Automotive Smart Lighting Market | Acumen Research and Consulting

Automotive Smart Lighting Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

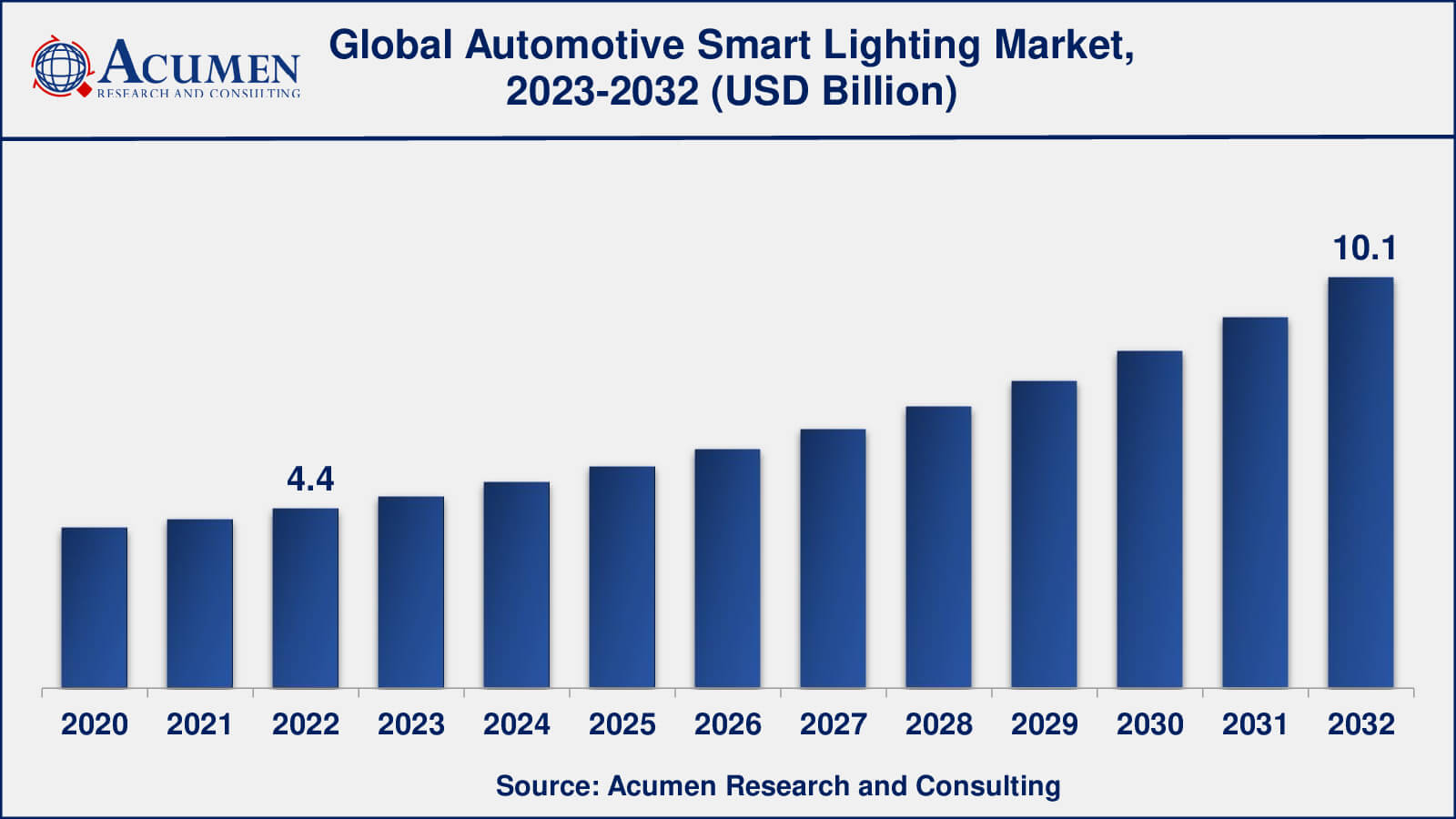

The Global Automotive Smart Lighting Market Size accounted for USD 4.4 Billion in 2022 and is estimated to achieve a market size of USD 10.1 Billion by 2032 growing at a CAGR of 8.8% from 2023 to 2032.

