3D Machine Vision Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

3D Machine Vision Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

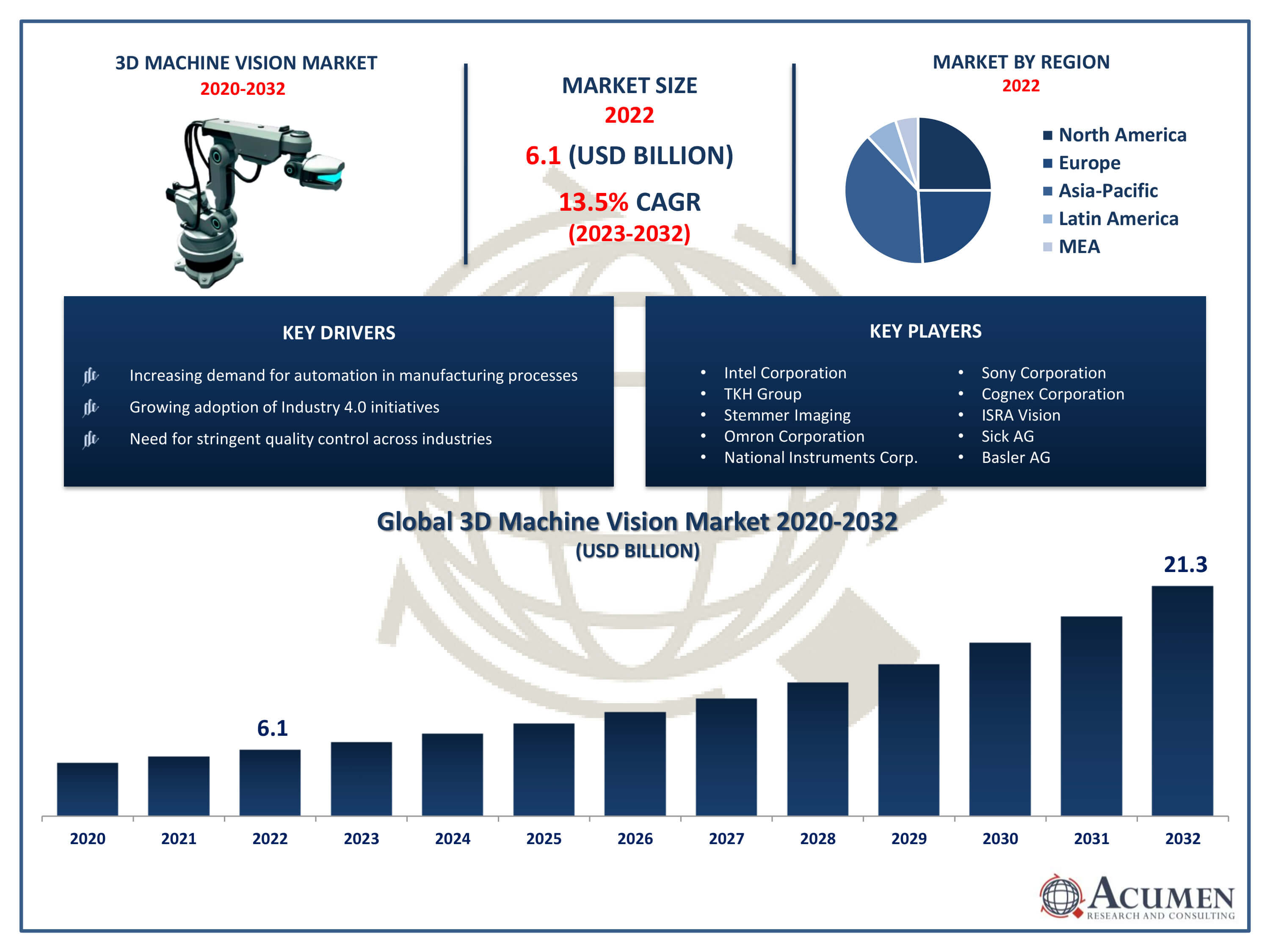

The 3D Machine Vision Market Size accounted for USD 6.1 Billion in 2022 and is projected to achieve a market size of USD 21.3 Billion by 2032 growing at a CAGR of 13.5% from 2023 to 2032.

