Animal Healthcare Market | Acumen Research and Consulting

Animal Healthcare Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

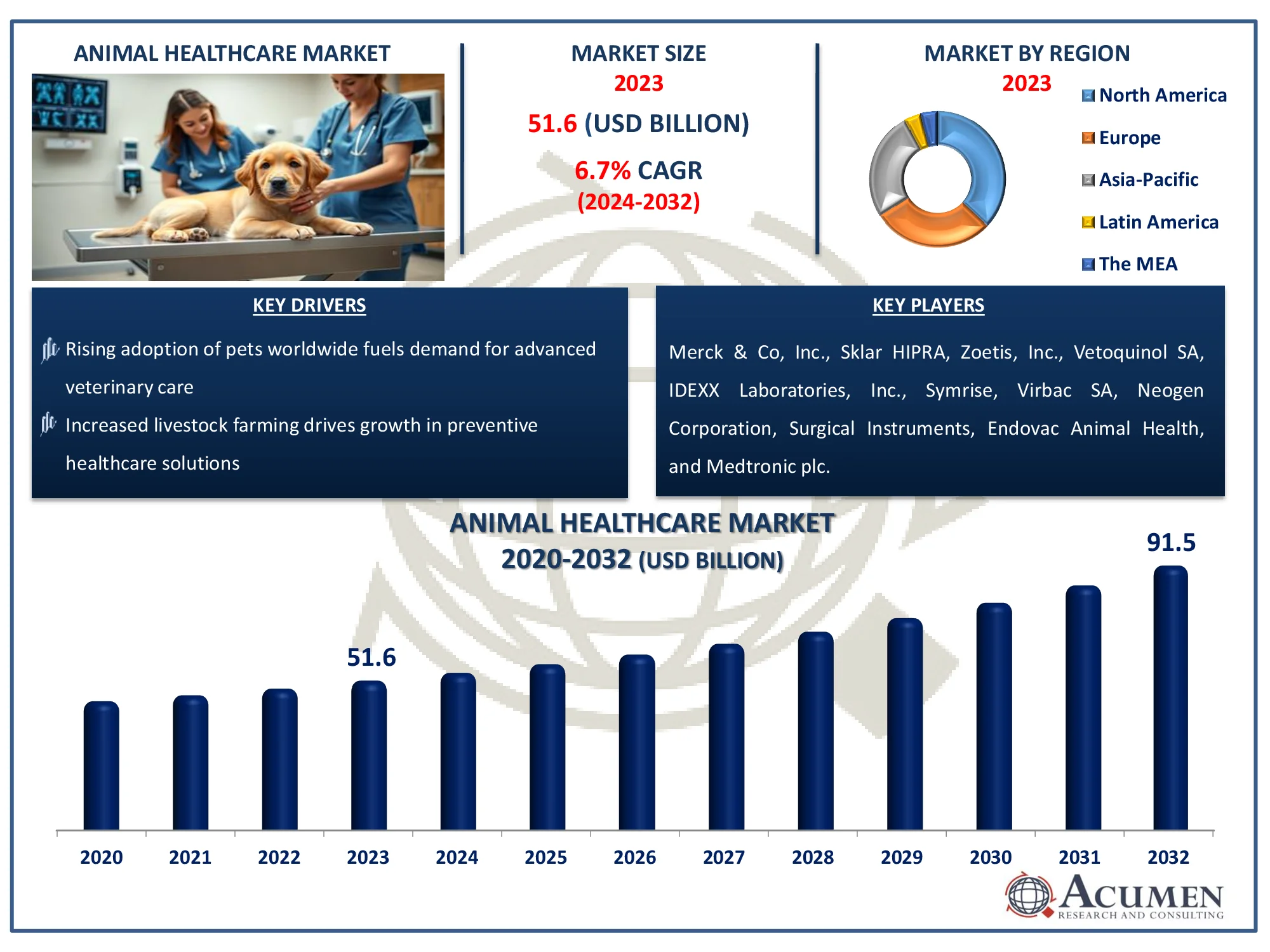

The Global Animal Healthcare Market Size accounted for USD 51.6 Billion in 2023 and is estimated to achieve a market size of USD 91.5 Billion by 2032 growing at a CAGR of 6.7% from 2024 to 2032.

