Vital Signs Monitoring Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Vital Signs Monitoring Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

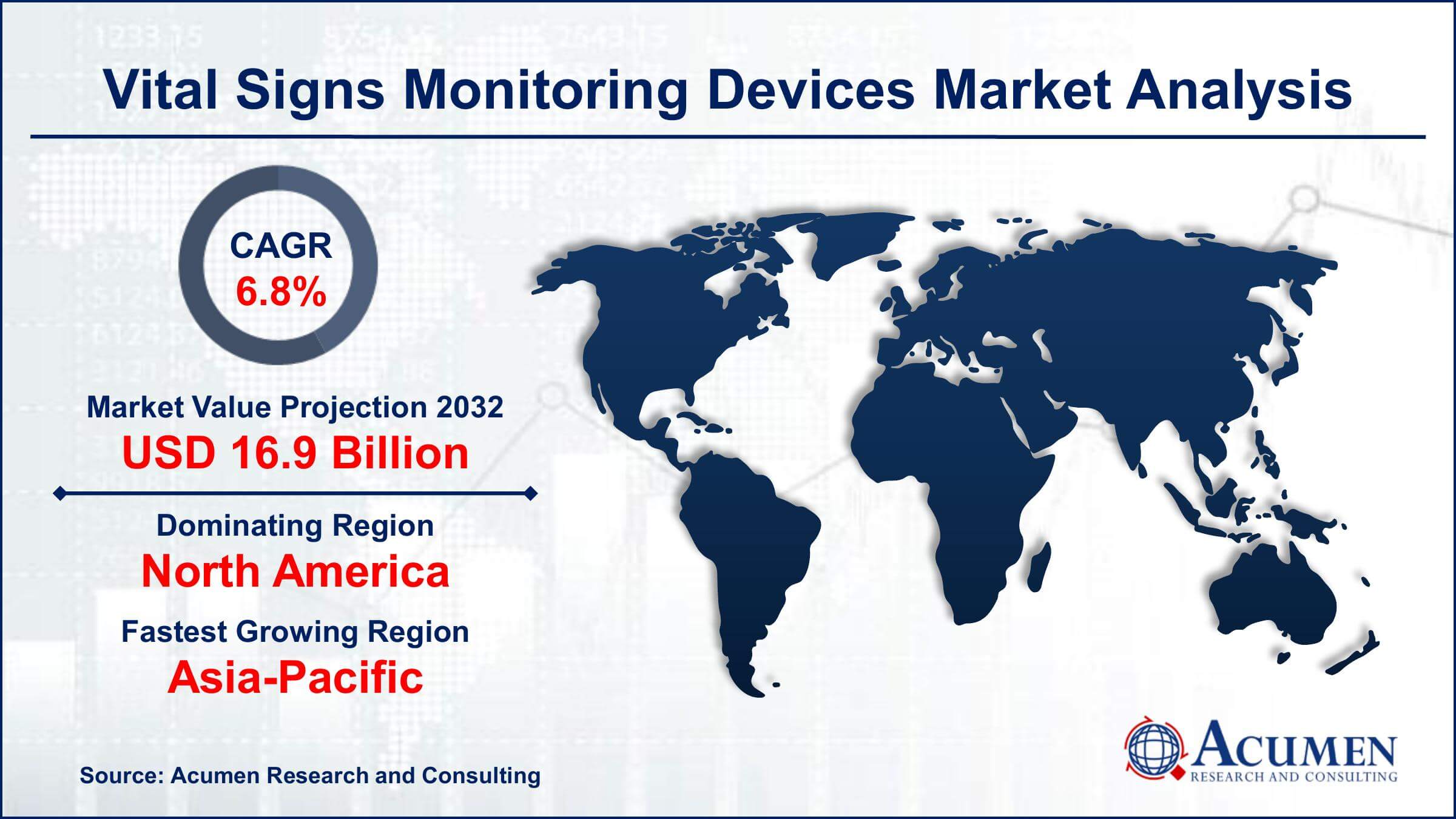

Request Sample Report

The Global Vital Signs Monitoring Devices Market Size accounted for USD 8.9 Billion in 2022 and is projected to achieve a market size of USD 16.9 Billion by 2032 growing at a CAGR of 6.8% from 2023 to 2032.

