Yogurt Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Yogurt Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

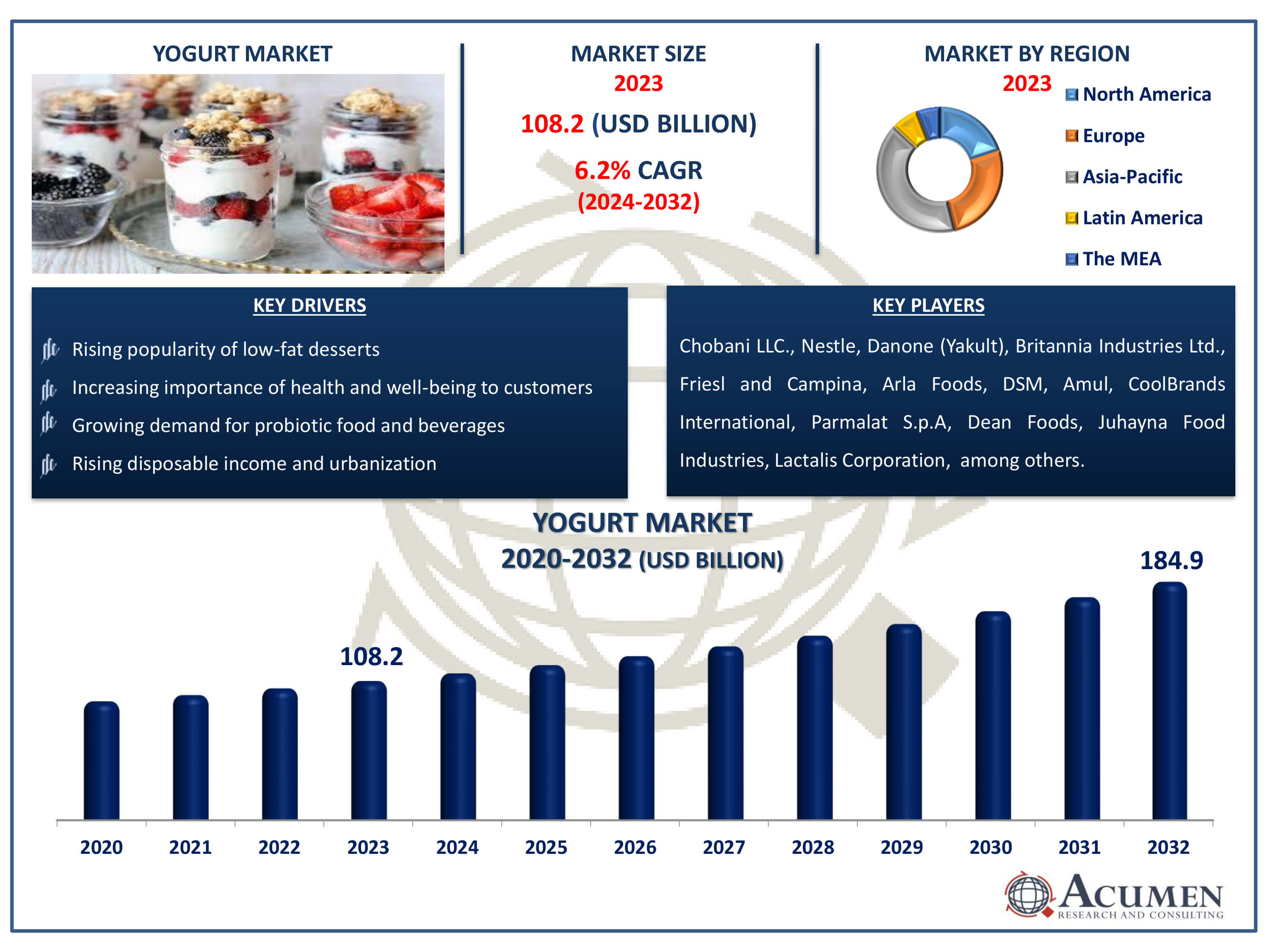

The Yogurt Market Size accounted for USD 108.2 Billion in 2023 and is estimated to achieve a market size of USD 184.9 Billion by 2032 growing at a CAGR of 6.2% from 2024 to 2032.

