Wire and Cable Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Wire and Cable Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

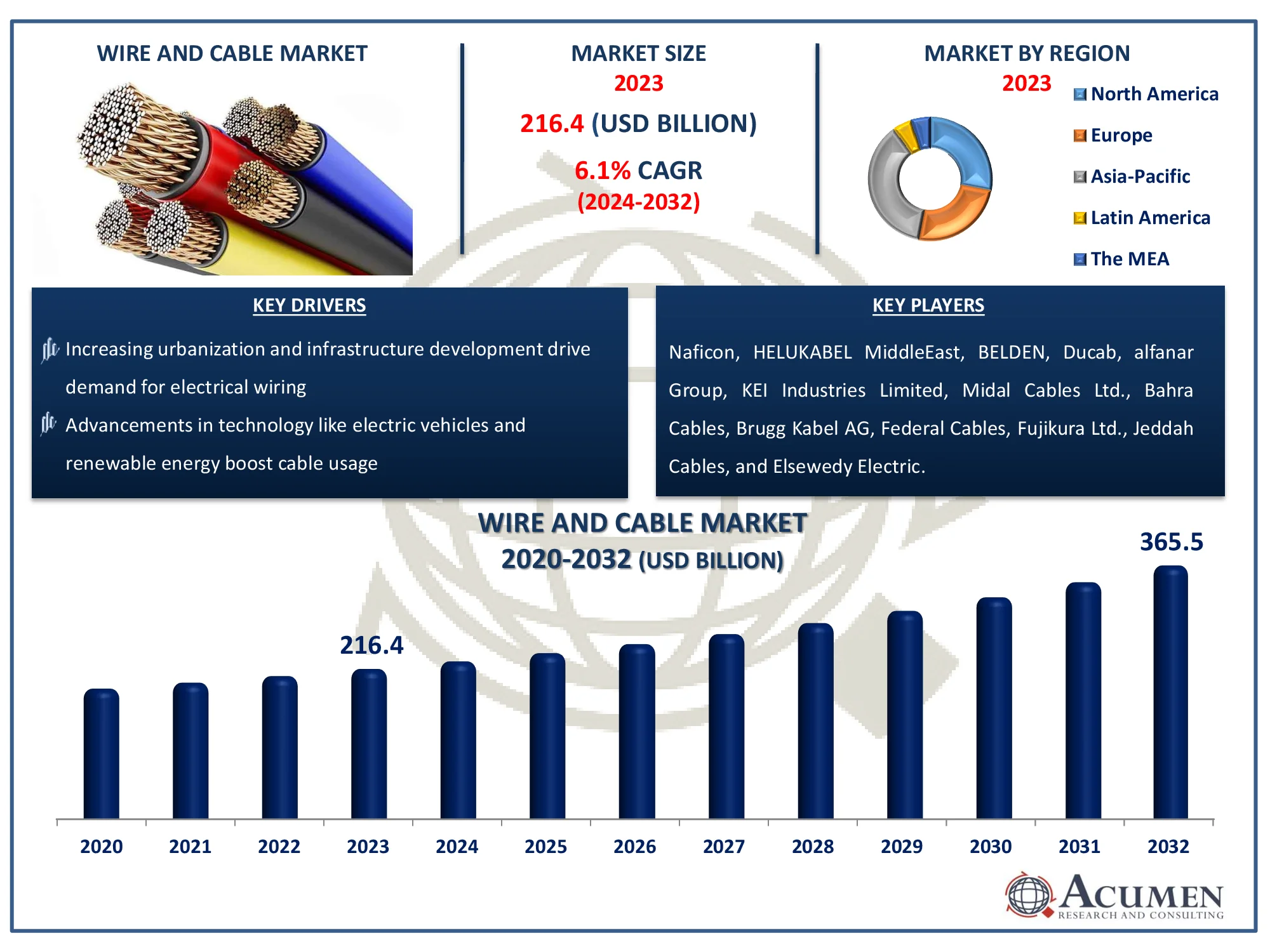

The Wire and Cable Market Size accounted for USD 216.4 Billion in 2023 and is estimated to achieve a market size of USD 365.5 Billion by 2032 growing at a CAGR of 6.1% from 2024 to 2032

Wire and Cable Market Highlights

- Global wire and cable market revenue is poised to garner USD 365.5 billion by 2032 with a CAGR of 6.1% from 2024 to 2032

