Purified Terephthalic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Purified Terephthalic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

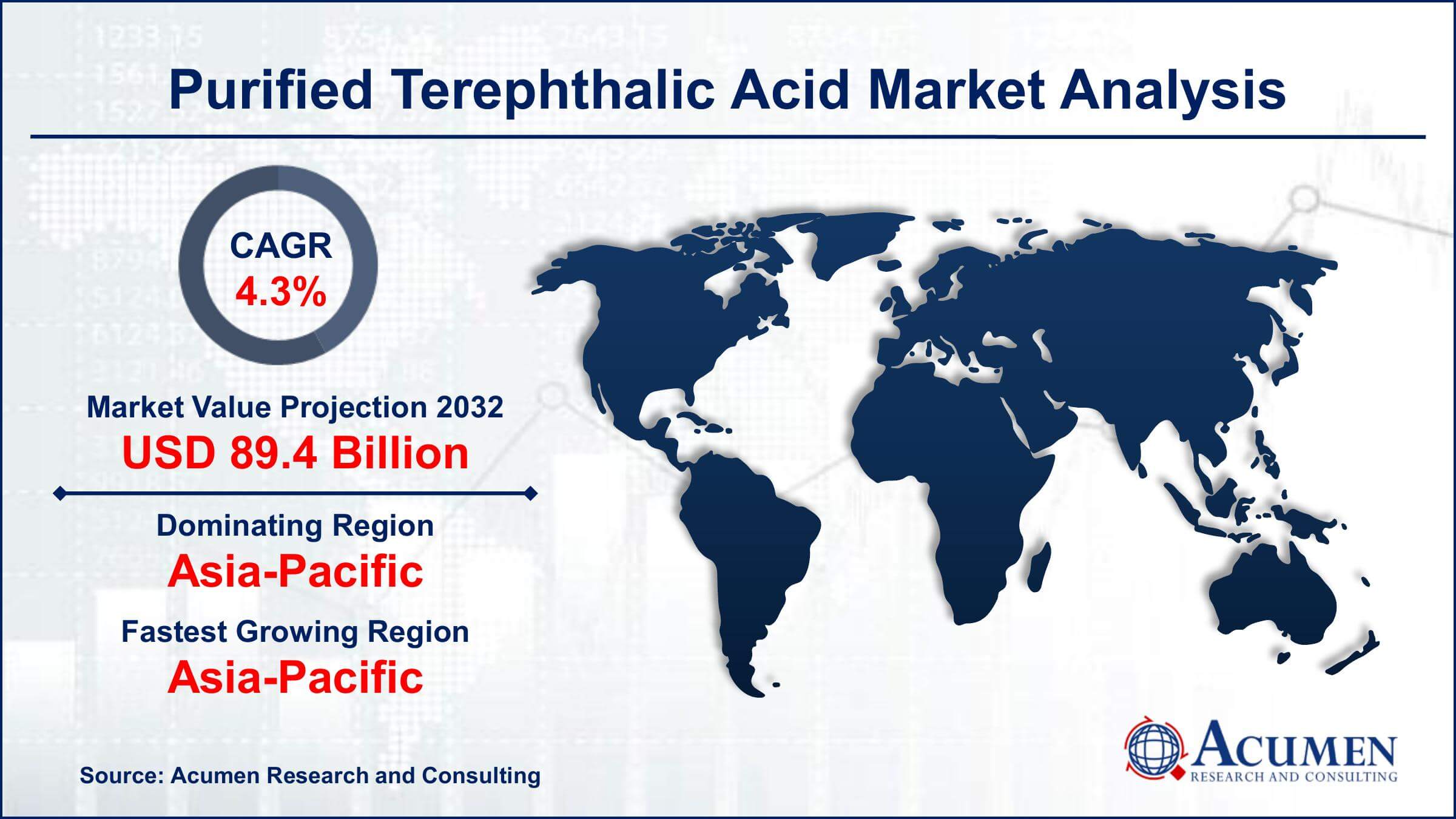

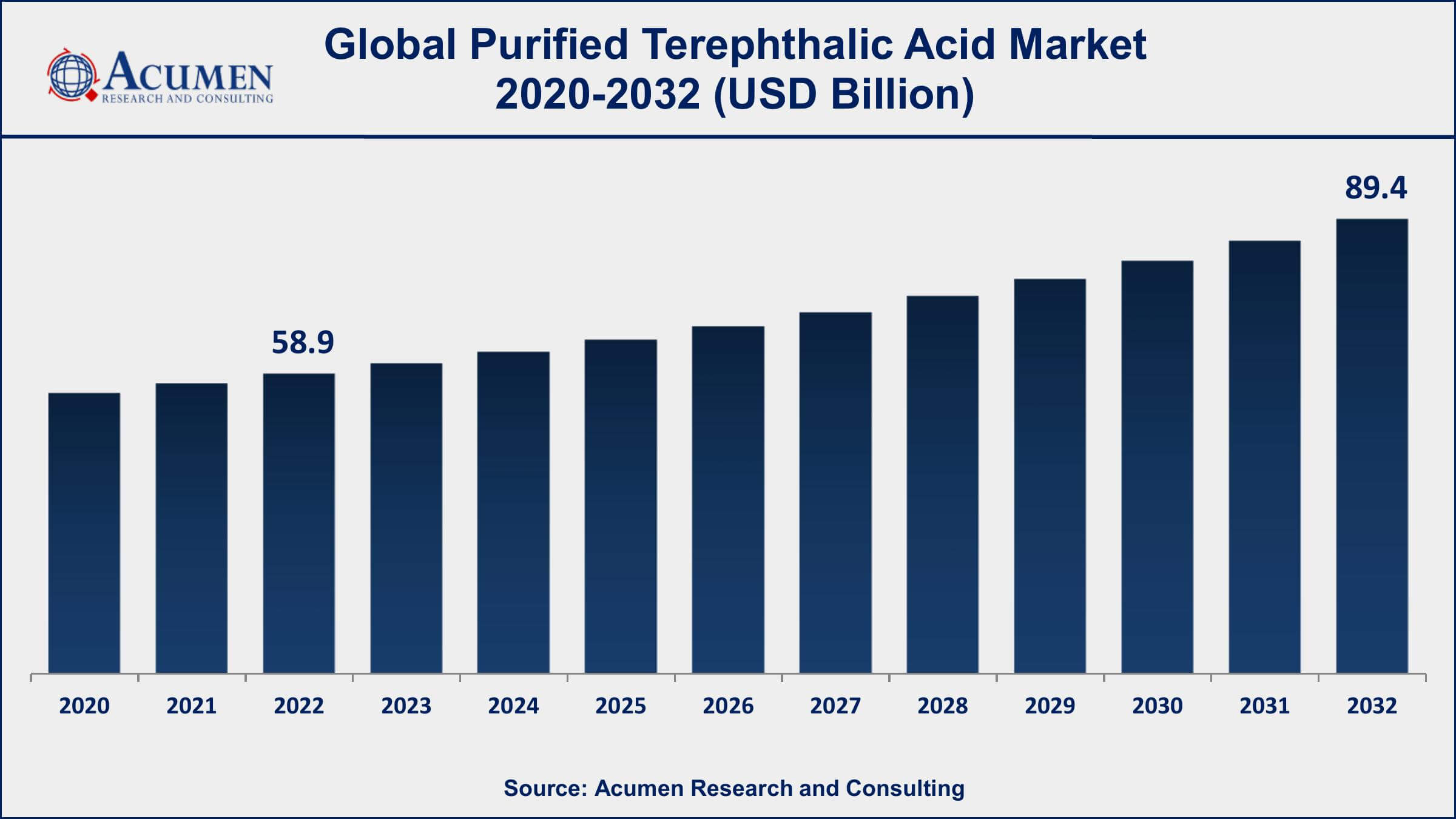

The Global Purified Terephthalic Acid (PTA) Market Size accounted for USD 58.9 Billion in 2022 and is projected to achieve a market size of USD 89.4 Billion by 2032 growing at a CAGR of 4.3% from 2023 to 2032.