Yogurt Market Highlights

- Global yogurt market revenue is poised to garner USD 184.9 billion by 2032 with a CAGR of 6.2% from 2024 to 2032

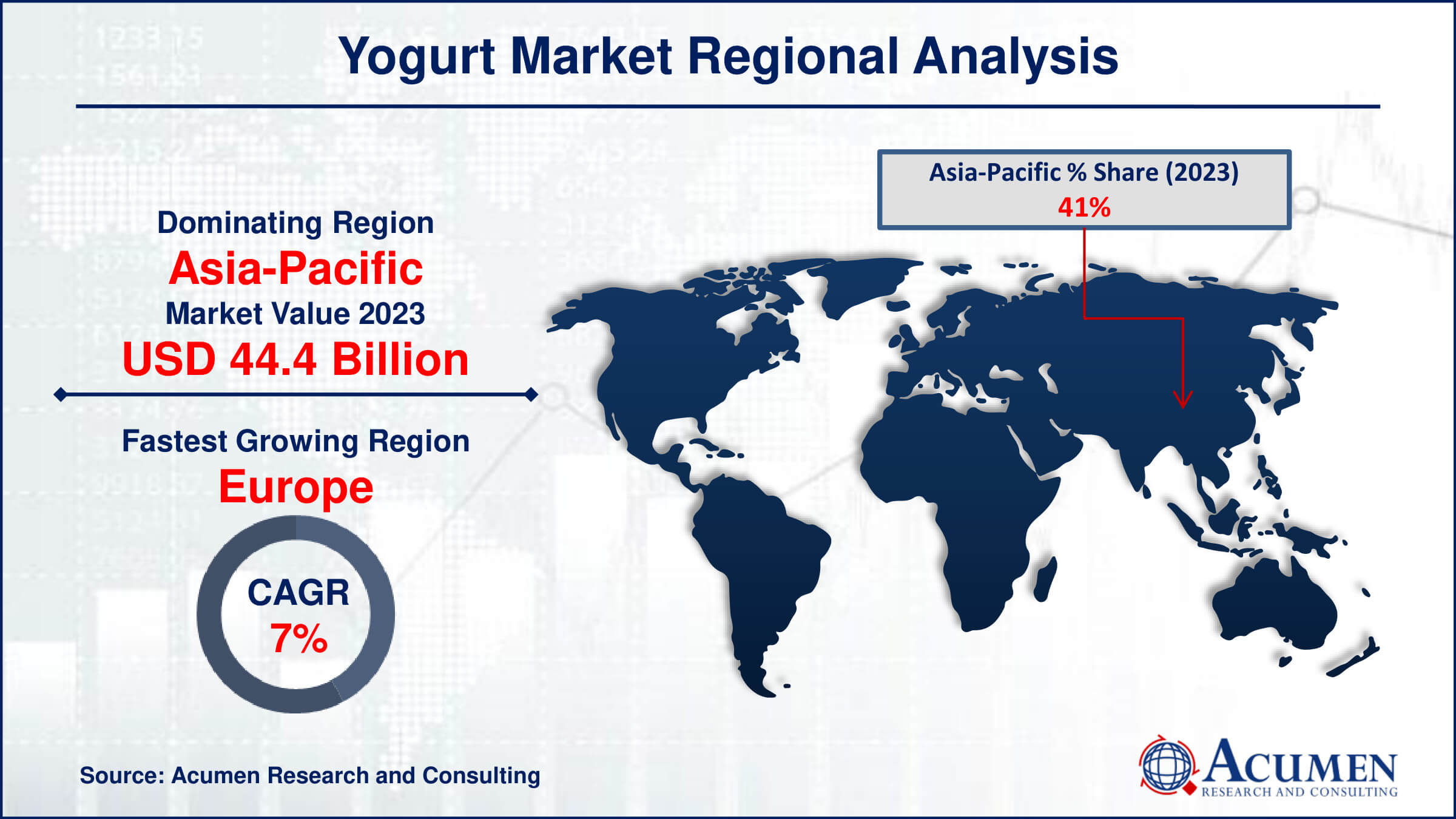

- Asia-Pacific yogurt market value occupied around USD 44.4 billion in 2023

- Europe yogurt market growth will record a CAGR of more than 7% from 2024 to 2032

