Architectural Flat Glass Market | Acumen Research and Consulting

Architectural Flat Glass Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format : ![]()

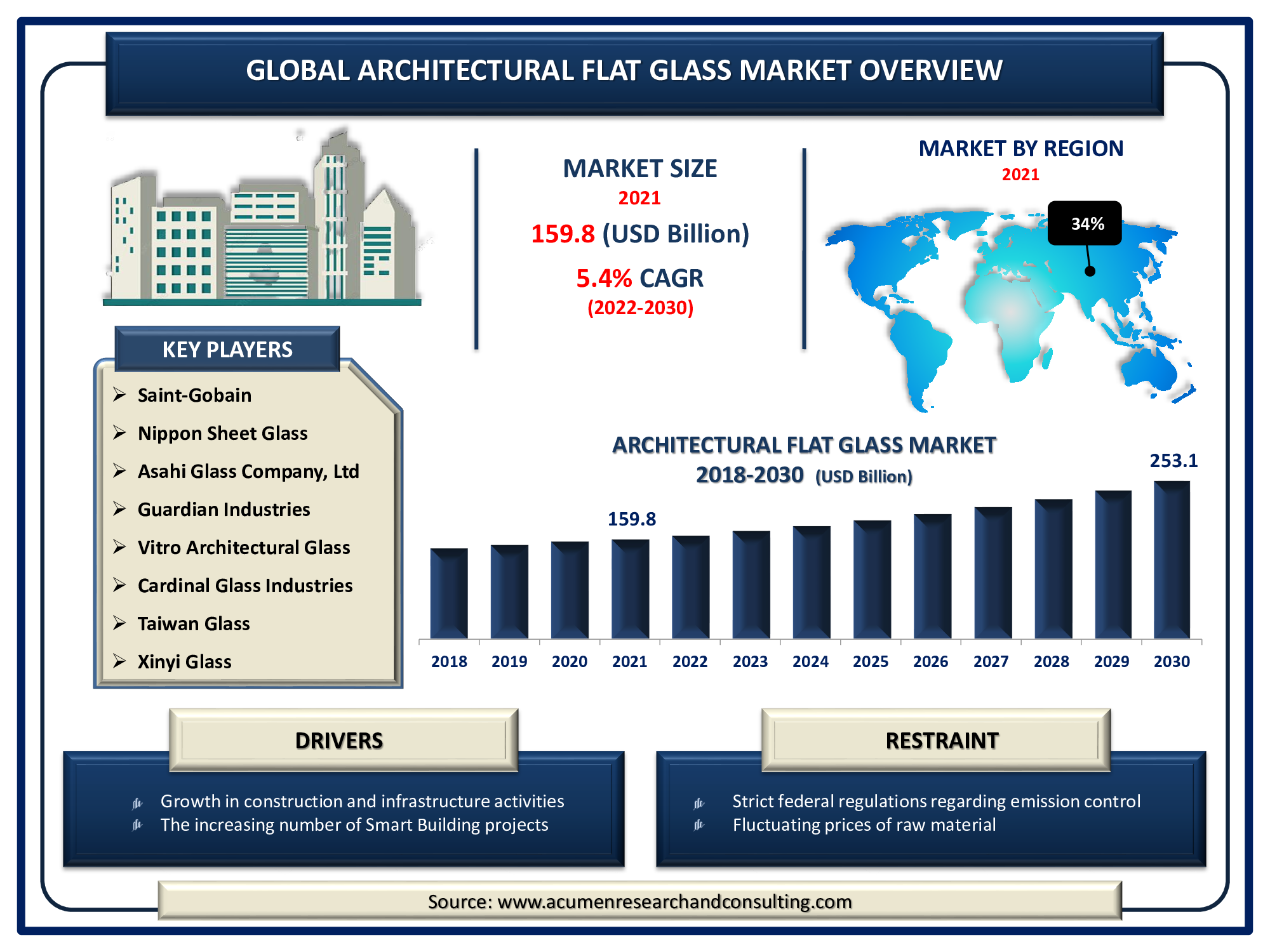

The Global Architectural Flat Glass Market size accounted for USD 159.8 Billion in 2021 and is expected to reach USD 253.1 Billion by 2030 with a considerable CAGR of 5.4% during the forecast timeframe of 2022 to 2030.

The growing numbers of new construction and renovation projects in existing infrastructure, as well as rising demand from the residential sector, are propelling the architectural flat glass market value. Furthermore, the adoption of smart home technology in key regions is driving the architectural flat glass market growth.

Architectural flat glass is a type of glass that is commonly used in construction and building infrastructure to make window frames, transparent walls, glass doors, roof lights, and reflectors. It is a promising material in the building and construction sector due to the unique combination of properties it possesses, such as chemical inertia, durability, transparency, availability, compressive strength, and low price. Flat glass produced by the float procedure is primarily used in the construction industry. Windows are among the most common architectural flat glass market applications in building design. A window is typically composed of one, two, or more flat sheets of glass connected to a window frame. Using two or more flat glass sheet windows instead of one improves thermodynamic efficiency.

