Automotive Communication Technology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Communication Technology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

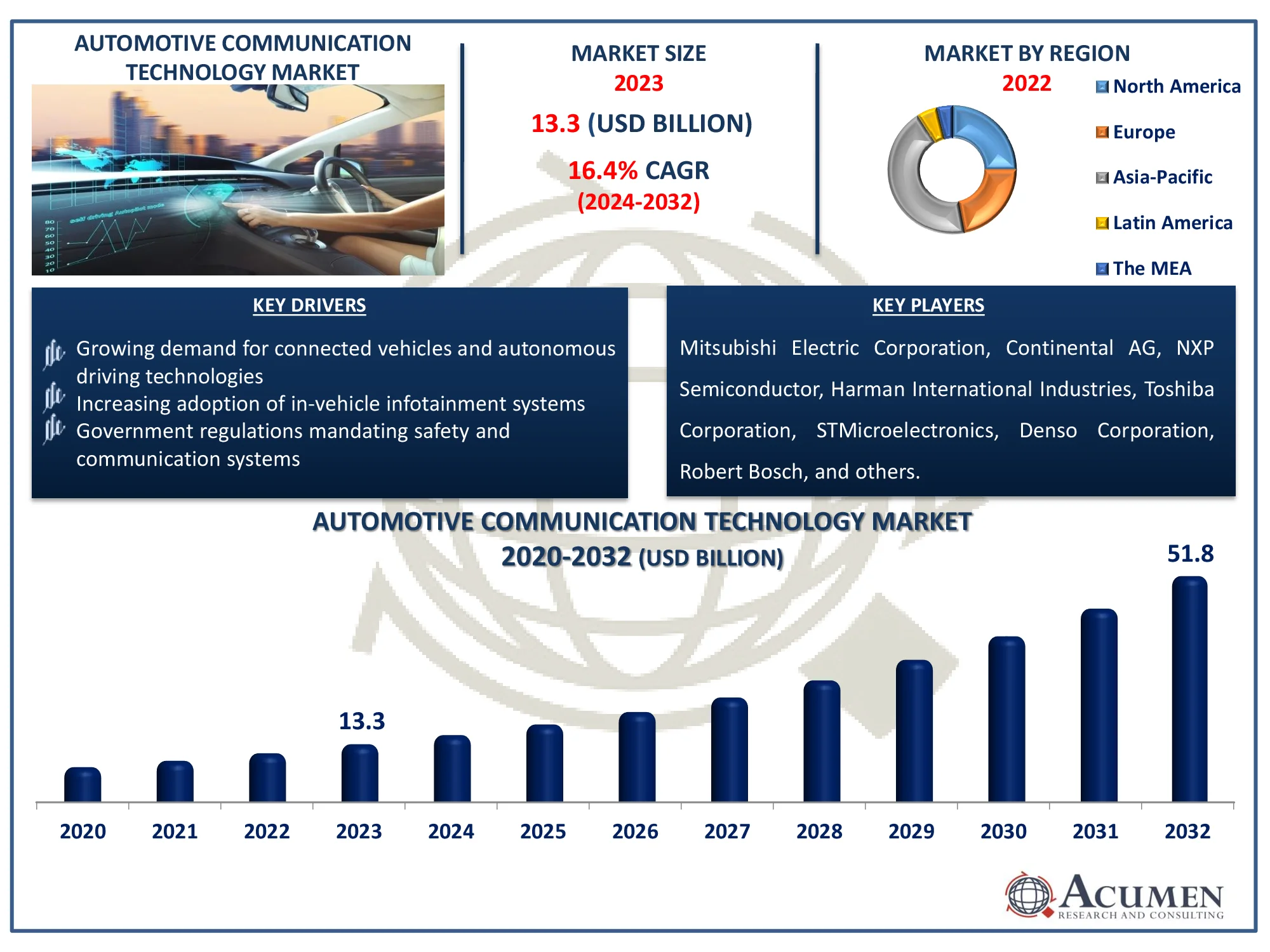

The Global Automotive Communication Technology Market Size accounted for USD 13.3 Billion in 2023 and is estimated to achieve a market size of USD 51.8 Billion by 2032 growing at a CAGR of 16.4% from 2024 to 2032.

