Wine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Wine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Wine Market Size accounted for USD 489.3 Billion in 2021 and is estimated to achieve a market size of USD 825.5 Billion by 2030 growing at a CAGR of 6.1% from 2022 to 2030. The growing acceptance of wine throughout all age groups, from the younger to the elderly, is a crucial factor driving the wine market growth worldwide. Furthermore, the wine market value is projected to be driven by rising demand due to health advantages and premiumization of wine goods, as well as flavor development and more modern distribution channels globally.

Wine Market Report Key Highlights

- Global wine market revenue is estimated to expand by USD 825.5 billion by 2030, with a 6.1% CAGR from 2022 to 2030.

- Europe wine market share accounted for over 45% shares in 2021

- Asia-Pacific wine market growth will observe fastest CAGR of 8% from 2022 to 2030

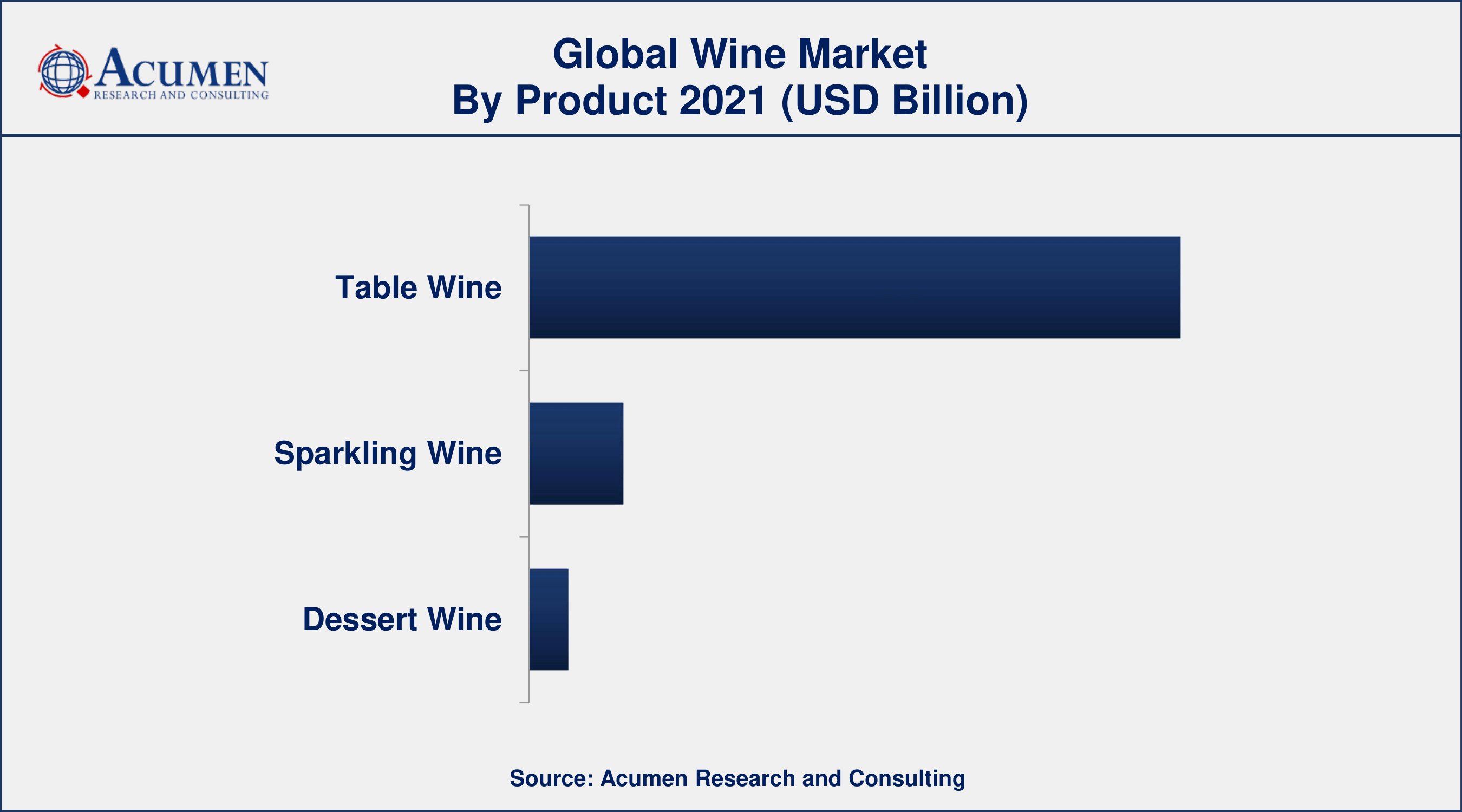

- Based on product, table wine segment accounted for over 80% of the overall market share in 2021

