Wireless Power Transmission Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Wireless Power Transmission Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

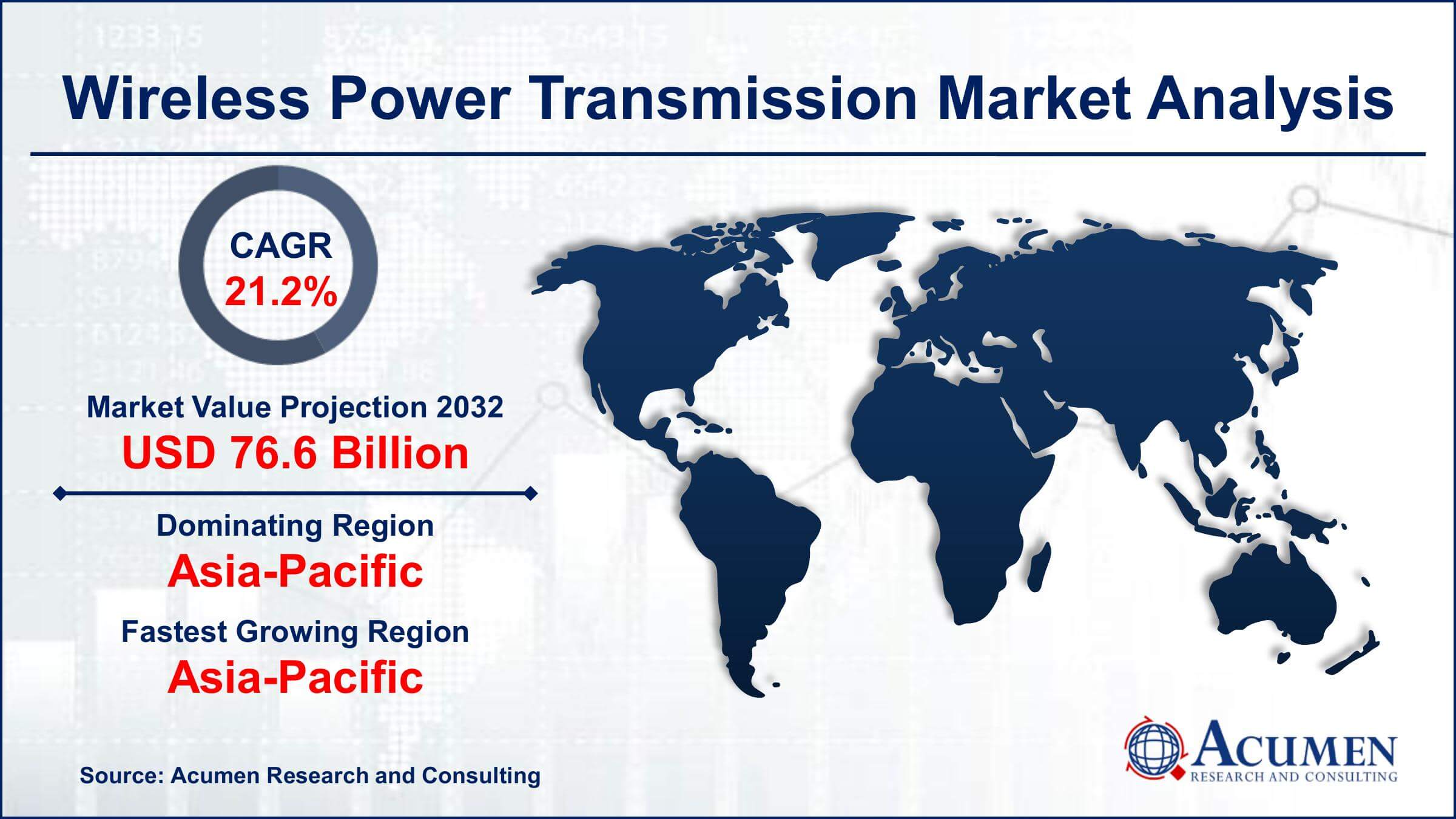

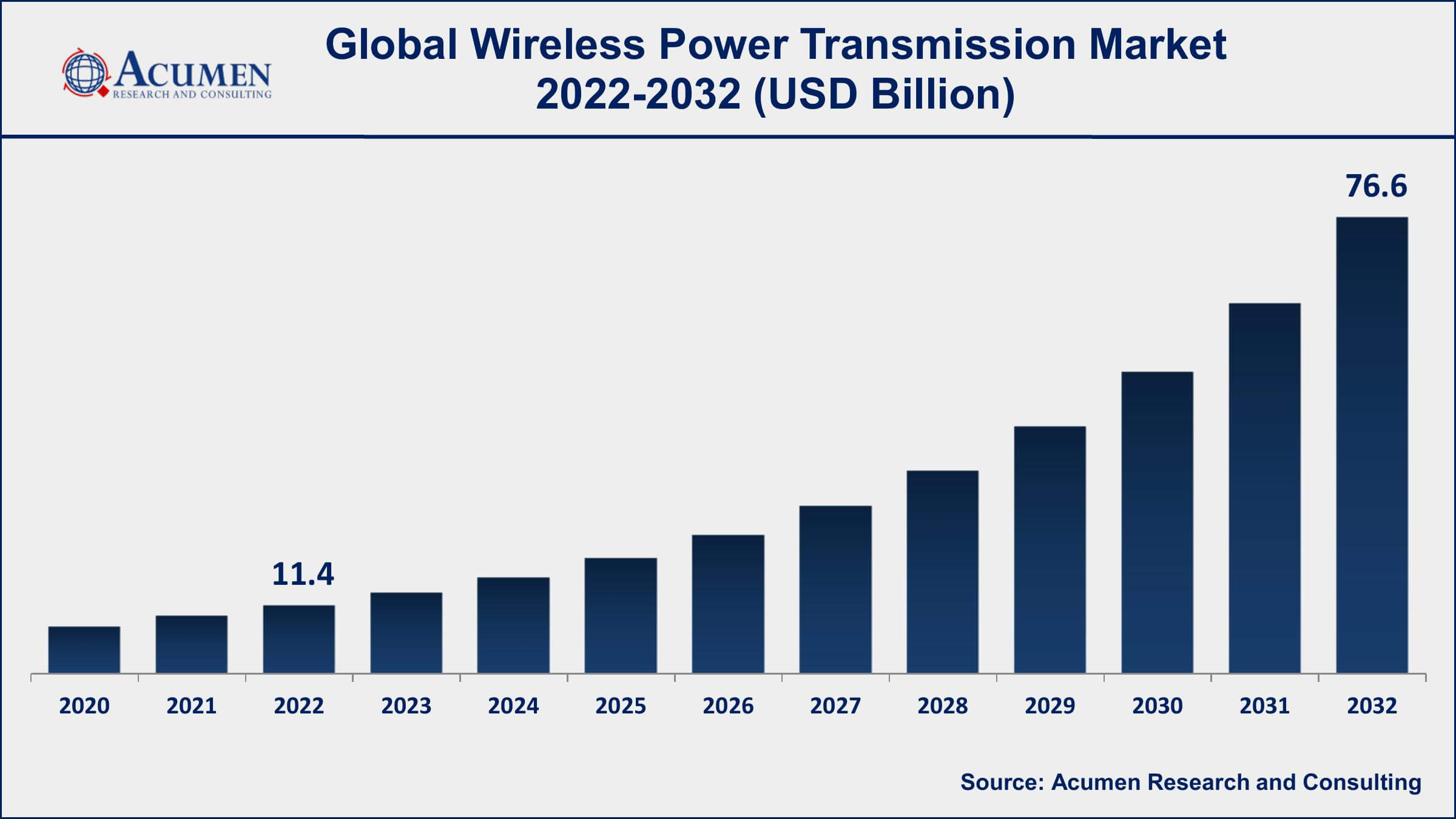

Request Sample Report

The Global Wireless Power Transmission Market Size accounted for USD 11.4 Billion in 2022 and is projected to achieve a market size of USD 76.6 Billion by 2032 growing at a CAGR of 21.2% from 2023 to 2032.

Wireless Power Transmission Market Highlights

- Global Wireless Power Transmission Market revenue is expected to increase by USD 76.6 Billion by 2032, with a 21.2% CAGR from 2023 to 2032

