Acetic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Acetic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

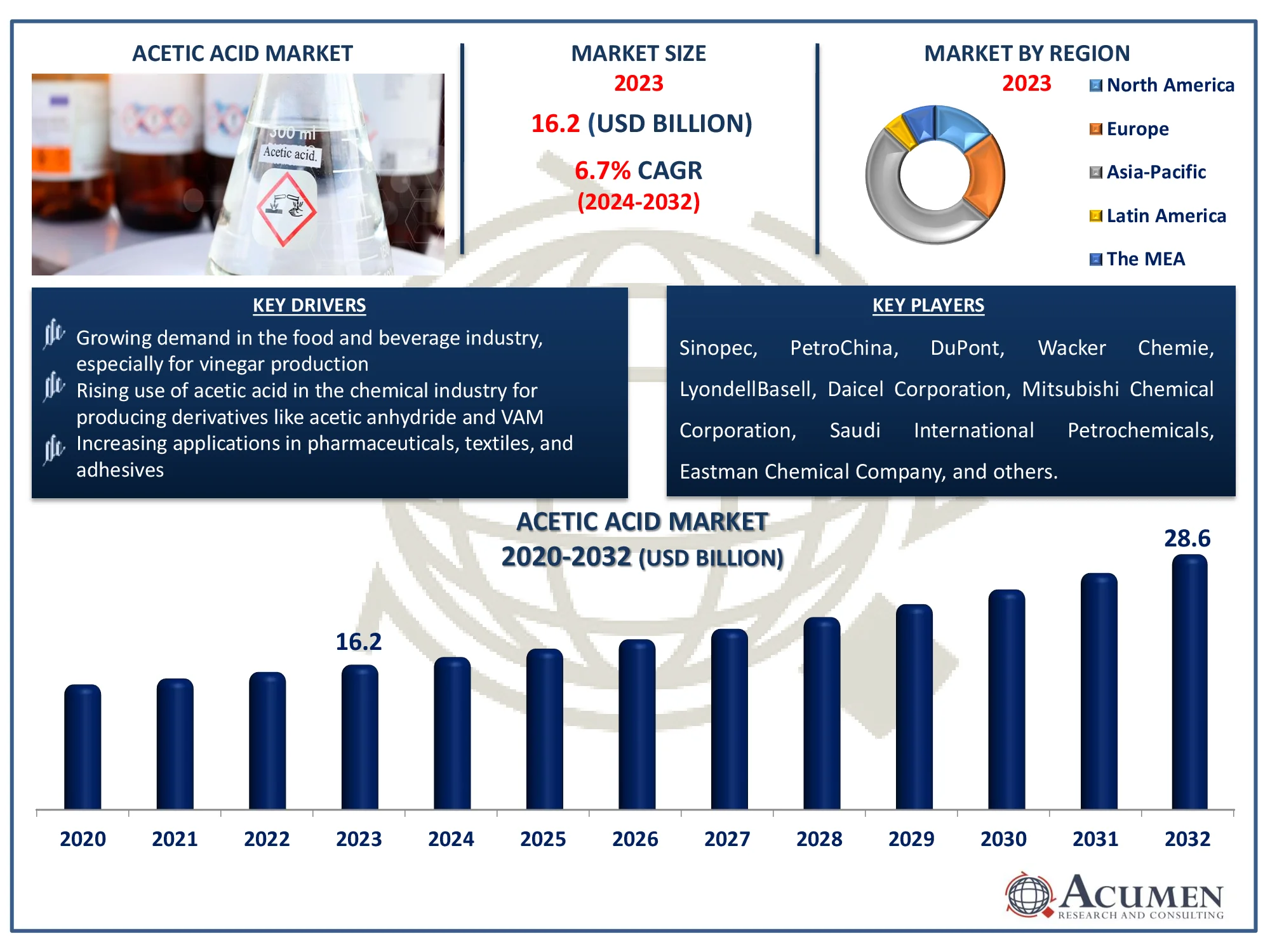

The Global Acetic Acid Market Size accounted for USD 16.2 Billion in 2023 and is estimated to achieve a market size of USD 28.6 Billion by 2032 growing at a CAGR of 6.7% from 2024 to 2032.