Architectural Flat Glass Market Dynamics

Drivers

- Growth in construction and infrastructure activities

- The increasing number of Smart Building projects

- Increasing demand for solar panels

- Rising demand for smart home technology

Restraints

- Strict federal regulations regarding emission control

- Fluctuating prices of raw material

Opportunity

- Growing urbanization in emerging nations

Report Coverage

| Market | Architectural Flat Glass Market |

| Market Size 2021 | USD 159.8 Billion |

| Market Forecast 2030 | USD 253.1 Billion |

| CAGR During 2022 - 2030 | 5.4% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Product Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Saint-Gobain, Nippon Sheet Glass Co., Ltd., Asahi Glass Company, Ltd, Guardian Industries, Vitro Architectural Glass, Cardinal Glass Industries, Taiwan Glass, Xinyi Glass, Sisecam, CSG Architectural Glass Co. LTD., Central Glass Co., Ltd., and Shanghai Yaohua Pilkington Glass Group Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Due to advancements in characteristics such as insulating material value and coating adaptability, the architecture flat glass market is becoming more important in both new and renovated buildings. Furthermore, improving the heat transfer performance of windows improves the energy performance of the building. Replacement of single-glazed windows with double-glazed windows is now a standard intervention to meet such energy requirements. This means that old flat glass is being replaced with newer, more insulation material windows.

Moreover, these glasses provide not only UV protection but also acoustic and thermal insulation in buildings. Increased energy efficiency through the use of natural light is one of the benefits of using this glass in building structures. Green building regulations enacted by governments increased demand and the architectural flat glass market. This glass is also increasingly being used in solar panels due to its properties such as high strength, low reflection, and high transmissibility. The demand for renewable energy has compelled governments to invest in renewable energy infrastructure, expanding the architectural flat glass market forecast.

Architectural Flat Glass Market Segmentation

The global architectural flat glass market segmentation based on the product type, application and geographical region.

Market by Product Type

- Basic Float

- Coated

- Laminated

- Toughened

- Extra Clear

- Others

Based on the product type, the toughened glass segment is expected to hold the majority market share in 2021. Toughened glass is also known as safety glass and tempered glass. These glasses are four to five times stronger than regular glass, making toughened glass panels ideal for architectural and construction applications. Toughened glass is commonly used in building construction applications such as windows, balcony doors, facades, exhibition areas, bathroom doors, shower doors, and displays. Additionally, it is structurally and thermodynamically strong, and studies show that it can withstand ground compaction of at least 10,000 pounds per square inch, which qualifies it as safety glass. As a result of these factors, demand for these segments is increasing and capturing the largest architectural flat glass market share.

