Veterinary Services Market | Acumen Research and Consulting

Veterinary Services Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

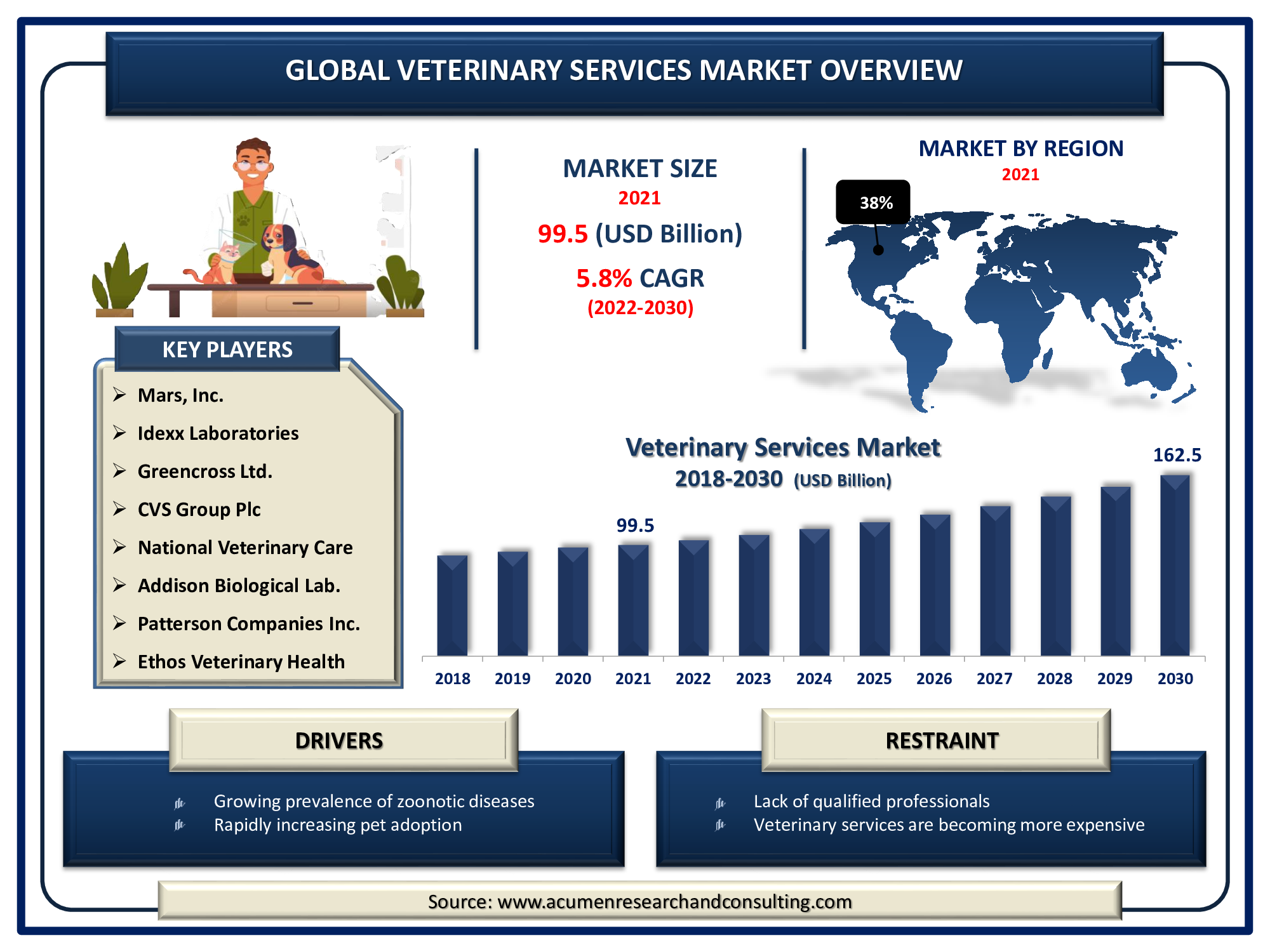

The Global Veterinary Services Market size accounted for USD 99.5 Billion in 2021 and is expected to reach USD 162.5 Billion by 2030 growing at a CAGR of 5.8% during the forecast timeframe from 2022 to 2030.

Rising demand for various animal healthcare products and services in a number of emerging countries worldwide is driving overall veterinary service market growth. Furthermore, the increased adoption of pet animals such as cats, dogs, and horses, the rising prevalence of zoonotic and food-borne diseases and increased per capita animal care spending are all expected to enhance the veterinary service market in the coming years.