- Among flavor, the plain sub-segment generated over US$ 77.9 billion revenue in 2023

- Based on distribution channel, the supermarkets and hypermarkets sub-segment generated around 40% share in 2023

- Expanding distribution channels, including online retail, enhancing product accessibility is a popular market trend that fuels the industry demand

Yogurt is a low-sugar, low-calorie, and digestive food product made from low-fat, skimmed milk, or whole. Yogurt products are also produced as non-dairy delicacies known as soy yogurt and coconut yogurt. It may consist of fermenting bacterial cultures, sweeteners, flavors, color additives, stabilizers, emulsifiers, and preservatives depending upon the way of production. The various nutrients present in yogurt include good bacteria for the digestive tract, protein, calcium, vitamin B-2, vitamin B-12, potassium, and magnesium. Plain yogurt or set yogurt is the most accepted variety with an average of 100 to 160 calories per serving based on fat content dependency. The flavored variety of yogurt ranges from simple vanilla with added sugar to different fruit-flavored types available in the market.

Global Yogurt Market Dynamics

Market Drivers

- Rising popularity of low-fat desserts

- Increasing importance of health and well-being to customers

- Growing demand for probiotic food and beverages

- Rising disposable income and urbanization

Market Restraints

- High competition

- Increasing use of artificial additives and ingredients in yogurt

- Fluctuating raw material prices impacting production costs

Market Opportunities

- Rising demand for yogurt in developing countries due to increasing disposable income and heightened health awareness

- Availability of a wide variety of plant-based and organic yogurt flavors

- Innovative product developments, such as functional and fortified yogurts, appealing to health-conscious consumers

Yogurt Market Report Coverage

| Market | Yogurt Market |

| Yogurt Market Size 2022 | USD 108.2 Million |

| Yogurt Market Forecast 2032 | USD 184.9 Million |

| Yogurt Market CAGR During 2023 - 2032 | 6.2% |

| Yogurt Market Analysis Period | 2020 - 2032 |

| Yogurt Market Base Year |

2022 |

| Yogurt Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Flavor, By Source, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Chobani LLC., Nestle, Danone (Yakult), Britannia Industries Ltd., Friesl and Campina, Arla Foods, DSM, Amul, CoolBrands International, Parmalat S.p.A, Dean Foods, Juhayna Food Industries, Lactalis Corporation, General Mills, Inc., and Schreiber Foods Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Yogurt Market Insights

The primary drivers of the market include health benefits associated with the consumption of yogurt and increasing awareness among people for losing weight. Other factors supporting the market growth are an expansion of the retail market in various regions and the lower lactose content for lactose intolerant people willing to eat dairy products. However, artificial additives & ingredients, often added to the yogurt, pose harmful effects on human health and are expected to restrict people from consuming yogurt, thus, limiting the market growth. Growth in demand for yogurt in emerging nations owing to a rise in disposable income as well as the increase in health awareness is expected to provide numerous opportunities for the expansion of the global yogurt market. Also growing popularity of low-fat and low-sugar yogurt will propel the market. Yogurt is available in frozen also it can consume as a dessert. The increasing popularity of ice cream alternatives by youngsters, and kids as well as rising health concerns among people will further boost the growth of the yogurt market in the coming years. Considering the Agri-food Canada and the ministry of Agriculture the consumption of yogurt increased in Canada from 1993 to 2012. Several health benefits of yogurt such as improved immune system, weight loss, control of cholesterol, and others benefits will be the increasing market of yogurt.

Yogurt Market Segmentation

The worldwide market for yogurt is split based on type, flavor, source, distribution channel, and geography.

Yogurt Types

- Set Yogurt

- Greek Yogurt

- Yogurt Drinks

- Regular

- Flavored

- Frozen Yogurt

According to the yogurt industry analysis, among all yogurt types, set yogurt held a major position in terms of market share. Increasing the use of set yogurt in several cooking recipes and consumption of yogurt as dessert is subsidizing the progression of the set yogurt product segment. However, yogurt drinks and frozen yogurt segments are expected to display strong growth during the upcoming period. The yogurt drinks segment is further bifurcated into flavored drinks and regular drinks. Flavored yogurt drink is anticipated to witness rapid growth during the forecast period. The growing accessibility of several fruits and other flavored yogurt with many health benefits is expected to support the demand for flavored yogurt drinks and flavored frozen yogurt segments in the near future.

