Automotive Laser Headlight Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Laser Headlight Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

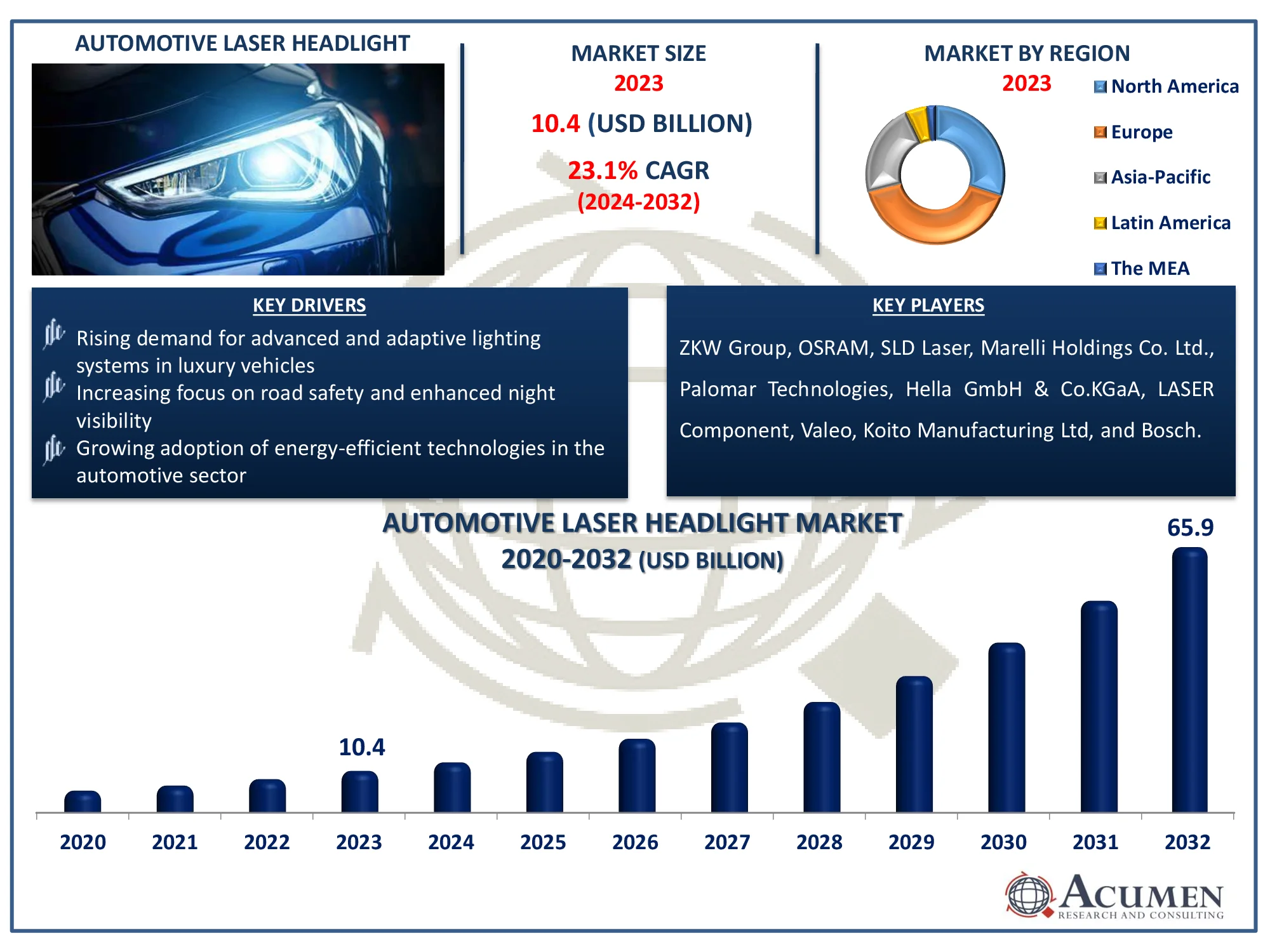

The Global Automotive Laser Headlight Market Size accounted for USD 10.4 Billion in 2023 and is estimated to achieve a market size of USD 65.9 Billion by 2032 growing at a CAGR of 23.1% from 2024 to 2032.

