Automotive Seat Belts Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Seat Belts Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

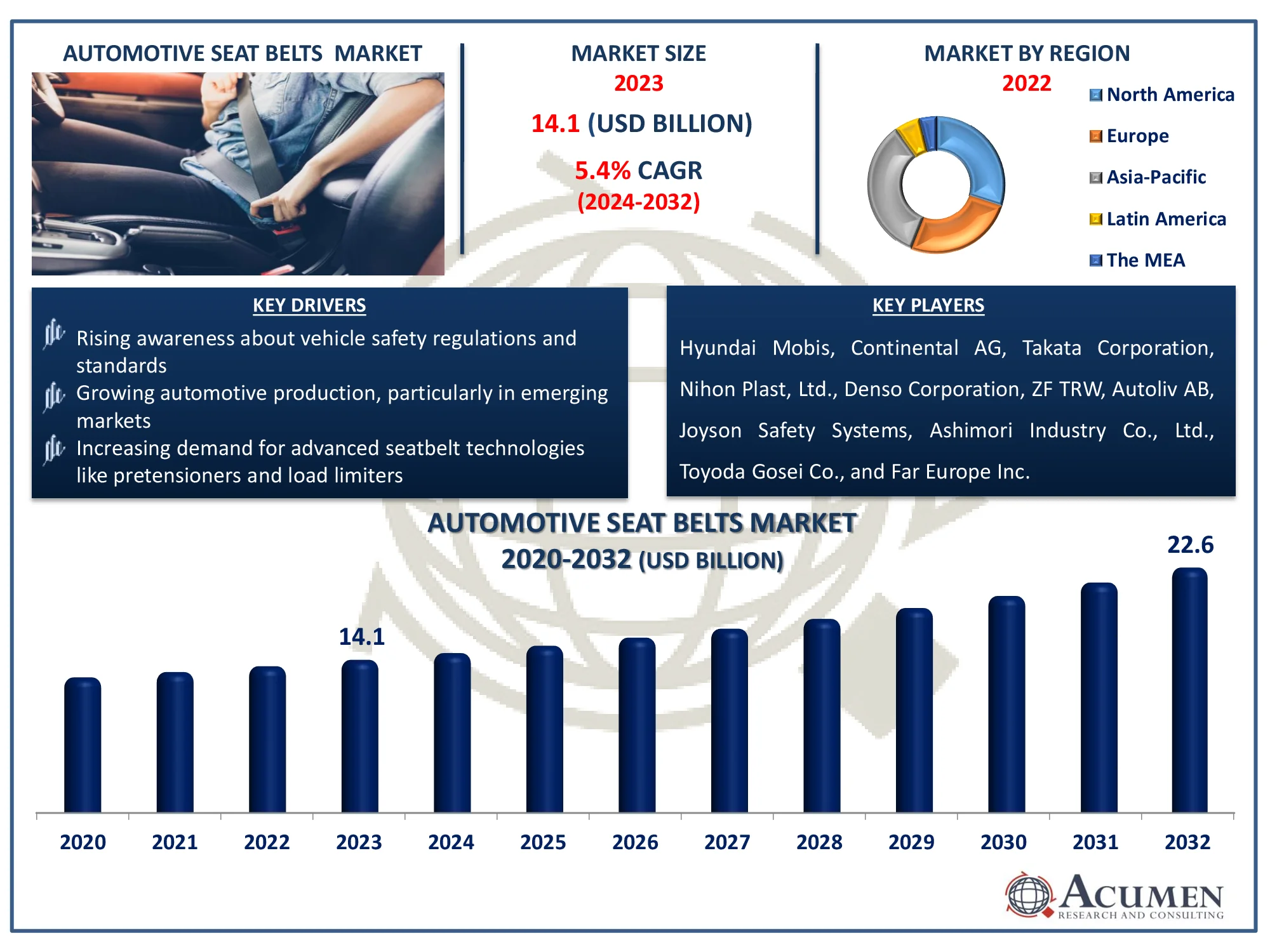

The Global Automotive Seat Belts Market Size accounted for USD 14.1 Billion in 2023 and is estimated to achieve a market size of USD 22.6 Billion by 2032 growing at a CAGR of 5.4% from 2024 to 2032.

