Flat Glass Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Flat Glass Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

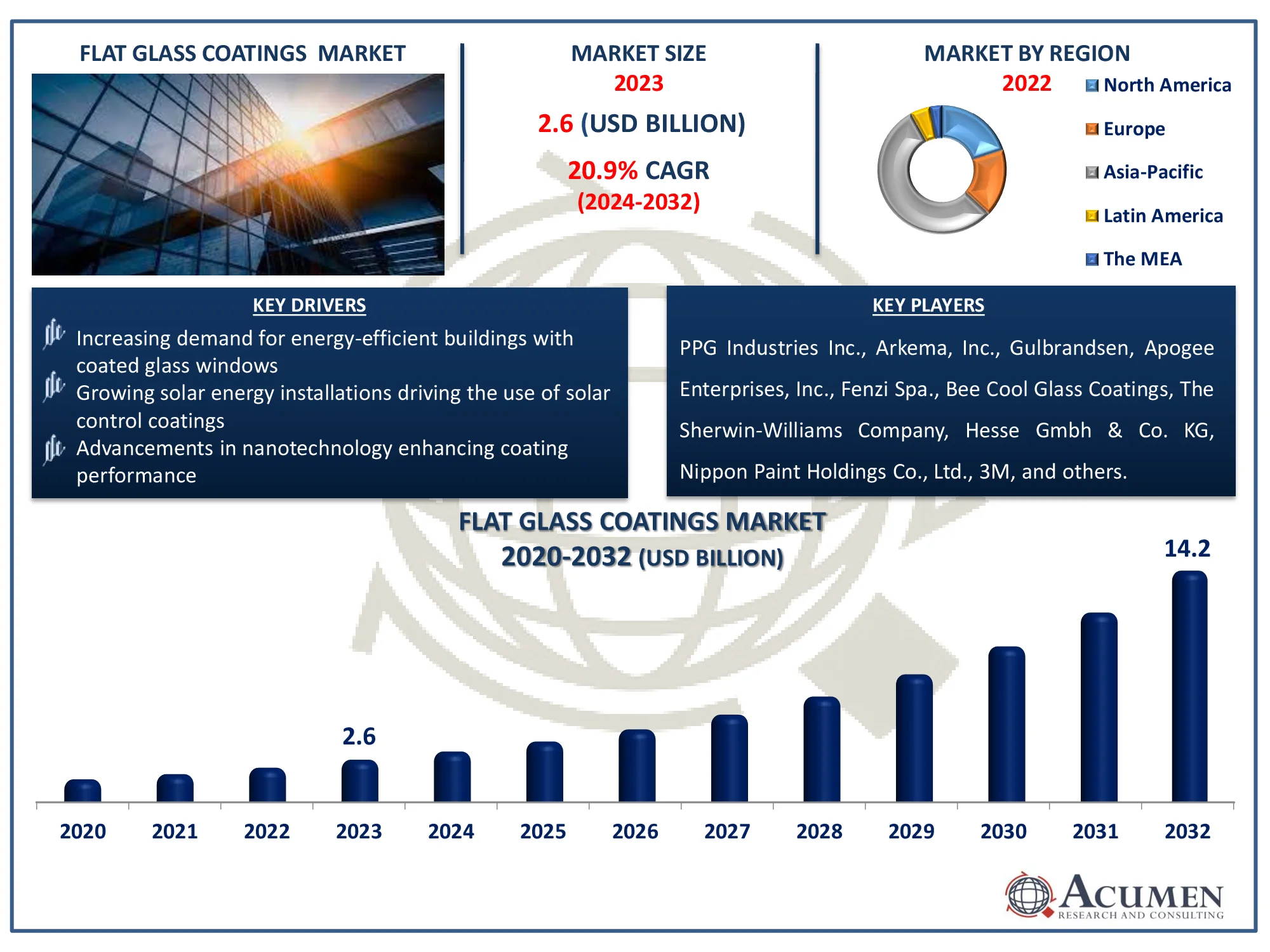

The Global Flat Glass Coatings Market Size accounted for USD 2.6 Billion in 2023 and is estimated to achieve a market size of USD 14.2 Billion by 2032 growing at a CAGR of 20.9% from 2024 to 2032