Vital Signs Monitoring Devices Market Highlights

- Global Vital Signs Monitoring Devices Market revenue is expected to increase by USD 16.9 Billion by 2032, with a 6.8% CAGR from 2023 to 2032

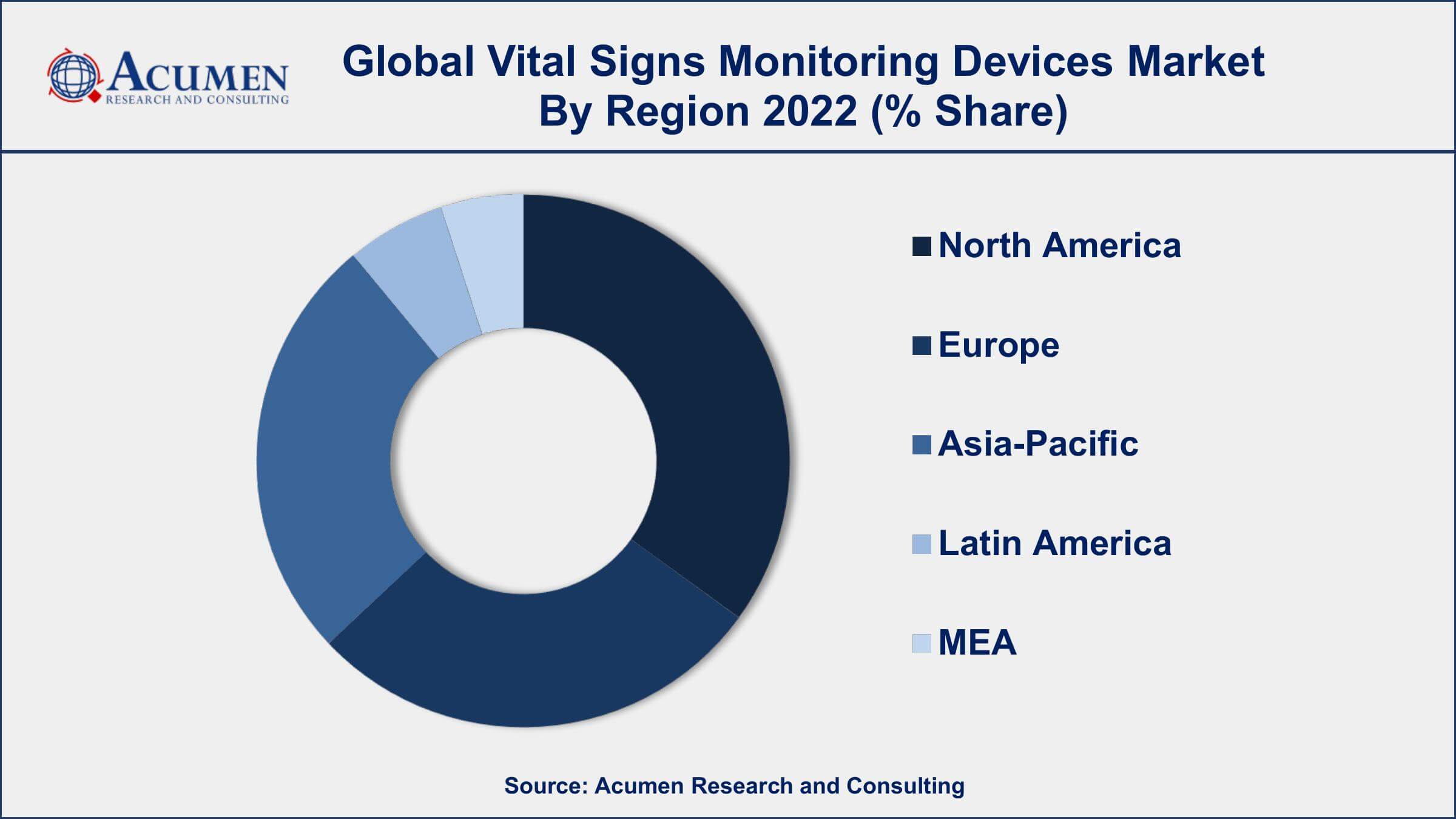

- North America region led with more than 41% of Vital Signs Monitoring Devices Market share in 2022

- Asia-Pacific Vital Signs Monitoring Devices Market growth will record a CAGR of more than 6.6% from 2023 to 2032

- By product, the blood pressure monitors segment has recorded more than 48% of the revenue share in 2022

- By end-use, the hospitals segment has accounted more than 35% of the revenue share in 2022

- Increasing prevalence of chronic diseases worldwide, drives the Vital Signs Monitoring Devices Market value

Vital signs monitoring devices are medical devices used to measure and monitor essential physiological parameters of a patient. These parameters include heart rate, blood pressure, respiratory rate, temperature, and oxygen saturation. Vital signs monitoring devices play a crucial role in healthcare settings, including hospitals, clinics, and home care, as they provide real-time information about a patient's health status and help healthcare professionals make informed decisions regarding diagnosis, treatment, and patient care.

