Vendor Risk Management Market Analysis - Global Industry Analysis, Market Size, Opportunities and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Vendor Risk Management Market Analysis - Global Industry Analysis, Market Size, Opportunities and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

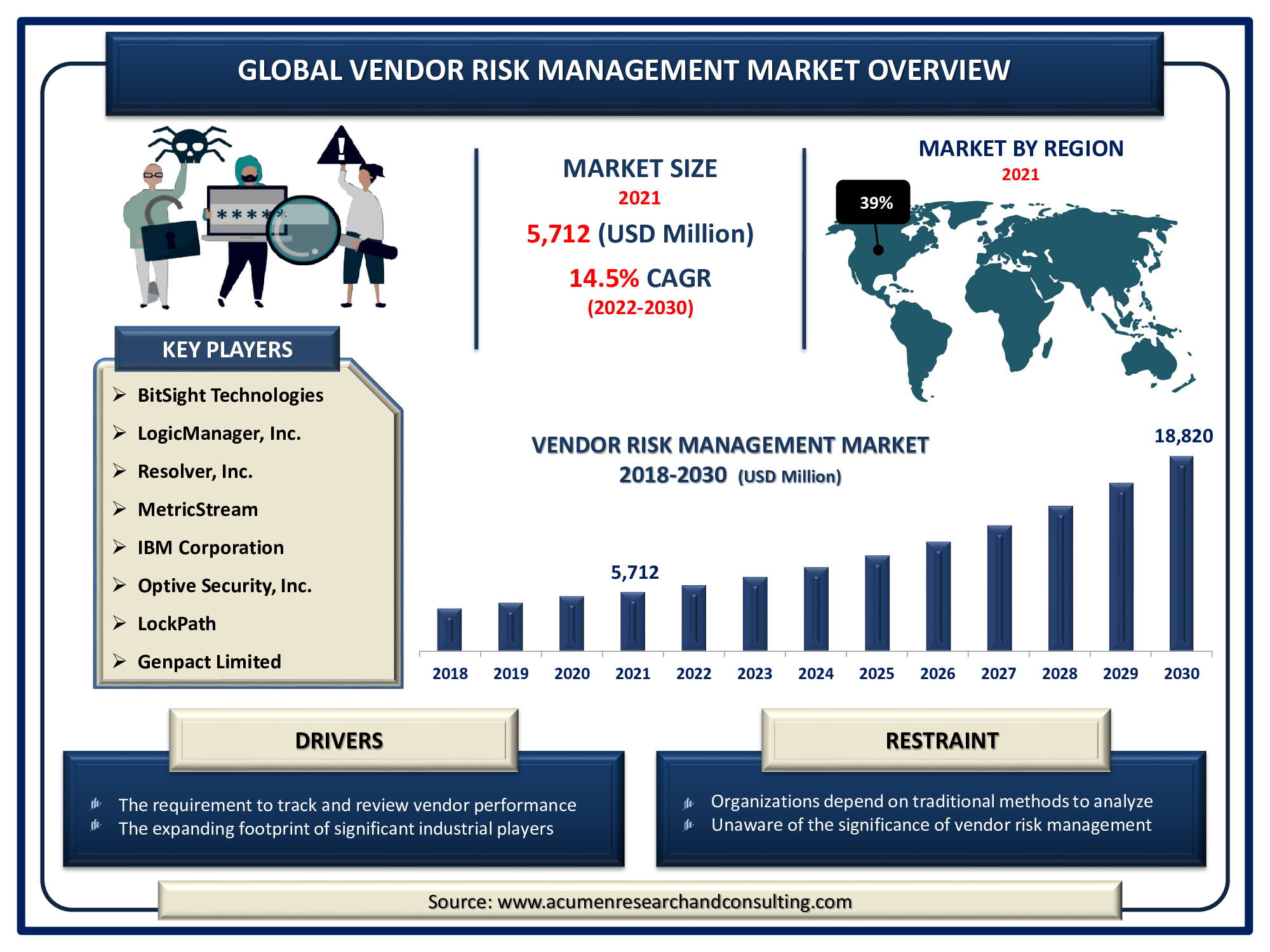

Request Sample Report

The Global Vendor Risk Management Market size accounted for USD 5,712 Mn in 2021 and is expected to reach USD 18,820 Mn by 2030 with a considerable CAGR of 14.5% during the forecast timeframe of 2022 to 2030.