Automotive Seat Belts Market (By Type: 3 Point Seatbelt, 2 Point Seatbelt; By Vehicle Type: Heavy Commercial Vehicles, Light Commercial Vehicles, Passenger Vehicles; By Component: Webbing Strap, Buckles, Tongues, Retractors, Pillar Loops; By Distribution Channel: Aftermarket, OEM; and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Automotive Seat Belts Market Highlights

- The global automotive seat belts market revenue is expected to reach USD 22.6 billion by 2032, with a CAGR of 5.4% from 2024 to 2032

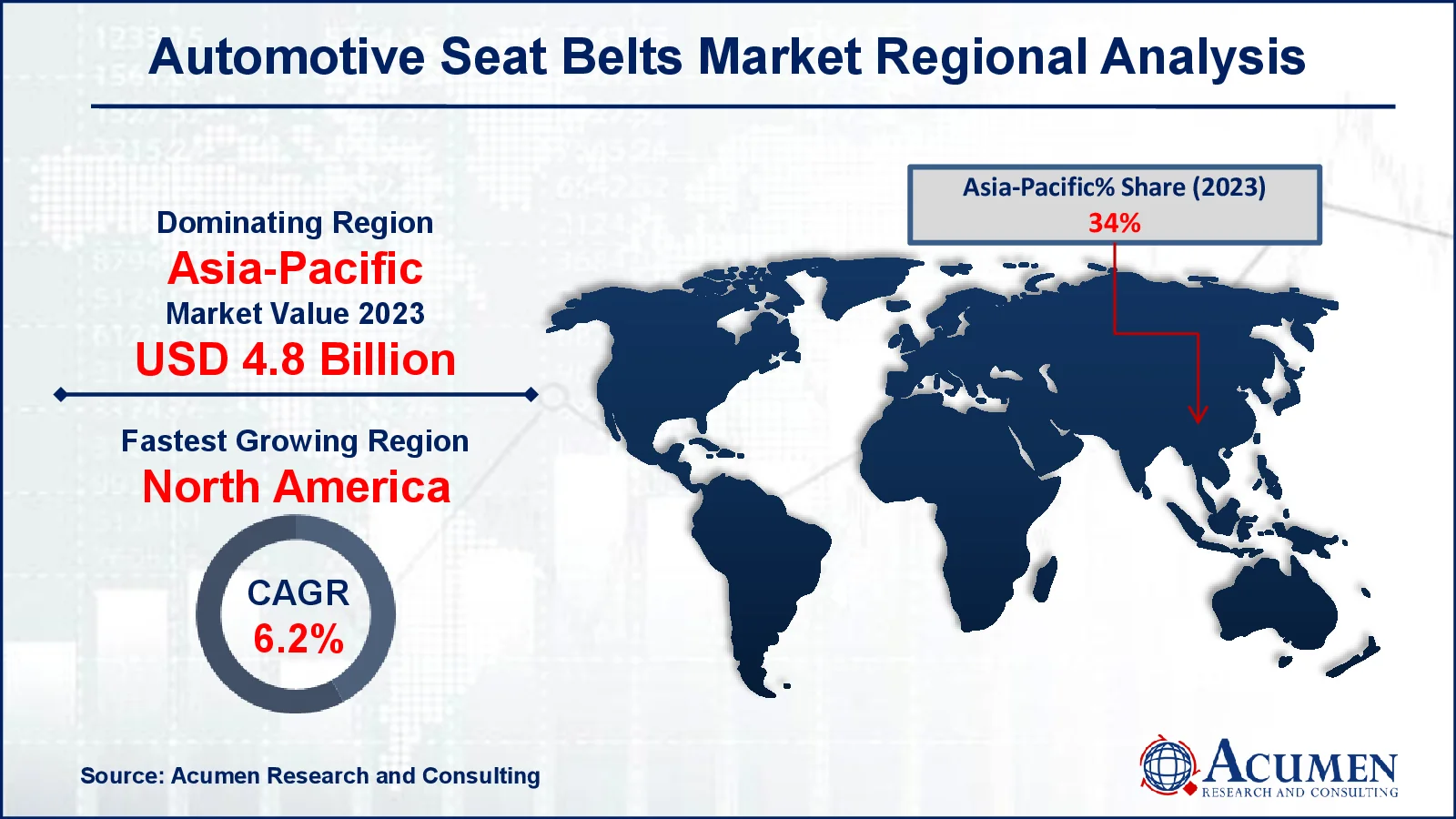

- In 2023, the Asia-Pacific automotive seat belts market was valued at approximately USD 4.8 billion

- The North America automotive seat belts market is projected to grow at a CAGR of over 6.2% from 2024 to 2032

- The 3-point seatbelt sub-segment accounted for 65% of the market share in 2023

- The passenger vehicles sub-segment generated 47% of the market share in 2023

- The retractors sub-segment made up 26% of the market share in 2023

- The OEM distribution channel accounted for 63% of the market share in 2023

- Enhanced customization options for seat belts to meet diverse consumer preferences and vehicle designs is the automotive seat belts market trend that fuels the industry demand