Automotive Smart Lighting Market Highlights

- Global automotive smart lighting market revenue is poised to garner USD 10.1 billion by 2032 with a CAGR of 8.8% from 2023 to 2032

- Europe automotive smart lighting market value occupied more than USD 1.6 billion in 2022

- Asia-Pacific automotive smart lighting market growth will record a CAGR of more than 9% from 2023 to 2032

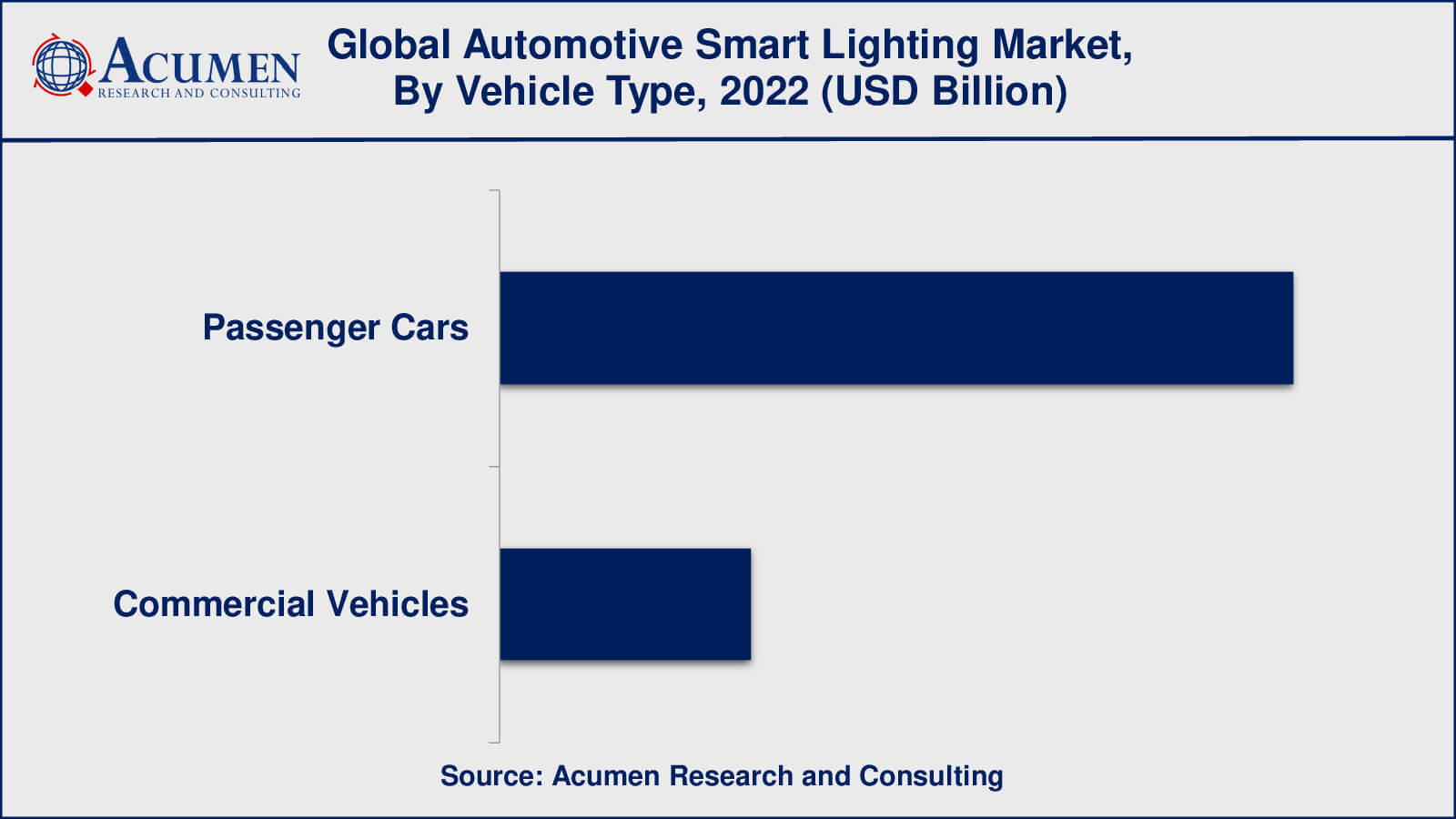

- Among vehicle type, the passenger cars sub-segment generated over US$ 3.4 billion revenue in 2022