Vendor risk management (VRM) is a corporate risk management solution method that focuses on detecting and reducing vendor risks. VRM informs organizations about the vendors with and who they work, how they work with partners, and whether distribution businesses use suitable security measures.

Many organizations have begun to outsource important activities to suppliers that can analyze both the benefits and drawbacks. Although working with a third-party provider can help organizations cut operational costs and manage their businesses more efficiently, it can also pose risks. Recent events, like the Covid-19 pandemic, cyber warfare, and other ransom offenses, have highlighted the significance of vendor-related vulnerabilities. In today's business world, business size, or nation, these actions have affected billions of dollars of companies and their third-party partners. However, the increasing number of third-party vendors in small and large businesses, rapidly changing rules and regulations across different regions, with the need to regularly monitor and evaluate vendor effectiveness are driving market growth in the vendor risk management market.

Vendor Risk Management Market Dynamics

Drivers

- An increasing number of third-party providers in large organizations

- The requirement to regularly track and review vendor performance

- The expanding footprint of significant industrial players

- Increasing small and medium enterprise's demand for cloud-based VRM solutions

Restraints

- Organizations depend on traditional techniques to identify hazards

- Unaware of the significance of vendor risk management solutions

Opportunity

- Increasing modernization and streamlining the vendor risk evaluation procedure

- The rising demand for efficient management of complex vendor ecosystems

Report Coverage

| Market | Vendor Risk Management Market |

| Market Size 2021 | US$ 5,712 Mn |

| Market Forecast 2030 | US$ 18,820 Mn |

| CAGR | 14.5% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Component, By Deployment, By Organization Size, By Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BitSight Technologies, LogicManager, Inc., Resolver, Inc., MetricStream, IBM Corporation, Optive Security, Inc., LockPath, Genpact Limited, RSA Security LLC, SAI Global, LexisNexis Group, Inc., and Rapid Ratings International, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

The primary factors driving the market growth are the increasing incidence of third-party vendors in public and private sector organizations, rapidly changing rules and regulations across multiple markets, and the need to monitor, manage and analyze vendor performance. Organizations have currently invested significant time and energy in analyzing vendors who provide goods and services that meet their specific business requirements. However, VRM solutions shorten the process of identifying critical components of vendor performance and evaluating vendor performance is based on the vendor delivering products and services, deliverability, and product quality. If the company works with a number of vendors, vendor risk management software can assist professionals in exploring and identifying critical issues when acquiring third-party goods and services. One of the key factors driving global demand for vendor risk management solutions is the rise in cyber-attacks and digital risks. Furthermore, organizations are shifting toward routine inspections supported by software solutions, paving the way for the global third-party risk management market revenue to grow.

Furthermore, many organizations use manual methods for determining threats and are unaware of the consequences of vendor risk management services and solutions in mitigating vendor risk, which are factors limiting the vendor risk management market size.

Vendor Risk Management Market Segmentation

The global vendor risk management market segmentation is based on the component, deployment, organization size, vertical, and geography.

Market by Component

Solutions

- Vendor Information Management

- Contract Management

- Financial Control

- Compliance Management

- Audit Management

- Quality Assurance Management

Services

- Professional Services

- Managed Services

Based on the components, the solution segment is expected to dominate the market in the coming years. The segment is further segmented into solutions such as contract management, finance management, operational risk management, compliance management, and audit management. In 2021, the financial control segment had the highest revenue share. The growing interest among businesses in managing financial threats and vulnerabilities associated with vendors and other factors is to be held responsible for the segment's size. Furthermore, the growing need to track financial transaction relevant information in a massively complex environment with multiple vendors is a trending factor driving the segment growth.