Seat loops are vital car components. Seat belts are known as life savers in the event of an accident. Such belts protect the driver and co-passengers of a vehicle at the time of an accident; hence seat belts should be worn at all times when driving. There are six distinct types of seat belts available, including two-point, three-point, four-point, and five-point belts. A two-point seat belt is fastened at both ends. A lap belt wraps around the waist, while a sash belt grips the shoulder. The automobile seat belts market is being pushed by a growing emphasis on passenger safety and compliance with severe safety standards worldwide. Seat belt technological innovations, are improving the efficiency of restraint systems, resulting in fewer fatalities in accidents. Vehicle manufacturing is increasing, particularly in emerging markets, creating major market expansion potential.

Global Automotive Seat Belts Market Dynamics

Market Drivers

- Rising awareness about vehicle safety regulations and standards

- Growing automotive production, particularly in emerging markets

- Increasing demand for advanced seatbelt technologies like pretensioners and load limiters

Market Restraints

- High costs associated with advanced safety systems

- Limited adoption of safety technologies in low-cost vehicles

- Market saturation in developed regions

Market Opportunities

- Integration of seat belts with intelligent safety systems (e.g., airbags, sensors)

- Expanding electric vehicle (EV) market driving demand for enhanced safety features

- Growth in automotive sales in developing economies offering untapped potential

Automotive Seat Belts Market Report Coverage

| Market | Automotive Seat Belts Market |

| Automotive Seat Belts Market Size 2022 |

USD 14.1 Billion |

| Automotive Seat Belts Market Forecast 2032 | USD 22.6 Billion |

| Automotive Seat Belts Market CAGR During 2023 - 2032 | 5.4% |

| Automotive Seat Belts Market Analysis Period | 2020 - 2032 |

| Automotive Seat Belts Market Base Year |

2022 |

| Automotive Seat Belts Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Vehicle Type, By Component, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Hyundai Mobis, Continental AG, Takata Corporation, Nihon Plast, Ltd., Denso Corporation, ZF TRW, Autoliv AB, Joyson Safety Systems, Ashimori Industry Co., Ltd., Toyoda Gosei Co., and Far Europe Inc.. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Seat Belts Market Insights

The automotive seatbelt market will gradually raise awareness of passenger and driver safety. The belts are exceptionally effective at preventing and reducing accident injuries. According to the ANCAP, approximately 90% of accidents are caused by human error, and safety belts boost the odds of survival in an accident event. Furthermore, automakers outfit cars with a variety of safety features to help the sector develop.

Automotive seat belts market share grows as vehicle ownership increases in both developed and emerging countries. According to the India Brand Equity Foundation, in April 2024, the total output of passenger vehicles, three-wheelers, two-wheelers, and quadricycles was 23, 58,041. Growing car sales in some regions, such as Europe, will help drive market development, as would the anticipated mandate for safety belt reminder systems. Furthermore, quick upgrades to these car technologies over the following six years will aid in product penetration.

Governmental legislation is enacted to decrease fatal injuries and improve passenger safety through the incorporation of a safety system. For instance, according to U.S Department of Transportation, primary enforcement seat belt regulations allow law enforcement personnel to pull over vehicles if a driver or passenger is not wearing a seat belt. Secondary enforcement seat belt regulations require law enforcement authorities to have another ground for stopping a vehicle before citation a driver or passenger for not wearing a seat belt. These activities will gradually increase the market size of car seat belts.

Participants in the sector develop their product line to boost efficiency and security. Continued efficiency advancements will drive market growth. Belt sensors are required to meet product demand while implementing novel systems like as V2V and ADAS. Advanced items, like as inflatable seat belts, and are paired with airbag technology to provide an extra layer of passive crash safety. The inflatable seatbelt is intended to lessen overall pressure while also providing rear seat passengers with increased head and neck motion. It also decreases the severity of injuries by distributing crash force energy over the occupant's body. These advances will gradually increase market penetration.

Automotive Seat Belts Market Segmentation

The worldwide market for automotive seat belts is split based on type, vehicle type, component, distribution channel, and geography.

Automotive Seat Belt Market By Type

- 3 Point Seatbelt

- 2 Point Seatbelt

According to the automotive seat belts industry analysis, because of greater safety and superior comfort, 3 points accounted for around 65% of the market in 2023. With a shorter length, the product has a higher strap capacity. Increased flexibility in adjusting belts for children and women will result in significant growth possibilities in the industrial landscape. Furthermore, mandatory usage of the system in passenger vehicles will boost product demand even further.