3D Machine Vision Market Highlights

- Global 3D machine vision market revenue is expected to increase by USD 21.3 billion by 2032, with a 13.5% CAGR from 2023 to 2032

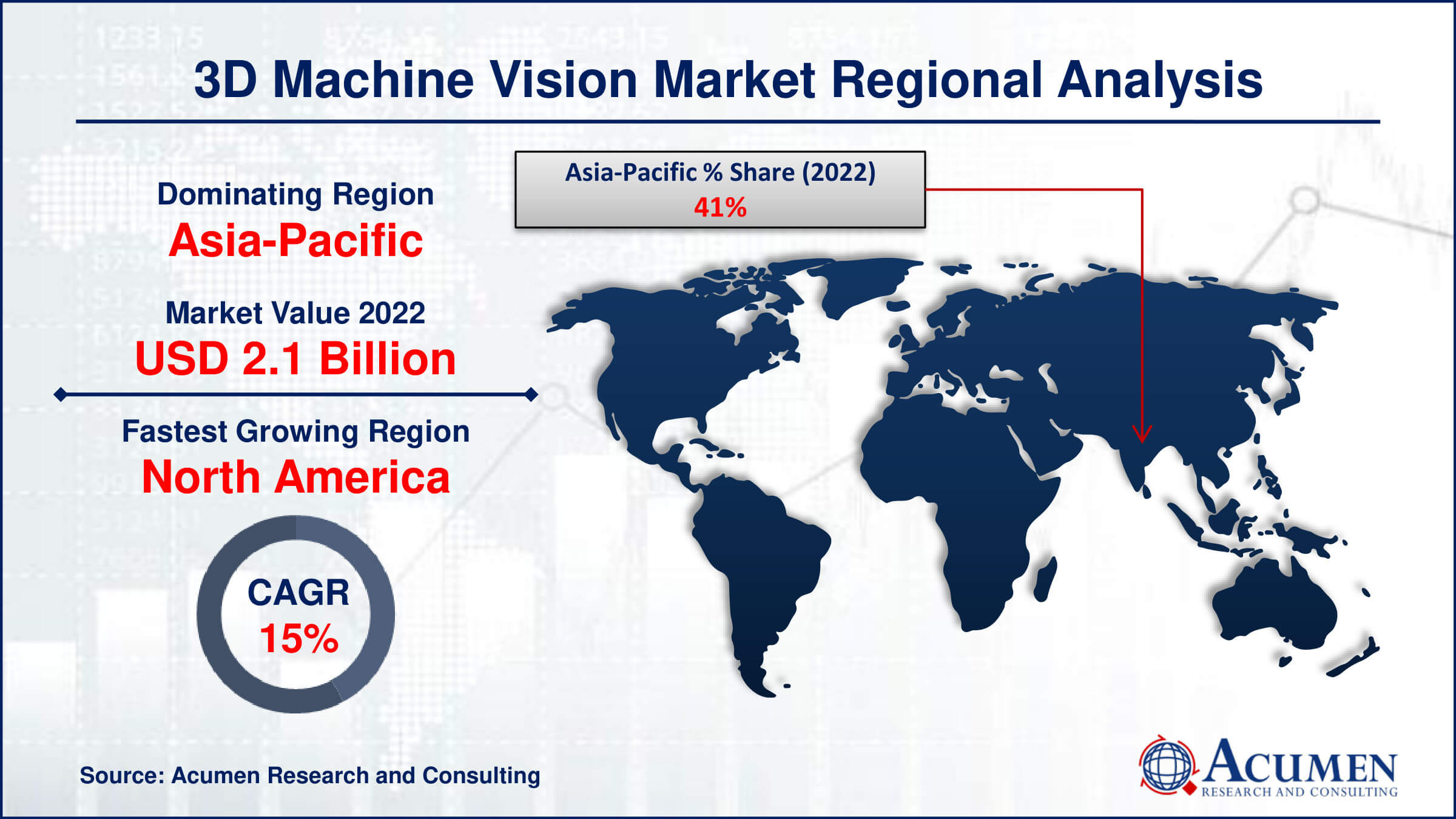

- Asia-Pacific region led with more than 41% of 3D machine vision market share in 2022

- North America 3D machine vision market growth will record a CAGR of around 15.1% from 2023 to 2032

- By offering, the hardware is the largest segment in the market, accounting for over 70% of the market share in 2022