Purified Terephthalic Acid Market Highlights

- Global purified Terephthalic Acid Market revenue is expected to increase by USD 89.4 Billion by 2032, with a 4.3% CAGR from 2023 to 2032

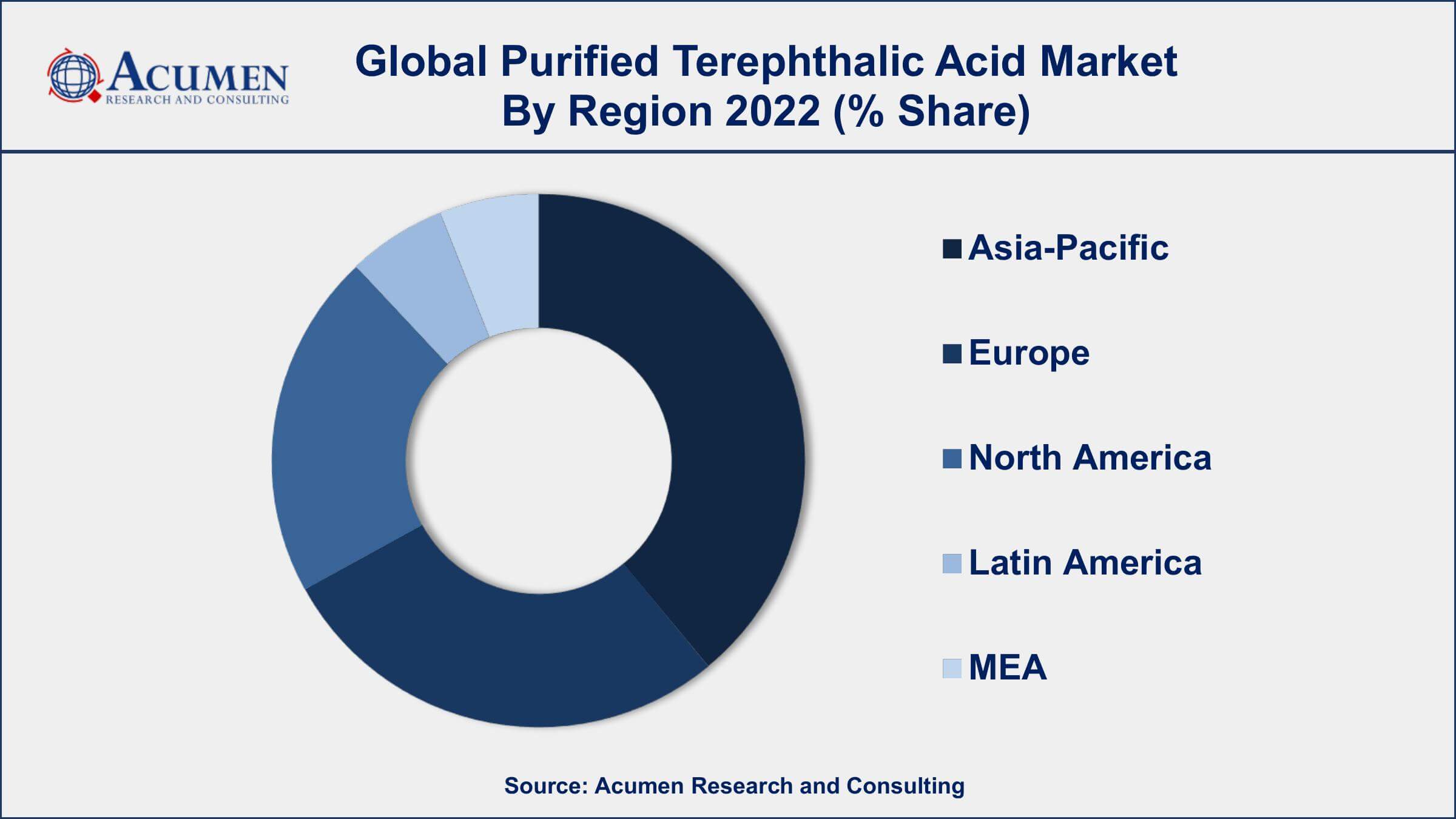

- Asia-Pacific region led with more than 43% of purified terephthalic acid (PTA) market share in 2022

- By application, the polyester segment has accounted more than 62% of the revenue share in 2022

- By end-use, the PET bottles segment has recorded more than 59% of the revenue share in 2022

- The textile segment is expected to grow, with China accounting for 38% of the global market

- Growing demand for polyester fibers and films in the textile and packaging industries, drives the purified Terephthalic Acid Market value

Purified Terephthalic Acid (PTA) is a chemical compound primarily used in the production of polyester fibers, films, and resins. It is derived from the oxidation of para-xylene, a petroleum-based feedstock. PTA is a key raw material in the manufacturing of polyethylene terephthalate (PET), which is widely used in various industries such as textiles, packaging, automotive, and construction.