Market by Deployment

- On-premise

- Cloud

In terms of deployment type, cloud computing will dominate the global market in 2021. The large share of this segment is mainly due to the growing benefits that it provides to companies in terms of remote access, scalability, low maintenance, self-solution, and elasticity at reasonable rates. Furthermore, the steadily increasing deployment of hybrid cloud solutions that help enterprises improve business operations, bandwidth utilization, cost optimization, user experience, and application modernization is expected to drive the market at a significant rate during the projected period.

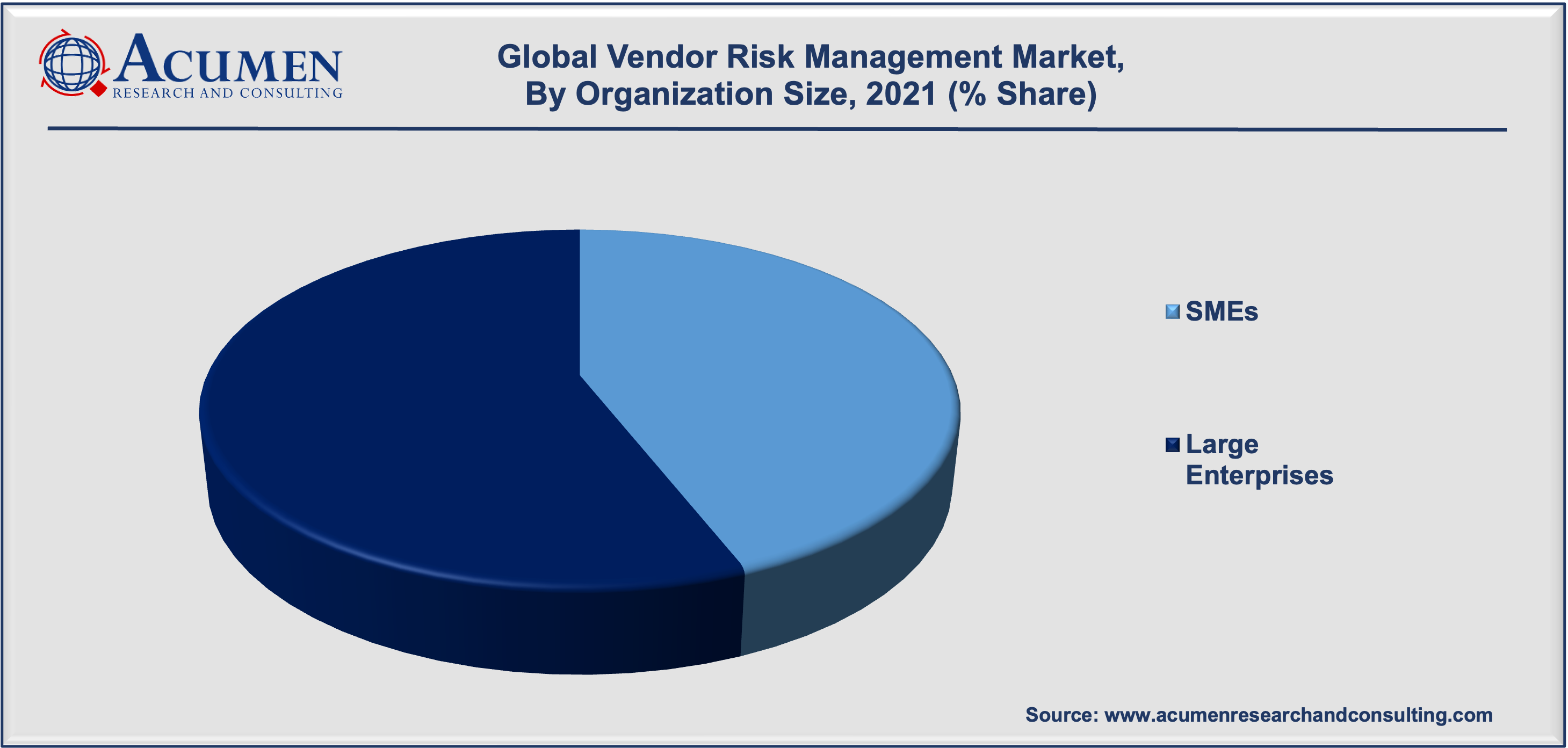

Market by Organization Size

- Large Enterprises

- Small & Medium Enterprises

In terms of organization type, large enterprises will have the biggest market share in 2021. This segment's growth can be attributed to increased coordination and collaboration activities, lower operating expenses, flexibility, and faster time to market. Furthermore, the growing need of many large organizations to manage globally distributed distribution networks and distributors is fueling segment growth. A rise in large enterprises' spending power on technological developments has also been a major factor influencing the segment.

