Vinyl Acetate Monomer Market

Published :

Report ID:

Pages :

Format :

Vinyl Acetate Monomer Market

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The global vinyl acetate monomer market accounted for US$ 8,198 Mn in 2021 and is expected to reach US$ 12,120 Mn by 2030 with a considerable CAGR of 4.6% during the forecast timeframe of 2022 to 2030.

Vinyl acetate monomer (VAM) is a key intermediary in the synthesis of polymers and resins for paints & coatings, glues and sealants, adhesives, elastomers, and textile finishing, as well as paper products, films, binders, and a variety of other consumer and industrial applications. VAM can be used in a wide range of polymers, such as vinyl-acrylic resins, vinyl acetate-acrylic acid copolymers, ethylene-vinyl acetate copolymers, and vinyl acetate-vinyl chloride copolymers. The different polymerization possibilities offered by VAM have enabled the development of products with a wide variety of quality and performance characteristics. However, increased demand for adhesives from different end-use industries drives the vinyl acetate monomer market.

Drivers

- Rising global demand for construction paints and coatings

- Increasing infrastructure and construction investment

- Growing demand for packaging applications

- Increasing demand for polyvinyl acetate

Restraints

- Uncertain raw material pricing

- Strict environmental regulations

Opportunity

- The growing interest in the cosmetics industry

- Increasing usage in the textile industry

Report Coverage

| Market | Vinyl Acetate Monomer Market |

| Market Size 2021 | US$ 8,198 Mn |

| Market Forecast 2028 | US$ 12,120 Mn |

| CAGR | 4.6% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | The Dow Chemical Company, Chang Chun Group, Sipchem, Celanese Corporation, Wacker Chemie, Sinopec Corp, Japan Vam & Poval Co., Ltd., Lyondellbasell, Kuraray Co., Ltd., Solventis Ltd., Dairen Chemical Corporation, and Ningxia Yinglite Chemical Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Vinyl Acetate Monomer Market Dynamics

Vinyl acetate monomer (VAM) is a colorless chemical polymer made by acetylating ethylene with acetic acid and oxygen. Among other things, it's used to make ethylene vinyl alcohol, polyvinyl alcohol, polyvinyl acetate, and ethylene-vinyl acetate. Due to its optical clarity, adhesion, and fiber-forming qualities, VAM is widely utilized in the construction, textile, packaging, and cosmetics industries. Furthermore, Acrylic fibers, nonwoven binders, adhesives, water-based paints, and paper coatings are all driving product demand. Over the forecast period, significant improvements in the polymer industry, as well as increased demand for adhesives, lubricants and sealants, paints and varnishes, paper coatings, binders, elastomers, textiles, and other products, are likely to enhance the vinyl acetate monomer market size. In addition, increasing adoption of packaged foods and infrastructure development, as well as demand from other end-use industries like textiles and cosmetics, are likely to increase demand for Vinyl Acetate Monomer market revenue during the projection period.

However, the market expansion is expected to be limited by VAM feedstock pricing variability. Furthermore, the COVID-19 pandemic had a massive effect on the chemicals and materials industry, as well as the vinyl acetate monomer market. The losses of operational efficiencies and supply chain disruptions caused by the unexpected closure of local and international gates have damaged the construction and textile industries. The complete suspension of construction operations has lowered the demand for vinyl acetate monomers.

Market Segmentation

The global market segmentation based on the application, end-use industry and geographical region.

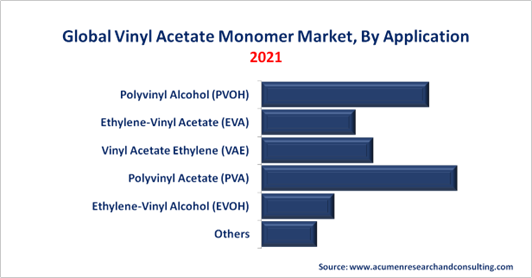

Market By Application

- Polyvinyl Alcohol (PVOH)

- Ethylene-Vinyl Acetate (EVA)

- Vinyl Acetate Ethylene (VAE)

- Polyvinyl Acetate (PVA)

- Ethylene-Vinyl Alcohol (EVOH)

- Others

Based on application, the polyvinyl acetate segment holds the largest market share in 2021. PVA stands for polyvinyl acetate, a synthetic resin made from the polymerization of vinyl acetate. Polyvinyl acetate is mostly used as a film-forming component in water-based paints, but it is also used in adhesives. It is compatible with a range of different painting chemicals and could be utilized as a polymeric ingredient in latex paints. Polyvinyl acetate can be also used in the lamination of protective coatings. It is usually favored over other types of adhesives due to its good light stability, low cost, and resistance to yellowing. PVA is used as a plasticizer and thickener in paints, polymers, textile treatments, cement, and chewing gum.