Flat Glass Coatings Market (By Resin: Polyurethane, Acrylic, Epoxy, and Others; By Technology: Solvent-based, Water-based, and Nano-based; By Application: Solar Power, Mirror, Architectural, Automotive & Transportation, and other; and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Flat Glass Coatings Market Highlights

- The global flat glass coatings market is projected to reach a revenue of USD 14.2 billion by 2032, with a CAGR of 20.9% from 2024 to 2032

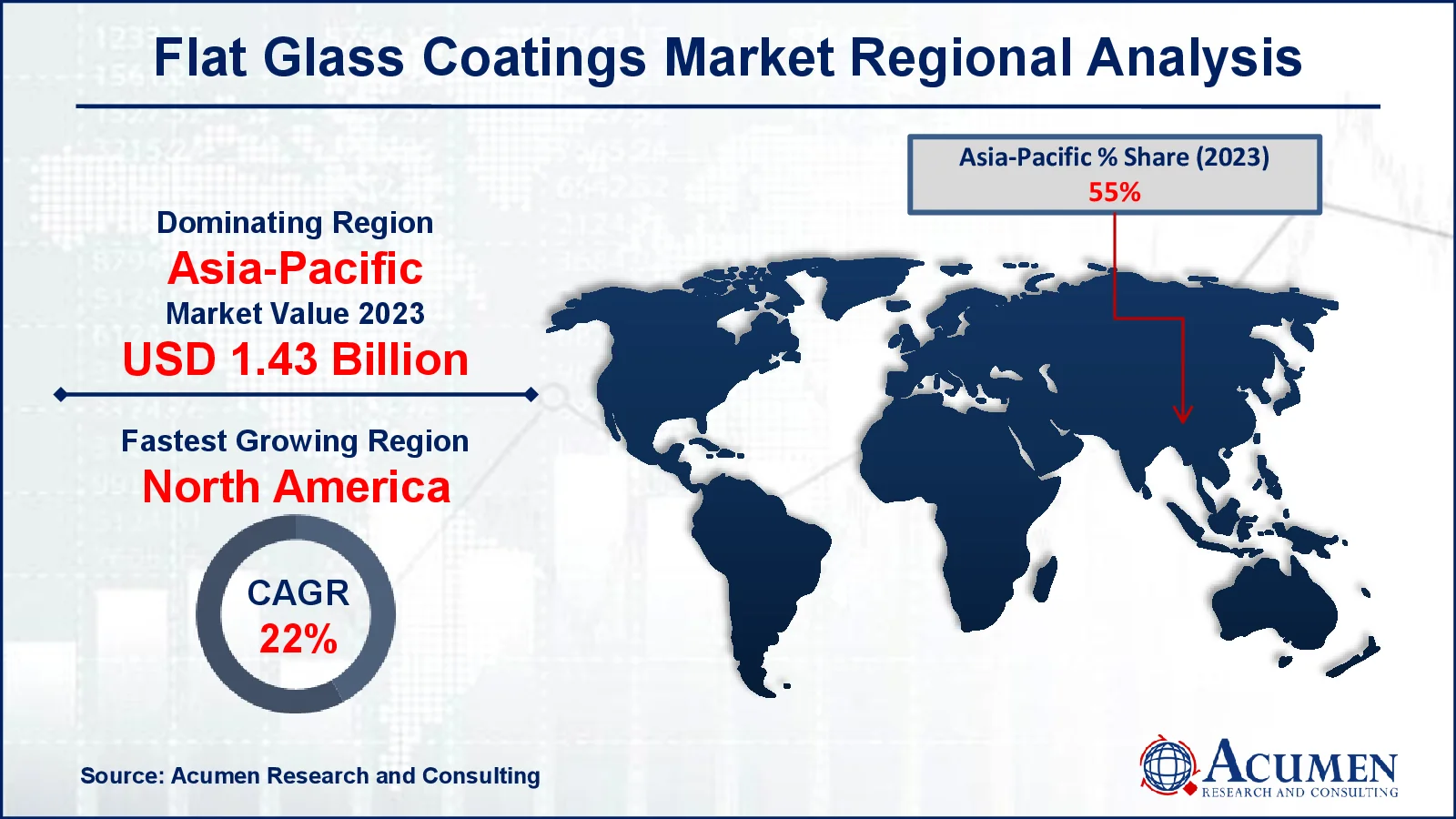

- The Asia-Pacific flat glass coatings market was valued at approximately USD 1.43 billion in 2023