The market for vital signs monitoring devices has been experiencing significant growth in recent years. Several factors contribute to this growth, including the increasing prevalence of chronic diseases, the aging population, and the rising demand for home-based healthcare. Technological advancements in vital signs monitoring devices have also played a vital role in driving market growth. Innovations such as wireless and wearable devices, remote patient monitoring systems, and integration with telehealth platforms have expanded the capabilities and convenience of vital signs monitoring, enabling healthcare providers to monitor patients remotely and in real-time. Furthermore, the COVID-19 pandemic has further accelerated the market growth of vital signs monitoring devices.

Global Vital Signs Monitoring Devices Market Trends

Market Drivers

- Increasing prevalence of chronic diseases worldwide

- Growing aging population and the associated rise in healthcare needs

- Growing awareness about the importance of regular health monitoring and preventive care

- Rising demand for home-based healthcare and remote patient monitoring solutions

Market Restraints

- High cost associated with advanced vital signs monitoring devices

- Stringent regulatory requirements and approval processes for medical devices

Market Opportunities

- Increasing focus on preventive healthcare and wellness programs

- Integration of artificial intelligence (AI) and machine learning (ML) algorithms in vital signs monitoring devices for more accurate and predictive monitoring

Vital Signs Monitoring Devices Market Report Coverage

| Market | Vital Signs Monitoring Devices Market |

| Vital Signs Monitoring Devices Market Size 2022 | USD 8.9 Billion |

| Vital Signs Monitoring Devices Market Forecast 2032 | USD 16.9 Billion |

| Vital Signs Monitoring Devices Market CAGR During 2023 - 2032 | 6.8% |

| Vital Signs Monitoring Devices Market Analysis Period | 2020 - 2032 |

| Vital Signs Monitoring Devices Market Base Year | 2022 |

| Vital Signs Monitoring Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Medtronic plc, Philips Healthcare, GE Healthcare, Nihon Kohden Corporation, Masimo Corporation, Welch Allyn (Hill-Rom), Smiths Medical, Omron Healthcare, Spacelabs Healthcare, and Nonin Medical Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Vital signs monitoring devices are medical devices used to measure and track important physiological parameters of a patient. These parameters include heart rate, blood pressure, respiratory rate, temperature, and oxygen saturation. Vital signs provide critical information about a person's overall health and help healthcare professionals assess the functioning of various organ systems. Monitoring these vital signs is essential in both acute and chronic care settings to detect any abnormalities or changes that may indicate an underlying health condition or the need for medical intervention.

The applications of vital signs monitoring devices are diverse and span across various healthcare settings. In hospitals and clinics, these devices are used for continuous monitoring of patients during surgeries, intensive care, and post-operative care. Vital signs monitoring helps healthcare providers detect any signs of distress or complications, enabling timely interventions and improving patient outcomes. In emergency medicine, these devices play a crucial role in triage and rapid assessment of patients, allowing medical professionals to prioritize care based on the severity of vital sign abnormalities.

The vital signs monitoring devices market has been experiencing significant growth in recent years and is expected to continue growing in the foreseeable future. Several factors contribute to this market growth including, the increasing prevalence of chronic diseases, such as cardiovascular diseases, respiratory disorders, and diabetes, has created a substantial demand for vital signs monitoring devices. These devices play a crucial role in monitoring patients' health parameters and alerting healthcare professionals to any abnormalities, enabling early intervention and better management of chronic conditions. Moreover, the aging population is a significant driver for market growth. With a larger proportion of elderly individuals, there is an increased need for regular monitoring of vital signs to manage age-related health conditions.

Vital Signs Monitoring Devices Market Segmentation

The global Vital Signs Monitoring Devices Market segmentation is based on product, end-use, and geography.