Veterinary services are critical for diagnosing and treating infectious animal infections such as zoonotic illnesses and foodborne zoonotic problems. Veterinary services are those offered to animals to help them diagnose, prevent, and manage sickness and accidents. These services are available for both companion and domesticated animals. Veterinary medications are widely available and can be administered with or without the assistance of a veterinarian. Veterinary services include diagnostic testing and imaging, surgical intervention, physical health management, and other services. It has broadened its professional activity by accepting positions at various points throughout the production chain.

Veterinary Services Market Drivers

- Growing prevalence of zoonotic diseases

- Rapidly increasing pet adoption

- Raising awareness about animal health

- The growing number of cattle and poultry farm

Veterinary Services Market Restraints

- Lack of qualified professionals

- Veterinary services are becoming more expensive

Veterinary Services Market Opportunity

- Increasing emphasis on providing the best pet care products and services

Report Coverage

| Market | Veterinary Services Market |

| Market Size 2021 | USD 99.5 Billion |

| Market Forecast 2030 | USD 162.5 Billion |

| CAGR During 2022 - 2030 | 5.8% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Animal Type, By Service, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Mars, Inc., Idexx Laboratories, Greencross Ltd., CVS Group Plc, National Veterinary Care Ltd., Addison Biological Laboratory, Patterson Companies Inc., Ethos Veterinary Health, Animart LLC, Armor Animal Health, Pets At Home Group Plc, and Petiq LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Veterinary Services Market Dynamics

Increasing consumer expenditure on veterinary care, an increasing trend for pet ownership, and a spike in the proportion of poultry and cattle farms are predicted to support the expansion of the veterinary services industry. Increased pet adoption in Central America and Southeast Asia will also drive the veterinary services market size throughout the projected period. Pet owners are more concerned about the well-being of their pets and take greater care of their animals or livestock in the event of an incident or infection. As a result, the veterinary services market value will increase substantially in the foreseeable future. However, many pet owners may not always be able to afford appropriate therapy for their animals, and some may be unaware of it, which may have a negative impact on the veterinary service market trend. The scarcity of veterinarian clinicians in low-income economies would further impede the expansion of the veterinary services market during the forecast period. A lack of public understanding of veterinary wellness will also limit the size of the Veterinary services market.

Furthermore, government agencies collaborate with veterinarian organizations to design programs that assure optimal inventory availability in fields for domesticated animal treatment. The increased demand for animal healthcare supplies reflects veterinary service market trends. Furthermore, increased per capita animal healthcare spending and an increase in animal health consciousness are expected to drive market expansion throughout the projection period.

Veterinary Services Market Segmentation

The global veterinary services market segmentation is based on animal type, service and geographical region.