- The North American flat glass coatings market is expected to grow at a CAGR of over 22% from 2024 to 2032

- The acrylic resin sub-segment accounted for 40% of the market share in 2023

- The water-based technology sub-segment captured 52% of the market share in 2023

- The mirror application sub-segment held 42% of the market share in 2023

- Environmentally friendly and low-emission coatings are gaining popularity due to stringent regulations is the flat glass coatings market trend that fuels the industry demand

Flat glass coatings are thin layers added to the surface of flat glass to improve performance, and durability. These coatings can have a variety of features, including antireflective, self-cleaning, sun management, and decorative impacts. They are commonly employed in architectural applications, such as windows and facades, to increase energy efficiency by limiting heat and light transmission. Flat glass treatments improve car safety and reduce glare. They are also used in solar panels to boost energy absorption and in electronic displays to improve clarity and eliminate reflections.

Global Flat Glass Coatings Market Dynamics

Market Drivers

- Increasing demand for energy-efficient buildings with coated glass windows

- Growing solar energy installations driving the use of solar control coatings

- Advancements in nanotechnology enhancing coating performance

Market Restraints

- High initial cost of coating technologies

- Stringent environmental regulations on chemical coatings

- Limited awareness in developing regions about the benefits of flat glass coatings

Market Opportunities

- Expanding application in automotive and transportation sectors

- Rising adoption of green building standards globally

- Innovations in eco-friendly and multifunctional coatings

Flat Glass Coatings Market Report Coverage

| Market | Flat Glass Coatings Market |

| Flat Glass Coatings Market Size 2022 |

USD 2.6 Billion |

| Flat Glass Coatings Market Forecast 2032 | USD 14.2 Billion |

| Flat Glass Coatings Market CAGR During 2023 - 2032 | 20.9% |

| Flat Glass Coatings Market Analysis Period | 2020 - 2032 |

| Flat Glass Coatings Market Base Year |

2022 |

| Flat Glass Coatings Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Resin, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | PPG Industries Inc., Arkema, Inc., Gulbrandsen, Apogee Enterprises, Inc., Fenzi Spa., Bee Cool Glass Coatings, The Sherwin-Williams Company, Hesse Gmbh & Co. KG, Nippon Paint Holdings Co., Ltd., 3M, Unelko Corporation, and Yantai Jialong Nano Tech Coatings. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Flat Glass Coatings Market Insights

Rising acceptability of solar installations, combined with interest in environmentally acceptable renewable sources or sustainable sources of vitality, is expected to stimulate demand for solar-powered boards, increasing the degree of glass coatings exhibited. Furthermore, increased awareness of the importance of energy conservation, independence, and good government regulations is expected to stimulate demand for design applications in the next years. For instance, National Energy Conservation Day is observed on December 14 every year in India to create awareness about the importance of energy conservation and to promote energy-efficient practices. "Raise awareness about global warming and climate change while encouraging initiatives" was the theme for 2023. Nations such as Italy, the United Kingdom, the United States, Japan, China, India, and Germany have highlighted one-sided enactments to the Kyoto Protocol in order to reduce greenhouse gas (GHG) outflows, which are also expected to accelerate market development.

Rising development investment due to urbanization and infrastructure plans from various governments will continue to drive business sector growth. For instance, by the end of 2023, the urbanization rate of permanent residents had risen to 66.16 percent, 0.94 percentage points higher than at the end of 2022 in China.

Furthermore, rapid developments in transportation, renewable energy sources, social and corporate frameworks, government convenience, and security infrastructure will all contribute to the extension. For instance, according to U.S. Energy Information and Administration, in 2023, the US electric power sector generated 4,017 billion kilowatthours (kWh) of electricity. Last year, renewable energy sources such as wind, solar, hydro, biomass, and geothermal contributed for 22% of total generation, or 874 billion kWh. Rising green business building development, particularly in North America, Asia Pacific, the Middle East, and Africa, is expected to drive demand for flat glass coatings over the projected period.