- By product, the PC based segment has recorded more than 55% of the revenue share in 2022

- Increasing demand for automation in manufacturing processes, drives the 3D machine vision market value

3D machine vision is a technology that enables machines to perceive and understand the three-dimensional characteristics of objects in their environment. Unlike traditional 2D vision systems, which can only capture flat images, 3D machine vision systems utilize various techniques such as stereo vision, structured light, time-of-flight, and laser triangulation to capture depth information along with the spatial dimensions of objects. This depth perception capability allows machines to accurately analyze and interact with objects in real-world scenarios, leading to applications in quality control, robotics, automated inspection, logistics, and more.

3D machine vision is a technology that enables machines to perceive and understand the three-dimensional characteristics of objects in their environment. Unlike traditional 2D vision systems, which can only capture flat images, 3D machine vision systems utilize various techniques such as stereo vision, structured light, time-of-flight, and laser triangulation to capture depth information along with the spatial dimensions of objects. This depth perception capability allows machines to accurately analyze and interact with objects in real-world scenarios, leading to applications in quality control, robotics, automated inspection, logistics, and more.

The market for 3D machine vision has been experiencing significant growth in recent years, driven by the increasing demand for automation and quality assurance across various industries. Advancements in sensor technologies, such as higher resolution cameras and more efficient depth sensing methods have expanded the capabilities of 3D machine vision systems, making them more accurate, reliable, and cost-effective. Additionally, the growing adoption of Industry 4.0 initiatives and the need for efficient manufacturing processes have further fueled the market growth of 3D machine vision solutions. As industries continue to embrace automation and robotics, the demand for advanced 3D machine vision systems is expected to rise, driving further innovation and expansion in the industry. For instance, Basler AG designs and produces digital cameras for use in medical devices, traffic systems, industrial applications, and video surveillance.

Global 3D Machine Vision Market Trends

Market Drivers

- Increasing demand for automation in manufacturing processes

- Advancements in sensor technologies improving system accuracy and efficiency

- Growing adoption of Industry 4.0 initiatives

- Need for stringent quality control across industries

- Integration of AI and machine learning algorithms enhancing system capabilities

Market Restraints

- High initial investment costs associated with deploying 3D machine vision systems

- Lack of skilled professionals for implementing and maintaining these systems

Market Opportunities

- Expansion of applications into emerging sectors such as healthcare and agriculture

- Development of compact and portable 3D machine vision solutions

3D Machine Vision Market Report Coverage

| Market | 3D Machine Vision Market |

| 3D Machine Vision Market Size 2022 | USD 6.1 Billion |

| 3D Machine Vision Market Forecast 2032 |

USD 21.3 Billion |

| 3D Machine Vision Market CAGR During 2023 - 2032 | 13.5% |

| 3D Machine Vision Market Analysis Period | 2020 - 2032 |

| 3D Machine Vision Market Base Year |

2022 |

| 3D Machine Vision Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Offering, By Product, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Intel Corporation, TKH Group, Stemmer Imaging, Omron Corporation, National Instruments Corporation, Sony Corporation, Cognex Corporation, ISRA Vision, Sick AG, Basler AG, and Keyence Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

3D machine vision is a technology that allows machines to perceive and comprehend the three-dimensional characteristics of objects within their environment. Unlike traditional 2D vision systems that only capture flat images, 3D machine vision systems employ various techniques such as stereo vision, structured light, and laser triangulation to gather depth information along with spatial dimensions. This depth perception capability enables machines to accurately analyze and interact with objects in real-world scenarios, contributing to advancements in automation, robotics, and quality control across industries. The applications of 3D machine vision span a wide range of industries and tasks. In manufacturing, it facilitates automated inspection and quality control by detecting defects, measuring dimensions, and ensuring product consistency. In robotics, 3D vision enables robots to navigate complex environments, manipulate objects with precision, and collaborate safely with humans. In logistics and warehouse management, it optimizes inventory tracking, picking, and sorting processes by accurately identifying and locating items in three-dimensional space.