Animal Healthcare Market Highlights

- Global animal healthcare market revenue is poised to garner USD 91.5 billion by 2032 with a CAGR of 6.7% from 2024 to 2032

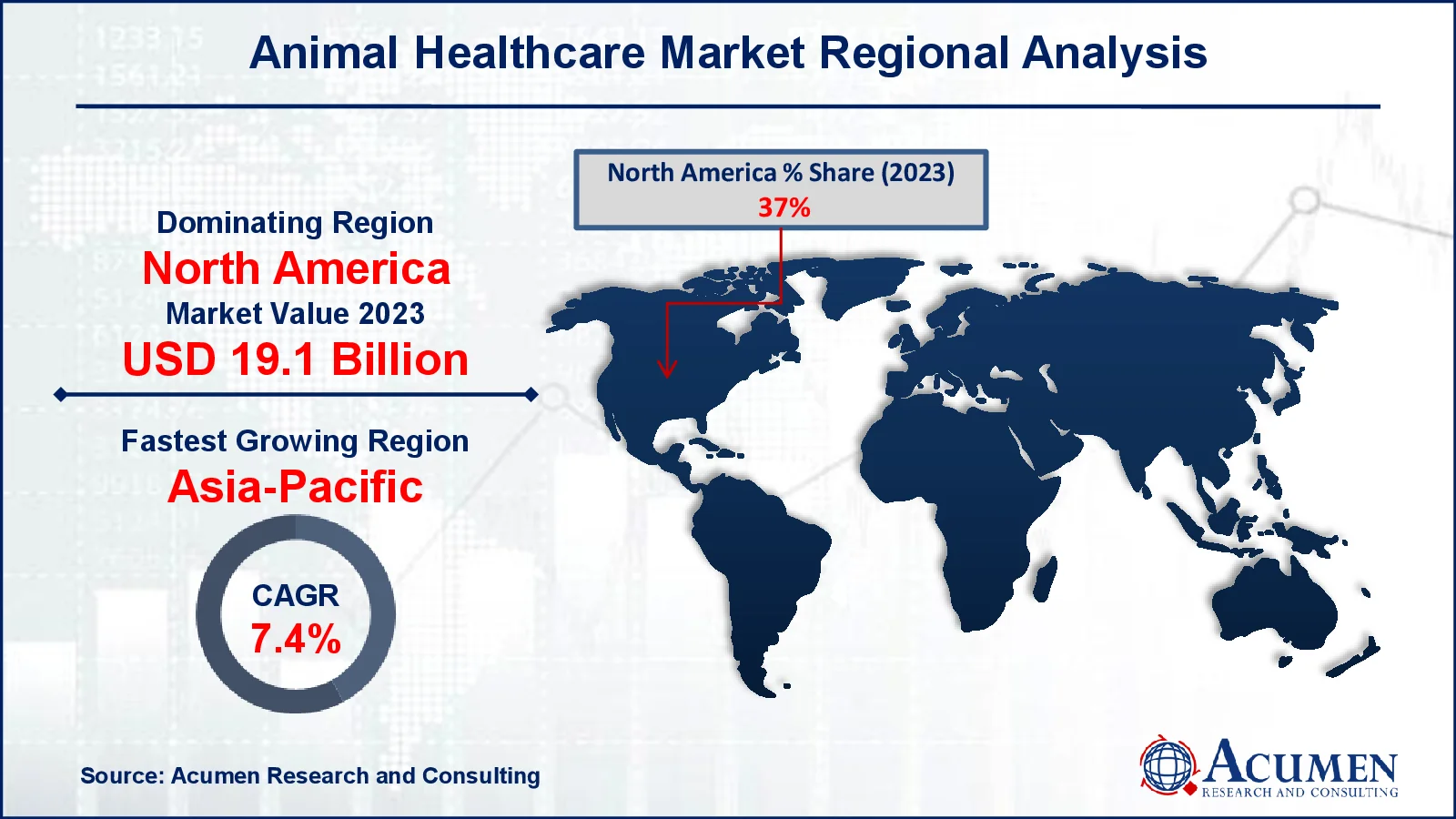

- North America animal healthcare market value occupied around USD 19.1 billion in 2023

- Asia-Pacific animal healthcare market growth will record a CAGR of more than 7.4% from 2024 to 2032

- Among animal type, the veterinary services sub-segment generated more than USD 39.2 billion revenue in 2023

- Based on animal type, the companion animals sub-segment generated around 60% market share in 2023

- Growth in emerging markets due to rising awareness and economic development is a popular animal healthcare market trend that fuels the industry demand

Animal healthcare is concerned with caring for the health of the animals. It encompasses various entities from the pet owners and farmers to animal welfare officers and veterinary staff. The aforementioned entities are involved in animal health as they have to understand the health needs of the specific animals in their care and well being. Animal healthcare is dependent on the parasiticides, feed additives, vaccines, anti-inflammatories, and anti-infectives among others. Various animal healthcare services provided by the major players include hospitalization, surgical care, wellness programs, behavioral counseling, boarding, grooming, and prescription heartworm and flea medication.