Automotive Communication Technology Market Highlights

- Global automotive communication technology market revenue is poised to garner USD 51.8 billion by 2032 with a CAGR of 16.4% from 2024 to 2032

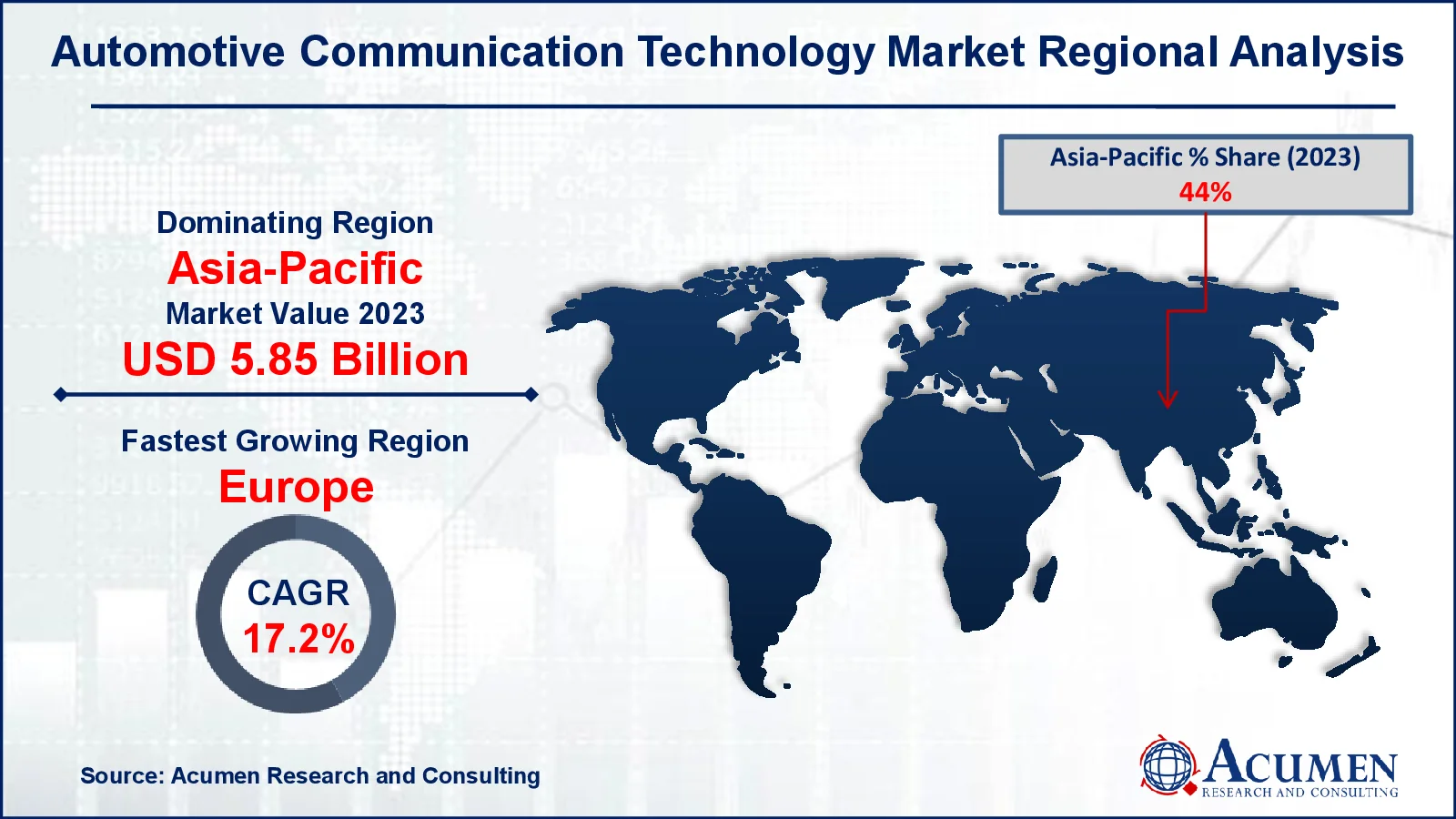

- Asia-Pacific automotive communication technology market value occupied around USD 5.85 billion in 2023

- Europe automotive communication technology market growth will record a CAGR of more than 17.2% from 2024 to 2032

- Among bus module, the controller area network (CAN) sub-segment generated 38% of the market share in 2023