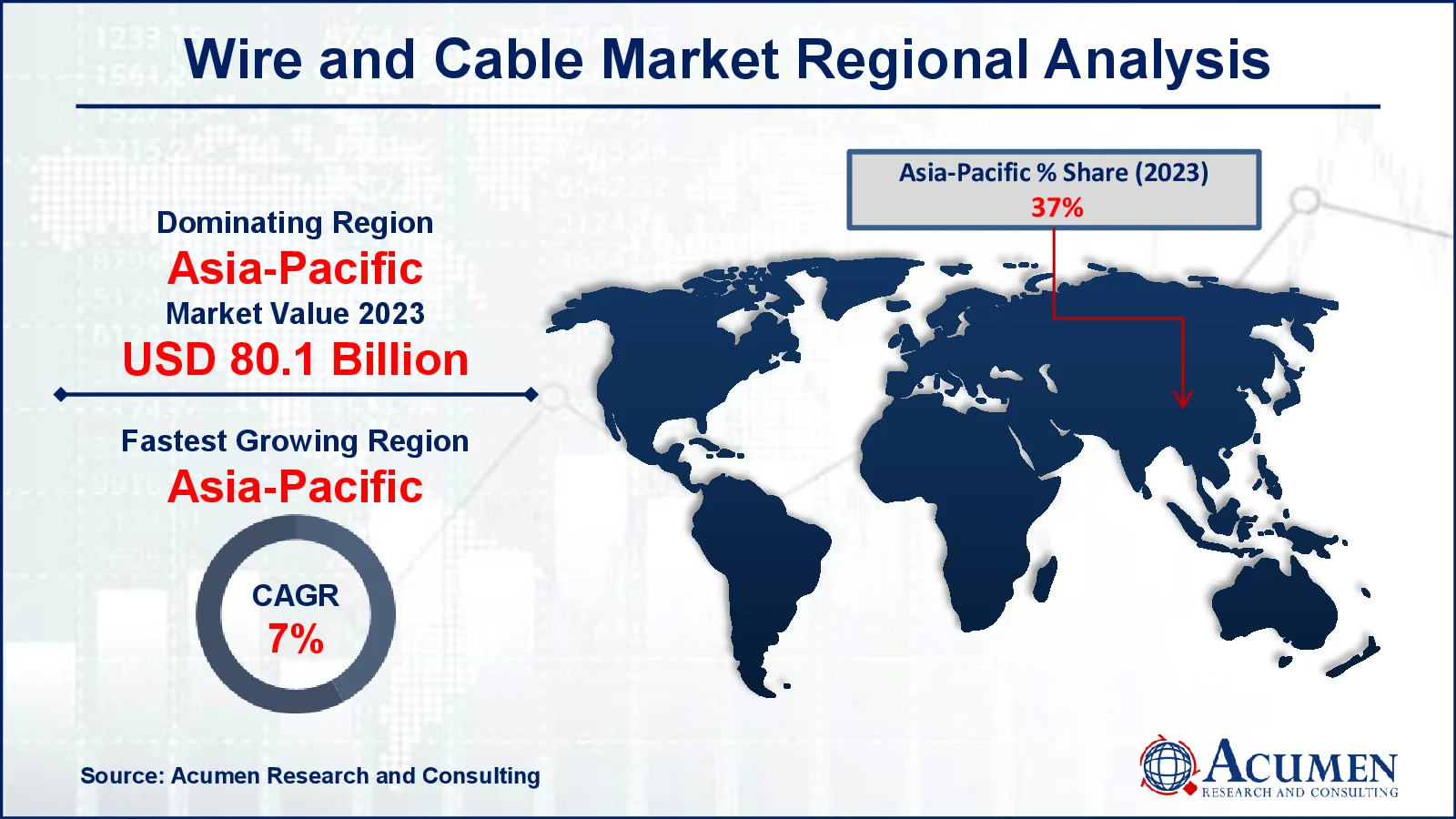

- Asia-Pacific wire and cable market value occupied around USD 80.1 billion in 2023

- Asia-Pacific wire and cable market growth will record a CAGR of more than 7% from 2024 to 2032

- Among voltage, the low voltage sub-segment generated more than USD 93 billion wire and cable market revenue in 2023

- Based on installation, the overhead sub-segment generated around 62% wire and cable market share in 2023

- Increased adoption of 5G technology is a popular wire and cable market trend that fuels the industry demand

Wires and cables are used in practically every industry, from building to healthcare, manufacturing to power generation, making them an essential element of today's world. As a result, it comes as no surprise that there is a high global need for wires and cables. The conducting substance used as the core to transfer electrical or light signals, as well as the insulation material used as the outside covering, are essential components of wires and cables. Aluminum and copper are the most common metal conductors used in cables. These conductors require insulation from polymers such as polyethylene, cross-linked polyethylene, PVC (polyvinyl chloride), Kapton, Teflon, and rubber-like polymers, among others. The other primary form of cable utilized is optical fiber cables, which employ glass fibers or strands as conductors and do not require insulation.