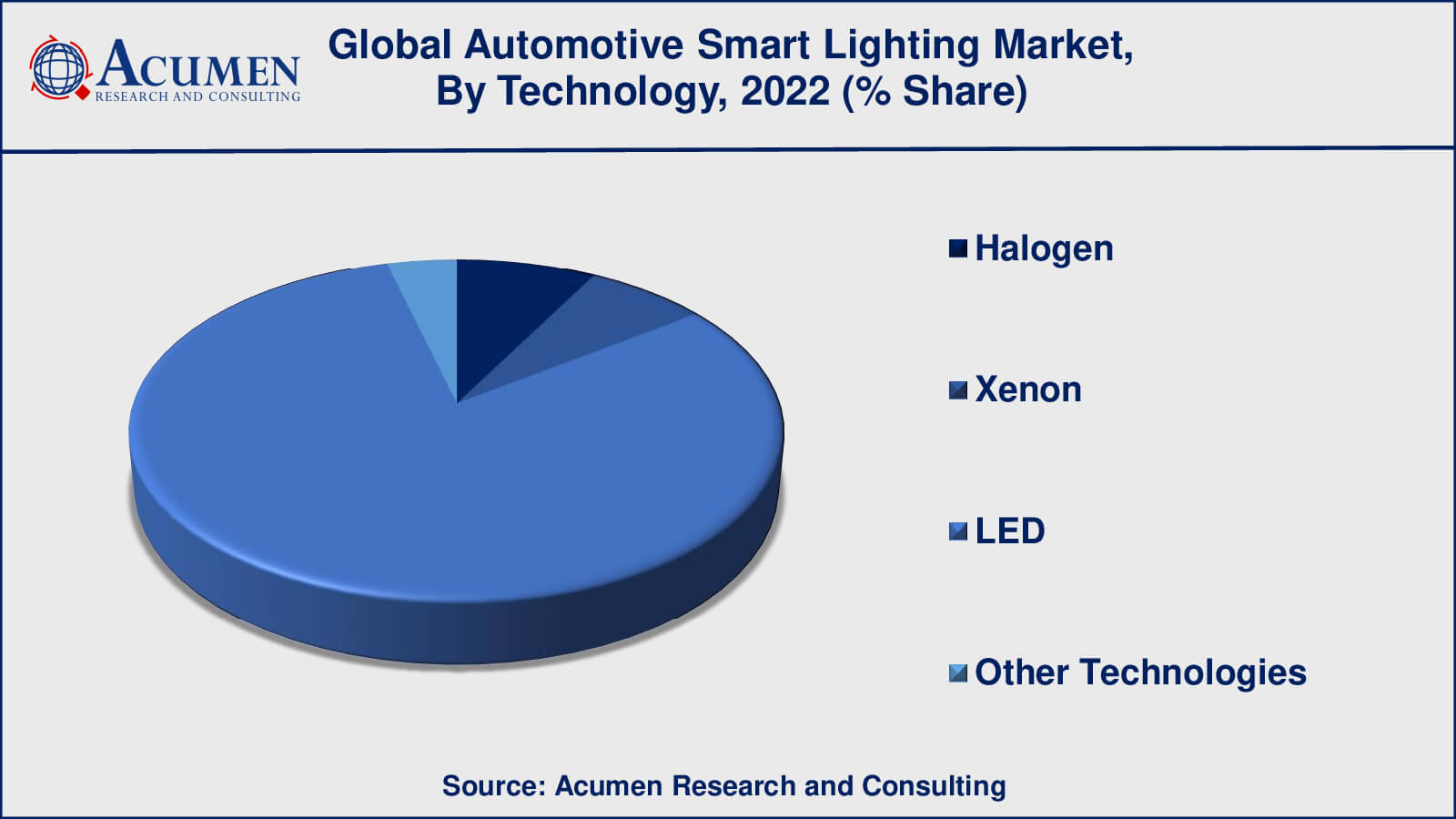

- Based technology, the LED sub-segment generated more than 80% share in 2022

- Automaker offering customizable lighting options is a popular automotive smart lighting market trend that fuels the industry demand

Automotive smart lighting is a cutting-edge technology that provides vehicles with an innovative lighting experience. Smart lighting systems detect changes in the driving environment and adjust the lighting accordingly, using a variety of sensors, cameras, and other technologies. This technology improves visibility, energy efficiency, and provides a more personalized and comfortable driving experience. The demand for automotive smart lighting is expected to rise in the coming years as automakers and consumers alike recognize the advantages of these advanced lighting technologies. The growing emphasis on safety and energy efficiency in the automotive industry, in particular, is driving the popularity of intelligent lighting systems, which can help reduce accidents, improve visibility, and reduce energy consumption.

Laser lighting technology is a relatively new advancement in the automotive industry that employs laser diodes to generate an intense, high-beam light that is both brighter and more energy-efficient than conventional lighting technologies. The use of augmented reality head-up displays (HUDs) in automotive smart lighting is a relatively new development. These HUDs use advanced lighting and projection technologies to exhibit important information on the windscreen in front of the driver, such as speed, navigation, and safety alerts. To provide more advanced and automated lighting features, AI and machine learning are increasingly being integrated into automotive smart lighting systems. AI-powered lighting systems, for example, can detect and react to shifts in the driving environment in real time, adjusting lighting patterns and intensity to optimize visibility and safety.

Global Automotive Smart Lighting Market Dynamics