Yogurt Flavors

- Plain

- Flavored

- Strawberry

- Blueberry

- Vanilla

- Peach

- Others

Within the flavor segment, the plain category emerged as the leader in terms of revenue share in previous years. Plain yogurt contains 12 grams of carbohydrates per 200 grams and another flavored yogurt contains 28 grams of carbohydrates. Plain yogurt is healthier as compared to flavor because they don’t have added sugar and artificial ingredients. Flavor yogurt has added sugar for taste and added sugar converts healthy food into junk food. Flavor yogurt is expected to hold a large share of the market in the previous year. In the flavor segment strawberry subsegment anticipate to grow over the forecast period its taken around 32% market share in recent years and expected to grow at a 7.5% CAGR.

Yogurt Sources

- Dairy Based Yogurt

- Non Dairy Based Yogurt

Based on the source the yogurt market is segmented into dairy-based yogurt and non-dairy-based yogurt. In recent years, the dairy-based yogurt segment has emerged as the dominant source segment in the yogurt market. The demand for dairy-based yogurt is increasing due to the dairy-based product being less expensive as compared to nondairy-based yogurts hench dairy-based yogurt is becoming popular in recent years. This segment is expected to keep growing during the forecast period. Another driving factor for dairy based yogurt is the increasing production of animal milk this will drive the growth of the segment.

Yogurt Distribution Channels

- Supermarkets And Hypermarkets

- Convenience Stores

- Specialist Retailers

- Online Stores

- Others

In terms of yogurt Market analysis, the distribution channels is divided into supermarkets and hypermarkets, convenience stores, specialist retailers, online stores, and others. according to the yogurt market forecast, the supermarkets and hypermarkets segments have dominated the market share and are likely to continue their dominance throughout the forecasted timeframe from 2024 to 2032. All popular brands are available in supermarkets other and the easy availability of the product is a driving factor of this segment. The supermarket segment generated the maximum revenue in this market. Moreover, the convenient store is expected to grow faster during the forecast period.

Yogurt Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Yogurt Market Regional Analysis

In terms of regional segments, Asia-Pacific has consistently held the largest revenue share and expected to grow in the yogurt market forecast period. This growth can be attributed to increased health awareness among people, and rising yogurt consumption the demand for Yogurt has risen due to the benefits for the consumption of yogurt, further bolstering market growth in the region.

Europe region significantly grows at the highest CAGR of nearly 7% during the yogurt forecast period. France, in particular, has increasing demand for flavored yogurt, leading to the change is a lifestyle, rising disposable income, and the increasing popularity of flavored yogurt in Europe is expected to drive further growth in the market in the coming years.

Yogurt Market Players

Some of the top yogurt companies offered in our report includes Chobani LLC., Nestle, Danone (Yakult), Britannia Industries Ltd., Friesl and Campina, Arla Foods, DSM, Amul, CoolBrands International, Parmalat S.p.A, Dean Foods, Juhayna Food Industries, Lactalis Corporation, General Mills, Inc., and Schreiber Foods Inc.

Frequently Asked Questions

What was the market size of the global yogurt in 2023?

The market size of yogurt was USD 108.2 billion in 2023.

What is the CAGR of the global yogurt market from 2024 to 2032?

The CAGR of yogurt is 6.2% during the analysis period of 2024 to 2032.

Which are the key players in the yogurt market?

The key players operating in the global market are including Chobani LLC., Nestle, Danone (Yakult), Britannia Industries Ltd., Friesl and Campina, Arla Foods, DSM, Amul, CoolBrands International, Parmalat S.p.A, Dean Foods, Juhayna Food Industries, Lactalis Corporation, General Mills, Inc., and Schreiber Foods Inc.

Which region dominated the global yogurt market share?

Asia-Pacific held the dominating position in yogurt industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of yogurt during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global yogurt industry?

The current trends and dynamics in the yogurt industry include rising popularity of low-fat desserts, increasing importance of health and well-being to customers, growing demand for probiotic food and beverages, and rising disposable income and urbanization.

Which Source held the maximum share in 2023?

The dairy based yogurt source held the maximum share of the yogurt industry.