Global Wire and Cable Market Dynamics

Market Drivers

- Increasing urbanization and infrastructure development drive demand for electrical wiring

- Advancements in technology like electric vehicles and renewable energy boost cable usage

- Rising demand for data centers and IT infrastructure require extensive cabling

- Growing awareness of energy efficiency leads to adoption of energy-efficient cables

Market Restraints

- Fluctuations in raw material prices can impact production costs

- Strict environmental regulations can increase compliance burdens

- Intense competition among manufacturers can lower profit margins

Market Opportunities

- Growing demand for specialized cables like fiber optics and high-temperature cables

- Expansion of renewable energy sectors presents opportunities for cable manufacturers

- Increasing adoption of smart cities will drive demand for advanced cabling solutions

Wire and Cable Market Report Coverage

| Market | Wire and Cable Market |

| Wire and Cable Market Size 2022 |

USD 216.4 Billion |

| Wire and Cable Market Forecast 2032 | USD 365.5 Billion |

| Wire and Cable Market CAGR During 2023 - 2032 | 6.1% |

| Wire and Cable Market Analysis Period | 2020 - 2032 |

| Wire and Cable Market Base Year |

2022 |

| Wire and Cable Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Voltage, By Installation, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Naficon, HELUKABEL Middle East DWC LLC, BELDEN, Ducab, alfanar Group, KEI Industries Limited, Midal Cables Ltd., Bahra Cables, Brugg Kabel AG, Federal Cables, Fujikura Ltd., Jeddah Cables, and Elsewedy Electric. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wire and Cable Market Insights

Wires and cables are used in power transmission, telecommunication and building wiring applications extensively and these accounts for the large share of their demand. Thus, the wire and cable market is largely dependent on the developments in electric communication, power generation and transmission and construction industry as well as industrial development and modernizing of infrastructure. Currently, all the application sectors of wires and cables market are exhibiting steady growth, with different geographies showing highest growth in different applications, which gives the industry a positive sustained growth prospect in the wire and cable market forecast period.

The modernization of existing wire and cable network from metal conductor wires to optical fibers for efficient use in telecommunication applications is giving a boost to wires and cables industry in developed countries. The switch towards electric vehicles will also help drive the wire and cable market further. In developing countries, the growth in construction and power transmission activities and increase in power transmission grid capacities has led to major part of the overall demand for wires and cables market.

However, all product types are not forecast to grow at the same rate. Since more and more industries are switching to the use of optical fibers in data transmission applications where high speed is required, the demand for copper metal conductors has reduced. In insulation materials market, the regulatory issues related to the use of PVC, which is most widely used insulating material in wires and cables, has meant a high degree of substitution by materials like polyolefins, XLPE and PPE, which have higher forecasted growth rates.

The slow transition to wireless devices is a potential restraint to the industry in the long term, but over the wires and cables market forecast period, the market is forecast to grow to its potential. Among the materials, the copper conductors have the largest market share as compared to their aluminum and fiber optic counterparts. But the growth rate for fiber optic cables will far supersede the growth in copper conductors. Although PVC has regulatory issues relating to the manufacture and disposal of PVC products, it will still dominate the wires and cables market, but will showcase slightly lower growth rates.

Wire and Cable Market Segmentation

The worldwide market for wire and cable is split based on type, voltage, installation, end user, and geography.

Wires and Cables Market By Types

- Optical Fiber

- Copper Cables

- Aluminum

- Others

According to wire and cable industry analysis, the optical fiber sector is likely to be the most important in the market. Its ability to transmit data at extremely high speeds and across long distances with minimum signal degradation makes it ideal for a wide range of applications. The broadband interne demand is increasing, data centers, and cloud computing has accelerated the deployment of optical fiber connections. Furthermore, the expanding use of fiber-to-the-home (FTTH) networks, which provide faster and more reliable internet access in residential areas, is increasing the need for optical fiber cables.