Automotive Laser Headlight Market Highlights

- The global automotive laser headlight market is expected to reach USD 65.9 billion by 2032, growing at a CAGR of 23.1% from 2024 to 2032

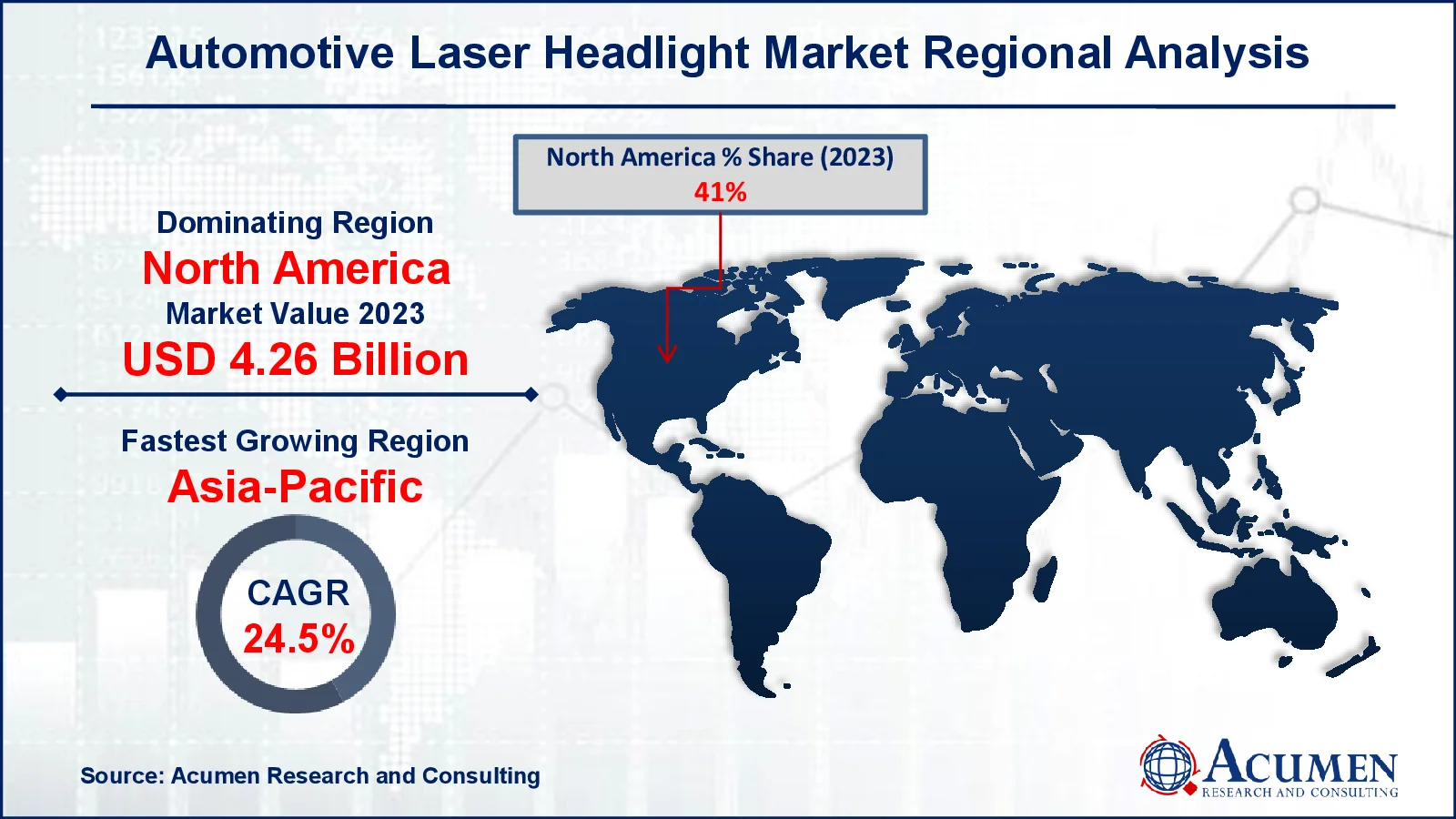

- North America's automotive laser headlight market was valued at approximately USD 4.26 billion in 2023

- The Asia-Pacific automotive laser headlight market is projected to grow at a CAGR of over 24.5% from 2024 to 2032

- The passenger vehicle segment accounted for 70% of the market share in 2023

- The OEM sales channel segment generated 65% of the market share in 2023

- Growth of intelligent lighting systems with adaptive beam control is the automotive laser headlight market trend that fuels the industry demand

Automotive laser headlights are vehicle components that illuminate the road surface to improve safety and reduce the chance of accidents. Laser headlights are an innovative technology used in automobiles in which laser beams are fired on mirrors incorporated into the headlight system, and the mirrors then focus the beams into a yellow phosphorous-filled lens, which eventually emits high intensity white light. The laser headlamp concept was first deployed by BMW and Audi in 2014. Laser headlights were previously used exclusively in expensive cars in Europe.