Veterinary Services Market By Animal Type

- Companion Animal

- Dogs

- Cats

- Horses

- Others

- Farm Animal

- Cattle

- Poultry

- Swine

- Others

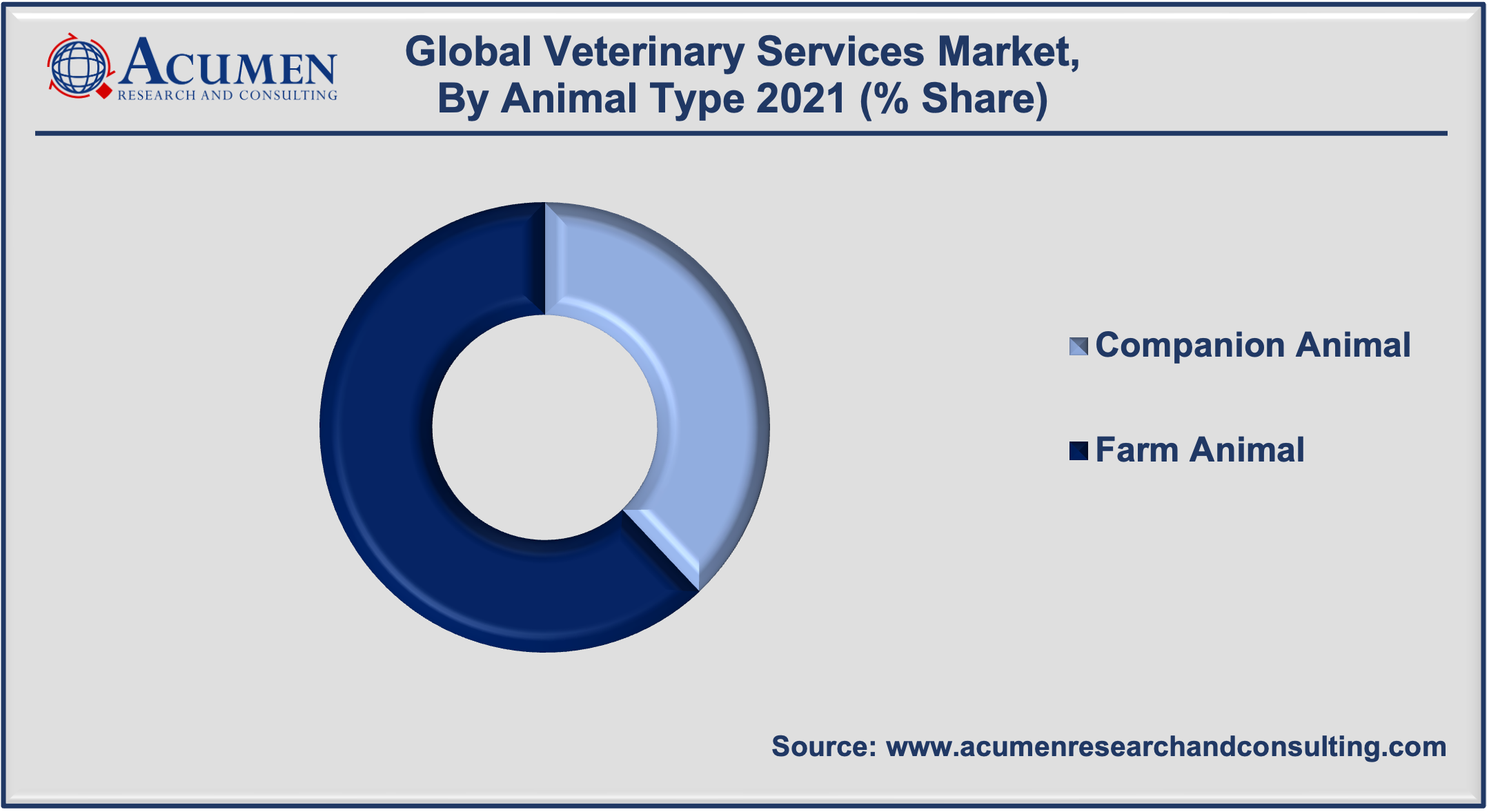

Based on the animal type, the farm animal segment is estimated to hold the largest market share in 2021. The segment's considerable market share can be ascribed to government healthcare providers' strong concern for food safety and sustainability around the globe. This trend in food hygiene is to examine dangers and their control throughout the entirety of commercial poultry production and distribution, which is increasing the farm animal segment's veterinary service market share. Organizations worldwide are attempting to achieve total food security, which promotes large-scale food supplies and improves livestock breeding. Furthermore, the COVID-19 infection has caused significant disruption in the animal industry. Numerous distribution and processing enterprises were unexpectedly closed around the world, and other facilities encountered delivery challenges as diners or food service establishments were forced to close their doors. In addition, during the COVID-19 outbreak, many veterinary laboratories received a restricted supply of commercial samples for testing, limiting sector expansion.