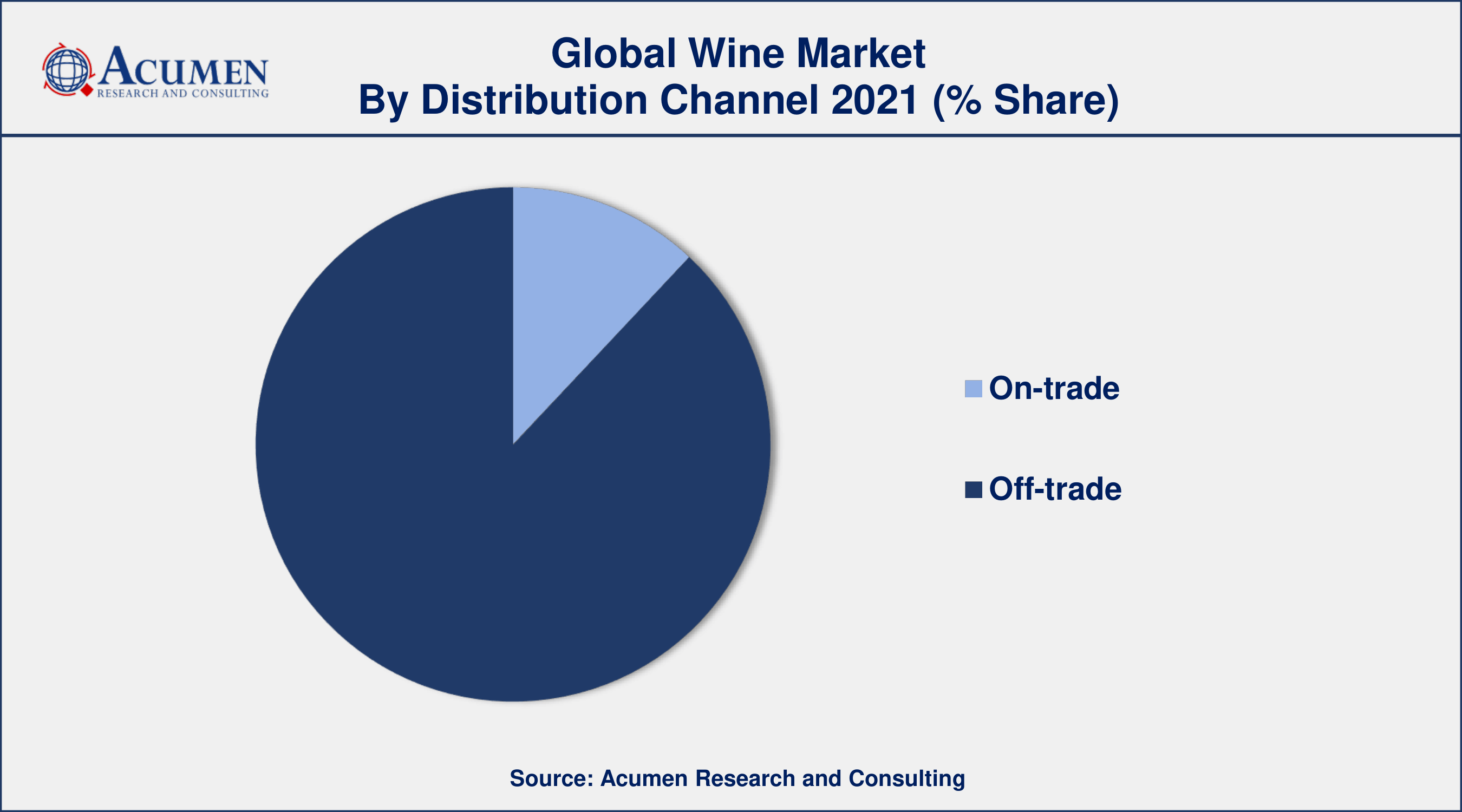

- Among distribution channel, off-trade sector engaged more than 85% of the total market share

- Increasing consumer socialization with alcohol, drives the wine market size

Wine is an alcoholic drink made through the fermentation process. Wine is manufactured from rice, fruits such as berries, pomegranates, cherries, grapes, and many others. Wine consumption has numerous health benefits, including increased bone density, reduced risk of heart disease, & lowering cholesterol levels, among others.