The 3D machine vision industry has been experiencing robust growth, driven by several factors. Advancements in sensor technologies, such as higher resolution cameras and more efficient depth-sensing methods, have significantly improved the capabilities and accuracy of 3D machine vision systems. For instance, in May 2021, MVTec Software GmbH released HALCON 21.05, the latest version of their machine vision software suite. A key feature of this upgrade is the Generic Form Matching, which simplifies the use of shape matching algorithms by consolidating them into a single set of operators, thereby reducing the number of operators needed. This has enabled industries to adopt these systems for a wide range of applications, including quality control, robotics, automated inspection, and logistics.

Additionally, the increasing demand for automation across various sectors, driven by the need for improved productivity, efficiency, and quality assurance, has further accelerated the growth of the 3D machine vision industry. Moreover, the adoption of Industry 4.0 initiatives has been a significant driver for the market growth of 3D machine vision systems. For instance, in September 2023, SSAFE released an extensive guide detailing the practical application of Industry 4.0 in the food supply chain, from farms to consumers. These advantages include enhanced traceability and transparency, process assurance, parametric release of food products, improved predictive capabilities for food safety issues, and increased resilience in food processes. Industry 4.0 emphasizes the integration of digital technologies into manufacturing processes to create smart factories that are more efficient, flexible, and connected.

3D Machine Vision Market Segmentation

The global 3D machine vision market segmentation is based on offering, product, application, end-use, and geography.

3D Machine Vision Market By Offering

- Hardware

- Camera

- Processor

- Frame Grabber

- LED Lighting

- Optics

- Software

- Deep Learning Software

- Application Specific

According to the 3D machine vision industry analysis, the hardware segment accounted for the largest market share in 2022. One of the primary drivers is the continuous advancements in hardware technologies, particularly in sensors and cameras, which have led to improved performance, accuracy, and reliability of 3D machine vision systems. Manufacturers are constantly innovating to develop sensors with higher resolutions, faster processing speeds, and enhanced depth-sensing capabilities, enabling more precise and detailed three-dimensional imaging. This progress in hardware technology has expanded the scope of applications for 3D machine vision across various industries, from automotive and electronics to pharmaceuticals and logistics. Moreover, the growing adoption of automation and robotics in manufacturing processes has fueled the demand for robust and reliable hardware components in 3D machine vision systems. Industries are increasingly investing in high-quality cameras, depth sensors, lighting systems, and other hardware components to ensure seamless integration and optimal performance of their automated systems.

3D Machine Vision Market By Product

- Smart Camera Based

- PC Based

In terms of products, the PC based segment is expected to witness significant growth in the coming years. One significant driver is the increasing demand for high-performance computing solutions capable of processing complex algorithms and handling large datasets generated by 3D machine vision systems. PCs offer the computational power and flexibility required to run sophisticated image processing and analysis software, enabling real-time decision-making and advanced functionalities such as object recognition, defect detection, and spatial mapping. As industries across sectors seek to enhance automation, quality control, and efficiency in their operations, the demand for powerful PC-based 3D machine vision solutions continues to rise. Furthermore, the convergence of 3D machine vision with other emerging technologies such as artificial intelligence (AI) and deep learning has further fueled the growth of the PC-based segment.

3D Machine Vision Market By Application

- Quality Assurance and Inspection

- Measurement

- Positioning and Guidance

- Identification

According to the 3D machine vision industry forecast, the quality assurance and inspection segment is expected to witness significant growth in the coming years. This growth is due to its crucial role in ensuring product quality, consistency, and compliance across various industries. As manufacturers face increasing pressure to meet stringent quality standards and regulations, the demand for advanced inspection solutions powered by 3D machine vision technology has surged. These systems offer unparalleled accuracy and precision in detecting defects, measuring dimensions, and identifying imperfections in manufactured components and products. By automating the inspection process, companies can significantly improve efficiency, reduce costs, and minimize the risk of defective products reaching the market. Furthermore, the adoption of 3D machine vision in quality assurance and inspection is driven by technological advancements that have enhanced the capabilities and versatility of these systems.