BMW employed laser headlights for its $136,000 model i8, which features three blue laser diodes per headlamp. In addition, Audi employed a laser headlamp concept in its 2014 model R8 LMX, which cost $289,000 and had four blue laser diodes for a single headlight, as well as a combination of LEDs. The use of headlights in the aforementioned models raised their pricing from $8,000 to $12,000 for a single vehicle. Furthermore, beginning in 2017, Audi A7 models included laser headlights. According to BMW estimations, laser lights have 1000 times the lighting power of LEDs, making them the most impressive bulb technologies available today. Furthermore, they require less energy to operate and are significantly smaller than traditional lighting systems.

Global Automotive Laser Headlight Market Dynamics

Market Drivers

- Rising demand for advanced and adaptive lighting systems in luxury vehicles

- Increasing focus on road safety and enhanced night visibility

- Growing adoption of energy-efficient technologies in the automotive sector

Market Restraints

- High manufacturing and installation costs of laser headlights

- Limited availability and integration in mid-segment vehicles

- Complex regulatory and safety standards for automotive lighting systems

Market Opportunities

- Expansion of laser headlight adoption in electric and autonomous vehicles

- Technological advancements reducing costs and increasing accessibility

- Emerging markets in Asia-Pacific with growing demand for premium vehicles

Automotive Laser Headlight Market Report Coverage

|

Market |

Automotive Laser Headlight Market |

|

Automotive Laser Headlight Market Size 2023 |

USD 10.4 Billion |

|

Automotive Laser Headlight Market Forecast 2032 |

USD 65.9 Billion |

|

Automotive Laser Headlight Market CAGR During 2024 - 2032 |

23.1% |

|

Automotive Laser Headlight Market Analysis Period |

2020 - 2032 |

|

Automotive Laser Headlight Market Base Year |

2023 |

|

Automotive Laser Headlight Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Vehicle, By Technology, By Power Type, By Sales Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

ZKW Group, OSRAM, SLD Laser, Marelli Holdings Co. Ltd., Palomar Technologies, Hella GmbH & Co.KGaA, LASER Component, Valeo, Koito Manufacturing Ltd, and Bosch. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Laser Headlight Market Insights

The worldwide automotive laser headlight market is growing primarily as people become more aware of the benefits of efficient lighting. The rising demand for luxury vehicles, driven by rising disposable incomes in emerging economies, is also boosting market value. According to India Brand Equity Foundation (IBBF), luxury car sales in India hit a record high of 42,731 units in 2023, representing a 20% year-on-year increase.

In addition, luxury vehicle manufacturers are incorporating innovative lighting systems, comfort, and safety features to increase market value. Additionally, Automotive Skills Development Council (ASDC) states that automotive lighting has progressed from basic bulbs to complex technology like as adaptive LEDs and laser headlights, which provide better visibility, longer range, and increased safety. Autonomous vehicles will use high-precision illumination to navigate. Interactive exterior and ambient interior lighting will improve connection with others on the road and create individualized places.

Laser headlights are gaining popularity due to a fast increasing number of accidents around the world. For instance, the Ministry of Road Transport and Highways' (MORTH) Annual Report 2023-24 in India includes accident numbers for the calendar year 2022. During the year, 461,312 accidents injured 443,366 individuals and died 168,491. This growing number of accidents is forcing manufacturers to install more efficient lighting systems into automobiles and helps to enhance industry’s growth in forecast year.

The respective governments are also implementing rigorous rules and regulations to improve road safety. Aside from this, the laser headlights provide high-intensity light, which increases visibility range when driving the growth.

Automotive Laser Headlight Market Segmentation

The worldwide market for automotive laser headlight is split based on vehicle, technology, power type, sales channel, and geography.

Automotive Laser Headlight Market By Vehicle

- Passenger Vehicle

- Commercial Vehicle

According to the automotive laser headlight industry analysis, passenger vehicles dominate market, because to the widespread use of advanced lighting systems in luxury and premium car categories. In January 2023, Mercedes-Benz claimed that had sold 2.05 million passenger vehicles in 2022. According to Mercedes, the number of battery-electric cars (BEVs) sold has more than doubled, reaching 117,800 in 2022. The United States saw the greatest gain in Mercedes-Benz passenger car sales this year, up 4%, while Europe saw a 1% increase. This rising innovations in passenger vehicles by manufacturers is driving demand for passenger cars segment in industry.