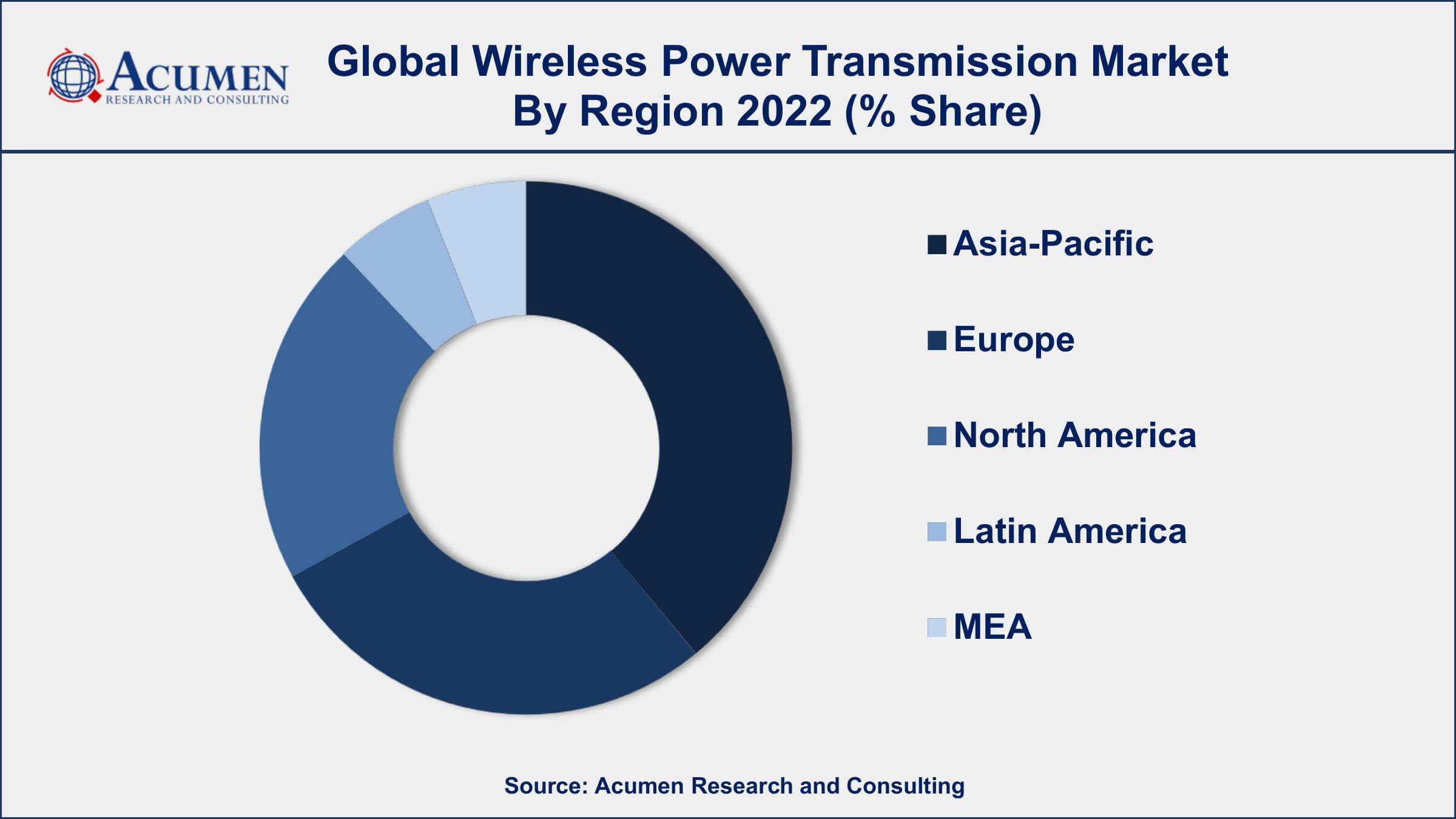

- Asia-Pacific region led with more than 38% of Wireless Power Transmission Market share in 2022

- The wireless power transmission market accounts for approximately 20.3% of the total power transmission market

- By technology, the near-field technologies segment has generated of about 86% of the revenue share in 2022

- By application, the receiver segment has accounted more than 71% of the revenue share in 2022

- Increasing adoption of wireless charging in consumer electronics such as smartphones, smartwatches, and wireless earphones, drives the Wireless Power Transmission Market value

Wireless power transmission, also known as wireless energy transfer or wireless charging, is a technology that enables the transfer of electrical energy from a power source to an electronic device without the need for physical connections or cables. It works by using electromagnetic fields to transfer energy between a transmitter and a receiver. This technology has gained significant attention and popularity in recent years due to its convenience and potential for eliminating the need for traditional wired charging methods.

The market for wireless power transmission has experienced substantial growth and is expected to continue expanding in the coming years. One of the key drivers behind this growth is the increasing adoption of wireless charging in consumer electronic devices such as smartphones, smartwatches, and wireless earphones. As more devices integrate wireless charging capabilities, the demand for wireless power transmission technologies is projected to rise.