3D Machine Vision Market By End-Use

- Automotive

- Electronics & Semiconductor

- Pharmaceuticals & Chemicals

- Postal & Logistics

- Pulp & Paper

- Glass & Metal

- Food & Beverage

- Others

Based on the end-use, the automotive segment is expected to continue its growth trajectory in the coming years. This growth is driven by the increasing integration of advanced driver assistance systems (ADAS), autonomous vehicles, and smart manufacturing technologies within the automotive industry. 3D machine vision plays a crucial role in enabling these advancements by providing vehicles with the ability to perceive and understand their surroundings in three dimensions. In ADAS applications, such as lane departure warning, adaptive cruise control, and pedestrian detection, 3D machine vision systems accurately detect and classify objects in real-time, enhancing safety and driver assistance functionalities. Moreover, in the development of autonomous vehicles, 3D machine vision technologies are essential for mapping the environment, identifying obstacles, and navigating complex road scenarios, paving the way for the realization of fully autonomous driving.

3D Machine Vision Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

3D Machine Vision Market Regional Analysis

The Asia-Pacific region is emerging as a dominant force in the 3D machine vision industry due to several key factors. One significant driver is the rapid industrialization and modernization across countries in this region. For instance, in September 2023, China's President Xi Jinping emphasized the crucial importance of high-quality development in driving new industrialization. As industries invest in automation and smart manufacturing technologies to improve efficiency and maintain competitiveness, the demand for 3D machine vision solutions has surged. Additionally, the growing adoption of Industry 4.0 initiatives and the Internet of Things (IoT) accelerates the deployment of 3D machine vision systems in sectors such as automotive, electronics, healthcare, and consumer goods.

The Asia-Pacific region also boasts a robust ecosystem of technology manufacturers, suppliers, and innovators contributing to the development and advancement of 3D machine vision technologies. For instance, in March 2021, OMRON Corporation introduced the FH-SMD series 3D vision sensor to integrate these sensors onto robots for tasks like recognition and inspection. This initiative aims to streamline assembly processes, facilitate the placement of automotive parts in three dimensions, and enhance automation for pick-and-place operations, ultimately boosting productivity. Countries like China, Japan, South Korea, and Taiwan are renowned for their expertise in electronics, semiconductor manufacturing, and robotics, driving innovation and pushing the boundaries of 3D machine vision capabilities.

Furthermore, government initiatives and investments in research and development support the growth of the 3D machine vision industry in the region. For example, China's Ministry of Science and Technology (MST) announced an 8.1% increase in R&D investment for 2023, bringing the total to over $458 billion. As the Asia-Pacific continues to experience rapid industrial growth and technological advancement, it is expected to maintain its dominant position in the global 3D machine vision market, driving further innovation, adoption, and expansion.

North America is the fastest-growing region in the 3D machine vision market due to its strong technological infrastructure and high adoption rates in industries such as automotive, healthcare, and manufacturing. The region's focus on automation and advanced manufacturing processes, along with significant investments in research and development, drives this growth. For instance, manufacturing firms in the United States significantly increased their investment in automation, with the total number of industrial robot installations surging by 12% in 2023, reaching 44,303 units. Additionally, the presence of key market players and increasing demand for quality inspection and automation solutions further bolster the industry’s expansion. This rapid growth is also fueled by advancements in AI and machine learning technologies integrated into 3D machine vision systems.

3D Machine Vision Market Player

Some of the top 3D machine vision market companies offered in the professional report include Intel Corporation, TKH Group, Stemmer Imaging, Omron Corporation, National Instruments Corporation, Sony Corporation, Cognex Corporation, ISRA Vision, Sick AG, Basler AG, and Keyence Corporation.

Frequently Asked Questions

How big is the 3D machine vision market?

The 3D machine vision market size was USD 6.1 Billion in 2022.

What is the CAGR of the global 3D machine vision market from 2023 to 2032?

The CAGR of 3D machine vision is 13.5% during the analysis period of 2023 to 2032.

Which are the key players in the 3D machine vision market?

The key players operating in the global market are including Intel Corporation, TKH Group, Stemmer Imaging, Omron Corporation, National Instruments Corporation, Sony Corporation, Cognex Corporation, ISRA Vision, Sick AG, Basler AG, and Keyence Corporation.

Which region dominated the global 3D machine vision market share?

Asia-Pacific held the dominating position in 3D machine vision industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of 3D machine vision during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global 3D machine vision industry?

The current trends and dynamics in the 3D machine vision industry include increasing demand for automation in manufacturing processes, growing adoption of Industry 4.0 initiatives, and need for stringent quality control across industries.

Which Product held the maximum share in 2022?

The PC-based product held the maximum share of the 3D machine vision industry.