Market Drivers

- Increasing focus on safety in the automotive industry

- Growing need for energy-efficient lighting solutions

- Rising consumer inclination towards advanced features

Market Restraints

- High cost of smart lighting

- Lack of awareness among some consumers

- Compatibility issues between different lighting technologies

Market Opportunities

- Stringent government regulations regarding vehicle safety

- Adoption of LEDs, OLEDs, and laser lightings

- Integration of artificial intelligence (AI) and machine learning

Automotive Smart Lighting Market Report Coverage

| Market | Automotive Smart Lighting Market |

| Automotive Smart Lighting Market Size 2022 | USD 4.4 Billion |

| Automotive Smart Lighting Market Forecast 2032 | USD 10.1 Billion |

| Automotive Smart Lighting Market CAGR During 2023 - 2032 | 8.8% |

| Automotive Smart Lighting Market Analysis Period | 2020 - 2032 |

| Automotive Smart Lighting Market Base Year | 2022 |

| Automotive Smart Lighting Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Vehicle Type, By Technology, By Application, By Sales Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Continental AG, Cree, Inc., Flex Ltd., Hella GmbH & Co. KGaA, Hyundai Mobis Co., Ltd., Ichikoh Industries, Ltd., Koito Manufacturing Co., Ltd., Magneti Marelli S.p.A., Osram GmbH, Philips Lighting BV, Stanley Electric Co., Ltd., Texas Instruments Incorporated, Valeo S.A., Varroc Lighting Systems, and ZKW Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Smart Lighting Market Insights

The automotive smart lighting market is expected to experience significant growth in the coming years due to several key factors. The increasing demand for advanced safety features in vehicles is one of the primary growth factors. Smart lighting systems can improve visibility and driver awareness, lowering the risk of an accident. Smart lighting systems are expected to become more popular as the automotive industry prioritizes safety.