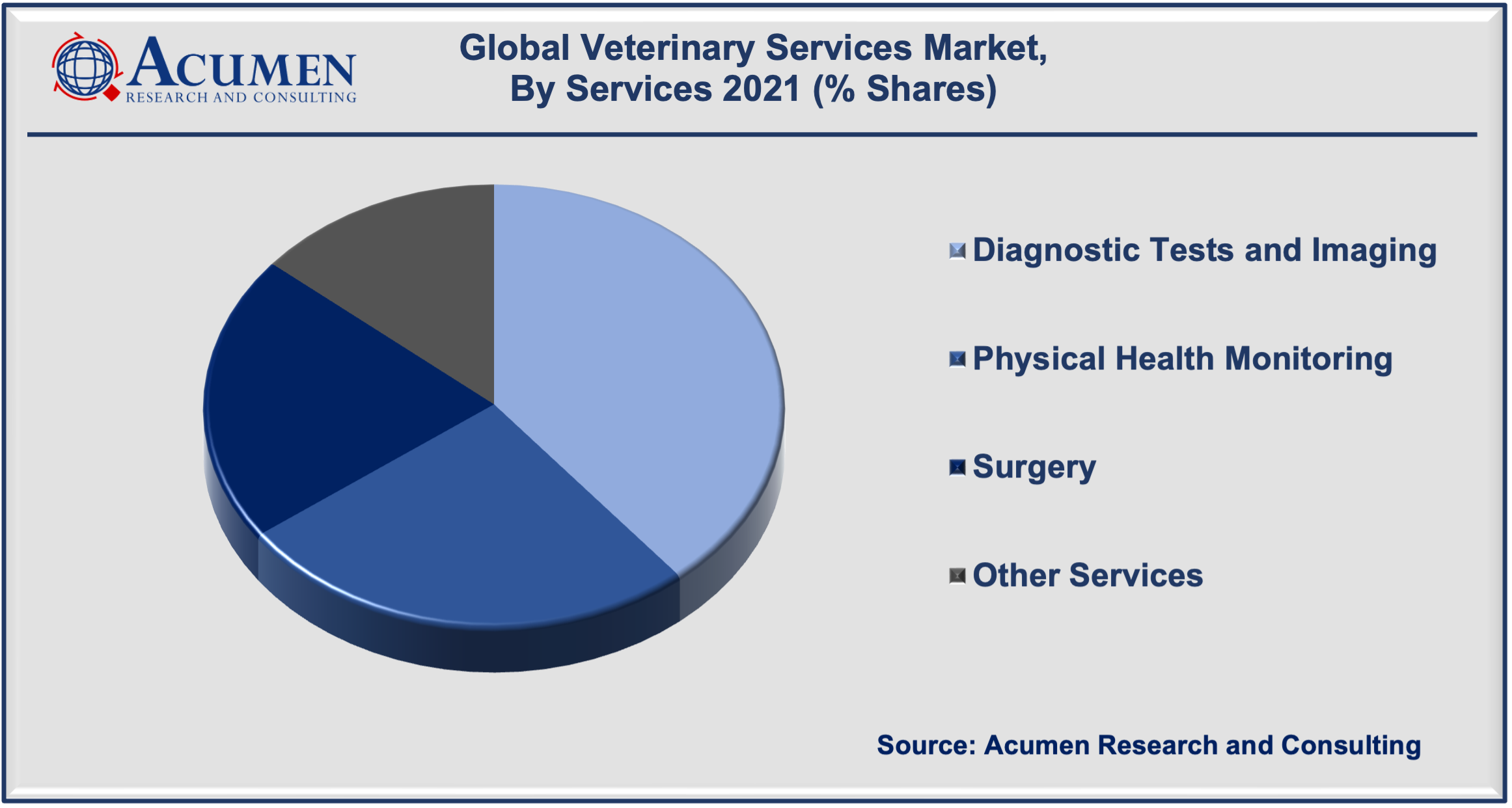

Veterinary Services Market By Service

- Diagnostic Tests and Imaging

- Surgery

- Physical Health Monitoring

- Other Services

Based on the service, the diagnostic tests and imaging segment is expected to grow significantly in the market over the next several years. The increasing worldwide incidence of numerous animal chronic illnesses is predicted to increase demand for a variety of veterinary services. Diagnostic tests that are efficient and accurate are essential to recognize, control, and eradicate such diseases. This has led to an increase in veterinary practitioners that specialize in diagnostics and imaging. Because imaging and screening methods are so important, equipment and auxiliary tools for faster and easier identification of animal diseases have evolved. Emerging technologies for personalized human medicine aid in the development of novel diagnostic processes for a wide range of zoonotic diseases.

Veterinary Services Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America is predicted to lead the veterinary services industry and will do so for the foreseeable future. North America will have the largest market share due to the prevalence of various animal ailments, increased awareness of animal diseases, and increased animal protection. The United States is projected to hold the major market share in the region due to reasons such as growing animal acceptance and increased per capita animal healthcare spending. The American Veterinary Medical Organization has made major efforts to raise awareness in the United States regarding veterinary healthcare services. In order to provide better care for pets, The American Veterinary Medical Association has also launched a number of veterinary wellness projects. These veterinary wellness programs are guided by experienced veterinary doctors and veterinary nurses.

Veterinary Services Market Players

Some of the prominent global veterinary services market companies are Mars, Inc., Idexx Laboratories, Greencross Ltd., CVS Group Plc, National Veterinary Care Ltd., Addison Biological Laboratory, Patterson Companies Inc., Ethos Veterinary Health, Animart LLC, Armor Animal Health, Pets At Home Group Plc, and Petiq LLC.

Frequently Asked Questions

How much was the global veterinary services market worth in 2021?

The global veterinary services market size accounted for USD 99.5 Billion in 2021.

What will be the projected CAGR for global veterinary services market during forecast period of 2022 to 2030?

The projected CAGR of veterinary services during the analysis period of 2022 to 2030 is 5.8%.

Which are the prominent competitors operating in the market?

The prominent players of the global veterinary services market involve Mars, Inc., Idexx Laboratories, Greencross Ltd., CVS Group Plc, National Veterinary Care Ltd., Addison Biological Laboratory, Patterson Companies Inc., Ethos Veterinary Health, Animart LLC, Armor Animal Health, Pets At Home Group Plc, and Petiq LLC.

Which region held the dominating position in the global veterinary services market?

North America held the dominating share for veterinary services during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for veterinary services during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global veterinary services market?

Growing prevalence of zoonotic diseases, rapidly increasing pet adoption, and raising awareness about animal health are the prominent factors that fuel the growth of global veterinary services market.

By segment animal type, which sub-segment held the maximum share?

Based on animal type, farm animal segment held the maximum share for veterinary services market in 2021.