Flat Glass Coatings Market Segmentation

The worldwide market for flat glass coatings is split based on resin, technology, application, and geography.

Flat Glass Coating Market By Resin

- Polyurethane

- Acrylic

- Epoxy

- Others

According to the flat glass coatings industry analysis, acrylic resin leads the flat glass coatings market because it's durable, resists UV light, and sticks well to glass. It adds a clear, protective layer that makes glass look better and last longer in buildings, cars, and solar panels. Acrylic resin is easy to use, making it popular with manufacturers. As more people seek for energy-efficient buildings and vehicles it becomes preferred choice in market.

Flat Glass Coating Market By Technology

- Solvent-Based

- Water-Based

- Nano-Based

The water-based segment leads the flat glass coatings market because it’s better for the environment and meets stricter rules on reducing harmful emissions. These coatings operate properly, offering strong protection against weather, and are safer than solvent-based options. They are widely used in building and car industries. Improvements in these coatings have made them even more popular, helping companies stay eco-friendly without losing quality. Nano-based flat glass coatings have seen tremendous growth in recent years as a result of many inventive work exercises paired with expanding consumer demands.

Flat Glass Coating Market By Application

- Solar Power

- Mirror

- Architectural

- Automotive & Transportation

- Others

According to the flat glass coatings market forecast, mirror was identified as the largest application segment of the market. Mirrors are widely used in a variety of purposes, including beauty, architecture, transportation, and decoration. Furthermore, rising demand for keen mirrors is expected to drive the market over the next few years. Brilliant mirrors serve as an effective substitute for rear view mirrors in automobile applications. They provide a coordinated GPS route, a reinforcement camera, and Bluetooth connectivity, which aids in operating the vehicle.

Flat Glass Coatings Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Flat Glass Coatings Market Regional Analysis

For several reasons, Asia-Pacific dominates in flat glass coatings market. Already emerging regional economies, such as Australia, China, Japan, and South Korea, are expected to contribute significantly to regional demand. The emerging automobile and construction sectors are expected to be the key drivers of demand for these items in the next years. For instance, the building industry in India is anticipated to reach $1.4 trillion by 2025. In addition, from April 2023 to March 2024, the automobile sector manufactured 28.43 Billion cars, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles. India has a prominent position in the international heavy vehicle arena, as the world's largest tractor maker, second-largest bus manufacturer, and third-largest heavy truck manufacturer.

North America expected to drive the flat glass coatings market due to developing development divisions, namely in the United States and Mexico. This is expected to accelerate development of private and business structures. Mexico relies on population growth, urbanization, and increased disposable income to promote province development.

Flat Glass Coatings Market Players

Some of the top flat glass coatings companies offered in our report includes PPG Industries Inc., Arkema, Inc., Gulbrandsen, Apogee Enterprises, Inc., Fenzi Spa., Bee Cool Glass Coatings, The Sherwin-Williams Company, Hesse Gmbh & Co. KG, Nippon Paint Holdings Co., Ltd., 3M, Unelko Corporation, and Yantai Jialong Nano Tech Coatings.

Frequently Asked Questions

How big is the flat glass coatings market?

The flat glass coatings market size was valued at USD 2.6 billion in 2023.

What is the CAGR of the global flat glass coatings market from 2024 to 2032?

The CAGR of flat glass coatings is 20.9% during the analysis period of 2024 to 2032.

Which are the key players in the flat glass coatings market?

The key players operating in the global market are including PPG Industries Inc., Arkema, Inc., Gulbrandsen, Apogee Enterprises, Inc., Fenzi Spa., Bee Cool Glass Coatings, The Sherwin-Williams Company, Hesse Gmbh & Co. KG, Nippon Paint Holdings Co., Ltd., 3M, Unelko Corporation, and Yantai Jialong Nano Tech Coatings.

Which region dominated the global flat glass coatings market share?

Asia-Pacific held the dominating position in flat glass coatings industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of flat glass coatings during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global flat glass coatings industry?

The current trends and dynamics in the flat glass coatings industry include increasing demand for energy-efficient buildings with coated glass windows, growing solar energy installations driving the use of solar control coatings, and advancements in nanotechnology enhancing coating performance.

Which resin held the maximum share in 2023?

The acrylic resin held the maximum share of the flat glass coatings industry.