Another driver of growth is the automotive industry's increasing emphasis on energy efficiency and sustainability. Smart lighting systems provide energy-efficient solutions that can aid in lowering energy consumption and carbon emissions. Smart lighting systems are expected to become more popular as governments around the world implement stricter regulations aimed at reducing carbon emissions.

Technological advancements are also expected to propel the automotive smart lighting market forward. Lighting materials, sensors, and connectivity technologies advancements are opening up new avenues for the development of advanced lighting systems with more sophisticated features and functionality. Collaborations and partnerships among automakers, lighting manufacturers, and technology companies are also expected to drive innovation and open up new opportunities in the automotive smart lighting market.

Finally, the growing demand for personalized and immersive driving experiences is expected to propel the automotive smart lighting market forward. Customizable lighting options can help create unique and immersive driving experiences, which is something that consumers are increasingly looking for. The adoption of smart lighting systems is expected to grow as automakers continue to develop more advanced lighting systems with customizable features.

However, a number of factors are impeding the impressive growth of the automotive lighting market. The high cost of smart lighting systems is one of the major factors. Advanced lighting systems can be significantly more expensive than traditional lighting systems, potentially limiting adoption in certain market segments.

The complexity of smart lighting systems is another consideration. Complex sensors, software, and control systems are required for advanced lighting systems, which can be challenging to incorporate into existing vehicle architectures. This complexity may limit or slow the rate of adoption in certain markets.

Regulatory constraints may also limit growth in the automotive smart lighting market. Vehicle lighting regulations and standards differ by region and can be difficult for automakers and suppliers to navigate. Furthermore, the implementation of new regulations aimed at improving vehicle safety and lowering carbon emissions may raise costs and limit adoption.

Automotive Smart Lighting Market Segmentation

The worldwide market for automotive smart lighting is split based on vehicle type, technology, application, sales channel, and geography.

Automotive Smart Lighting Vehicle Types

- Passenger Cars

- Commercial Vehicles

As per the automotive smart lighting industry analysis, the passenger cars segment dominates the automotive smart lighting market, with the largest market share in 2022. This is because passenger cars are produced and sold at a higher rate than commercial vehicles. Furthermore, passenger cars are frequently outfitted with more advanced features and technologies, such as smart lighting systems. However, due to increased demand for advanced safety features in commercial vehicles, the commercial vehicle segment is expected to grow significantly. The increasing adoption of advanced driver assistance systems (ADAS) and the soaring demand for energy-efficient and sustainable lighting solutions in commercial vehicles are expected to drive this growth.

Automotive Smart Lighting Technologies

- Halogen

- Xenon

- LED

- Other Technologies

According to automotive smart lighting market forecast, LED technology currently has the largest market share in the automotive smart lighting market. Because of its energy efficiency, durability, and superior performance, LED technology is favored over conventional halogen and xenon lighting systems. LED lighting systems are also more adaptable to new design trends and offer a greater variety of design options. LED technology is also more adaptable, enabling more advanced features like adaptive lighting and dynamic lighting effects.

While halogen and xenon technologies are still extensively used in the automotive industry, their market share is decreasing as LED technology becomes more widely adopted. Other emerging technologies in the automotive smart lighting market include OLED (organic light-emitting diodes) and laser lighting systems, but their market share is currently limited.