- Based on vehicle class, the mid-sized sub-segment generated notable market share in 2023

- 5G is becoming crucial for vehicle-to-everything (V2X) communication which is a popular automotive communication technology market trend that fuels the industry demand

Growing safety technologies include air bags, seat belts, anti-lock braking systems (ABS), blind spot detection (BSD), electronic stability control (ECS), lane change assist (LCA), and adaptive cruise control (ACC), among others. Data communication networks are also being employed in automobiles due to the increasing amount of gadgets. Transceivers transmit and receive digital signals between various electronic equipment in order to communicate with the car's electronic control unit (ECU). The global automotive communication technology market is expected to increase at a CAGR of more than 16.4% over the forecast period. Furthermore, industry participants are largely focused on developing new innovative technologies to support the growth of the automotive communication technology market.

Global Automotive Communication Technology Market Dynamics

Market Drivers

- Growing demand for connected vehicles and autonomous driving technologies

- Increasing adoption of in-vehicle infotainment systems

- Government regulations mandating safety and communication systems

Market Restraints

- High costs associated with advanced communication technologies

- Complexity in integrating communication systems across multiple platforms

- Security concerns related to automotive communication networks

Market Opportunities

- Advancements in 5G technology to enhance vehicle communication capabilities

- Expansion of electric vehicles requiring advanced communication systems

- Growing interest in vehicle-to-everything (V2X) communication for smart cities

Automotive Communication Technology Market Report Coverage

| Market | Automotive Communication Technology Market |

| Automotive Communication Technology Market Size 2022 |

USD 13.3 Billion |

| Automotive Communication Technology Market Forecast 2032 | USD 51.8 Billion |

| Automotive Communication Technology Market CAGR During 2023 - 2032 | 16.4% |

| Automotive Communication Technology Market Analysis Period | 2020 - 2032 |

| Automotive Communication Technology Market Base Year |

2023 |

| Automotive Communication Technology Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Bus Module, By Vehicle Class, By Application, By Distribution Channel Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Mitsubishi Electric Corporation, Robert Bosch, Continental AG, NXP Semiconductor, Harman International Industries, Toshiba Corporation, STMicroelectronics, Denso Corporation, Aptiv PLC, Valeo SA, Intel Corporation, ZF Friedrichshafen, Lear Corporation, Autoliv Inc, Broadcom Inc., Magna International Inc, and Yazaki Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Communication Technology Market Insights

Some of the fundamental factors driving the global automotive communication technology market growth include increased demand for transceivers in modern vehicles, a growing need for superior networking and communication, increased adoption of advanced driver assistance systems (ADAS), rising use of radar technologies in automotive applications, and ever-increasing safety regulations. The increased requirement for transceivers in modern automobiles is responsible for data interchange between the associated systems and control units. The increasing deployment of electronic systems and ECUs in automobiles, driven by the growing need for greater networking and communication between these systems, is propelling the worldwide automotive communication technology market forward.

The increased requirement for transceivers in modern automobiles is responsible for data interchange between the associated systems and control units. The increasing deployment of electronic systems and ECUs in automobiles, driven by the growing need for greater networking and communication between these systems, is propelling the worldwide automotive communication technology market forward. The rapidly expanding electric car industry is a primary driver driving global market growth. Factors driving market expansion include enhanced vehicle safety to reduce road deaths, the growing adoption of connected and smart mobility solutions, and strict carbon dioxide emission rules.

Furthermore, automobile manufacturers are working on designing application-specific ECUs, which will increase demand for automotive communication technology. Market participants are largely focused on developing new innovative technologies to support the growth of the automotive communication technology market. However, the increasing complexity of electronic systems may stymie the growth of the global automotive communication technology market.

Automotive Communication Technology Market Segmentation

The worldwide market for automotive communication technology is split based on bus module, vehicle class, application, end-use industry, and geography.

Automotive Communication Technology Bus Module

- Local Interconnect Network (LIN)

- Controller Area Network (CAN)

- FlexRay

- Media-oriented Systems Transport (MOST)

- Ethernet

As per the automotive communication technology industry analysis, the controller area network (CAN) product dominates the market due to its robust, real-time communication capabilities, essential for modern vehicles. It supports the efficient exchange of data between various electronic control units (ECUs) in vehicles, ensuring reliability and scalability. CAN's widespread adoption is driven by its cost-effectiveness, simplicity, and ability to handle the increasing complexity of automotive systems.