Acetic Acid Market Highlights

- The global acetic acid market is projected to reach USD 28.6 billion by 2032, with a CAGR of 6.7% from 2024 to 2032

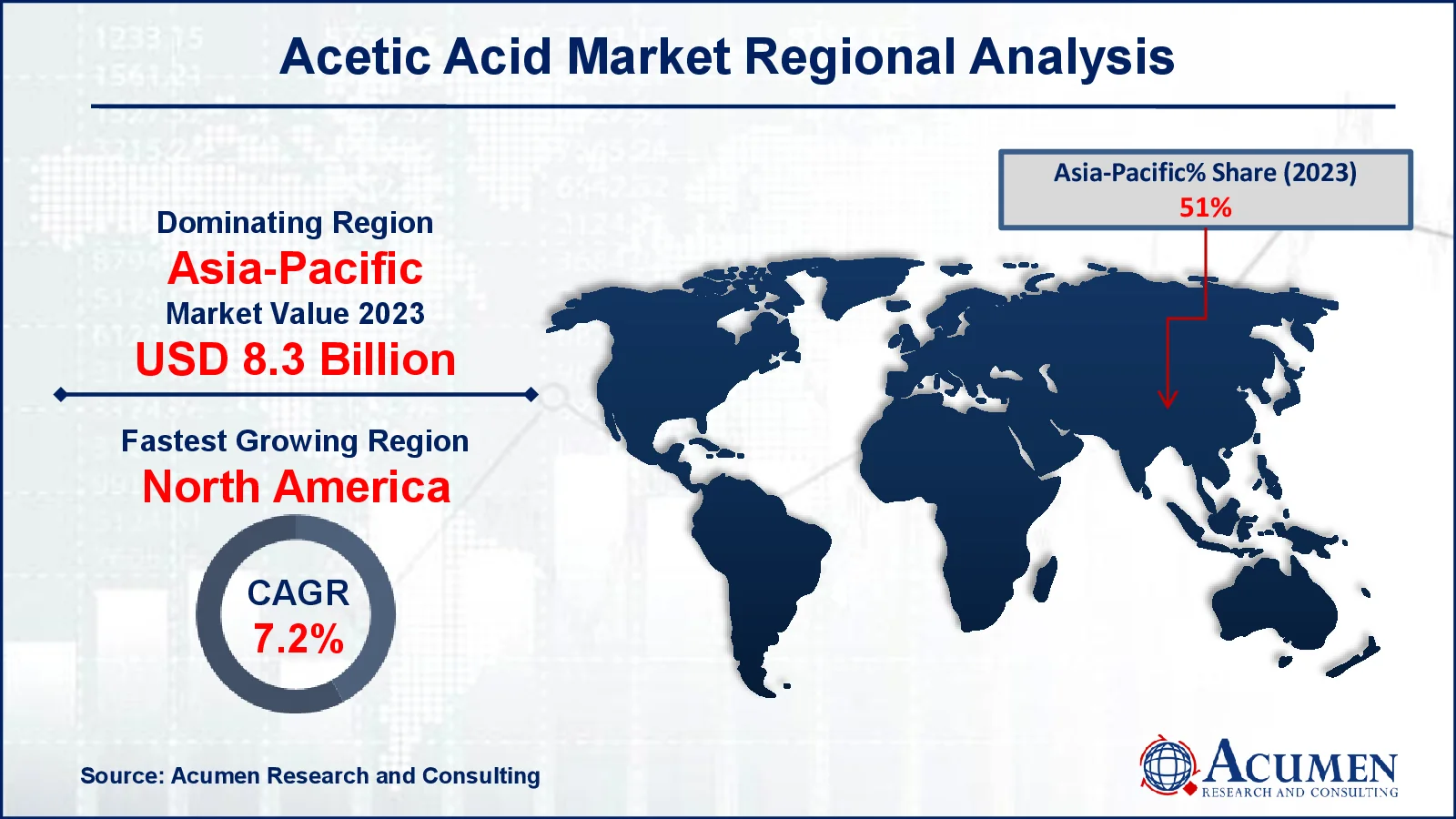

- In 2023, the Asia-Pacific acetic acid market held a value of approximately USD 8.3 billion

- The North America region is expected to grow at a CAGR of over 7.2% from 2024 to 2032

- The vinyl acetate monomer (VAM) application sub-segment captured 43% of the market share in 2023

- Increasing utilization of acetic acid derivatives like VAM and acetic anhydride in adhesives, textiles, and packaging applications is the acetic acid market trend that fuels the industry demand

Acetic acid, also known as ethanoic acid, is a colorless liquid that serves as a major precursor to the production of a variety of chemicals used in the fabric, gum, and plastic industries. It serves as an intermediary in the production of a variety of coatings, sealants, and greases used in the construction, personal care and cosmetics, and packaging industries. During the projection period, acetic acid consumption is expected to grow significantly. Acetic acid is often used to produce VAM, which is used to synthesize a variety of resins and polymers for use in adhesives, films, paints, coatings, textiles, and other end-user industries. PVA and polyvinyl alcohol (PVOH) are the primary derivatives produced by VAM. PVA is widely utilized in textiles, adhesives, packaging films, photosensitive coatings, and thickeners, whereas PVOH finds applications in paper coatings, paints, and industrial coatings due to its excellent adhesion properties.