Global Animal Healthcare Market Dynamics

Market Drivers

- Rising adoption of pets worldwide fuels demand for advanced veterinary care

- Increased livestock farming drives growth in preventive healthcare solutions

- Technological advancements in diagnostic tools enhance treatment accuracy

- Growing awareness of zoonotic diseases boosts animal healthcare expenditure

Market Restraints

- High cost of advanced veterinary treatments limits affordability

- Stringent regulatory approvals slow down product commercialization

- Shortage of skilled veterinary professionals impacts service availability

Market Opportunities

- Expanding telemedicine solutions in veterinary care enhance accessibility

- Increasing investment in animal vaccines to prevent disease outbreaks

- Development of personalized medicine for pets opens new revenue streams

Animal Healthcare Market Report Coverage

| Market | Animal Healthcare Market |

| Animal Healthcare Market Size 2022 |

USD 51.6 Billion |

| Animal Healthcare Market Forecast 2032 | USD 91.5 Billion |

| Animal Healthcare Market CAGR During 2023 - 2032 | 6.7% |

| Animal Healthcare Market Analysis Period | 2020 - 2032 |

| Animal Healthcare Market Base Year |

2022 |

| Animal Healthcare Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product, By Animal Type, By End-use, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Merck & Co, Inc., Sklar Surgical Instruments, HIPRA, Zoetis, Inc., Vetoquinol SA, IDEXX Laboratories, Inc., Symrise, Virbac SA, Neogen Corporation, Endovac Animal Health, and Medtronic plc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Animal Healthcare Market Insights

The expanding emphasis on the development of companion animal healthcare goods and services, as well as the increasing availability of veterinary services in emerging nations, is driving market expansion. Animal healthcare is benefiting from rising disposable income, pet ownership, and ongoing technological advancements. The presence of sophisticated and technologically advanced instruments in the veterinary pharmacies is additionally contributing to the market value.

Moreover, the increasing purchasing power of individuals in developing countries and the launch of animal-specific products due to the growing number of pet adoption are projected to provide potential opportunities over the animal healthcare market forecast period. According to Shelter Animals Count, cat adoptions have increased significantly, with 34,000 more adoptions in 2023 compared to the previous year, and a 319,000 increase since 2019. The adoption rate, expressed as a percentage of total intakes, has increased from 59% in 2019 to an outstanding 65% in 2023.

On the other hand, lack of awareness and high cost associated with animal healthcare drugs in developing market additionally, mismatch of data management systems create complications in the exchange of knowledge between the scientific community, policymakers, and the animal food production sector are some of the factors likely to hamper the market growth to an extent.

Animal Healthcare Market Segmentation

The worldwide market for animal healthcare is split based on product, animal type, end-use, distribution channel, and geography.

Animal Healthcare Market By Type

- Pharmaceuticals

- Drugs

- Antiparasitic

- Anti-Inflammatory

- Anti-Infectives

- Others

- Vaccines

- Modified Live Vaccines (MLV)

- Killed Inactivated Vaccines

- Others

- Medicated Feed Additives

- Antibiotics

- Vitamins

- Amino Acids

- Enzymes

- Antioxidants

- Prebiotics and Probiotics

- Minerals

- Others

- Drugs

- Medical Devices

- Veterinary Diagnostic Equipment

- Anesthesia Equipment

- Patient Monitoring Equipment

- Veterinary Surgical Equipment

- Veterinary Consumables

- Others

- Veterinary Services

According to animal healthcare industry analysis, the veterinary services sector dominates the market, owing to rising demand for specialized care for companion and livestock animals. Routine health checks, immunizations, surgical operations, diagnostic tests, and emergency treatment are all part of this segment. The increased awareness among pet owners about preventative healthcare, together with developments in veterinary diagnostics and treatments, has fueled the expansion of this market sector. Furthermore, veterinary services help the livestock industry by assuring animal health, production, and food safety standards. The growth of pet insurance coverage, as well as increased pet ownership, drive demand for high-quality veterinary care, confirming the segment's position as the leading contributor to the animal healthcare market.

Animal Healthcare Market By Animal Type

- Livestock animals

- Poultry

- Swine

- Cattle

- Fish

- Others

- Companion animals

- Dogs

- Cats

- Horses

- Others

The companion animals sector drives the animal healthcare market as pet ownership becomes more common and humans form emotional bonds with their pets. This industry comprises dogs, cats, and other domesticated animals that require regular health checks, vaccinations, and specialized treatments. Rising disposable income and awareness of pet health have led to increased spending on preventive and therapeutic care. Furthermore, innovations in veterinary care, including as individualized feeding regimens, diagnostic technologies, and chronic illness management solutions, are specifically intended for companion animals. Pet insurance adoption, along with an increase in urbanization, where pets are increasingly seen as family members, strengthens this segment's dominance, making it the largest contributor to overall market growth.

