehicles, all cars in the United States are mandated to feature front seat belts. As an additional measure to bolster occupant safety, automotive manufacturers are integrating seat belt pretensioners, which act in conjunction with seat belts to enhance protection during sudden deceleration events. By preemptively tightening the seatbelt, pretensioners ensure occupants are securely positioned before the deployment of airbags, thereby minimizing the risk of injury upon impact.

Seatbelts are the most common and effective occupant restraint system component. Meanwhile, airbags are life-saving devices that must be installed in front passenger and driver positions across North America. This trend is mirrored in China, where the Chinese New Car Assessment Programme requires the installation of front airbags in all vehicles, increasing demand for these vital safety features. In the field of head restraints, automakers such as Mercedes-Benz and BMW have embraced new methods to reduce the danger of whiplash. These manufacturers use modern active head restraint systems, which use pressurised gas or spring mechanisms to quickly and efficiently cushion the head following a crash, lowering the risk of neck injuries. Overall, these collaborative initiatives demonstrate the automobile industry's commitment to improving occupant safety via a holistic strategy that includes both active and passive safety elements.

Automotive Safety System Market Segmentation

The worldwide market for automotive safety system is split based on type, vehicle end use, and geography.

Automotive Safety System Types

- Active

- Automatic Emergency Braking (AEB)

- Anti-Lock Braking Systems (ABS)

- Electronic Stability Control (ESC)

- Blind Spot Detection (BSD)

- Tire Pressure Monitoring Systems (TPMS)

- Forward-collision Warning (FCW)

- Lane Departure Warning Systems (LDWS)

- Other Active Types

- Passive

- Airbags

- Seatbelts

- Other

According to automotive safety system industry analysis, the active category is expected to have the highest share. This estimate is based on a number of variables, including increased regulatory requirements for the integration of active safety technology in automobiles such as collision avoidance systems, lane departure alerts, and adaptive cruise control. Furthermore, advances in sensor technology, artificial intelligence, and vehicle-to-vehicle communication have accelerated the deployment of active safety systems. Furthermore, increased customer desire for automobiles with sophisticated safety features helps to maintain the Active segment's dominance. As automobile manufacturers work to improve vehicle safety and satisfy growing safety regulations, the Active sector is projected to continue its dominance over the automotive safety system market forecast period by providing complete protection and accident prevention capabilities.

Automotive Safety System Vehicles

- Passenger Cars

- Commercial Vehicles

Passenger cars are expected to have the greatest share throught the automotive safety system industry forecast period. This is because passenger automobiles are produced and sold at a higher rate than commercial vehicles. Furthermore, passenger automobiles are frequently utilised for everyday commute and family transportation, thus customers place a high value on safety. As a result, automobile manufacturers place a high priority on providing modern safety equipment such as airbags, anti-lock brake systems, and electronic stability control. Furthermore, regulatory authorities throughout the world frequently establish tighter safety regulations for passenger automobiles, which drives up the use of safety technologies in this sector. Passenger Cars are predicted to dominate the automotive safety system market due to their bigger market size and customer demand for safer driving experiences.

Automotive Safety System End Uses

- Aftermarket

- OEM

In the automotive safety system market, the original equipment manufacturer (OEM) segment is expected to claim the largest share. This is primarily because OEMs integrate safety systems directly into new vehicles during manufacturing, ensuring widespread adoption of advanced safety features. Consumers often prioritize safety when purchasing new vehicles, leading OEMs to invest heavily in cutting-edge safety technologies to meet market demand. Additionally, stringent safety regulations and standards worldwide compel OEMs to include comprehensive safety systems in their vehicles. While the aftermarket also offers safety system upgrades, the OEM segment benefits from the advantage of seamless integration and assurance of compatibility with vehicle specifications. As a result, OEMs are poised to maintain their dominance in the automotive safety system market, catering to the safety-conscious preferences of consumers worldwide.

Automotive Safety System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Safety System Market Regional Analysis

In terms of automotive safety system market analysis, North America is expected to maintain its position as the top active industry, aided by continuous advances and developments in active safety technology. Simultaneously, Asia-Pacific emerges as the key centre for passive protection systems, demonstrating a determined commitment to improve occupant safety via improved passive safety features. The Asia-Pacific area, notably China and India, has a rising market for passive defense systems, driven by a constant growth in vehicle production and the growing integration of passive safety technology into each vehicle. Furthermore, the implementation of stronger laws increases demand for passive safety systems, highlighting the region's dedication to increasing vehicle safety standards.

On the other hand, the United States remains a key growth engine for the North American sector, notably in the field of active safety systems. The need for these systems is driven by a number of causes, including the enforcement of severe safety rules and the ongoing development of novel safety technology targeted at improving passenger safety. In parallel, Europe is experiencing an increase in active safety programs, matching the pattern seen in North America. These activities are in reaction to more strict legal measures aimed at improving road safety standards. Together, these areas make major contributions to the global innovation and adoption of both active and passive vehicle safety technologies, demonstrating a shared commitment to prioritizing passenger safety on the road globally.

Automotive Safety System Market Players

Some of the top automotive safety system companies offered in our report include Aptiv, Infineon, Magna International, Continental, ZF Friedrichshafen AG, Toyoda Gosei, Robert Bosch, Aisin, Denso, and Infineon Technologies.

Frequently Asked Questions

How big is the automotive safety system market?

The automotive safety system market size was valued at USD 106.2 billion in 2023.

What is the CAGR of the global automotive safety system market from 2024 to 2032?

The CAGR of automotive safety system is 8.1% during the analysis period of 2024 to 2032.

Which are the key players in the automotive safety system market?

The key players operating in the global market are including Aptiv, Infineon, Magna International, Continental, ZF Friedrichshafen AG, Toyoda Gosei, Robert Bosch, Aisin, Denso, and Infineon Technologies.

Which region dominated the global automotive safety system market share?

North America held the dominating position in automotive safety system industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive safety system during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive safety system industry?

The current trends and dynamics in the automotive safety system industry include rising demand for autonomous vehicles with advanced safety functionalities, continuous emphasis on reducing road accidents and fatalities globally, growing consumer awareness regarding vehicle safety features, and adoption of vehicle-to-vehicle (V2V) communication technologies to enhance collision avoidance capabilities.

Which vehicle held the maximum share in 2023?

The passenger cars vehicle held the maximum share of the automotive safety system industry.