Global Wine Market Dynamics

Market Drivers

- Rising urban preference for exotic wine

- Increase in the demand for alcoholic beverages

- Increasing consumer socialization with alcohol

- Emergence of e-commerce platforms

Market Restraints

- Gradual shift of consumers towards other alcoholic drinks

- High prices of wines due to high manufacturing costs

Market Opportunities

- Changing and evolving way of life

- Increasing demand for low-calorie alcoholic beverages

Wine Market Report Coverage

| Market | Wine Market |

| Wine Market Size 2021 | USD 489.3 Billion |

| Wine Market Forecast 2030 | USD 825.5 Billion |

| Wine Market CAGR During 2022 - 2030 | 6.1% |

| Wine Market Analysis Period | 2018 - 2030 |

| Wine Market Base Year | 2021 |

| Wine Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Asahi Group Holdings, Ltd., E. & J. Gallo Winery, Beijing Yanjing Beer Group Corporation, Treasury Wine Estates (TWE), Castel Frères, Constellation Brands, Accolade Wines, Pernod Ricard, The Wine Group, and Viña Concha y Toro. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Acceptance of liquor consumption socially, high consumer spending capacity on beverage products, and rising travel & tourism activities across the globe serving liquor beverages are major factors expected to drive the growth of the global wine market trend. Consumer interest in the consumption of wine is changing. With the high spending capacity demand for wine with different tastes is gaining attraction. U.S. consumers spent about 140 U.S. dollars per year on the wine they consumed at home, compared to about 46 U.S. dollars for wine at full-service restaurants. With the rising demand, manufacturers are focused on enhancing the production capacity in order to cater to the rising need. In the US production of wine in 2016 was over 800 million gallons which were nearly 9 percent of the global wine production volume. Favorable business policies by the government and the establishment of new wineries are factors expected to impact market growth. According to Wines & Vines, in 2020 in the US there were 10,742 wineries catering to the rising demand. In addition, the major player's approach towards enhancing the business through strategic partnerships and new product launches is expected to augment the growth of the global wine market.

The preset pandemic situation across the globe and supportive lockdown are impacting the sales of wine positively. The 2020 pandemic changed the way that Americans purchase alcohol, with an amazing 167% increase in online alcohol sales. White wine is the second most popular before COVID also showed a 22 percent increase in consumption during the pandemic. These factors are expected to support market growth. Factors such as the high cost of wine and the availability of other alcohol alternatives are expected to hamper the growth of the global wine market. In addition, the influence on consumers related to living a healthy lifestyle is expected to lower the consumption of alcohol which is expected to challenge the growth of the target market. However, increasing players' spending on product development, increasing partnership activities and new product launch are factors expected to create new opportunities for players operating in the wine market over the forecast period. In addition, high demand from the food sector as the flavor is expected to support the revenue transaction of the target market.

Wine Market Segmentation

The worldwide wine market segmentation is based on the product, distribution channel, and geography.

Wine Market By Product

- Table Wine

- Sparkling Wine

- Dessert Wine

According to the wine industry analysis, the table wine segment held the largest market share in 2021. Table wines are popular among new customers due to their being affordable and widely available through physical stores. With changing lifestyles, alcohol use has shifted from hard liquor to light alcoholic drinks such as wine, beer, and seltzers. This tendency is significant in attracting potential consumers, which contributes to the segment's expanding demand.

Wine Market By Distribution Channel

- On-trade

- Off-trade

According to the wine market forecast, the on-trade segment is predicted to rise significantly in the market over the next several years. The expanding party lifestyle among the world's youthful as well as working-class populations is predicted to promote product sales through an on-trade distribution platform.

Wine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific Is Expected To Grow Significantly In the Global Wine Market

The Asia-Pacific region is projected to expand more significantly in the global wine market due to changing consumer preferences. The government of developing countries is spending high on the development of the liquor sector considering it as an early-income sector. Their approach towards the establishment of new enterprises and the emergence of small & mid-size enterprises are expected to support the growth of the target market. Indian local wine production was 17 Mn liters whereas import was 5.2 Mn liters in 2018 valued at US$ 28.3 Mn. Players' approach towards tracking the untapped market in developing countries through strategic partnership is expected to support the growth of the regional market.

Wine Market Players

Some of the top wine market companies offered in the professional report include Asahi Group Holdings, Ltd., E. & J. Gallo Winery, Beijing Yanjing Beer Group Corporation, Treasury Wine Estates (TWE), Castel Frères, Constellation Brands, Accolade Wines, Pernod Ricard, The Wine Group, and Viña Concha y Toro.

Wine Market Strategies

Some of the key strategies in Market:

- In 2020, Riboli Family Wines, a global wine provider launched “Highlands 41” its newest estate-based wine brand. The product launch is expected to help the company enhance its business and increase its product portfolio.

- In 2020, Bronconess, a US-based winery partnered with St. Julian Winery with the focus to launch its new product “Bronconess Peach Bubbly”. The collaborative approach is expected to help the enterprise enhance its customer base and enhance its business.

Frequently Asked Questions

What is the size of global wine market in 2021?

The estimated value of global wine market in 2021 was accounted to be USD 489.3 Billion.

What is the CAGR of global wine market during forecast period of 2022 to 2030?

The projected CAGR wine market during the analysis period of 2022 to 2030 is 6.1%.

Which are the key players operating in the market?

The prominent players of the global wine market are Asahi Group Holdings, Ltd., E. & J. Gallo Winery, Beijing Yanjing Beer Group Corporation, Treasury Wine Estates (TWE), Castel Fr�res, Constellation Brands, Accolade Wines, Pernod Ricard, The Wine Group, and Vi�a Concha y Toro.

Which region held the dominating position in the global wine market?

Europe held the dominating wine during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for wine during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global wine market?

Rising urban preference for exotic wine, and increase in the demand for alcoholic beverages drives the growth of global wine market.

By distribution channel segment, which sub-segment held the maximum share?

Based on distribution channel, off-trade segment is expected to hold the maximum share of the wine market.