Market by Vertical

- BFSI

- Telecom and IT

- Healthcare and Life Sciences

- Consumer Goods and Retail

- Energy and Utilities

- Manufacturing

- Government

- Others

Based on the vertical, the manufacturing segment is projected to grow at the fastest rate in the market over the forecasting years. The growing use of vendor risk management solutions in the manufacturing industry to appropriately manage the high risk associated with suppliers in terms of spending, regulation, and quality is mainly responsible for this segment's significant share. Furthermore, the industry's increasing digital revolution allows the organization to use efficient alternatives, such as vendor risk management, to boost manufacturer performance and reduce risks. Furthermore, in comparison with other industries, manufacturers have a large number of vendors for a wide range of products and services. As a result, the requirement for vendor risk management solutions is substantial in this industry in order to better manage risk involving various providers, supporting the segment's growth.

Vendor Risk Management Market Regional Overview

North America

· U.S.

· Canada

Europe

· U.K.

· France

· Germany

· Spain

· Rest of Europe

Latin America

· Mexico

· Brazil

· Rest of Latin America

Asia-Pacific

· India

· China

· Japan

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· South Africa

· GCC

· Rest of Middle East & Africa

The North American region holds a large portion of the market due to the advancement of advanced technologies in machine learning, deep learning, IoT, cloud, and Industry 4.0, as well as increasing focus on data security and increased investment. The region's vendor risk management market is developing as a consequence of sophisticated technological breakthroughs in AI, deep learning, software as a service, and internet of things, the rise of end-user industries such as healthcare, manufacturing, and others, an increase in invested capital, and an increasing focus on cyber security. The large share of this region is primarily due to enterprises' increasing reliance on vendor risk management solutions to effectively and efficiently manage potential vendor risks, the existence of global leading companies offering a variety of solutions at reasonable prices, and the high consumption capacity of local businesses on risk management solutions.

Global Vendor Risk Management Market Players

Some of the prominent players in global vendor risk management market are BitSight Technologies, LogicManager, Inc., Resolver, Inc., MetricStream, IBM Corporation, Optive Security, Inc., LockPath, Genpact Limited, RSA Security LLC, SAI Global, LexisNexis Group, Inc., and Rapid Ratings International, Inc.

Frequently Asked Questions

How much was the estimated value of the global vendor risk management market in 2021?

The estimated value of global vendor risk management market in 2021 was accounted to be USD 5,712 Mn.

What will be the projected CAGR for global vendor risk management market during forecast period of 2022 to 2030?

The projected CAGR of vendor risk management during the analysis period of 2022 to 2030 is 14.5%.

Which are the prominent competitors operating in the market?

The prominent players of the global vendor risk management market involve BitSight Technologies, LogicManager, Inc., Resolver, Inc., MetricStream, IBM Corporation, Optive Security, Inc., LockPath, Genpact Limited, RSA Security LLC, SAI Global, LexisNexis Group, Inc., and Rapid Ratings International, Inc.

Which region held the dominating position in the global vendor risk management market?

North America held the dominating share for vendor risk management during the analysis period of 2022 to 2030

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for vendor risk management during the analysis period of 2022 to 2030

What are the current trends and dynamics in the global vendor risk management market?

An increasing number of third-party suppliers, the necessity to analyze and monitor vendor performance on a regular basis, and large industrial players' expanding regional reach are the prominent factors that fuel the growth of global vendor risk management market

By segment component, which sub-segment held the maximum share?

Based on component, solutions segment held the maximum share for vendor risk management market in 2021