In addition, the surging demand for this product is the result of its chemical properties, which include odorless, colorlessness, tastelessness, non-toxicity, transparency, and high solubility in oils, water, and fats. Because of its chemical properties, polyvinyl acetate is used as oil-based paint, water-based emulsion paints, ink, adhesives, surgical dressings, and lacquers. Polyvinyl acetate is in high demand in the construction and packaging industries, as well as the cosmetics, textile, and printing industries.

Market By End-use Industry

- Packaging

- Textile

- Construction

- Cosmetics

- Others

Based on the end-use industry, the construction segment is expected to gain significant market share throughout the forecast period. The fast development of new residential and commercial structures around the world as a result of rapid urbanization, advanced economies, and growing disposable incomes will drive market expansion. Vinyl acetate monomer (VAM) is also an important chemical ingredient in the production of a variety of industrial and consumer products. Vinyl acetate is a colorless, pungent-smelling fluid that can be polymerized in a variety of ways, including bulk, suspension, solution, and emulsion. VAM is also utilized in the production of paints, adhesives, coatings, water-soluble films textile finishes, fibers, and laminated window glass.

Vinyl Acetate Monomer Market Regional Overview

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

The Asia-Pacific region owns the largest share of the global vinyl acetate monomer market, owing to increased demand in the construction and packaging industries. Exterior paint and varnishes are frequently made with the environmentally beneficial vinyl acetate monomer, which drives the regional market. Another factor influencing demand growth in the Asia-Pacific area is the rising population and per capita consumption in developing markets like India and Japan, as well as the increasing number of sectors that utilize vinyl acetate monomer. Rising construction expenditures and automobile manufacturing in emerging economies like China and India are projected to fuel the regional industry. China is the largest manufacturer of automobiles and paints and coatings in the world. It is also the world's largest consumer and manufacturer of adhesives and sealants. As a result, China now dominates the Asia-Pacific market.

Competitive Landscape

Some of the prominent players in global vinyl acetate monomer market are The Dow Chemical Company, Chang Chun Group, Sipchem, Celanese Corporation, Wacker Chemie, Sinopec Corp, Japan Vam & Poval Co., Ltd., Lyondellbasell, Kuraray Co., Ltd., Solventis Ltd., Dairen Chemical Corporation, and Ningxia Yinglite Chemical Co., Ltd.

Frequently Asked Questions

How much was the estimated value of the global vinyl acetate monomer market in 2021?

The estimated value of global vinyl acetate monomer market in 2021 was accounted to be US$ 8,198 Mn.

What will be the projected CAGR for global vinyl acetate monomer market during forecast period of 2022 to 2030?

The projected CAGR of vinyl acetate monomer during the analysis period of 2022 to 2030 is 4.6%.

Which are the prominent competitors operating in the market?

The prominent players of the global vinyl acetate monomer market involve The Dow Chemical Company, Chang Chun Group, Sipchem, Celanese Corporation, Wacker Chemie, Sinopec Corp, Japan Vam & Poval Co., Ltd., Lyondellbasell, Kuraray Co., Ltd., Solventis Ltd., Dairen Chemical Corporation, and Ningxia Yinglite Chemical Co., Ltd.

Which region held the dominating position in the global vinyl acetate monomer market?

Asia-Pacific held the dominating share for vinyl acetate monomer during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for vinyl acetate monomer during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global vinyl acetate monomer market?

Increasing investment in infrastructure and construction activities, and growing demand for packaging applications and polyvinyl acetate are the prominent factors that fuel the growth of global vinyl acetate monomer market.

By segment application, which sub-segment held the maximum share?

Based on application, polyvinyl acetate (PVA) segment held the maximum share for vinyl acetate monomer market in 2021.