Additionally, the automotive industry has also embraced wireless charging for electric vehicles (EVs). Wireless charging pads embedded in parking spots or garages allow EV owners to conveniently charge their vehicles without the hassle of plugging in cables. This technology not only simplifies the charging process but also paves the way for autonomous charging, where EVs can wirelessly charge themselves without human intervention. As the adoption of electric vehicles continues to rise, the demand for wireless power transmission in the automotive sector is expected to contribute significantly to the wireless power transmission market growth.

Global Wireless Power Transmission Market Trends

Market Drivers

- Increasing adoption of wireless charging in consumer electronics such as smartphones, smartwatches, and wireless earphones

- Growing demand for electric vehicles (EVs) and the need for convenient wireless charging solutions

- Rising popularity of smart home devices and the Internet of Things (IoT), creating a demand for wireless power transmission

- Enhanced user experience and convenience offered by wireless charging, eliminating the need for cables and plugs

Market Restraints

- Limited charging range and power transfer efficiency compared to wired charging methods

- High implementation costs associated with integrating wireless charging technologies into devices and infrastructure

Market Opportunities

- Integration of wireless charging technology into public spaces, such as airports, coffee shops, and restaurants, providing convenient charging options for consumers

- Development of wireless power transmission for industrial applications, including robotics, drones, and medical devices

Wireless Power Transmission Market Report Coverage

| Market | Wireless Power Transmission Market |

| Wireless Power Transmission Market Size 2022 | USD 11.4 Billion |

| Wireless Power Transmission Market Forecast 2032 | USD 76.6 Billion |

| Wireless Power Transmission Market CAGR During 2023 - 2032 | 21.2% |

| Wireless Power Transmission Market Analysis Period | 2020 - 2032 |

| Wireless Power Transmission Market Base Year | 2022 |

| Wireless Power Transmission Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Qualcomm Incorporated, Samsung Electronics Co., Ltd., Powermat Technologies Ltd., WiTricity Corporation, Energous Corporation, Ossia Inc., Integrated Device Technology, Inc., TDK Corporation, Powercast Corporation, NuCurrent Inc., uBeam Inc., and PowerSphyr Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wireless power transmission, also known as wireless energy transfer or wireless charging, is a technology that enables the transfer of electrical energy from a power source to an electronic device without the need for physical connections or cables. It utilizes electromagnetic fields to transfer energy between a transmitter and a receiver, allowing devices to charge wirelessly. This technology offers convenience and eliminates the clutter and limitations of traditional wired charging methods.

The applications of wireless power transmission are diverse and span across various industries. One of the prominent applications is in consumer electronics. Smartphones, smartwatches, and wireless earphones now commonly incorporate wireless charging capabilities. Users can simply place their devices on a wireless charging pad, eliminating the need to plug in cables. This technology also enables the charging of multiple devices simultaneously, offering a convenient and clutter-free charging experience.

The wireless power transmission market has been experiencing significant growth and is poised for further expansion in the coming years. The increasing adoption of wireless charging in consumer electronics, electric vehicles, and smart home devices is a major driver behind this growth. As more devices integrate wireless charging capabilities, the demand for wireless power transmission technologies is expected to soar. The convenience and hassle-free charging experience offered by wireless charging have contributed to its popularity among consumers.

Another significant factor driving market growth is the rising adoption of electric vehicles. Wireless charging pads embedded in parking spots or garages enable EV owners to conveniently charge their vehicles without the need for cables. This technology simplifies the charging process and eliminates the inconvenience associated with plugging and unplugging cables. As the adoption of electric vehicles continues to rise, the demand for wireless power transmission solutions in the automotive sector is expected to fuel market growth.

Wireless Power Transmission Market Segmentation

The global Wireless Power Transmission Market segmentation is based on technology, type, application, and geography.

Wireless Power Transmission Market By Technology

- Near-field technologies

- Capacitive coupling/conductive

- Magnetic resonance technologies

- Inductive technology

- Far-field technologies

- Laser/Infrared

- Microwave

According to the wireless power transmission industry analysis, the near-field technologies segment accounted for the largest market share in 2022. Near-field technologies, such as inductive and magnetic resonance charging, enable efficient power transfer over short distances, typically within a few centimeters to a few inches. This technology is widely used in various applications, including smartphones, smartwatches, and other portable electronic devices. One of the key drivers behind the growth of near-field technologies is the increasing adoption of wireless charging in consumer electronics. Smartphone manufacturers have been integrating wireless charging capabilities into their devices, which has resulted in a surge in demand for near-field technologies. The convenience of wireless charging, coupled with the elimination of cables and connectors, has significantly enhanced the user experience and spurred the adoption of near-field wireless charging.