Vital Signs Monitoring Devices Market By Product

- Blood Pressure Monitors

- Digital Blood Pressure Monitor

- Aneroid Blood Pressure Monitors

- Blood Pressure Instrument Accessories

- Ambulatory Blood Pressure Monitors

- Instrument & Accessories

- Pulse Oximeters

- Table-top/Bedside Pulse Oximeters

- Hand-held Pulse Oximeters

- Fingertip Pulse Oximeter

- Wrist-worn Pulse Oximeters

- Pulse Oximeter Accessories

- Pediatric Pulse Oximeters

- Temperature Monitoring Devices

- Mercury Filled Thermometers

- Infrared Thermometers

- Digital Thermometers

- Liquid Crystal Thermometer

- Temperature Monitoring Device Accessories

- Others

In terms of products, the blood pressure monitors segment has seen significant growth in the recent years. Blood pressure monitoring is a fundamental aspect of healthcare, and the increasing prevalence of hypertension and cardiovascular diseases has driven the demand for accurate and reliable blood pressure monitoring devices. This segment includes both conventional blood pressure monitors and advanced digital blood pressure monitors. One of the key factors driving the growth of the blood pressure monitors segment is the rising awareness about the importance of monitoring and managing blood pressure for early detection and prevention of cardiovascular diseases. Governments, healthcare organizations, and public health campaigns have focused on promoting regular blood pressure monitoring, leading to increased adoption of blood pressure monitors in both clinical settings and for home use. Moreover, technological advancements have significantly enhanced the performance and convenience of blood pressure monitors.

Vital Signs Monitoring Devices Market By End-use

- Hospitals

- Home Healthcare

- Physician’s Office

- Emergency Care Centers

- Ambulatory Centers

- Others

According to the vital signs monitoring devices market forecast, the hospitals segment is expected to witness significant growth in the coming years. Hospitals play a vital role in patient care and require a wide range of monitoring devices to assess patients' vital signs accurately and continuously. Vital signs monitoring devices are extensively used in hospital settings for various applications, including emergency care, critical care, operating rooms, general wards, and post-operative monitoring. One of the significant factors contributing to the growth of the hospitals segment is the increasing patient population in hospitals due to a variety of health conditions. The rising prevalence of chronic diseases, an aging population, and the growing number of hospital admissions have led to a greater need for comprehensive vital signs monitoring. Hospitals require an array of monitoring devices, including those for measuring blood pressure, heart rate, respiratory rate, temperature, and oxygen saturation, to ensure prompt detection of any changes in a patient's condition and facilitate timely interventions.

Vital Signs Monitoring Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Vital Signs Monitoring Devices Market Regional Analysis

Geographically, North America dominates the vital signs monitoring devices market in 2022. North America has a well-developed healthcare infrastructure and a high level of healthcare expenditure. This enables healthcare facilities in North America, including hospitals, clinics, and ambulatory care centers, to invest in advanced medical technologies, including vital signs monitoring devices. The availability of financial resources and reimbursement systems supports the adoption of these devices, driving market growth. Moreover, North America is home to several leading companies in the medical device industry, which have a strong presence and extensive distribution networks in the region. These companies invest in research and development to innovate and improve vital signs monitoring devices, making them more accurate, user-friendly, and technologically advanced. The presence of established market players enhances the availability and accessibility of vital signs monitoring devices in North America, further contributing to its dominance.

Vital Signs Monitoring Devices Market Player

Some of the top vital signs monitoring devices market companies offered in the professional report include Medtronic plc, Philips Healthcare, GE Healthcare, Nihon Kohden Corporation, Masimo Corporation, Welch Allyn (Hill-Rom), Smiths Medical, Omron Healthcare, Spacelabs Healthcare, and Nonin Medical Inc.

Frequently Asked Questions

What was the market size of the global vital signs monitoring devices in 2022?

The market size of vital signs monitoring devices was USD 8.9 Billion in 2022.

What is the CAGR of the global vital signs monitoring devices market from 2023 to 2032?

The CAGR of vital signs monitoring devices is 6.8% during the analysis period of 2023 to 2032.

Which are the key players in the vital signs monitoring devices market?

The key players operating in the global market are including Medtronic plc, Philips Healthcare, GE Healthcare, Nihon Kohden Corporation, Masimo Corporation, Welch Allyn (Hill-Rom), Smiths Medical, Omron Healthcare, Spacelabs Healthcare, and Nonin Medical Inc.

Which region dominated the global vital signs monitoring devices market share?

North America held the dominating position in vital signs monitoring devices industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of vital signs monitoring devices during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global vital signs monitoring devices industry?

The current trends and dynamics in the Vital Signs Monitoring Devices Market growth include increasing prevalence of chronic diseases worldwide, and growing aging population and the associated rise in healthcare needs.

Which product held the maximum share in 2022?

The blood pressure monitors product held the maximum share of the vital signs monitoring devices industry.