The market for purified terephthalic acid has experienced significant growth in recent years. This can be attributed to several factors, including the rising demand for polyester fibers and films in the textile and packaging industries. PTA offers excellent mechanical and chemical properties, making it an ideal choice for these applications. Additionally, the increasing disposable income and changing lifestyles of consumers have led to a surge in demand for polyester-based products such as clothing, home furnishings, and packaging materials. Furthermore, the rapid industrialization and urbanization in emerging economies, particularly in Asia Pacific, have boosted the demand for PTA. Countries like China and India have witnessed substantial growth in their textile and packaging sectors, driving the demand for PTA in the region. Additionally, advancements in technology and the development of bio-based PTA have opened up new opportunities in the market, leading to further growth.

Global Purified Terephthalic Acid Market Trends

Market Drivers

- Growing demand for polyester fibers and films in the textile and packaging industries

- Increasing disposable income and changing consumer lifestyles, leading to higher demand for polyester-based products

- Rapid industrialization and urbanization in emerging economies, particularly in Asia-Pacific

- Advancements in technology and the development of bio-based PTA

Market Restraints

- Volatility in raw material prices, particularly the price fluctuations of para-xylene

- Environmental concerns related to the production and disposal of polyester products

Market Opportunities

- Increasing focus on sustainability and eco-friendly packaging solutions, driving the demand for PTA

- Development of new applications for PTA in sectors such as electronics, construction, and healthcare

Purified Terephthalic Acid Market Report Coverage

| Market | Purified Terephthalic Acid Market |

| Purified Terephthalic Acid Market Size 2022 | USD 58.9 Billion |

| Purified Terephthalic Acid Market Forecast 2032 | USD 89.4 Billion |

| Purified Terephthalic Acid Market CAGR During 2023 - 2032 | 4.3% |

| Purified Terephthalic Acid Market Analysis Period | 2020 - 2032 |

| Purified Terephthalic Acid Market Base Year | 2022 |

| Purified Terephthalic Acid Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Reliance Industries Limited, SABIC (Saudi Basic Industries Corporation), BP plc, Eastman Chemical Company, Indorama Ventures Public Company Limited, Mitsui Chemicals, Inc., Sinopec Limited, Dow Chemical Company, Lotte Chemical Corporation, Jiangsu Sopo (Group) Co., Ltd., China Petrochemical Corporation (Sinopec Group), and Formosa Plastics Corporation |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Purified Terephthalic Acid (PTA) is a white, crystalline solid chemical compound that is widely used in the production of polyester. It is derived from the oxidation of para-xylene, a petroleum-based feedstock. PTA serves as a key raw material in the manufacturing of polyethylene terephthalate (PET), which is extensively utilized in various applications across industries.

One of the primary applications of PTA is in the textile industry. PTA, along with monoethylene glycol (MEG), is polymerized to produce PET, which is then spun into fibers to create polyester fabrics. Polyester fibers have gained immense popularity in the textile industry due to their durability, wrinkle resistance, and excellent strength. They are extensively used in the production of apparel, sportswear, home furnishings, and industrial textiles. Another significant application of PTA lies in the packaging industry. PET, produced from PTA, is widely used for manufacturing plastic bottles and containers. PET bottles offer numerous advantages such as lightweight, transparency, recyclability, and excellent barrier properties against gases and moisture. These properties make PET bottles suitable for packaging beverages, food products, personal care items, and household chemicals.

The PTA market has been experiencing steady growth in recent years and is expected to continue its positive trajectory. One of the primary factors driving market growth is the increasing demand for polyester fibers and films, particularly in the textile and packaging industries. Polyester offers excellent durability, flexibility, and resistance to chemicals, making it a preferred choice in various applications. The growing population, urbanization, and changing consumer lifestyles further contribute to the rising demand for polyester products, thus propelling the PTA market. Moreover, the industrialization and economic development in emerging economies, especially in Asia Pacific, have played a significant role in the growth of the PTA market.

Purified Terephthalic Acid Market Segmentation

The global purified terephthalic acids (PTA) market segmentation is based on application, end-use, and geography.