Global Acetic Acid Market Dynamics

Market Drivers

- Growing demand in the food and beverage industry, especially for vinegar production

- Rising use of acetic acid in the chemical industry for producing derivatives like acetic anhydride and VAM

- Increasing applications in pharmaceuticals, textiles, and adhesives

Market Restraints

- Fluctuating raw material prices impacting production costs

- Health and environmental concerns due to the corrosive nature of acetic acid

- Stringent regulatory restrictions on chemical manufacturing processes

Market Opportunities

- Expanding applications in bioplastics and sustainable chemicals

- Growth in the Asia-Pacific region due to rising industrialization and demand in emerging economies

- Development of bio-based acetic acid production methods to reduce environmental impact

Acetic Acid Market Report Coverage

| Market | Acetic Acid Market |

| Acetic Acid Market Size 2022 |

USD 16.2 Billion |

| Acetic Acid Market Forecast 2032 | USD 28.6 Billion |

| Acetic Acid Market CAGR During 2023 - 2032 | 6.7% |

| Acetic Acid Market Analysis Period | 2020 - 2032 |

| Acetic Acid Market Base Year |

2022 |

| Acetic Acid Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Manufacturing Process, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Sinopec, PetroChina, Wacker Chemie, DuPont, LyondellBasell, Daicel Corporation, Mitsubishi Chemical Corporation, Saudi International Petrochemicals, Eastman Chemical Company, British Petroleum, Celanese Corporation, GNFC Limited, Jiangsu Sopo (Group), and HELM AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Acetic Acid Market Insights

The increasing usage of acetate acid in the production of a variety of products, including vinyl acetate monomers (VAM) and refined terephthalate acid, is predicted to boost business volume throughout the evaluation period. Growing infrastructure projects around the world are predicted to raise demand for coatings and sealants, contributing positively to the development of supply for acetic acid monomers during the forecast period. According to Invest India, the government's commitment is demonstrated by the allocation of 3.3% of GDP to the infrastructure sector in fiscal year 2024, with a special emphasis on the transportation and logistics divisions. Roads and highways have the biggest percentage, followed by railways and urban public transport. Furthermore, the increasing use of acetic acid in terephthalic acid manufacture is expected to boost market growth during the forecast period. Terephthalic acid is a key building element in the production of polyester resins, which are widely utilized in polyester films, PET resins, and polyester polymers. Terephthalic acid is also utilized in home furnishings and textile production, including bed linen, gowns, and curtains.

The market's leading companies are expected to invest in R&D operations to improve their production capabilities. For instance, in July 2022, BASF made a large investment in Guangdong Province, South China, to increase its car refinish coatings production capacity to 30,000 metric tons per year. This ongoing tendency will contribute significantly to the sector during the review period. Celanese Corporation, a major rival, for example, announced the expansion of its acetic acid and VAM crop facility in Clear Lake, Texas, by 150 kilotonnes. Eastman Chemical Company recently announced at its Longview, Texas, facility the expansion of its carboxylic acid crop capabilities.

The acetic acid business is expected to expand rapidly in emerging markets. These countries are seeing rapid economic growth as a result of large-scale developments in equipment production, chemicals, textiles, and coatings. As a result, progress in the development of these projects provides huge growth opportunities in acetic acid supply. Rising petroleum feedstock prices, along with rigorous regulations, are expected to create new corporate growth opportunities. The skilled players are frequently seen transitioning to bio-based acetic acid production from sugar, corn, cheese whey waste, poplar tree, and other bakery leftovers. Bio-based acetate provides the same properties as convectional acid with less environmental impact. Furthermore, the price volatility of traditional raw materials like methanol will accelerate the shift to bio-based acetic acid in the future years.

Acetic Acid Market Segmentation

The worldwide market for acetic acid is split based on manufacturing process, application, end-use industry, and geography.