Wireless Power Transmission Market By Type

- Devices without battery

- Devices with battery

In terms of types, the devices with battery segment is expected to witness significant growth in the coming years. This segment encompasses a wide range of devices that rely on batteries for power, such as smartphones, tablets, smartwatches, wireless earphones, and other portable electronic devices. One of the key drivers behind the growth of this segment is the increasing adoption of wireless charging in consumer electronics. As more device manufacturers integrate wireless charging capabilities into their products, consumers are becoming more inclined to choose devices that offer the convenience of wireless power transmission. The seamless and hassle-free charging experience provided by wireless charging has contributed to the popularity of this technology among users of devices with batteries.

Wireless Power Transmission Market By Application

- Receiver application

- Wearable Electronics

- Smartphones

- Notebooks

- Tablets

- Other Consumer Electronics

- Electric vehicle charging

- Transmitter application

- Automotive (In-Vehicle Charging System)

- Standalone Chargers

- Electric Vehicle Charging

- Furniture

According to the wireless power transmission market forecast, the receiver application segment is expected to witness significant growth in the coming years. The receiver application segment refers to the devices or applications that receive wireless power and convert it into usable energy. These receivers can be integrated into a wide range of devices across various industries. One of the primary drivers behind the growth of the receiver application segment is the increasing adoption of wireless charging in consumer electronics. Smartphones, smartwatches, wireless earphones, and other portable devices now commonly incorporate wireless charging capabilities, driving the demand for compatible receivers. As consumers seek the convenience of wireless charging, manufacturers are integrating receiver technology into their devices to meet this growing demand.

Wireless Power Transmission Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Wireless Power Transmission Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the wireless power transmission market due to several key factors. Firstly, the region is home to major manufacturing hubs for consumer electronics and mobile devices. Countries like China, South Korea, and Japan have a strong presence in the global electronics industry, which includes the production of smartphones, smartwatches, and other wireless charging-enabled devices. The availability of a robust supply chain, skilled labor, and technological expertise in these countries has facilitated the mass production and adoption of wireless power transmission technologies. Moreover, the Asia-Pacific region has a large and rapidly growing consumer market. With a rising middle class and increasing disposable incomes, there is a strong demand for innovative and convenient technologies, including wireless charging solutions. The region's tech-savvy population is quick to adopt new technologies, contributing to the widespread adoption of wireless power transmission in consumer electronics. The sheer size of the market and the high penetration of smartphones and other portable devices in the region further amplify the dominance of Asia-Pacific in the wireless power transmission market.

Wireless Power Transmission Market Player

Some of the top wireless power transmission market companies offered in the professional report include Qualcomm Incorporated, Samsung Electronics Co., Ltd., Powermat Technologies Ltd., WiTricity Corporation, Energous Corporation, Ossia Inc., Integrated Device Technology, Inc., TDK Corporation, Powercast Corporation, NuCurrent Inc., uBeam Inc., and PowerSphyr Inc.

Frequently Asked Questions

What was the market size of the global wireless power transmission in 2022?

The market size of wireless power transmission was USD 11.4 Billion in 2022.

What is the CAGR of the global wireless power transmission market from 2023 to 2032?

The CAGR of wireless power transmission is 21.2% during the analysis period of 2023 to 2032.

Which are the key players in the wireless power transmission market?

The key players operating in the global market are including Qualcomm Incorporated, Samsung Electronics Co., Ltd., Powermat Technologies Ltd., WiTricity Corporation, Energous Corporation, Ossia Inc., Integrated Device Technology, Inc., TDK Corporation, Powercast Corporation, NuCurrent Inc., uBeam Inc., and PowerSphyr Inc.

Which region dominated the global wireless power transmission market share?

Asia-Pacific held the dominating position in wireless power transmission industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of wireless power transmission during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global wireless power transmission industry?

The current trends and dynamics in the wireless power transmission industry include increasing adoption of wireless charging in consumer electronics such as smartphones, smartwatches, and wireless earphones, and growing demand for electric vehicles (EVs) and the need for convenient wireless charging solutions.

Which type held the maximum share in 2022?

The devices with battery type held the maximum share of the wireless power transmission industry.