Purified Terephthalic Acid Market By Application

- Polyester

- Plasticizers

- Polybutylene Terephthalate (PBT)

- Others

In terms of applications, the polyester segment has seen significant growth in the recent years. Polyester, produced from PTA, has witnessed significant demand across multiple industries, contributing to the overall market growth. In the textile industry, polyester fibers have gained immense popularity due to their versatile properties and cost-effectiveness. Polyester fibers offer advantages such as high strength, durability, wrinkle resistance, and ease of care. They are used in a wide range of textile applications, including clothing, home furnishings, upholstery, and industrial fabrics. The growing global population, rising disposable income, and changing consumer lifestyles have fueled the demand for polyester textiles, driving the growth of the polyester segment in the PTA market. Furthermore, the packaging industry has been a major contributor to the growth of the polyester segment. PET, produced from PTA, is widely used for manufacturing plastic bottles and containers. PET bottles offer excellent barrier properties, transparency, lightweight, and recyclability.

Purified Terephthalic Acid Market By End-Use

- Textile

- Home Furnishing

- Packaging

- PET Bottles

- Others

According to the purified terephthalic acid market forecast, the PET bottles segment is expected to witness significant growth in the coming years. PET (polyethylene terephthalate), produced from PTA, is widely used for manufacturing plastic bottles and containers. The segment has experienced substantial growth due to the increasing demand for packaged beverages, food products, personal care items, and household chemicals. One of the key factors driving the growth of the PET bottles segment is the rise in consumer preference for lightweight, convenient, and environmentally friendly packaging solutions. PET bottles offer several advantages such as lightweight, transparency, shatter resistance, and recyclability. These bottles provide a safe and cost-effective packaging option for various products while reducing transportation costs and carbon emissions. The growing awareness and initiatives to reduce plastic waste have further propelled the demand for PET bottles, as they are highly recyclable and can be used as a sustainable packaging alternative. Additionally, the expanding consumer base, particularly in developing economies, has driven the consumption of packaged goods.

Purified Terephthalic Acid Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Purified Terephthalic Acid Market Regional Analysis

Asia-Pacific is the dominating region in the purified terephthalic acid (PTA) market in 2022. The Asia-Pacific region has witnessed rapid industrialization and urbanization, leading to a surge in demand for PTA. Countries such as China, India, and Southeast Asian nations have experienced significant growth in their textile, packaging, and automotive industries, all of which heavily rely on PTA as a crucial raw material. The large population in the region, coupled with increasing disposable income, has fueled the demand for polyester-based products, driving the need for PTA production. Moreover, Asia-Pacific benefits from a favorable manufacturing environment, including access to abundant and cost-effective feedstock, skilled labor, and established production infrastructure. The region is home to several major PTA manufacturers and has a robust supply chain network that supports the production and distribution of PTA and its downstream products. This advantageous ecosystem has allowed Asia-Pacific to become a manufacturing hub for PTA, attracting investments and further solidifying its dominant position in the market.

Purified Terephthalic Acid Market Player

Some of the top purified terephthalic acid market companies offered in the professional report include Reliance Industries Limited, SABIC (Saudi Basic Industries Corporation), BP plc, Eastman Chemical Company, Indorama Ventures Public Company Limited, Mitsui Chemicals, Inc., Sinopec Limited, Dow Chemical Company, Lotte Chemical Corporation, Jiangsu Sopo (Group) Co., Ltd., China Petrochemical Corporation (Sinopec Group), and Formosa Plastics Corporation.

Frequently Asked Questions

What was the market size of the global purified terephthalic acid in 2022?

The market size of purified terephthalic acid was USD 58.9 Billion in 2022.

What is the CAGR of the global purified terephthalic acid market from 2023 to 2032?

The CAGR of purified terephthalic acid is 4.3% during the analysis period of 2023 to 2032.

Which are the key players in the purified terephthalic acid market?

The key players operating in the global market are including Reliance Industries Limited, SABIC (Saudi Basic Industries Corporation), BP plc, Eastman Chemical Company, Indorama Ventures Public Company Limited, Mitsui Chemicals, Inc., Sinopec Limited, Dow Chemical Company, Lotte Chemical Corporation, Jiangsu Sopo (Group) Co., Ltd., China Petrochemical Corporation (Sinopec Group), and Formosa Plastics Corporation.

Which region dominated the global purified terephthalic acid (PTA) market share?

Asia-Pacific held the dominating position in purified terephthalic acid industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of purified terephthalic acid during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global purified terephthalic acid industry?

The current trends and dynamics in the purified terephthalic acid market growth include growing demand for polyester fibers and films in the textile and packaging industries, and increasing focus on sustainability and eco-friendly packaging solutions.

Which application held the maximum share in 2022?

The polyester application held the maximum share of the PTA industry.