Acetic Acid Market By Manufacturing Process

- Synthetic Route

- Methanol Carbonylation

- Terephthalic/Isophthalic Acid Coproduct

- Paraffin Oxidation

- Oxidation Of Hydrocarbons

- Olefin Oxidation

- Biological Route

According to the acetic acid industry analysis, because to its scalability and cost-effectiveness the synthetic method is gaining traction in market. Processes like methanol carbonylation, which dominate this approach, produce high yields while using relatively little energy, making them the favored choice for large-scale commercial manufacturing. The broad availability of raw ingredients such as methanol and carbon monoxide promotes the use of this approach. Furthermore, the synthetic approach meets the increasing demand for acetic acid derivatives such vinyl acetate monomer (VAM) and acetic anhydride in industries such as adhesives, textiles, and packaging.

Acetic Acid Market By Application

- Acetic Anhydride

- Chloroacetic Acid

- Vinyl Acetate Monomer (VAM)

- Purified Terephthalic Acid (PTA)

- Cellulose Acetate

- Others

VAM's acetic acid industry was the largest in 2023, and it is expected to show similar developments throughout the projected period. VAM is an important intermediary in the production of polymers and resins used in paints, coatings, adhesives, films, fabrics, and other end-use products. Growing global demand for these apps is predicted to contribute positively to segment development by the end of the forecast period. Vinyl acetate monomer is a chemical building component utilized in a variety of industrial and consumer goods. Polyvinyl acetate is used in the production of paints, varnishes, and adhesives, as well as adaptable substrates and textile sizing for polyester fiber-fill insulation. VAM is a key raw material in the production of water-based adhesives, with a significant impact on the global adhesives and sealants industry.

Acetic Acid Market By End-Use Industry

- Personal Care and Cosmetics

- Chemical Manufacturing

- Agriculture

- Food and Beverage

- Textile

- Pharmaceutical

- Others

According to the acetic acid market forecast, the chemical manufacturing industry is a major user of acetic acid, producing derivatives such as vinyl acetate monomer (VAM), acetic anhydride, and acetate esters, which are used in adhesives, coatings, and plastics. Acetic acid is also used in the food and beverage industries, mostly to make vinegar and as a food preservative. Acetic acid is used in textile dyeing and fabric treatment operations to improve color and texture. Other industries, such as personal care, medicines, and agricultural, use acetic acid for a variety of purposes, including cosmetics and drug development, as well as herbicides and pesticide.

Acetic Acid Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Acetic Acid Market Regional Analysis

For several reasons, the global market for acetic acid is divided into North America, Latin America, Asia-Pacific excluding Japan (APEJ), Europe, and the Middle East and Africa (MEA). Asia-Pacific has the largest acetic acid industry. Taiwan and China are Asia-Pacific's leading acetic acid markets. Acetic acid is in high demand in Asia-Pacific for paints and coatings. India will also see significant growth in the global acetic acid industry throughout the projection period due to rising assets, rising population, favorable public policies, consistently increasing demand from end-use sectors, and burgeoning industries in the region. North America and Europe are also major acetic acid markets.

In the APAC area, increased apparel demand has prompted textile manufacturers to use innovative methods to boost output and profit margins. The textile industry uses a variety of chemicals, the most common of which is acetic acid. Increased textile manufacturing is expected to boost the acetic acid sector in the future years.

Acetic Acid Market Players

Some of the top acetic acid companies offered in our report include Sinopec, PetroChina, Wacker Chemie, DuPont, LyondellBasell, Daicel Corporation, Mitsubishi Chemical Corporation, Saudi International Petrochemicals, Eastman Chemical Company, British Petroleum, Celanese Corporation, GNFC Limited, Jiangsu Sopo (Group), and HELM AG.

Frequently Asked Questions

How big is the acetic acid market?

The acetic acid market size was valued at USD 16.2 billion in 2023.

What is the CAGR of the global acetic acid market from 2024 to 2032?

The CAGR of acetic acid is 6.7% during the analysis period of 2024 to 2032.

Which are the key players in the acetic acid market?

The key players operating in the global market are including Sinopec, PetroChina, Wacker Chemie, DuPont, LyondellBasell, Daicel Corporation, Mitsubishi Chemical Corporation, Saudi International Petrochemicals, Eastman Chemical Company, British Petroleum, Celanese Corporation, GNFC Limited, Jiangsu Sopo (Group), and HELM AG.

Which region dominated the global acetic acid market share?

North America held the dominating position in acetic acid industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of acetic acid during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global acetic acid industry?

The current trends and dynamics in the acetic acid industry include growing demand in the food and beverage industry, especially for vinegar production, rising use of acetic acid in the chemical industry for producing derivatives like acetic anhydride and VAM, and increasing applications in pharmaceuticals, textiles, and adhesives.

Which application held the maxim um share in 2023?

The vinyl acetate monomer (VAM) manufacturing process held the maximum share of the acetic acid industry.