Additionally, due to the availability of customized lengths, different color combinations, and variants such as chromium latches, the market share of two vehicle seat belts will rapidly increase. Low building costs and implementation will increase segment penetration for rear passengers. However, higher risks of linked injuries compared to the three-point system will limit segment growth over the next years.

Automotive Seat Belt Market By Vehicle Type

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Passenger Vehicles

According to the automotive seat belts industry analysis, the seatbelt percentage of passenger vehicles is projected to rise dramatically as automobiles get more adaptable and new car types are introduced. Increased consumer spending and cheap financing lead to increased automobile ownership. Participants in the automotive sector are introducing enhanced safety-related vehicles to better serve the general consumer base. Because of the growth of the logistics industry, light commercial vehicles have a sizable market share in the car seat strap market. Increased cargo activity worldwide creates demand for cars.

Automotive Seat Belt Market By Component

- Webbing Strap

- Buckles

- Tongues

- Retractors

- Pillar Loops

According to the automotive seat belts market forecast, retractors are crucial components in the market because they control the length and tension of the seat belt when in use. Their design enables for seamless retraction and stretches the seat belt as needed, increasing user comfort and safety. As vehicle manufacturers focus more on integrating modern safety systems, the demand for high-performance retractors has increased significantly. Furthermore, advances in retractor technology, such as automatic locking mechanisms and sophisticated sensors, are increasing their market domination.

Automotive Seat Belt Market By Distribution Channel

- Aftermarket

- OEM

According to the automotive seat belts market analysis, OEM dominates the industry through execution throughout automobile manufacture. The dominance can also be described to increased vehicle production and the mandatory requirement to incorporate items into new vehicles in various nations. Over time, the sector is boosted by new car introductions with increased safety features.

The introduction of low-cost belt technology has resulted in a significant increase in market growth. The new design allows automobile owners to install safety belts for a cost of one-third to one-half. Furthermore, higher need for the replacement of outdated automobiles will drive up product demand.

Automotive Seat Belts Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Seat Belts Market Regional Analysis

For several reasons, the Asia-Pacific area leads the automotive seat belts market due to the automotive industry's strong growth, which is being driven by increased vehicle ownership. Furthermore, severe safety rules and government measures to promote vehicle safety standards increase demand for improved seat belt technologies in this region. For instance, the Indian government has launched the Bharat New Car Assessment Program (Bharat NCAP), which marks a key milestone in road safety in India. Key automotive companies in China, India, and Japan are growing their production capabilities, which contribute significantly to the market's supremacy in Asia-Pacific.

North America expected to boost demand of automotive seat belts market in forecast year because of mandatory vehicle seatbelt laws. Increased industry expansion is fueling the development of a variety of safety measures, including a 5-star safety rating program to promote passenger and driver safety. Key players investment to boosts market demand further enhance regional growth. For instance, Dayco, Inc., a manufacturer of engine products and drive systems for the automotive, industrial, and aftermarket industries, has established a new manufacturing facility in San Luis Potosí, Mexico, to produce its globally recognized OE-quality drive belts.

Automotive Seat Belts Market Players

Some of the top automotive seat belts companies offered in our report include Hyundai Mobis, Continental AG, Takata Corporation, Nihon Plast, Ltd., Denso Corporation, ZF TRW, Autoliv AB, Joyson Safety Systems, Ashimori Industry Co., Ltd., Toyoda Gosei Co., and Far Europe Inc.

Frequently Asked Questions

How big is the automotive seat belts market?

The automotive seat belts market size was valued at USD 14.1 billion in 2023.

What is the CAGR of the global automotive seat belts market from 2024 to 2032?

The CAGR of automotive seat belts is 5.4% during the analysis period of 2024 to 2032.

Which are the key players in the automotive seat belts market?

The key players operating in the global market are including Hyundai Mobis, Continental AG, Takata Corporation, Nihon Plast, Ltd., Denso Corporation, ZF TRW, Autoliv AB, Joyson Safety Systems, Ashimori Industry Co., Ltd., Toyoda Gosei Co., and Far Europe Inc.

Which region dominated the global automotive seat belts market share?

Asia-Pacific held the dominating position in automotive seat belts industry during the analysis period of 2024 to 2032.

Which region registered fastest-growing CAGR from 2024 to 2032?

North America region exhibited fastest-growing growing CAGR for market of automotive seat belts during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive seat belts industry?

The current trends and dynamics in the automotive seat belts industry include rising awareness about vehicle safety regulations and standards, growing automotive production, particularly in emerging markets, and increasing demand for advanced seatbelt technologies like pretensioners and load limiters.

Which type held the maximum share in 2023?

The 3 point seatbelt type held the maximum share of the automotive seat belts industry.