Automotive Smart Lighting Applications

- Interior Lighting

- Exterior Lighting

Exterior lighting has a larger share of the automotive smart lighting market than interior lighting. This is due to the growing demand for advanced safety features in vehicles, such as intelligent headlights and adaptive lighting systems, which help to improve visibility and reduce road accidents. Exterior lighting systems must also include daytime running lights (DRLs), turn signals, and brake lights, which are required in many countries. The growing trend towards electric and autonomous vehicles is also expected to drive demand for advanced exterior lighting systems, which can aid in vehicle-to-vehicle communication and overall vehicle safety.

Automotive Smart Lighting Sales Channels

- OEM

- Aftermarket

The original equipment manufacturer (OEM) segment currently leads the market for automotive smart lighting. This segment includes automakers that include smart lighting systems as standard equipment in their vehicles during the manufacturing process. The OEM segment has a significant market advantage because it has direct access to the latest technology and can seamlessly integrate smart lighting systems into their vehicles. In the automotive smart lighting market, the aftermarket segment, which includes suppliers and third-party vendors who can provide smart lighting systems as an add-on feature for vehicles, is also expanding. However, the aftermarket segment has a smaller market share than the OEM segment.

Automotive Smart Lighting Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Smart Lighting Market Regional Analysis

Europe currently holds the largest share of the automotive smart lighting market, with an estimated 35% share. This is due to the presence of major automakers and the region's high demand for luxury vehicles. The increasing emphasis on energy efficiency and environmental sustainability is also projected to fuel market expansion in the region. Europe's major markets are Germany, the United Kingdom, and France.

North America is one of the most important markets for automotive smart lighting, owing to the region's high demand for advanced safety features and technological innovations. The increasing adoption of electric and self-driving vehicles is also expected to fuel market growth in the region. The region's largest market is the United States, followed by Canada and Mexico.

The Asia-Pacific region is expected to be the fastest-growing industry for automotive smart lighting, driven by rising vehicle demand and a growing trend towards technological innovations in the automotive industry. The region's major markets are China, Japan, South Korea, and India. The region's increasing adoption of electric and hybrid vehicles is also expected to drive market growth.

Automotive Smart Lighting Market Players

Some of the top automotive smart lighting companies offered in the professional report include Continental AG, Cree, Inc., Flex Ltd., Hella GmbH & Co. KGaA, Hyundai Mobis Co., Ltd., Ichikoh Industries, Ltd., Koito Manufacturing Co., Ltd., Magneti Marelli S.p.A., Osram GmbH, Philips Lighting BV, Stanley Electric Co., Ltd., Texas Instruments Incorporated, Valeo S.A., Varroc Lighting Systems, and ZKW Group.

Frequently Asked Questions

What was the market size of the global automotive smart lighting in 2022?

The market size of automotive smart lighting was USD 4.4 Billion in 2022.

What is the CAGR of the global automotive smart lighting market from 2023 to 2032?

The CAGR of automotive smart lighting is 8.8% during the analysis period of 2023 to 2032.

Which are the key players in the automotive smart lighting market?

The key players operating in the global market are including Continental AG, Cree, Inc., Flex Ltd., Hella GmbH & Co. KGaA, Hyundai Mobis Co., Ltd., Ichikoh Industries, Ltd., Koito Manufacturing Co., Ltd., Magneti Marelli S.p.A., Osram GmbH, Philips Lighting BV, Stanley Electric Co., Ltd., Texas Instruments Incorporated, Valeo S.A., Varroc Lighting Systems, and ZKW Group.

Which region dominated the global automotive smart lighting market share?

Europe held the dominating position in automotive smart lighting industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive smart lighting during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive smart lighting industry?

The current trends and dynamics in the automotive smart lighting industry include increasing focus on safety in the automotive industry, growing need for energy-efficient lighting solutions, and rising consumer inclination towards advanced features.

Which vehicle type held the maximum share in 2022?

The passenger vehicles vehicle type held the maximum share of the automotive smart lighting industry.