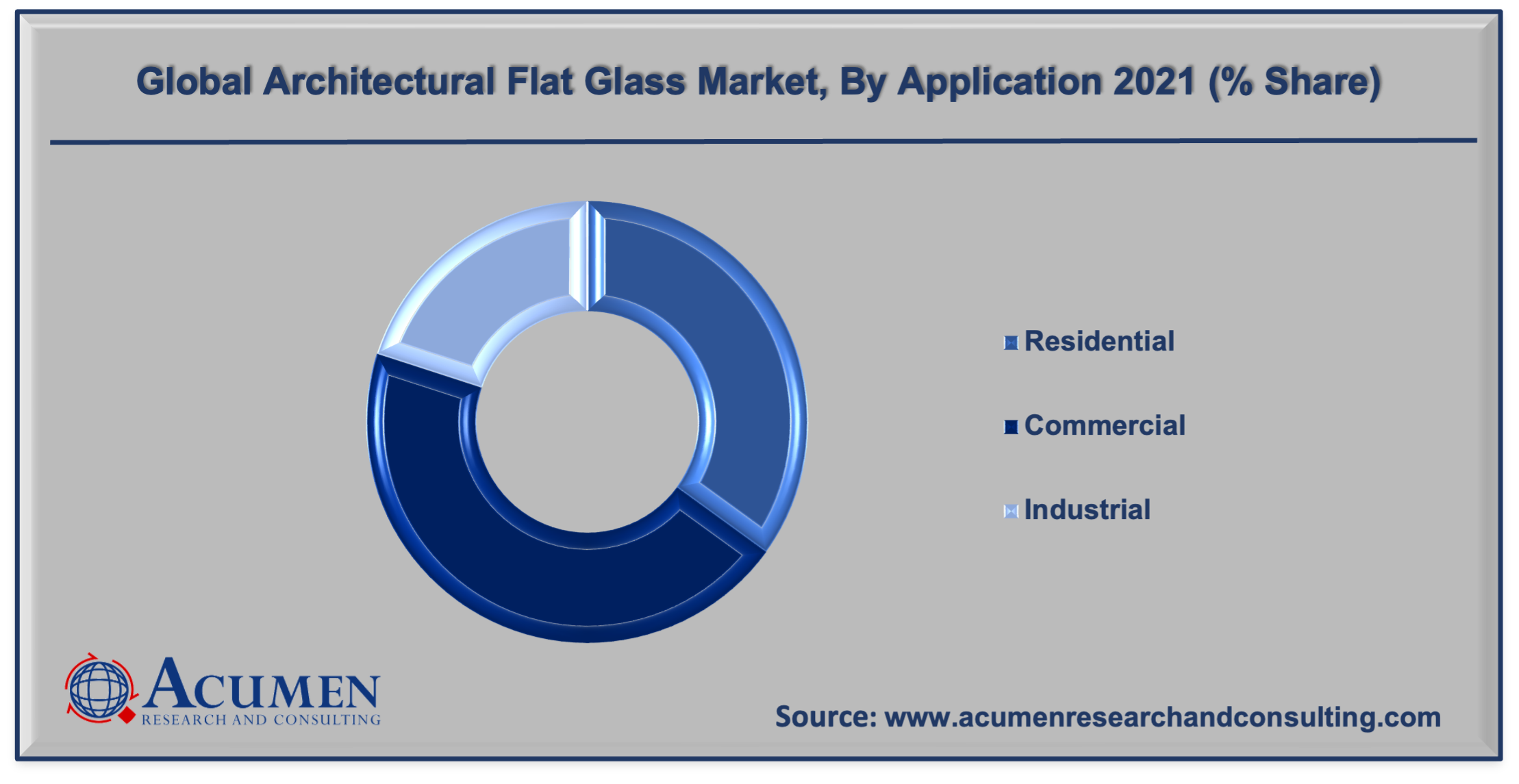

Market by Application

- Residential

- Commercial

- Industrial

Based on the end-use, the commercial segment is expected to grow with significant market shares in 2021. Flat glass is increasingly being used in commercial buildings and infrastructures due to its adaptability and versatility. These glasses enhance a building's appearance and ambiance by allowing an effective look, creating a sense of interior and adding simplicity and charm. However, the qualities and applications of flat glass are in commercial buildings to make them look more attractive and insightful while also increasing their performance. Flat glass is 100% recyclable, which contributes significantly to its popularity as a construction material and drives the architectural flat glass market trend.

Furthermore, due to the industry's widespread desire for environmental sustainability, flat glass is an attractive proposition for a wide range of people. Rising corporate business operations in both the services and manufacturing sectors, government infrastructure spending and internal security initiatives, and significant investments in education and healthcare infrastructure are just a few of the major factors driving rising construction expenditure.

Architectural Flat Glass Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

The Asia-Pacific region accounted for the largest market share in 2021, because of the growing construction industry, increase in advancement in technology, and increase in demand for energy-efficient temperature management. Architectural flat glass helps increase the amount of natural light that enters the building. Because of these features, innovative glazing solutions are utilized to greatly reduce the requirement for heating and cooling in buildings, lowering energy consumption and CO2 emissions. Solar control glass, soundproof glass, self-cleaning glass, double glazing, and other advancements in construction glassware have raised demand for residential and non-residential construction glassware, which has boosted the market growth of the architectural flat market in Asia-Pacific. Emerging countries such as India, Malaysia, Thailand, and Japan are likely to be the forerunners in terms of the usage of architectural flat glass, which drives the regional market forward.

Architectural Flat Glass Market Players

Some of the prominent global architectural flat glass market companies are Saint-Gobain, Nippon Sheet Glass Co., Ltd., Asahi Glass Company, Ltd, Guardian Industries, Vitro Architectural Glass, Cardinal Glass Industries, Taiwan Glass, Xinyi Glass, Sisecam, CSG Architectural Glass Co. LTD., Central Glass Co., Ltd., and Shanghai Yaohua Pilkington Glass Group Co., Ltd.

Frequently Asked Questions

What was the market size of global architectural flat glass market in 2021?

The global architectural flat glass market size was valued at USD 159.8 Billion in 2021.

What will be the projected CAGR for global architectural flat glass market during forecast period of 2022 to 2030?

The projected CAGR of architectural flat glass during the analysis period of 2022 to 2030 is 5.4%.

Which are the prominent competitors operating in the market?

The prominent players of the global architectural flat glass market involve Saint-Gobain, Nippon Sheet Glass Co., Ltd., Asahi Glass Company, Ltd, Guardian Industries, Vitro Architectural Glass, Cardinal Glass Industries, Taiwan Glass, Xinyi Glass, Sisecam, CSG Architectural Glass Co. LTD., Central Glass Co., Ltd., and Shanghai Yaohua Pilkington Glass Group Co., Ltd.

Which region held the dominating position in the global architectural flat glass market?

Asia-Pacific held the dominating share for architectural flat glass during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for architectural flat glass during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global architectural flat glass market?

Growth in construction and infrastructure activities and increasing number of Smart Building projects are the prominent factors that fuel the growth of global architectural flat glass market.

By segment product type, which sub-segment held the maximum share?

Based on product type, toughened segment held the maximum share for architectural flat glass market in 2021.