Animal Healthcare Market By End-use

- Point-of-care Testing/In-house Testing

- Veterinary Reference Laboratories

- Veterinary Hospitals & Clinics

- Others

On the basis of the distribution channels, the veterinary hospital segment dominated the animal healthcare market with a major share in 2023. The veterinary hospital segment is particularly gaining positive growth due to the rising preference of pet owners because complete healthcare solutions for pets are available in hospitals. Furthermore, the American Pet Products Association (APPA) performed a survey for National Pet Ownership, which revealed that approximately 58 million homes in the United States own dogs.

Animal Healthcare Market By Distribution Channels

- E-commerce

- Retail

- Hospital/ Clinic Pharmacy

The hospital/clinic pharmacy category appears as the most important in the animal healthcare market, owing to its integration with direct veterinarian consultations and treatments. These pharmacies give fast access to prescribed medications, vaccinations, and therapeutic goods, ensuring that both livestock and companion animals receive optimal care. Pet owners and livestock managers choose this channel because they trust veterinarians and value the convenience of an on-site pharmacy. Furthermore, hospital/clinic pharmacies frequently stock specialized items that are not widely available in retail or e-commerce channels, addressing specific health needs. Their role in verifying compliance with veterinarian prescriptions and offering professional advice strengthens their position in the distribution chain.

Animal Healthcare Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Animal Healthcare Market Regional Analysis

North America leads the animal healthcare business in terms of income, thanks to extensive adoption of companion animals, robust livestock agriculture practices, and enhanced veterinary infrastructure. According to the 2024 APPA National Pet Owners Survey, which is mentioned in APPA's State of the Industry Report, 82 million households in the United States own a pet. The region's substantial investment in animal research, widespread availability of veterinary services, and a well-established pet insurance business all contribute to its leadership status. Furthermore, the rising incidence of zoonotic diseases has increased demand for preventive care and vaccines, hence strengthening the market. Key nations, such as the United States and Canada, have robust regulatory frameworks in place to assure the quality and safety of animal healthcare products, which is driving market growth.

On the other hand, the Asia-Pacific region is experiencing the fastest development in the animal healthcare industry, owing to rising populations, rising disposable incomes, and more awareness of animal welfare. Rapid urbanization and changing nutritional tastes have resulted in an increase in animal husbandry, particularly in China, India, and Indonesia. For example, by 2023, India's pet dog population will top 33 million. The population is expected to exceed 51 million by 2028. The rise in the number of pet dogs has resulted in an increase in pet food sales around the country. Furthermore, government attempts to upgrade veterinary healthcare services and enhance domestic animal health have contributed to market growth. The market in this region is also being catalyzed by increased multinational company penetration and biotechnology developments. Asia-Pacific's rapid expansion indicates its potential to become a prominent participant in the global animal healthcare landscape.

Animal Healthcare Market Players

Some of the top animal healthcare companies offered in our report includes Merck & Co, Inc., Sklar Surgical Instruments, HIPRA, Zoetis, Inc., Vetoquinol SA, IDEXX Laboratories, Inc., Symrise, Virbac SA, Neogen Corporation, Endovac Animal Health, and Medtronic plc.

Frequently Asked Questions

How big is the animal healthcare market?

The animal healthcare market size was valued at USD 51.6 billion in 2023.

What is the CAGR of the global animal healthcare market from 2024 to 2032?

The CAGR of Animal Healthcare is 6.7% during the analysis period of 2024 to 2032.

Which are the key players in the animal healthcare market?

The key players operating in the global market are including Merck & Co, Inc., Sklar Surgical Instruments, HIPRA, Zoetis, Inc., Vetoquinol SA, IDEXX Laboratories, Inc., Symrise, Virbac SA, Neogen Corporation, Endovac Animal Health, and Medtronic plc.

Which region dominated the global animal healthcare market share?

North America held the dominating position in animal healthcare industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of animal healthcare during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global animal healthcare industry?

The current trends and dynamics in the animal healthcare industry include rising adoption of pets worldwide fuels demand for advanced veterinary care, and increased livestock farming drives growth in preventive healthcare solutions.

Which animal type held the maximum share in 2023?

The companion animal type held the maximum share of the animal healthcare industry.