Automotive Laser Headlight Market By Technology

- Intelligent

- Conventional

According to the automotive laser headlight industry analysis, the intelligent technology segment is expected to increase significantly in business due to its capacity to improve driving safety and convenience. Adaptive beam control, laser high-beam assist, and integration with driver-assistance systems improve visibility and provide dynamic lighting that is suited to road conditions. Automakers are increasingly using intelligent lighting systems to suit consumer demand for sophisticated safety features and luxury upgrades. Furthermore, breakthroughs in AI and IoT are propelling innovation, making intelligent laser headlamps more accessible across a variety of vehicle segments.

Automotive Laser Headlight Market By Power Type

- 35W

- 40W

- 60W

According to the automotive laser headlight market forecast, the 60w power type is widely adopted in premium and luxury vehicles for its superior brightness and extended range. This segment caters to consumers prioritizing advanced lighting solutions for enhanced safety and visibility, particularly in high-speed and long-distance driving conditions. Meanwhile, the 35W and 40W segments are gaining traction in mid-range and energy-efficient vehicles, appealing to cost-sensitive consumers seeking moderate lighting performance with lower energy consumption.

Automotive Laser Headlight Market By Sales Channel

- OEM

- Aftermarket

According to the automotive laser headlight market forecast, the OEM sales channel dominates in sector because these lighting systems are primarily incorporated during vehicle production. OEMs offer a seamless and dependable solution, assuring compliance with vehicle design and modern safety features. Automakers highlight laser headlights as a significant feature in premium and luxury cars, resulting in increased adoption through OEM channels. Furthermore, the growing popularity of factory-installed advanced lighting technology strengthens this segment's lead over aftermarket alternatives.

Automotive Laser Headlight Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Laser Headlight Market Regional Analysis

For several reasons, North America dominates the automotive laser headlight market due to the strong presence of luxury car manufacturers and early adoption of advanced automotive technologies. The United States Department of Transportation's National Roadway Safety Strategy (NRSS) is a plan to make roads safer and reduce the number of serious injuries and deaths caused by traffic accidents. The ultimate goal is to eliminate all roadway fatalities in the future. This strategy is the first step toward achieving that goal. These initiatives further drive the demand for safer alternatives in the automotive industry, which, in turn, enhances the growth of the automotive laser headlight market in the North American region.

Asia-Pacific is witnessing rapid growth in the automotive laser headlight market, fueled by the increasing production of vehicles in countries like China, Japan, and South Korea. India Brand Equity Foundation states that by 2030, India might be a global leader in shared transportation, opening up potential for electric and autonomous vehicles. Rising disposable income and growing consumer preference for advanced automotive features are boosting demand in this region. Moreover, expanding EV adoption and government incentives for high-tech vehicle manufacturing support market expansion in Asian region.

Automotive Laser Headlight Market Players

Some of the top automotive laser headlight companies offered in our report includes ZKW Group, OSRAM, SLD Laser, Marelli Holdings Co. Ltd., Palomar Technologies, Hella GmbH & Co.KGaA, LASER Component, Valeo, Koito Manufacturing Ltd, and Bosch.

Frequently Asked Questions

How big is the automotive laser headlight market?

The automotive laser headlight market size was valued at USD 10.4 billion in 2023.

What is the CAGR of the global automotive laser headlight market from 2024 to 2032?

The CAGR of automotive laser headlight is 23.1% during the analysis period of 2024 to 2032.

Which are the key players in the automotive laser headlight market?

The key players operating in the global market are including ZKW Group, OSRAM, SLD Laser, Marelli Holdings Co. Ltd., Palomar Technologies, Hella GmbH & Co.KGaA, LASER Component, Valeo, Koito Manufacturing Ltd, and Bosch.

Which region dominated the global automotive laser headlight market share?

North America held the dominating position in automotive laser headlight industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive laser headlight during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive laser headlight industry?

The current trends and dynamics in the automotive laser headlight industry include rising demand for advanced and adaptive lighting systems in luxury vehicles, increasing focus on road safety and enhanced night visibility, and growing adoption of energy-efficient technologies in the automotive sector.

Which vehicle held the maximum share in 2023?

The passenger vehicle held the maximum share of the automotive laser headlight industry.