Automotive Communication Technology Vehicle Class

- Economy

- Mid-Sized

- Luxury

According to the automotive communication technology industry analysis, mid-sized vehicle glass segment is expected to dominate the market due to its widespread use in mass-market vehicles, where cost-effectiveness and advanced features such as heads-up displays and embedded sensors are becoming increasingly significant. This business benefits from large manufacturing volumes, which lead to economies of scale, as well as rising demand for safety and driver assistance systems.

Automotive Communication Technology Application

- Powertrain

- Body and Comfort Electronics

- Infotainment and Communication

- Safety and ADAS

- Others

According to the automotive communication technology industry forecast, the market is increasingly dominated by safety and advanced driver assistance systems (ADAS) due to the growing demand for enhanced vehicle safety and automation. These systems require high-speed, reliable data transmission for real-time decision-making, driving the adoption of sophisticated communication protocols. As vehicles become more connected and autonomous, the integration of ADAS and safety features are critical, making them key drivers in the market.

Automotive Communication Technology Distribution Channel

- OEM

- Distributors

According to the automotive communication technology market forecast, OEMs (Original Equipment Manufacturers) shows notable growth in forecast year. This is because OEMs are directly involved in integrating communication technologies into vehicles during the manufacturing process, ensuring seamless compatibility and compliance with industry standards. Additionally, OEMs have established relationships with suppliers, enabling them to adopt advanced technologies faster and more efficiently than distributors.

Automotive Communication Technology Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Communication Technology Market Regional Analysis

For several reasons, Asia-Pacific leads the automotive communication technology market due to the rapid growth of the automotive industry in countries like China, Japan, and South Korea. The region's focus on advanced vehicle safety, connected car technologies, and increasing investments in electric vehicles (EVs) drive this dominance. For instance, in March 2023, Toshiba created a new communication driver/receiver IC for the CXPI standard. Its common applications include steering switches, instrument cluster switches, light switches, door locks, exterior mirrors, and others. The most recent improvement establishes the physical layer interface for CXPI-compliant vehicle communication protocols. It also provides a number of defect detection features, including overheating and low voltage detection. Moreover, government initiatives promoting smart transportation and infrastructure further bolster the market's expansion in this region.

Europe is experiencing significant growth in the automotive communication technology market due to the increasing adoption of advanced driver-assistance systems (ADAS), electric vehicles (EVs), and connected car technologies. The region's strong focus on reducing carbon emissions and stringent regulatory requirements are driving investments in automotive communication infrastructure.

Automotive Communication Technology Market Players

Some of the top automotive communication technology companies offered in our report includes Mitsubishi Electric Corporation, Robert Bosch, Continental AG, NXP Semiconductor, Harman International Industries, Toshiba Corporation, STMicroelectronics, Denso Corporation, Aptiv PLC, Valeo SA, Intel Corporation, ZF Friedrichshafen, Lear Corporation, Autoliv Inc, Broadcom Inc., Magna International Inc, and Yazaki Corporation.

Frequently Asked Questions

How big is the automotive communication technology market?

The automotive communication technology market size was valued at USD 13.3 billion in 2023.

What is the CAGR of the global automotive communication technology market from 2024 to 2032?

The CAGR of automotive communication technology is 16.4% during the analysis period of 2024 to 2032.

Which are the key players in the automotive communication technology market?

The key players operating in the global market are including Mitsubishi Electric Corporation, Robert Bosch, Continental AG, NXP Semiconductor, Harman International Industries, Toshiba Corporation, STMicroelectronicsDenso Corporation, Aptiv PLC, Valeo SA, Intel Corporation, ZF Friedrichshafen, Lear Corporation, Autoliv Inc, Broadcom Inc., Magna International Inc, and Yazaki Corporation.

Which region dominated the global automotive communication technology market share?

Asia-Pacific held the dominating position in automotive communication technology industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of automotive communication technology during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive communication technology industry?

The current trends and dynamics in the automotive communication technology industry include quick delivery of medical services to remote or underserved areas, technological advancements improve reliability and versatility of Automotive Communication Technology, and government support for using modern gadgets to deliver greater care.

Which bus module held the maximum share in 2023?

The controller area network (CAN) bus module held the maximum share of the automotive communication technology industry.?