On other hand, advanced fiber optic technologies, such as wavelength division multiplexing (WDM), allow for the transmission of several data streams over a single fibre, boosting capacity and efficiency. All of these factors contribute to optical fiber's dominance as the largest segment in the wire and cable market.

Wires and Cables Market By Voltage

- Medium Voltage

- Low Voltage

- Extra High Voltage

- High Voltage

Low voltage cables are the most popular sub-segment in the wire and cable market forecast period, owing to their widespread application in a variety of industries and residential settings. Low voltage cables are widely used for voltages up to 1,000 volts and are needed to power electrical equipment, appliances, and lighting systems. The widespread electrification of homes, workplaces, and industrial structures has created a significant need for low voltage cables. Low voltage cables are expected to generate approximately 93.05 billion in sales by 2023. Additionally, the increased usage of renewable energy sources, such as solar panels and wind turbines, necessitates a robust network of low voltage cables to connect these systems to the power grid.

Wires and Cables Market By Installation

- Submarine

- Underground

- Overhead

The overhead segment leads the wire and cable market because of its broad use in power transmission and distribution. Overhead cables are popular because they are inexpensive, simple to install, and capable of covering vast distances. Overhead cables, unlike underground and submarine cables, are open to the elements, making them easier to maintain and replace. Their construction uses fewer materials and labor, lowering overall expenses. This segment is especially important in regions with expansive landscapes and a need for rapid infrastructure development, cementing its market leadership.

Wires and Cables Market By End Users

- Energy and Power

- Aerospace and Defense

- IT and Telecommunication

- Building & Construction

- Oil and Gas

- Others

Within the end user category, the energy and power industry is the most significant segment of wire and cable market because of its critical role in supplying electricity to several sectors and homes, These cables are essential for the safe and efficient supply of electricity by power plants, transmission lines, and distribution networks alike.

The rising need for electricity, driven by economic development and population growth, has accelerated the rise of the energy and power sectors. As a result, the demand for long-lasting and reliable wire and cable solutions has grown. Furthermore, the transition toward renewable energy sources, such as solar and wind power, has created new opportunities for wire and cable manufacturers to provide specialized solutions for these applications.

Wire and Cable Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Wire and Cable Market Regional Analysis

In terms of wire and cable market analysis, Asia-Pacific accounts for more than half of worldwide demand for wire and cable products. This supremacy is largely due to the widespread outsourcing of manufacturing activity to the region as corporations want to cut labor costs. The region's rising infrastructure developments, fast industrialization, and telecommunications expansion all contribute to its large wires and cables market share.

Looking ahead, Asia-Pacific demand for wires and cables market is predicted to rise slightly faster than North America, owing to ongoing urbanization and industrial expansion. While Europe maintains its dominant position, growth is expected to be more moderate as the market matures and transitions toward greener technology.

Wire and Cable Market Players

Some of the top wire and cable market companies offered in our report includes Naficon, HELUKABEL Middle East DWC LLC, BELDEN, Ducab, alfanar Group, KEI Industries Limited, Midal Cables Ltd., Bahra Cables, Brugg Kabel AG, Federal Cables, Fujikura Ltd., Jeddah Cables, and Elsewedy Electric.

Frequently Asked Questions

How big is the wire and cable market?

The wire and cable market size was valued at USD 216.4 billion in 2023.

What is the CAGR of the global wire and cable market from 2024 to 2032?

The CAGR of wire and cable is 6.1% during the analysis period of 2024 to 2032.

Which are the key players in the wire and cable market?

The key players operating in the global market are including Naficon, HELUKABEL Middle East DWC LLC, BELDEN, Ducab, alfanar Group, KEI Industries Limited, Midal Cables Ltd., Bahra Cables, Brugg Kabel AG, Federal Cables, Fujikura Ltd., Jeddah Cables, and Elsewedy Electric.

Which region dominated the global wire and cable market share?

Asia-Pacific held the dominating position in wire and cable industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of wire and cable during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global wire and cable industry?

The current trends and dynamics in the wire and cable industry include increasing urbanization and infrastructure development drive demand for electrical wiring, advancements in technology like electric vehicles and renewable energy boost cable usage, rising demand for data centers and IT infrastructure require extensive cabling, and growing awareness of energy efficiency leads to adoption of energy-efficient cables.

Which end user held the maximum share in 2023?

The energy and power end user held the maximum share of the wire and cable industry.